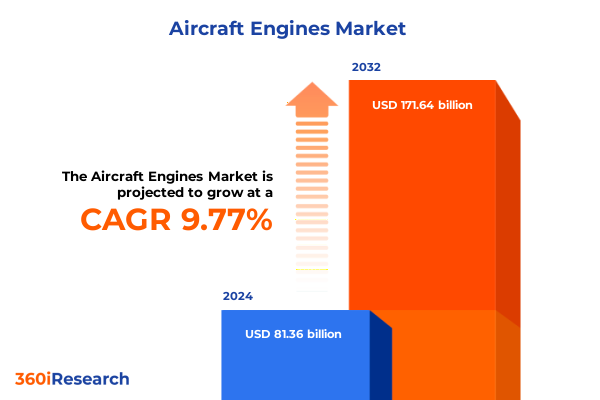

The Aircraft Engines Market size was estimated at USD 88.96 billion in 2025 and expected to reach USD 97.37 billion in 2026, at a CAGR of 9.84% to reach USD 171.64 billion by 2032.

Forging the Future of Aircraft Propulsion Through Innovation, Compliance, and Sustainability Strategies That Define the Industry’s Competitive Edge

The evolution of aircraft propulsion represents one of the most critical vectors defining the broader aerospace ecosystem. Modern air travel and defense capabilities are underpinned by continual advances in engine performance, reliability, and sustainability, forming the backbone of an industry that demands precision at every stage. The rising emphasis on environmental stewardship, coupled with stringent safety and efficiency benchmarks, has accelerated the push for innovative materials and architectures. Against this backdrop, stakeholders ranging from original equipment manufacturers to maintenance providers must align their strategic priorities with emerging regulatory frameworks and market expectations.

Transitioning from legacy systems to next-generation solutions requires a clear understanding of the complex interplay between technological breakthroughs, supply chain resilience, and workforce readiness. As consumer and governmental pressures intersect, companies that approach development holistically-integrating digitalization and sustainability at the outset-are best positioned to capture premium market segments. This introductory overview lays the foundation for an in-depth examination of the industry’s transformative shifts, the implications of new trade policies, and the nuanced segmentation driving competitive differentiation.

Navigating Disruptive Technological Innovations, Regulatory Overhauls, and Strategic Alliances That Are Reshaping Engine Design and Industry Dynamics

The landscape of aircraft engines is being reshaped by a confluence of disruptive technologies, regulatory overhauls, and strategic partnerships that collectively redefine competitive priorities. Additive manufacturing for critical components has moved from experimental to operational phases, yielding lighter, more durable parts while compressing production cycles. Simultaneously, digital twin ecosystems enable real-time monitoring and predictive maintenance, ushering in a paradigm shift for aftermarket services. Environmental regulations, including carbon offsetting schemes and emissions caps, have prompted engine developers to explore alternative fuels and hybrid propulsion architectures more aggressively than ever.

Moreover, alliance models between legacy manufacturers, technology start-ups, and research institutes drive a holistic approach to risk and innovation management. Joint ventures focused on adaptive cycle engines exemplify how shared investment and cross-disciplinary expertise can accelerate time to market. Across all fronts, these transformative shifts underscore the necessity of agile corporate structures and robust collaboration networks, setting the stage for an industry that is simultaneously more interconnected and more competitive.

Evaluating the Multifaceted Consequences of New United States Import Tariffs on Supply Chains, Pricing Strategies, and International Partnerships

In 2025, the United States implemented new tariff measures targeting imported engine components and assemblies, marking a watershed moment for global supply chains. Manufacturers accustomed to sourcing high-precision parts from established overseas suppliers have been compelled to reevaluate vendor relationships and cost management strategies. Tariff-induced price adjustments have rippled through contractual negotiations with airlines and defense agencies, occasionally prompting deferral of retrofit programs in favor of short-term budgetary relief.

Amid rising trade tensions, several engine producers have explored nearshoring critical operations to mitigate exposure to sudden tariff escalations. This shift, however, has required significant capital outlays and time to establish compliant manufacturing lines domestically. Meanwhile, long-standing partnerships in Asia and Europe have adapted via tariff-indemnified service agreements, absorbing portions of extra costs while preserving operational continuity. The cumulative effect has been a recalibration of global procurement strategies, with firms seeking a balanced portfolio of local and international suppliers to maintain both cost efficiency and resilience.

