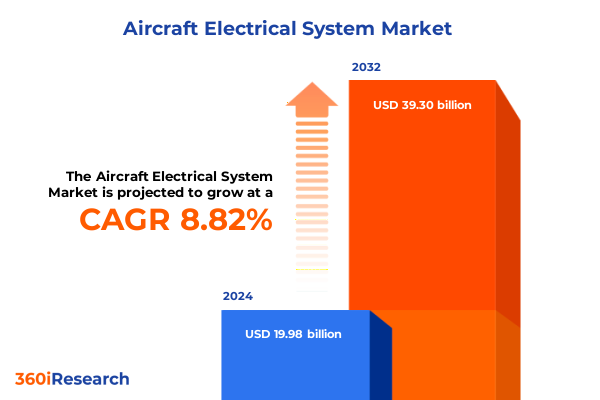

The Aircraft Electrical System Market size was estimated at USD 21.76 billion in 2025 and expected to reach USD 23.71 billion in 2026, at a CAGR of 9.04% to reach USD 39.90 billion by 2032.

Setting the Stage for Future Advancements in Aircraft Electrical Systems Against the Backdrop of Rapidly Evolving Aviation Demands and Innovations

The aviation industry stands on the threshold of a new era driven by continuous innovation and intensifying performance demands. Electrical systems have evolved far beyond their rudimentary origins, transitioning into critical lifelines that ensure operational safety, power redundancy, and system-wide connectivity. As aircraft become increasingly sophisticated, integrating advanced avionics, electric propulsion, and digital networks, electrical architectures assume an ever more pivotal role. This heralds a profound redefinition of design priorities, manufacturing processes, and maintenance paradigms that industry stakeholders must navigate.

Against this backdrop, market participants face a dual mandate: to embrace cutting-edge technologies while simultaneously managing cost, reliability, and certification challenges. Emerging materials, such as high-temperature superconductors, and novel topologies, like distributed electrical generation, promise to unlock significant efficiency gains. Concurrently, stringent environmental targets are compelling makers and operators to pursue lighter, more energy-efficient systems. These converging forces catalyze decision-making at every level, from original equipment manufacturers to maintenance providers and regulatory bodies.

By framing the landscape in terms of technological progression, regulatory evolution, and operational imperatives, this analysis lays the groundwork for understanding the factors reshaping aircraft electrical systems. An informed perspective on these dynamics will empower leaders to forge resilient strategies and capture value in an increasingly electrified aviation ecosystem.

Navigating the Technological Revolution and Sustainability-Driven Transformation Reshaping Aircraft Electrical Architectures and Operational Paradigms

A profound wave of transformation is redefining the very core of aircraft electrical landscapes, as cutting-edge technology intersects with the imperatives of sustainability and operational agility. First, the ascent of electric and hybrid-electric propulsion configurations is catalyzing a shift from centralized powerplants toward decentralized, modular electrical architectures. This reconfiguration demands robust power distribution networks capable of handling dynamic loads and ensuring fail-safe operation across multiple domains, thus inviting innovation in both hardware and control software.

Simultaneously, advances in materials science are enabling the development of ultra-lightweight wiring harnesses and next-generation capacitors that deliver enhanced energy density and thermal stability. These breakthroughs help mitigate the weight penalties traditionally associated with electrical systems, directly supporting improved fuel efficiency and reduced emissions. Furthermore, industry consensus around open-architecture avionics and data-driven maintenance protocols is fostering an era of predictive diagnostics, where real-time monitoring of electrical health can prevent failures before they occur.

Lastly, the convergence of digital twins and simulation-based certification workflows is streamlining design cycles and expediting regulatory approvals. By virtualizing system behavior under a spectrum of flight conditions, stakeholders can validate performance and safety characteristics with unprecedented speed and accuracy. Such transformative trends underscore the necessity for organizations to retool capabilities, cultivate cross-domain expertise, and forge collaborative partnerships that accelerate system integration and deployment.

