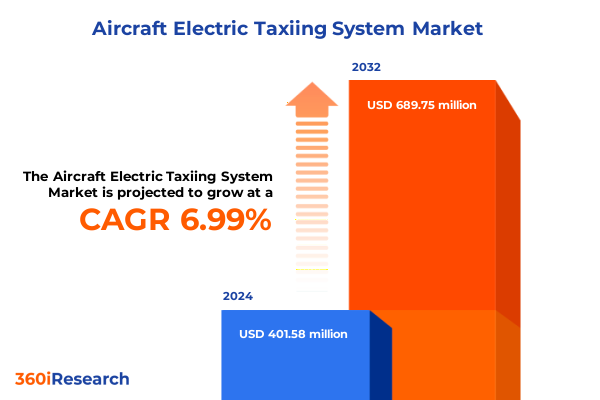

The Aircraft Electric Taxiing System Market size was estimated at USD 429.20 million in 2025 and expected to reach USD 457.59 million in 2026, at a CAGR of 7.01% to reach USD 689.75 million by 2032.

Charting the Transformation of Aircraft Ground Movement through Electric Taxiing Systems to Drive Operational Efficiency and Sustainable Aviation

The advent of electric taxiing systems marks a pivotal evolution in aircraft ground movement, addressing longstanding challenges around fuel consumption, emissions, and operational efficiency. Traditional engine-based taxiing relies on jet fuel and creates noise, air pollution, and wear on powerplant components. Electric taxiing integrates specialized motors into the landing gear or harnesses external tractor units powered by batteries or auxiliary power units (APUs), enabling aircraft to taxi independently without firing main engines. This shift not only yields direct savings in fuel burn and engine maintenance but also supports broader sustainability agendas and airport emission targets.

Early milestones in this journey include the 2017 Airbus and Safran collaboration, which secured market authorization for an onboard electric taxiing solution on the A320 family. By powering integrated wheel motors via the APU, that system demonstrated how airlines could execute pushback and taxi phases without external tugs or engine thrust, thereby reducing both ground service coordination and carbon output. Pilots maintain full directional control from the cockpit, ensuring seamless integration with existing flight decks while unlocking substantial eco-performance benefits.

Unveiling the Paradigm Shifts Redefining Aircraft Operations through Electrified Taxiing: From Technological Advances to Regulatory Incentives

Recent years have witnessed a confluence of technological breakthroughs and regulatory momentum that together are redefining the ground operations landscape. Advances in high-density battery chemistries, lightweight electric motors, and sophisticated power management software have elevated system reliability and extended duty cycles, making both onboard and offboard electric taxiing more viable for a spectrum of aircraft platforms. Hybrid electric configurations have emerged as a transitional strategy, combining traditional APUs with supplementary battery modules to optimize energy utilization and expand taxi range, especially for larger narrowbody and widebody fleets.

Concurrently, airports and aviation authorities are incentivizing low-emission ground operations through environmental regulations, fee mitigations, and dedicated taxi lanes for electrified aircraft. Collaborative frameworks among airframers, component suppliers, ground service operators, and research institutions are accelerating proof-of-concept trials and certification efforts. These strategic partnerships not only share development risks and expertise but also foster standardized interfaces and interoperable solutions. As a result, electric taxiing is transitioning from isolated demonstrations to scalable deployments, heralding a new era of sustainable ground mobility that aligns with industry decarbonization roadmaps.

Assessing the Far-Reaching Effects of 2025 United States Tariff Measures on Electric Taxiing System Supply Chains and Cost Structures

The introduction of new United States tariffs on imported aerospace ground support components in 2025 has introduced headwinds and strategic inflection points for electric taxiing system suppliers. Levies imposed on electric motors, power electronics, and advanced battery cells have elevated procurement costs, prompting equipment manufacturers to reevaluate global sourcing models and explore nearshore production options. In many cases, suppliers have entered into domestic partnerships or expanded local manufacturing footprints to mitigate tariff pressure and ensure uninterrupted access to critical subassemblies.

Airlines and ground service operators have responded with a mix of procurement deferments and adaptive financing structures. Some carriers opted to delay acquisitions pending tariff adjustments or the establishment of in-region production facilities, while others accepted the higher up-front costs to meet corporate sustainability targets and regulatory deadlines. Service providers adjusted maintenance contract terms and component pricing models to preserve adoption momentum, and leasing companies began incorporating tariff-indexed clauses into their mid-life retrofit agreements. Ultimately, the 2025 tariff landscape is fostering a more resilient supply chain, encouraging vertical integration and collaborative R&D efforts to develop alternative chemistries and recycled materials that can shield stakeholders from future trade fluctuations.

