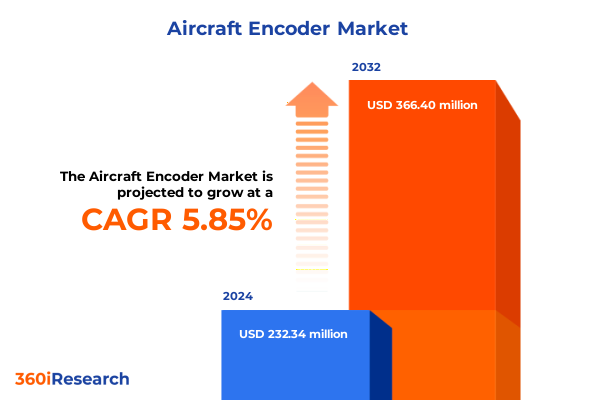

The Aircraft Encoder Market size was estimated at USD 243.32 million in 2025 and expected to reach USD 257.98 million in 2026, at a CAGR of 6.02% to reach USD 366.40 million by 2032.

Pioneering the Future of Aircraft Encoders in a Rapidly Evolving Aeronautics Landscape

Aircraft encoders serve as the critical feedback mechanism at the heart of modern avionics and control systems, translating rotational and positional movements into precise electrical signals that enable safer, more efficient flight operations. These sensors underpin an array of aerospace subsystems-from flight control surfaces and landing gear actuation to navigation equipment and engine management-ensuring that every command corresponds to an accurate mechanical response. As aircraft architectures grow more sophisticated, the role of encoders has expanded beyond simple position measurement to become an integral node within a highly interconnected avionics network, where reliability, redundancy, and data security are paramount.

Against this backdrop, the aircraft encoder market is witnessing an evolutionary leap driven by the confluence of digitalization, stringent safety regulations, and escalating demands for operational efficiency. Original equipment manufacturers are collaborating closely with tier one and tier two suppliers to integrate feedback devices at the design stage, while an expanding aftermarket ecosystem-encompassing calibration services, component replacement, and retrofit kit providers-is emerging to support fleet maintenance and modernization initiatives. Moreover, absolute encoder technologies, prized for their non-ambiguous position reporting, increasingly complement incremental variants in applications that demand uncompromising accuracy. These dynamics underscore the market’s layered complexity, spanning technology choices, distribution channels, and application requirements, all of which will shape competitive positioning in the years ahead.

Looking ahead, the introduction of novel materials, miniaturization techniques, and cybersecurity protocols is poised to further differentiate encoder offerings. Whether serving fixed-wing platforms-ranging from light business jets to widebody commercial airliners-or rotary wing and military programs, manufacturers must align their product roadmaps with evolving certification norms and the relentless pressure to reduce weight, power consumption, and lifecycle costs. This report offers a panoramic view of these trends, setting the stage for a detailed exploration of transformative shifts, tariff impacts, segmentation insights, regional nuances, and strategic imperatives that collectively define the future of aircraft encoder technology.

Navigating the Digital Transformation Wave, Sustainability Imperatives, and Supply Chain Resilience

The landscape of aircraft encoder technology is being reshaped by the rapid adoption of digital twins, artificial intelligence, and the Internet of Things, accelerating the shift from standalone sensors to intelligent, networked devices that contribute to predictive maintenance and autonomous operations. Digital twin implementations now leverage high-resolution encoder data to simulate system behavior under varying conditions, enabling airlines and MRO providers to anticipate component wear and optimize service schedules. This trend dovetails with broader regulatory initiatives mandating cybersecurity measures during type-certification processes, ensuring that interconnectivity does not compromise the safety or integrity of critical flight control systems.

At the same time, sustainability and environmental imperatives are prompting manufacturers to explore lightweight, compact encoder designs that support emerging electric, hybrid, and hydrogen propulsion architectures. Innovations in additive manufacturing techniques are enabling customized encoder housings and integrated sensor assemblies, reducing part counts and streamlining supply chains. Geopolitical disruptions and pandemic-induced challenges have further underscored the importance of resilient sourcing strategies, with industry leaders investing in regional hubs and diversified manufacturing footprints to mitigate risk and ensure continuity of critical component supply.