Uncovering Distinct Market Dynamics Across Engine Configurations, Aircraft Classifications, Propulsion Technologies, and Distribution Channels

Engine type remains a cornerstone of competitive differentiation, as each configuration presents unique value propositions. Piston engines continue to serve niche markets in light general aviation, appreciated for their established track record and low entry cost, while turbofan technology dominates commercial aviation by offering a blend of thrust, fuel economy, and reliability. Turboprops fill regional connectivity gaps with efficient short-haul operations, and turboshaft engines power rotary-wing platforms where power-to-weight considerations are paramount.

Segmentation by aircraft type reveals further complexity. Fixed-wing platforms divide into high-volume commercial airliners, versatile general-aviation craft, and mission-critical military applications, each demanding tailored engine performance profiles and life-cycle support. Rotary-wing assets bifurcate into commercial helicopters for offshore and urban transport roles and their military counterparts, where robustness under extreme conditions is essential.

Technological choices represent another axis of differentiation. Conventional engine architectures continue to advance through materials science and aerodynamic optimizations, while hybrid propulsion systems promise transitional pathways toward fully electric flight. Balancing the maturity of conventional powerplants with the disruptive potential of hybrid systems is a central strategic challenge for all stakeholders.

Finally, distribution channel analysis underscores the strategic interplay between aftermarket services and original equipment provision. Aftermarket operations have become a significant enabler of revenue stability, leveraging predictive analytics and modular overhauls to extend engine life. Conversely, original equipment manufacturers focus on integrated offerings that bundle engine sales with long-term maintenance contracts, thus locking in customer loyalty through end-to-end support models.

This comprehensive research report categorizes the Aircraft Engines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Type

- Aircraft Type

- Technology

- Distribution Channel

Analyzing Regional Variations in Demand, Technological Adoption, and Regulatory Environments Across Major Global Aviation Markets

Regional dynamics in the Americas are shaped by the United States’ dual role as a leading developer and consumer of advanced propulsion systems. The robust commercial aviation sector continues to drive demand for high-bypass turbofan upgrades and retrofit kits, while defense modernization programs sustain turbofan and turboshaft orders under long-term contracts. Latin American markets, though smaller, are witnessing renewed interest in turboprop technology for regional connectivity, supported by government incentives for fleet modernization.

In Europe, Middle East & Africa, regulatory focus on emissions reduction has catalyzed investment in both conventional efficiency enhancements and exploratory hybrid propulsion programs. The Middle East, buoyed by sovereign wealth funding, has emerged as an incubator for new engine ventures and joint research centers. Conversely, African markets remain predominantly reliant on legacy piston and turboprop platforms, with infrastructure and training gaps limiting large-scale technology adoption.

The Asia-Pacific region continues to register the fastest pace of fleet renewal, propelled by expanding low-cost carrier networks and military modernization drives. China and India prioritize indigenization initiatives, encouraging local production of conventional engines even as they partner with global majors on next-generation turbofan designs. Meanwhile, Australia focuses on comprehensive MRO capabilities to support both fixed-wing and rotary-wing assets across vast operational theaters.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Engines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Collaborative Ventures, and Innovation Roadmaps of Leading Engine Manufacturers Driving Market Competitiveness

Leading engine manufacturers are accelerating roadmaps that integrate digital services and sustainable initiatives into their core propositions. One global player has committed to leveraging data-driven maintenance platforms that reduce unplanned downtime by predicting component wear with unprecedented precision. Another market leader has formalized partnerships with biofuel producers to certify engines for blended sustainable aviation fuels, positioning itself at the forefront of decarbonization efforts.

Collaborative ventures have also become key to technology advancement and risk sharing. A recent alliance between established OEMs and aerospace software specialists has yielded an open architecture for digital twins, enabling cross-fleet analytics and unified performance monitoring. At the same time, strategic acquisitions of boutique firms specializing in additive manufacturing have fortified certain manufacturers’ ability to produce complex geometries at scale. These initiatives underscore a shift towards integrated solutions that span from design and production to in-field support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Engines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aero Engine Corporation of China

- BRP-Rotax GmbH & Co KG

- CFM International

- Continental Aerospace Technologies, Inc.

- General Electric Company

- GKN Aerospace Services Limited

- Hanwha Corporation

- Honda Motor Co., Ltd.