Unlocking Critical Market Segmentation Insights to Illuminate Diverse Dimensions of Offering, Aircraft Type, Propulsion, End User, and System Type

The electric taxiing market spans distinct offerings, each tailored to specific customer requirements. Equipment solutions encompass both fixed systems, integrated directly into aircraft landing gear assemblies, and portable units that can be deployed across diverse fleets. Service offerings complement these products by delivering specialized integration and consulting engagements to streamline installations, alongside comprehensive maintenance and support programs that ensure peak system availability and performance.

Aircraft platform diversity further amplifies market complexity. Business jets and military transports pursue bespoke electrification schemes to meet unique operational profiles, while narrowbody, regional, and widebody airliners seek standardized modules optimized for high-cycle commercial service. Propulsion choices bifurcate into full battery electric designs, which rely solely on onboard energy storage for pushback and taxi phases, and hybrid electric configurations that blend battery packs with APU power for extended ground movement capabilities. End users range from aftermarket retrofit specialists capitalizing on fleet modernization waves to original equipment manufacturers embedding electric taxiing as a factory-option line item. System type segmentation differentiates between offboard tractors-whether fixed electric tractors installed at gates or portable units dispatched on demand-and onboard architectures, which may employ motors mounted in the wheel hub or nacelle to impart thrust directly to the aircraft wheels.

This comprehensive research report categorizes the Aircraft Electric Taxiing System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Aircraft Type

- Propulsion Type

- System Type

- End User

Exploring Pivotal Regional Dynamics Shaping the Adoption and Evolution of Electric Taxiing Systems across the Americas, EMEA, and Asia-Pacific

Regional dynamics are reshaping the pace and profile of electric taxiing adoption around the globe. In the Americas, robust infrastructure investments and forward-looking policies have cemented North America’s leadership role. The Federal Aviation Administration’s Green Aviation Program and targeted R&D grants have enabled multiple testbeds across major hubs such as Atlanta and Los Angeles, where trials have demonstrated consistent reductions in taxi fuel consumption and noise footprints.

Across Europe, an aggregation of EASA assessments and EU emissions-based taxiing guidelines is propelling momentum, with Germany, France, and the UK spearheading pilot projects that integrate electric taxiing into broader airport decarbonization roadmaps. Public-private partnerships and carbon grant schemes are enabling airlines and ground handlers to co-invest in next-generation systems, thereby accelerating the journey from feasibility studies to full operational roll-out.

Asia-Pacific has emerged as a dynamic theater for innovation, driven by expansive aviation growth and strong government sustainability mandates. Regional carriers, particularly in China, Japan, and South Korea, are increasingly trialing both onboard and offboard electric taxiing units to curtail emissions and optimize turnaround times amid surging passenger demand. Strategic collaborations between local universities, national research agencies, and global suppliers are forging customized solutions that address Asia-Pacific’s unique airport layouts and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Electric Taxiing System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves and Competitive Innovations of Leading Electric Taxiing System Providers in a Rapidly Evolving Aerospace Market

Leading aerospace conglomerates and innovative startups are jockeying to define the competitive frontier of electric taxiing. Airbus’s partnership with EGTS International-a Safran and Honeywell joint venture-remains a cornerstone initiative, having secured market authorization for the A320 family and advanced cockpit-integrated pushback capabilities. This collaboration underscores how legacy airframers and system integrators can pool R&D investments to expedite certification and scale early deployments.

Concurrently, emerging specialists such as WheelTug and Delos Aerospace are pioneering modular, battery-agnostic offboard tractors that promise rapid cross-fleet compatibility. Honeywell’s scalable units for regional jets and Safran Landing Systems’ full retrofit on the 737 MAX illustrate how competitive differentiation is manifesting through versatile form factors and software-enabled cockpit interfaces. Meanwhile, defense integrators like Technodinamika have begun trialing onboard solutions for tactical platforms, highlighting the technology’s dual-use potential across commercial and military segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Electric Taxiing System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus S A S

- BAE Systems plc

- Boeing Company

- Collins Aerospace Technologies Company

- Crane Co

- Diehl Stiftung Co KG

- Embraer S A

- General Electric Company

- Honeywell International Inc

- Israel Aerospace Industries Ltd

- Liebherr International Deutschland GmbH

- Lufthansa Technik AG

- Meggitt PLC

- Moog Inc

- Parker Hannifin Corporation

- Raytheon Technologies Corporation

- Rolls Royce Holdings plc

- Safran S A

- Thales S A

- WheelTug plc

Crafting Practical Strategic Recommendations to Empower Industry Leaders and Accelerate Adoption of Electric Taxiing Technologies in Aviation Ground Operations

Industry leaders should prioritize collaborative pilots that align electric taxiing demonstrations with airport decarbonization goals and flight schedule optimization. Establishing multi-stakeholder working groups-including airline operations teams, ground handlers, and air traffic control-will foster interoperability standards and expedite technology integration without disrupting gate sequences.