These transformative shifts have fostered a collaborative market ethos, where traditional encoder specialists partner with software providers, avionics integrators, and cybersecurity firms to deliver holistic solutions. Modular architectures now allow for over-the-air firmware updates, enabling rapid deployment of functional enhancements and security patches. As airlines increasingly demand turnkey, service-enabled offerings, the encoder market is evolving from a commodity-centric model to one defined by system-level partnerships, data analytics capabilities, and lifecycle support services that align with the broader digital thread of aircraft operations.

Assessing the Layered Consequences of 2025 United States Tariffs on Aerospace Components

In mid-2025, the landscape of U.S. trade policy has introduced a nuanced tapestry of tariffs and exemptions that cumulatively influence component costs, production planning, and maintenance strategies across the aerospace value chain. A landmark EU-U.S. accord announced in July reinstated a duty-free framework for civil aircraft, engines, and parts, alleviating earlier uncertainties and stabilizing the flow of critical components across the Atlantic. However, the provisional nature of this pact underscores the potential for future variability, particularly for peripheral parts and emerging markets that may not fall squarely within the traditional civil aircraft definition.

Concurrently, ongoing Section 232 investigations by the Department of Commerce have heightened the prospect of tariffs on domestic aircraft and parts imported from non-allied nations, prompting industry stakeholders to monitor policy developments closely. Manufacturers and maintenance providers are recalibrating supply chain strategies to address potential duties on aluminum alloys and precision components-a move that has already shifted procurement toward domestic and near-shore sources in response to rising raw material levies.

The introduction of a 25% U.S. aluminum tariff for aerospace-grade alloys has significantly impacted the cost structure for fuselage and wing assemblies, driving leading suppliers to revisit dual-sourcing and alloy specification alternatives. Meanwhile, maintenance, repair, and overhaul operations are anticipating increased repair-versus-replacement decisions as tariff-related surcharges elevate the cost of imported spares. This dynamic has catalyzed greater local investment in certification of PMA parts and expanded calibration services to extend component life and maintain fleet readiness.

Against this backdrop, airlines and OEMs are employing tactical measures-such as delivery routing via non-U.S. gateways and selective production shifts-to circumvent surcharges on high-value imports. Though these workarounds offer near-term relief, the layered tariff environment continues to inject complexity into long-term procurement planning, underlining the strategic necessity of agile supply-chain frameworks and proactive engagement with policymakers.

Unraveling the Market Through Layered Distribution, Technological, Aircraft, Encoder, and Application Perspectives

Deep segmentation analysis reveals that the market’s distribution channels bifurcate into a vibrant aftermarket ecosystem-where calibration services, component replacements, and retrofit kits drive ongoing fleet support-and an OEM domain dominated by Tier One and Tier Two suppliers constructing encoders into aircraft designs at source. This duality highlights the interplay between sustaining legacy platforms and innovating next-generation architectures. Similarly, the technology segmentation juxtaposes absolute encoders, prized for their definitive positional feedback in critical control loops, against incremental variants favored in cost-sensitive applications where continuous monitoring suffices.

Examining aircraft type categories uncovers nuanced demand patterns: the business aviation segment, spanning light jets, midsize jets, and turboprops, prioritizes compact form factors and rapid calibration cycles; commercial narrowbody, regional, and wide-body airliners demand high-throughput production and streamlined maintenance pathways; military fighters, trainers, and transports require rugged, redundant encoders capable of withstanding extreme operational environments; and rotary-wing platforms-whether heavy, medium, or light-leverage specialized sensors to manage complex rotor dynamics.

Encoder type segmentation further differentiates market offerings through capacitive, eddy current, magnetic, and optical architectures. Within magnetic solutions, Hall effect and sensorless variants cater to distinct application thresholds, balancing robustness, cost, and electromagnetic resilience. In parallel, application segmentation sheds light on the diverse functional roles of encoders-from avionics and engine control to flight-control monitoring of aileron, elevator, and rudder positions, through landing-gear extension and retraction sensors, to precision navigation within GNSS and inertial navigation systems. This layered insight framework illuminates the unique drivers and competitive dynamics at play within each slice of the aircraft encoder market.

This comprehensive research report categorizes the Aircraft Encoder market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Aircraft Type

- Encoder Type

- Application

Decoding Regional Nuances Influencing Encoder Adoption and Innovation Across Key Geographies

In the Americas, sustained investment in aging fleet maintenance and next-generation narrowbody programs in North America continues to propel encoder demand, with MRO providers and airline OEM partnerships at the forefront of aftersales innovation. The United States remains a center of excellence for calibration services and precision manufacturing, complemented by burgeoning aerospace clusters in Mexico and Brazil that amplify regional supply resilience through near-shore fabrication and assembly capabilities.