Assessing the Reverberations of 2025 United States Tariff Policies on Aircraft Electrical System Supply Chains and Cost Optimization Strategies

The imposition of new United States tariffs in 2025 has introduced complex headwinds for the aircraft electrical sector, with implications reverberating across supply chains and cost baselines. Raw materials essential for wiring harnesses, power distribution components, and advanced capacitors have experienced elevated import duties, prompting manufacturers to reassess sourcing strategies. These added expenses have triggered renegotiations of supplier contracts and compelled OEMs to expedite vertical integration efforts to secure continuity and control over critical inputs.

Moreover, the tariff environment has accentuated regional cost disparities, influencing assembly footprints and investment decisions. Companies with established manufacturing capabilities in the United States and neighboring markets are better positioned to absorb incremental tariffs, while those dependent on overseas fabrication face tighter margin pressures. This dynamic has accelerated consolidation among tier-2 and tier-3 suppliers, as scale becomes a decisive factor in negotiating favorable terms and distributing tariffs over larger production volumes.

In response, stakeholders are adopting diversified procurement models that blend domestic sourcing with nearshore partnerships to mitigate exposure. Strategic stockpiling of key components and the pursuit of duty-drawback mechanisms have emerged as tactical responses to preserve cost competitiveness. As a result, the cumulative impact of the 2025 tariff measures underscores the criticality of supply chain resilience and cost optimization in securing long-term success within the aircraft electrical market.

Unlocking Complex Market Dynamics Through Layered Segmentation Analysis Across Aircraft Types Systems Components Propulsion and End Users

A thorough analysis of the aircraft electrical systems landscape unveils multiple segmentation layers that collectively define the market’s contours and growth trajectories. By aircraft type, business jets encompassing heavy, mid, and light jets demand modular systems designed for variable mission profiles, while narrow and wide-body commercial airliners prioritize high-capacity power distribution networks with strict safety redundancies. Within general aviation, single and multi-engine platforms emphasize cost-effective, lightweight electrical assemblies, whereas civil and military helicopters necessitate compact, vibration-resilient solutions. Fighter, transport, and unmanned aerial vehicles each impose unique performance and reliability requirements, driving bespoke component innovations.

From a system perspective, backup power solutions such as ram air turbines and uninterruptible power supplies are vital for emergency protocols, while busbars, circuit breakers, and contactors form the backbone of power distribution. Auxiliary and emergency power units alongside engine-driven generators contribute to the generation of electrical energy under varying flight regimes. Battery and capacitor technologies underpin power storage strategies that ensure stable energy delivery, particularly in the event of primary power loss. On a component level, batteries, circuit breakers, generators, inverters, switches, transformers, and wiring harnesses each embody distinct functional roles. Notably, variations in breaker architectures and switch form factors illustrate how fine-tuned component choices can optimize system performance.

Propulsion segmentation differentiates electric hybrid, turbofan, and turboprop configurations, each presenting specific electrical load and integration challenges. Meanwhile, end user segments span aftermarket replacement and service agreements, in-house and third-party MRO operations, and OEM relationships with Airbus, Boeing, and Embraer. Collectively, these intersecting segmentation frameworks illuminate the multifaceted nature of demand and guide strategic alignment of product portfolios.

This comprehensive research report categorizes the Aircraft Electrical System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Aircraft Type

- Component Type

- Propulsion Type

- End User

Regional Nuances Driving Innovation and Adoption Patterns in Aircraft Electrical Systems Across Americas EMEA and Asia-Pacific Markets

Regional variations play a pivotal role in shaping the adoption and development of aircraft electrical systems, with distinct drivers evident across the Americas, Europe, Middle East & Africa, and Asia-Pacific jurisdictions. In the Americas, a mature commercial aviation sector and growing business jet market spur demand for advanced electrical architectures, underpinned by strong aftermarket activities and a robust MRO ecosystem. This environment fosters experimentation with novel materials and system redundancies to meet stringent safety and performance standards.

