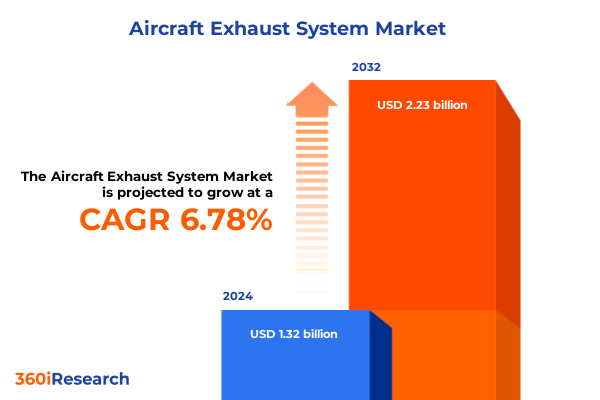

The Aircraft Exhaust System Market size was estimated at USD 1.40 billion in 2025 and expected to reach USD 1.50 billion in 2026, at a CAGR of 6.78% to reach USD 2.23 billion by 2032.

Setting the Stage for Aircraft Exhaust System Innovations Amid Evolving Environmental Regulations and Rapid Technological Advancements

Aircraft exhaust systems have become a focal point for innovation and regulatory scrutiny as global aviation stakeholders strive to reduce environmental impact and enhance performance. This introduction lays the groundwork by highlighting the dual imperatives of emissions reduction and propulsion efficiency that define the contemporary aerospace agenda. In recent years, policymakers and certification authorities have tightened emissions thresholds, while original equipment manufacturers have pursued materials and design breakthroughs to meet these stricter standards without sacrificing safety or reliability. Consequently, engineers and supply chain managers are collaborating more closely than ever to integrate advanced coatings, high-performance alloys, and novel manufacturing processes into exhaust assemblies.

This examination also underscores the critical role of exhaust diffusers, exhaust gas recirculation systems, exhaust manifolds, nozzles, and piping in balancing thermal management, noise attenuation, and structural integrity. Each component must be optimized not only for its individual performance characteristics but also for systemic integration with turbines, afterburners, and auxiliary power units. As the industry pivots toward hybrid-electric and fully electric propulsion, the traditional requirements for thermal robustness and weight minimization are evolving, prompting design teams to rethink airflow dynamics and material selection. By exploring these foundational themes, readers will appreciate the complex interplay between regulation, technology, and operational demands that shapes the aircraft exhaust system landscape.

Exploring Transformational Shifts in the Aircraft Exhaust System Landscape Driven by Sustainability Goals and Digital Engineering Solutions

The aircraft exhaust system market is undergoing a seismic transformation driven by sustainability objectives, digital engineering tools, and heightened performance expectations. Environmental mandates have accelerated the adoption of low-emissivity ceramic coatings and optimized recirculation pathways, while additive manufacturing techniques now enable the production of complex, topology-optimized components that were previously unattainable through conventional casting or forging. Moreover, the integration of digital twins and advanced computational fluid dynamics has empowered engineers to simulate thermal and acoustic performance at unprecedented levels of fidelity, enabling rapid iteration and risk mitigation prior to physical prototyping.

In addition to technological convergence, the shift toward predictive maintenance models has redefined aftermarket service agreements. By embedding sensor networks and leveraging machine learning algorithms, operators can now forecast component wear and schedule overhauls based on actual usage patterns rather than predetermined intervals. This proactive approach not only reduces unscheduled downtime but also extends service life and minimizes total cost of ownership. Equally important, greater collaboration between propulsion system manufacturers and Tier 1 suppliers has emerged, fostering end-to-end lifecycle management strategies that prioritize modularity and ease of refurbishment. Those strategic realignments are redefining competitive boundaries and setting new benchmarks for reliability and sustainability within the aerospace ecosystem.

Assessing the Cumulative Impacts of 2025 United States Tariff Measures on Aircraft Exhaust System Supply Chains and Cost Structures

United States tariff measures enacted in 2025 have exerted significant pressure on the cost structures and supply chain architectures of the aircraft exhaust system sector. By imposing duties on key raw materials such as nickel alloy powders, titanium forgings, and certain ceramic precursors, these policies have prompted manufacturers to reassess their sourcing strategies. In response, many firms have accelerated efforts to relocate production to domestic facilities or diversified into alternative suppliers in allied geographies. While the immediate effect was an uptick in input costs, the longer-term impact has been a renewed emphasis on vertically integrated operations and strategic stockpiling of critical materials to insulate against future policy shifts.