- Honeywell International Inc.

- IHI Corporation

- Industria de Turbo Propulsores, S.A.

- International Aero Engines AG

- Kawasaki Heavy Industries, Ltd.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- MOTOR SICH JSC

- MTU Aero Engines AG

- PBS Group, a. s.

- Rolls-Royce plc

- RTX Corporation

- Safran S.A.

- Textron Inc.

- The State Corporation Rostec

- Williams International Co., L.L.C.

- ZeroAvia, Inc.

Empowering Industry Leaders with Targeted Strategies for Technological Integration, Supply Chain Resilience, and Regulatory Compliance in the Evolving Aviation Ecosystem

Industry leaders should prioritize the establishment of resilient, diversified supply chains to weather future trade policy shifts. Proactive investment in digital twin environments not only enhances predictive maintenance but also accelerates certification cycles for new engine variants. Companies are advised to leverage government funding streams dedicated to sustainable aviation research, thereby offsetting development costs and signaling environmental leadership to key stakeholders.

Furthermore, strengthening aftermarket service portfolios through long-term performance-based contracts can create stable revenue streams and reinforce customer relationships. Strategic collaborations with universities and research centers can guide roadmap decisions for hybrid propulsion, ensuring that pilot programs align with operational realities. Finally, agile regulatory compliance frameworks will enable rapid adaptation to evolving emissions standards, mitigating the risk of costly retrofit mandates and reputational damage.

Outlining Rigorous Data Collection, Expert Consultations, and Analytical Frameworks That Ensure Comprehensive and Reliable Market Intelligence

This analysis is grounded in a multi-tiered approach combining primary interviews with senior executives, engineers, and regulatory experts across major OEMs, suppliers, and airlines. Secondary data was sourced from technical white papers, government trade records, patent databases, and industry journals, ensuring a comprehensive view of technological advancements and policy developments. A rigorous triangulation process compared qualitative insights with quantitative trade flow data, verifying consistency across all inputs.

Expert consultations helped refine key assumptions around cost drivers and adoption timelines, while scenario analysis explored the impacts of varying tariff levels and regulatory scenarios. Segmentation matrices and regional breakdowns were constructed to reveal granular dynamics, and all findings underwent peer review by an independent panel of aerospace specialists. This methodological framework guarantees that the insights presented are both robust and directly relevant to strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Engines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Engines Market, by Engine Type

- Aircraft Engines Market, by Aircraft Type

- Aircraft Engines Market, by Technology

- Aircraft Engines Market, by Distribution Channel

- Aircraft Engines Market, by Region

- Aircraft Engines Market, by Group

- Aircraft Engines Market, by Country

- United States Aircraft Engines Market

- China Aircraft Engines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Distilling Key Insights and Strategic Imperatives That Will Propel Future Innovations and Sustained Growth in the Global Aircraft Engine Market

In sum, the converging forces of technological innovation, evolving trade policies, and differentiated regional growth trajectories are rapidly redefining competitive parameters within the aircraft engines sector. Stakeholders who integrate digital and sustainability considerations into their development strategies will unlock operational efficiencies and establish durable market positions. The interplay between conventional and hybrid technologies highlights an inflection point: companies that navigate this transition with foresight will secure long-term advantages.

Looking ahead, partnerships that bridge legacy expertise with emerging digital capabilities will shape the next generation of propulsion systems. As industry leaders adapt to regulatory and tariff headwinds, a customer-centric service model-anchored by predictive maintenance and performance-based agreements-will become increasingly vital. Ultimately, the strategic imperatives distilled here serve as a blueprint for sustained innovation and resilience in a highly dynamic global environment.

Seize the Opportunity to Gain Competitive Intelligence and Drive Strategic Decisions by Securing This Comprehensive Aircraft Engine Market Research Report

Engage with Ketan Rohom, who as Associate Director, Sales & Marketing, brings unparalleled insight into the intricacies of the aircraft engine sector. His expertise spans decades of driving strategic initiatives and guiding clients through complex procurement processes. By reaching out to him, you will gain tailored guidance on how this research can address your specific challenges and objectives. Partnering with his team ensures you receive a seamless experience from in-depth briefings to expedited access to proprietary data. Secure your competitive advantage today by initiating a conversation that will illuminate critical insights and empower your next strategic move.

- How big is the Aircraft Engines Market?

- What is the Aircraft Engines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?