Within Europe, Middle East & Africa, regulatory focus on emission reduction and noise abatement accelerates the embrace of electrified propulsion and energy-efficient electrical subsystems. High levels of infrastructure investment in the Gulf region, combined with legacy aerospace hubs in Western Europe, create fertile ground for partnerships between OEMs, technology providers, and maintenance operators seeking to co-develop next-generation solutions.

In the Asia-Pacific corridor, rapid fleet expansions and aggressive regional connectivity strategies drive volume growth in electrical system deployments. Local manufacturers are increasingly forging collaborations with global suppliers to tailor modular power generation and distribution offerings that address high-temperature, high-humidity operational contexts. Across all regions, policy frameworks centered on supply chain security, localization incentives, and green aviation targets are influencing where and how companies invest, innovate, and collaborate to deliver compliant, cost-effective solutions.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Electrical System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Blend of Established Aerospace Power Specialists and Agile Technology Disruptors Shaping the Aircraft Electrical System Ecosystem

The competitive landscape of aircraft electrical systems is characterized by a blend of established aerospace power specialists and emerging technology disruptors. Legacy firms with decades of domain expertise continue to reinforce their market positions by investing in next-generation electrical distribution products and strategic joint ventures. These incumbents leverage global service networks to support operators with predictive maintenance platforms and lifecycle management services, thereby deepening customer relationships and generating recurring revenue streams.

At the same time, agile startups and mid-tier engineering houses are challenging the status quo by introducing advanced materials, high-speed digital circuit breakers, and integrated health monitoring solutions. By focusing on modular architectures and software-defined power management, these newcomers are capturing niche applications in business jets, UAVs, and electric‐hybrid propulsion prototypes. Strategic alliances between these innovators and tier-1 suppliers enable rapid scaling, while also diversifying the product portfolios of larger OEMs.

Collaborative research initiatives among industry consortia, universities, and defense agencies further enrich the ecosystem by accelerating the translation of laboratory breakthroughs into certified products. This confluence of established scale and entrepreneurial ingenuity underscores the dynamic nature of the competitive arena and highlights the importance of flexible partnership models and continuous R&D investment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Electrical System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Amphenol Corporation

- BAE Systems plc

- Collins Aerospace Technologies Inc.

- General Electric Company

- Honeywell International Inc.

- Liebherr-International AG

- Moog Inc.

- Parker-Hannifin Corporation

- Rolls-Royce Holdings plc

- Safran SA

- TE Connectivity plc

- Thales SA

- TransDigm Group Incorporated

Strategic Imperatives for Industry Leaders to Capitalize on Technological Breakthroughs and Strengthen Resilience in Aircraft Electrical Markets

To thrive amidst accelerating innovation and complex market forces, industry leaders must prioritize strategic alignment of capabilities with emerging trends. First, forging cross-sector partnerships can expedite the commercialization of electric and hybrid-electric propulsion technologies; collaboration with battery and power electronics experts is essential to meet performance, weight, and certification requirements. In parallel, investing in digital twin platforms and advanced simulation environments will accelerate design iterations and facilitate compliance with evolving regulatory frameworks.

Second, supply chain resilience should be elevated to a board-level imperative through diversified sourcing and strategic inventory management. Cultivating relationships with both domestic and nearshore suppliers of critical materials can buffer against tariff volatility and geopolitical disruptions. Additionally, embedding traceability into the procurement process via blockchain or equivalent ledger solutions enhances transparency and reinforces quality assurance.

Finally, embracing service-centric business models can unlock new revenue streams and deepen customer engagement. Offering outcome-based maintenance agreements, predictive diagnostics subscriptions, and modular upgrade packages not only differentiates offerings but also generates predictable recurring income. Through these integrated strategies-anchored in collaboration, risk management, and customer-focused services-organizations can secure sustainable competitive advantage in the rapidly evolving aircraft electrical domain.