Moreover, these tariff-induced dynamics have catalyzed a reconfiguration of supplier relationships. Engines originally imported under preferential trade agreements now face duty burdens, encouraging OEMs to negotiate long-term contracts with U.S.-based Tier 2 and Tier 3 producers. At the same time, the aftermarket segment has adapted by redefining overhaul and replacement protocols; the increased cost of imported components has spurred growth in refurbishment services and remanufacturing processes. In parallel, regulatory uncertainty surrounding tariffs has underscored the importance of scenario planning and risk management, compelling procurement teams to develop flexible frameworks capable of rapidly adjusting to policy changes. Ultimately, these cumulative tariff impacts have reshaped cost equations and supply chain resilience within the American aerospace supply base.

Unlocking Critical Product, Material, Aircraft, and Distribution Channel Insights to Navigate Complex Segmentation Dynamics

A nuanced understanding of product and material segmentation is pivotal for identifying high-value opportunities within the aircraft exhaust system market. By examining components such as diffusers, gas recirculation systems, manifolds, nozzles, and pipes, stakeholders can pinpoint areas where aerodynamic optimization or thermal management innovations deliver the greatest performance gains. For instance, the intricate geometry of nozzles necessitates specialized manufacturing techniques, creating a distinct value proposition compared to more standardized piping solutions. Similarly, exhaust diffusers demand precision-engineered designs to balance pressure recovery with structural rigidity without introducing prohibitive weight penalties.

Equally significant, material type segmentation reveals divergent investment trajectories for ceramic coatings, nickel alloys, stainless steel, and titanium. Ceramic-based layers continue to gain traction as regulatory frameworks tighten emission limits, while high-temperature nickel alloys remain indispensable for core duct sections exposed to extreme thermal loads. Stainless steel, prized for its cost-effectiveness and weldability, retains a key role in midstream exhaust manifolding, whereas titanium’s superior strength-to-weight ratio makes it the material of choice for sections where weight savings directly translate into fuel efficiency.

Aircraft type segmentation further refines market perspectives by distinguishing between business jets, commercial airliners, and military platforms. Within the business jet category, heavy, mid-size, and light jets each engage with unique performance criteria, from thrust modulation to cabin noise control. Commercial applications span narrow-body, regional, and wide-body aircraft, each requiring tailored exhaust iterations to align with engine cycles and operational profiles. Meanwhile, military platforms, including fighter jets, helicopters, and transport aircraft, impose exacting standards for signature reduction, survivability, and stealth compatibility.

Finally, distribution channel segmentation underscores the diverging priorities of OEM and aftermarket avenues. Original equipment demands stringent qualification processes, comprehensive lifecycle support, and integrated design collaboration. In contrast, aftermarket services center on overhaul and replacement dynamics, with an emphasis on rapid turnarounds, cost containment, and performance restoration. These segmentation insights collectively elucidate where innovation, investment, and strategic alliances converge to redefine the competitive landscape.

This comprehensive research report categorizes the Aircraft Exhaust System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Material Type

- Aircraft Type

- Distribution Channel

Highlighting Distinct Growth Drivers and Challenges Across Americas, Europe Middle East and Africa, and Asia-Pacific Aviation Sectors

Regional dynamics play an instrumental role in shaping aircraft exhaust system strategies, as variation in regulatory frameworks, infrastructure development, and fleet compositions influences both demand and innovation pathways. In the Americas, a robust defense spending trajectory and an expansive aftermarket ecosystem foster opportunities for specialized military exhaust assemblies and performance-driven aftermarket retrofits. Meanwhile, the United States Environmental Protection Agency’s evolving emissions mandates continue to drive material upgrades and system enhancements that improve fuel efficiency across business and commercial aviation segments.

Conversely, Europe, the Middle East, and Africa present a mosaic of regulatory stringency and growth prospects. The European Union’s stringent CO₂ emissions trading schemes and noise abatement policies have accelerated the deployment of low-emission ceramic coatings and advanced recirculation designs. In the Gulf region, significant fleet expansion plans, buoyed by rising passenger traffic, stimulate demand for narrow-body and wide-body exhaust solutions tailored to both new aircraft deliveries and extensive retrofit programs. Across Africa, emerging carriers with lean maintenance budgets seek cost-effective stainless steel and nickel alloy assemblies, often supported by collaborative programs between OEMs and regional service providers.