Leveraging adaptive financing mechanisms such as performance-based contracts and tariff-indexed procurement clauses can mitigate upfront capital constraints and insulation against future trade policy shifts. These models preserve adoption momentum while sharing risk across OEMs, lessors, and operators.

On the technology front, developing modular electric taxiing solutions with open-architecture interfaces will enable rapid deployment across mixed fleets. Embedding digital twin simulations and real-time energy management analytics will optimize system performance, reduce maintenance costs, and deliver quantifiable carbon and fuel savings.

Finally, forging strategic partnerships with battery cell producers and advanced materials suppliers can secure prioritized access to next-generation chemistries that enhance energy density and recyclability. This vertical integration approach will strengthen supply chain resilience and align with long-term environmental commitments.

Detailing Rigorous Research Methodology Combining Primary Interviews, Secondary Analysis, and Expert Validation for Comprehensive Insights

This study employs a rigorous research methodology combining primary and secondary data collection to ensure comprehensive and objective insights. Primary research involved in-depth interviews with senior executives, engineers, and ground operations specialists across airlines, OEMs, and GSE manufacturers. These discussions illuminated real-world operational challenges, technology readiness levels, and procurement dynamics.

Secondary research encompassed an extensive review of regulatory filings, white papers, technical journals, and industry conference proceedings. Publicly available sources such as EASA certifications, FAA program documentation, and academic publications were triangulated to validate emerging trends and technological forecasts.

Data triangulation was applied to reconcile qualitative expert opinions with quantitative deployment metrics and tariff impact assessments. An expert validation panel comprising aerospace consultants, university researchers, and policy analysts reviewed interim findings to refine assumptions and ensure analytical robustness.

Finally, the segmentation framework and regional analyses were stress-tested through scenario planning to capture sensitivities around regulatory changes, tariff fluctuations, and battery technology breakthroughs. This methodology underpins the report’s reliability and practical relevance for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Electric Taxiing System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Electric Taxiing System Market, by Offering

- Aircraft Electric Taxiing System Market, by Aircraft Type

- Aircraft Electric Taxiing System Market, by Propulsion Type

- Aircraft Electric Taxiing System Market, by System Type

- Aircraft Electric Taxiing System Market, by End User

- Aircraft Electric Taxiing System Market, by Region

- Aircraft Electric Taxiing System Market, by Group

- Aircraft Electric Taxiing System Market, by Country

- United States Aircraft Electric Taxiing System Market

- China Aircraft Electric Taxiing System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Strategic Imperative and Environmental Promise of Electric Taxiing Systems for Sustainable Aviation Progress

As aviation stakeholders navigate an era of heightened environmental scrutiny and fuel market volatility, electric taxiing systems stand out as a strategically imperative innovation. By decoupling ground propulsion from main engines, these systems yield immediate reductions in fuel consumption, emissions, and noise, while enhancing gate-to-runway efficiency.

The convergence of regulatory incentives, technological maturation, and collaborative partnerships is creating a fertile environment for broader deployment. Nevertheless, success hinges on agile supply chain strategies that mitigate tariff exposures and secure access to advanced battery chemistries. Equally crucial are financing innovations and open-architecture solutions that lower adoption barriers among airlines and ground service providers.

Ultimately, the electrification of taxi operations transcends incremental efficiency gains; it represents a foundational shift toward zero-emission ground mobility. Organizations that embrace these technologies early will not only achieve operational cost savings but also reinforce their sustainability leadership in a decarbonizing aerospace ecosystem.

Seize the Opportunity to Transform Aviation Ground Operations by Securing Your Comprehensive Electric Taxiing System Market Report Today

Ready your strategic advantage today by securing the full Aircraft Electric Taxiing System Market Research Report directly from our Associate Director of Sales & Marketing, Ketan Rohom. This comprehensive study delivers an in-depth examination of transformative technologies, regulatory influences, tariff implications, and segmentation insights tailored to inform and accelerate your decision-making. Elevate your competitive positioning by leveraging actionable data on regional adoption patterns, emerging propulsion types, and end-user dynamics. Engage with Ketan Rohom to receive a customized quote, discuss bulk licensing options, and access exclusive executive summaries. Don’t miss the opportunity to gain unrivaled visibility into the future of aviation ground operations and secure the intelligence you need to drive your business forward with confidence.

- How big is the Aircraft Electric Taxiing System Market?

- What is the Aircraft Electric Taxiing System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?