Elucidating the Rigorous Multi-Source Research Approach and Analytical Framework Underpinning the Comprehensive Aircraft Electrical System Study

This comprehensive analysis of the aircraft electrical system domain is grounded in a multi-faceted research design combining primary interviews, secondary literature review, and quantitative data collection. Primary insights were gleaned from in-depth discussions with engineers, procurement executives, and regulatory specialists across OEMs, tier-1 suppliers, and maintenance organizations. These dialogues were structured to surface firsthand observations of technology adoption rates, certification challenges, and operational priorities.

Secondary research encompassed an exhaustive survey of industry publications, technical standards, regulatory filings, and peer-reviewed journals to chart macro-level trends and historical benchmarks. Emphasis was placed on synthesizing data from diverse sources, including aerospace trade associations and governmental agencies, to triangulate findings and ensure analytical rigor. Quantitative inputs were derived from proprietary transaction databases and supply chain analyses, facilitating a robust evaluation of procurement patterns and component lifecycles.

The methodological framework also integrated scenario modeling to assess the potential impacts of regulatory shifts and tariff regimes on supply chain strategies. Cross-validation measures were applied to align qualitative insights with quantitative indicators, thereby fortifying the credibility of conclusions and recommendations. This structured approach ensures that the insights presented reflect both the nuanced realities of industry practitioners and the broader strategic imperatives shaping the aircraft electrical systems landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Electrical System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Electrical System Market, by Aircraft Type

- Aircraft Electrical System Market, by Component Type

- Aircraft Electrical System Market, by Propulsion Type

- Aircraft Electrical System Market, by End User

- Aircraft Electrical System Market, by Region

- Aircraft Electrical System Market, by Group

- Aircraft Electrical System Market, by Country

- United States Aircraft Electrical System Market

- China Aircraft Electrical System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Pivotal Trends and Forward-Looking Perspectives to Illuminate the Future Trajectory of Aircraft Electrical Systems

The aircraft electrical systems sector is on the cusp of transformative growth, driven by electrification trends, material innovations, and evolving regulatory landscapes. Through layered segmentation analysis, we have illuminated the distinct requirements of various aircraft platforms, system types, components, propulsion architectures, and end-user groups. Concurrently, the cumulative effects of 2025 United States tariffs and regional policy divergences underscore the importance of strategic supply chain management.

Competitive dynamics reveal a marketplace where legacy aerospace powerhouses and nimble technology entrants converge, forging partnerships that accelerate product development and market penetration. The actionable recommendations presented emphasize the need for collaborative R&D, supply chain diversification, and service-led business models to harness emerging opportunities and fortify resilience.

Looking forward, stakeholders who adopt a holistic approach-balancing technical innovation with cost optimization and regulatory compliance-will be best positioned to capture value. By embracing data-driven decision-making and customer-centric offerings, industry participants can navigate the complexities of the modern aviation ecosystem and drive sustainable growth in aircraft electrical systems.

Engage with Ketan Rohom to Secure Your In-Depth Market Intelligence Report on Aircraft Electrical Systems for Strategic Growth

To obtain the comprehensive Aircraft Electrical System market research report and unlock strategic intelligence that can drive your organization’s next wave of growth, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan ensures you gain exclusive access to our in-depth analysis, robust data sets, and actionable insights tailored to the requirements of decision-makers, engineers, and procurement teams. By leveraging this specialized report, you will be empowered to anticipate market shifts, optimize supply chain strategies, and align product roadmaps with emerging demands in the aviation sector.

Connect with Ketan to explore custom briefing options, secure detailed presentations, or arrange a private consultation. Seize this opportunity to elevate your competitive stance, reinforce partnerships, and position your organization at the forefront of innovation in aircraft electrical systems. The pathways to future-proofing your operations and capitalizing on the latest technological and regulatory trends begin with a single step-engagement with Ketan Rohom.

- How big is the Aircraft Electrical System Market?

- What is the Aircraft Electrical System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?