Asia-Pacific stands out for its rapid expansion in both commercial and business jet segments, with burgeoning markets in China, India, and Southeast Asia driving OEM partnerships and local content requirements. Chinese airframers are increasingly investing in domestic exhaust manifold production, leveraging joint ventures to transfer expertise in additive manufacturing and high-performance alloys. In India, government initiatives to modernize the military fleet have spurred upgrades to helicopter and transport aircraft exhaust subsystems. Furthermore, the region’s aftermarket demand is buoyed by a growing base of low-cost carriers and private operators seeking overhaul and replacement services that align with their aggressive operational tempos.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Exhaust System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Aircraft Exhaust System Providers and Strategic Partnerships Shaping Competitive Dynamics and Innovation Trajectories

Leading companies in the aircraft exhaust system space are differentiating themselves through strategic partnerships, targeted R&D investments, and capacity expansions that match evolving industry requirements. A prominent propulsion and aerospace conglomerate has fortified its position by integrating advanced ceramic coating facilities with its core engine manufacturing lines, thereby streamlining qualification protocols and reducing lead times. Another global technology provider, renowned for fluid conveyance solutions, has pursued multiple acquisitions of boutique titanium fabricators, enhancing its ability to deliver lightweight nozzle and diffuser assemblies for premium business jets.

Meanwhile, a specialist in high-temperature nickel alloys has entered into collaborative agreements with engine OEMs to co-develop next-generation gas recirculation systems that meet forthcoming regulatory standards. A European veteran in aircraft interiors and systems has extended its portfolio through a joint venture with a defense supplier, targeting military-grade manifolds optimized for signature reduction. Additional market participants are strengthening aftermarket service capabilities by establishing networked overhaul centers capable of handling both metal reclamation and ceramic recoating processes under one roof.

These strategic maneuvers reflect a broader trend toward convergence between component manufacturers and full-service maintenance, repair, and overhaul providers. By aligning product roadmaps with end-user maintenance cycles, leading firms are not only deepening customer engagement but also generating recurring revenue streams. Furthermore, collaborative R&D platforms supported by academic-industry consortia are accelerating the translation of advanced materials research into scalable manufacturing methods, ensuring that innovation pipelines remain robust and responsive to emerging flight profiles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Exhaust System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CFM International

- General Electric Company

- GKN Aerospace Services Limited

- IHI Corporation

- Kawasaki Heavy Industries, Ltd.

- Magellan Aerospace

- Middleton Sheet Metal Co. Ltd

- MTU Aero Engines AG

- Parker-Hannifin Corporation

- Raytheon Technologies Corporation

- Rolls-Royce plc

- Safran S.A.

Formulating Actionable Strategies for Industry Leaders to Enhance Efficiency, Strengthen Supply Chains, and Capitalize on Emerging Trends

To thrive in a market defined by rapid technological evolution and regulatory flux, industry leaders must adopt a multipronged strategic approach centered on resilience and innovation. First, organizations should prioritize investments in lightweight, high-temperature materials research, fostering in-house capabilities or partnerships with specialized alloy and coating developers. By cultivating this expertise, firms can reduce dependency on high-cost imports and secure intellectual property that underpins differentiated product offerings.

In parallel, establishing a resilient, multi-tier supply chain is imperative. Companies must map critical material flows, assess geopolitical risks, and implement dual-source architectures that can swiftly pivot in response to tariff changes or logistical disruptions. Embedding advanced analytics within procurement processes will enable real-time visibility into inventory levels and vendor performance, thereby streamlining decision-making and minimizing potential bottlenecks.

Another cornerstone of competitive advantage lies in embracing digital twins and predictive maintenance frameworks. By integrating sensor data from exhaust assemblies with cloud-based analytics, operators can forecast wear patterns, optimize maintenance schedules, and extend component lifecycles. This data-driven service model not only enhances operational uptime but also informs iterative design improvements that feed back into R&D investments.

Finally, cultivating strategic alliances across the value chain is critical for co-innovating next-generation exhaust solutions. Whether through joint ventures with aircraft OEMs or consortium-based research initiatives, collaborative ventures can pool resources and share technical risk. By aligning commercial incentives and establishing clear governance structures, these partnerships will facilitate the rapid commercialization of breakthrough technologies and reinforce a culture of continuous improvement.