Within Europe, the Middle East, and Africa, regulatory alignment under EASA and growing defense modernization initiatives are accelerating certification of cyber-hardened encoders. European OEMs emphasize sustainability targets, driving lighter, lower-power feedback devices as part of flagship green aviation programs. Meanwhile, Middle Eastern hubs are investing heavily in large-scale commercial fleets, fostering competitive ecosystems for encoder calibration and retrofit services.

Asia-Pacific stands out for its rapid capacity expansion, with India emerging as a critical supplier of precision components and maintenance services, and Southeast Asian nations advancing localized manufacturing through government-backed aerospace incentives. China’s domestic aerospace ambitions further underscore the region’s dual role as both a consumer market and a production powerhouse, challenging global suppliers to adapt product roadmaps for localized certification and market access.

These regional dynamics underscore the importance of tailored strategies that account for diverse regulatory frameworks, infrastructure maturity, and end-user priorities across key geographies. By understanding these nuanced interplay factors, stakeholders can optimize investment portfolios, forge strategic partnerships, and align product development with the unique requirements of each region’s aerospace ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Encoder market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Leading Players Shaping Encoder Technology Through Collaborations and Breakthroughs

Leading aerospace encoder providers are forging cross-industry alliances to deliver integrated sensor solutions with embedded analytics, as exemplified by Airbus’s adoption of digital twin frameworks and Siemens’s Xcelerator platform collaboration with emerging OEMs. Dassault Systèmes has extended its 3DEXPERIENCE ecosystem to streamline in-service encoder data management, while GE Aerospace continues to leverage its engine-maintenance expertise to co-develop high-reliability encoder modules with specialized software firms.

On the sensor technology front, Renishaw’s advanced optical encoder offerings-ranging from high-radiation GEO-qualified angle devices to miniature absolute systems-demonstrate the potential for additive manufacturing to enhance precision and durability. Complementary to this, Heidenhain and Bourns are refining eddy current and capacitive designs to achieve sub-micron resolution and improved electromagnetic resilience. Hall effect and sensorless magnetic encoders have also gained traction through partnerships with automotive electronics specialists, driving cost efficiencies for rotary-wing and general aviation markets.

In aftermarket and service domains, tier-one calibration vendors are expanding global networks of accredited laboratories and leveraging remote diagnostics to accelerate turnaround times. Meanwhile, engineering services firms and specialized MRO providers are intensifying investments in training and certification programs to meet the surge in calibration demand for both absolute and incremental devices. This confluence of product innovation and service ecosystem development underscores the competitive differentiation strategies employed by top players seeking to capture value across the encoder lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Encoder market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Motion Technologies, Inc.

- Amphenol Corporation

- Balluff GmbH

- Baumer Group

- Bourns, Inc.

- DR. JOHANNES HEIDENHAIN GmbH

- Dynapar Corporation

- Eltra S.p.A.

- Grayhill, Inc.

- Honeywell International Inc.

- Kübler Group

- Maxon Motor AG

- Moog Inc.

- Omron Corporation

- Pepperl+Fuchs GmbH

- Renishaw plc

- Rockwell Automation, Inc.

- RTX Corporation

- Same Sky

- Schneider Electric SE

- Sensata Technologies, Inc.

- SICK AG

- TE Connectivity Ltd.

- Tokyo Cosmos Electric Co., Ltd.

Strategic Imperatives for Industry Leaders to Thrive Amid Technological and Regulatory Disruptions

Industry leaders seeking to maintain a competitive edge in the evolving encoder landscape should prioritize the development of modular, software-centric offerings that facilitate over-the-air updates and real-time analytics integration. Establishing formal partnerships with avionics integrators and cybersecurity specialists will be essential to ensure compliance with emerging certification mandates and to safeguard against increasing digital threats. Organizations should also invest in regional manufacturing and dual-sourcing strategies, leveraging near-shore facilities and alternate supply hubs to buffer against geopolitical and logistical disruptions.

Simultaneously, a robust aftermarket service strategy-anchored by accredited calibration networks and rapid turnaround capabilities-can extend the lifecycle value of existing fleets. By creating flexible service-level agreements that blend preventative maintenance with condition-based monitoring, providers can generate recurring revenue streams while enhancing customer retention. Equally important is a data-driven approach to customer engagement, harnessing encoder performance metrics to inform predictive maintenance models and to co-create value-added solutions with airline and defense operators.