Detailing Robust Research Methodology Emphasizing Data Triangulation, Expert Interviews, and Rigorous Validation Processes for Comprehensive Insights

This research leverages a comprehensive methodology that synthesizes both primary and secondary data sources to ensure accuracy and depth of insight. Initially, an exhaustive review of regulatory documents, patent filings, and technical journals provided a structured framework for understanding the latest material science and design innovations. Industry white papers, conference proceedings, and technical standards from aerospace authorities were systematically analyzed to map technological trajectories and certification pathways.

To validate these findings, over twenty expert interviews were conducted with engineers, supply chain executives, and regulatory specialists across leading aerospace corporations and Tier 1 suppliers. These one-on-one discussions yielded qualitative insights into real-world implementation challenges, procurement strategies, and aftermarket service models. Additionally, a series of executive surveys captured quantitative assessments of segment priorities, investment horizons, and regional growth expectations.

Analytical rigor was maintained through data triangulation techniques, whereby insights from interviews and surveys were cross-referenced against publicly available financial disclosures, company press releases, and academic research. This iterative process ensured that key conclusions were substantiated by multiple evidence streams. Finally, the research underwent an internal peer review led by seasoned aerospace analysts and was presented to an external advisory panel for additional critique, further bolstering the credibility and relevance of the final report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Exhaust System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Exhaust System Market, by Product

- Aircraft Exhaust System Market, by Material Type

- Aircraft Exhaust System Market, by Aircraft Type

- Aircraft Exhaust System Market, by Distribution Channel

- Aircraft Exhaust System Market, by Region

- Aircraft Exhaust System Market, by Group

- Aircraft Exhaust System Market, by Country

- United States Aircraft Exhaust System Market

- China Aircraft Exhaust System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing Clear Conclusions That Synthesize Key Insights Across Technological Advancements, Regulatory Impacts, and Industry Best Practices

The synthesis of technological, regulatory, and commercial insights underscores a vibrant yet complex aircraft exhaust system market poised for continued evolution. Advanced materials such as ceramic coatings and nickel alloys are cemented as critical enablers for meeting stringent emissions and performance benchmarks, while additive manufacturing and digital twin simulations are redefining the boundaries of component design. Tariffs introduced in 2025 have catalyzed supply chain reassessment, prompting an increased focus on domestic sourcing and risk mitigation frameworks that bolster long-term resilience.

Segmentation analysis reveals nuanced opportunities across product types, material selections, aircraft categories, and distribution channels. Businesses targeting high-performance niches benefit from specialized manufacturing capabilities, whereas the aftermarket ecosystem is evolving to accommodate predictive maintenance models that optimize lifecycle costs. Regionally, the Americas, EMEA, and Asia-Pacific each present distinct regulatory landscapes and demand drivers, requiring tailored go-to-market strategies and partnership alignments.

Leading companies are forging strategic alliances, pursuing targeted acquisitions, and scaling R&D investments to maintain competitive momentum. Their efforts highlight the growing convergence between component manufacturing and full-service MRO solutions, a trend that promises to reshape customer relationships and revenue paradigms. By adopting data-driven service models and resilient supply chain architectures, industry leaders can not only navigate current challenges but also capitalize on the next wave of innovation.

In conclusion, the aircraft exhaust system sector stands at an inflection point, where technology, policy, and market dynamics converge to create unprecedented opportunities. Stakeholders who embrace collaborative R&D, invest in advanced materials, and proactively manage regulatory uncertainties will be best positioned to drive sustainable growth and deliver the performance enhancements demanded by the aerospace industry’s next generation of aircraft.

Encouraging Prompt Engagement with Ketan Rohom to Secure Exclusive Aircraft Exhaust System Market Intelligence for Strategic Decision-Making

Don’t let evolving regulations and competitive pressures leave your organization behind. Connect with Ketan Rohom to gain unparalleled access to in-depth analysis, expert validation, and strategic recommendations tailored to the aircraft exhaust system market. By engaging directly, you’ll unlock proprietary insights on supply chain resilience, material innovation, and segment-specific opportunities that can propel your decision-making and give you a competitive edge. Reach out today to secure your copy of the full market research report and empower your team with the critical intelligence required to navigate complex industry dynamics and accelerate growth ambitions.

- How big is the Aircraft Exhaust System Market?

- What is the Aircraft Exhaust System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?