Finally, embedding sustainability principles into product development-by reducing device weight, power consumption, and material waste-will align encoder roadmaps with broader environmental goals across global aviation agendas. Proactive engagement with regulatory bodies to shape consensus standards and to advocate for harmonized certification processes will position market participants as trusted partners, fostering an environment conducive to continuous innovation and growth.

Comprehensive Approach Employed to Deliver Rigorous, Multi-Dimensional Encoder Market Insights

This report integrates a mixed-method research approach, combining extensive primary interviews with aerospace OEM executives, MRO directors, and technology partners with secondary data from industry journals, certification databases, and trade association publications. The segmentation framework is derived from rigorous market mapping, encompassing distribution channel analysis, technology benchmarking, aircraft type verticals, encoder architecture distinctions, and application-specific use cases.

Quantitative insights are supported by historical product adoption trends, patent filings, and procurement data, while qualitative assessments capture forward-looking perspectives on innovation roadmaps, regulatory trajectories, and competitive positioning. Regional market dynamics are analyzed through a blend of government aerospace forecasts, trade statistics, and direct feedback from localized supply chain stakeholders. This dual-lens methodology ensures a holistic, multi-dimensional understanding of the encoder market’s present state and future direction.

To validate findings, triangulation techniques were employed across five global benchmarks, supplemented by scenario planning workshops with subject-matter experts. The research team adhered to strict data quality protocols, cross-verifying sources and standardizing categorization to guarantee consistency and transparency. The report’s conclusions and recommendations reflect a synthesis of empirical evidence and strategic foresight, designed to equip decision-makers with the tools necessary to navigate the complex, dynamic aircraft encoder ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Encoder market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Encoder Market, by Technology

- Aircraft Encoder Market, by Aircraft Type

- Aircraft Encoder Market, by Encoder Type

- Aircraft Encoder Market, by Application

- Aircraft Encoder Market, by Region

- Aircraft Encoder Market, by Group

- Aircraft Encoder Market, by Country

- United States Aircraft Encoder Market

- China Aircraft Encoder Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding Reflections on Encoder Market Dynamics and Strategic Outlook

The aircraft encoder market stands at the confluence of advanced digitalization, evolving regulatory imperatives, and heightened supply-chain complexity. As absolute and incremental technologies both find defined roles, the interplay between OEM integration and aftermarket support underlines the multifaceted nature of this sector. Divergent regional dynamics-from North America’s maintenance-driven aftermarket to Europe’s sustainability-focused certifications and Asia-Pacific’s emergent production hubs-underscore the necessity for tailored strategies that reflect local priorities.

Emerging trends such as digital twin-enabled predictive maintenance, embedded cybersecurity protocols, and additive-manufacturing-facilitated miniaturization will continue to reshape encoder design and service paradigms. Tariff volatility, particularly within the U.S. trade environment, adds another layer of strategic urgency, compelling market participants to invest in agile sourcing models and cross-border policy engagement. At the same time, the maturation of application verticals-whether flight-control monitoring, landing-gear actuation, or navigation integration-highlights ever-higher accuracy, reliability, and data-integrity standards.

Collectively, these forces point to a future in which encoders transcend their status as discrete components to become integral enablers of the connected, autonomous, and sustainable aircraft. Success in this landscape will hinge on the ability to marry deep technical expertise with system-level partnerships, to harness data-driven intelligence, and to remain adaptable in the face of shifting regulatory and geopolitical tides. This report’s insights lay the groundwork for organizations to capitalize on these dynamics and to guide their strategic course forward.

Partner with Ketan Rohom to Access a Cutting-Edge Aircraft Encoder Market Research Report Today

Elevate your strategic foresight and operational readiness by securing the full Aircraft Encoder Market Research Report from Ketan Rohom, Associate Director of Sales & Marketing. Connect with Ketan today to receive a tailored consultation on how this comprehensive analysis can empower your organization with actionable insights, robust segmentation intelligence, and a forward-looking roadmap. Unlock exclusive access to in-depth regional dynamics, transformative shifts, and a curated repository of expert recommendations that will drive your competitive advantage in aircraft encoder innovation. Don’t let pivotal market developments pass you by-reach out now to collaborate with Ketan Rohom and transform data-driven intelligence into decisive business growth.

- How big is the Aircraft Encoder Market?

- What is the Aircraft Encoder Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?