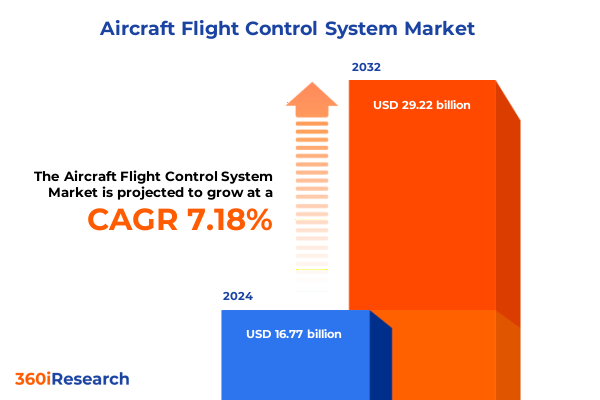

The Aircraft Flight Control System Market size was estimated at USD 16.77 billion in 2024 and expected to reach USD 17.94 billion in 2025, at a CAGR of 7.18% to reach USD 29.22 billion by 2032.

Exploring the Strategic Importance of Modern Flight Control Architectures in Enhancing Aircraft Maneuverability, Reliability, and Operational Efficiency

Modern aviation demands ever-greater precision, reliability, and safety, and at the heart of this imperative lies the flight control system architecture. These integrated networks of sensors, actuators, computers, firmware, and algorithms serve as the critical nexus between pilot intent, aircraft performance, and automated guidance. With an increasing emphasis on digital fly-by-wire and autonomous operations, the strategic importance of robust flight control frameworks has soared. This executive summary offers a holistic overview of the current landscape, highlighting key technological inflection points, tariff-driven supply chain dynamics, and segmentation insights that will inform strategic planning across OEM, aftermarket, defense, and airline sectors.

In addition to presenting transformative market shifts, this report synthesizes the cumulative impact of United States tariff policies enacted in 2025 and examines their ripple effects across global sourcing, manufacturing costs, and competitive positioning. Through detailed analysis of component-level innovations, platform-specific adoption patterns, and regional regulatory environments, readers will uncover actionable intelligence tailored to support data-driven decision-making. Whether your focus centers on hardware integrations, software enhancements, or end-user operational strategies, this introduction sets the context for a nuanced exploration of the flight control system domain.

Analyzing How Digitalization, Artificial Intelligence, and Predictive Analytics Are Transforming Flight Control Systems Across Modern Aviation Operations

The flight control system landscape has undergone a profound transformation, driven by accelerated digitalization, artificial intelligence, and predictive analytics. No longer confined to mechanical linkages and purely analog controls, modern systems leverage high-fidelity sensors, adaptive control laws, and real-time data integration to optimize performance under varied flight regimes. Moreover, the adoption of model-based systems engineering has streamlined certification pathways, enabling faster iteration cycles while maintaining compliance with stringent safety standards.

Simultaneously, the rise of autonomous and remotely piloted platforms has spurred the development of advanced fault-tolerant architectures that can dynamically reconfigure control loops in response to component anomalies. These shifts have been complemented by the integration of digital twins for virtual validation, which offer comprehensive simulation environments for stress testing control algorithms before deployment. As a result, collaboration between software developers, hardware suppliers, and regulatory bodies has intensified, fostering an ecosystem oriented toward continuous improvement. Consequently, vendors are increasingly prioritizing modular, open-architecture solutions that can be tailored across fixed wing, rotary wing, and unmanned aerial vehicle applications.

Evaluating the Cumulative Effects of 2025 United States Tariffs on Aircraft Flight Control System Supply Chains, Manufacturing Costs, and Global Competitiveness

The introduction of new United States tariffs in 2025 has introduced complex dynamics into the cost structure and supply chain configuration of flight control systems. By imposing levies on key subcomponents such as actuators, avionics sensors, and flight control computers, these measures have elevated landed costs and compelled manufacturers to reassess global sourcing strategies. Consequently, many industry participants have been prompted to explore near-shoring and regional manufacturing partnerships to mitigate the impact of increased duties.

Moreover, the ripple effect extends to software development and firmware licensing, as the interdependence between software providers and hardware OEMs necessitates recalibrated contract structures and pricing models. Additionally, regulatory agencies have responded by expediting evaluation processes for domestically produced components in order to bolster supply chain resilience. As a result, collaborative consortia have emerged, bringing together defense branches, airlines, and tier-one suppliers to share best practices and co-invest in tariff-resilient architectures. Thus, the cumulative impact of the 2025 tariffs serves as a catalyst for more agile procurement frameworks and diversified partnership networks.

Uncovering Critical Market Segmentation Drivers Across Component Types, Platform Variants, Aircraft Categories, Sales Channels, and End User Dynamics

Delving into the market through a multifaceted lens reveals distinct drivers within each segmentation axis, which collectively shape innovation pathways and procurement priorities. In the realm of component type, firmware and software advancements in control laws and flight management software are increasingly matched by hardware evolutions in actuators, avionics sensors, and flight control computers, creating layered opportunities for system integrators. Concurrently, platform diversity spanning fixed wing, rotary wing, and unmanned aerial vehicle configurations has led to specialized control architectures designed to meet the unique aerodynamic and operational demands of each platform.

In parallel, the segmentation by aircraft type underscores how business jets emphasize rapid system upgrades for performance enhancements, commercial aircraft demand scalability and redundancy for high-utilization fleets, and military aircraft require ruggedized, secure control channels for mission-critical operations. Looking through the lens of sales channel, the distinction between aftermarket and original equipment manufacturer engagements has sharpened, with aftermarket providers focusing on retrofit opportunities and OEMs embedding controls within new airframes. Finally, end-user dynamics differentiate airlines-where full service carriers look for comprehensive system support and low cost operators seek cost-efficient, modular solutions-from defense entities such as the air force, army aviation units, and navy aviation branches, each of which pursue tailored specifications for resilience, interoperability, and mission adaptability.

This comprehensive research report categorizes the Aircraft Flight Control System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Component

- Platform

- Fitment

- Actuation Technology

- Application

- End User

- Sales Channel

Examining Regional Variations in Flight Control System Adoption and Regulatory Environments Across the Americas, Europe Middle East Africa, and Asia Pacific

A regional examination highlights divergent adoption curves and regulatory environments that influence flight control system strategies around the globe. In the Americas, established aerospace hubs in North America continue to lead in digital fly-by-wire innovation, supported by extensive infrastructure, R&D incentives, and a mature supply base. Latin American markets, meanwhile, are gradually expanding retrofit programs to enhance fleet safety and efficiency, driven by partnerships with established vendors.

Across Europe, the Middle East, and Africa, harmonization under European safety authorities and significant investments in Gulf nations have accelerated the introduction of advanced control architectures in both civil and defense sectors. African nations are also demonstrating increased interest in UAV applications for surveillance and logistics, creating nascent opportunities for system integrators. Meanwhile, the Asia-Pacific region is experiencing robust growth, propelled by commercial airline expansion in Southeast Asia, defense modernization initiatives in East Asia, and burgeoning UAV deployments for agricultural and infrastructure monitoring. Consequently, each region presents a distinct matrix of regulatory frameworks, investment priorities, and innovation partnerships that participants must navigate.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Flight Control System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Initiatives, Technological Partnerships, and Competitive Positioning Among Leading Flight Control System Manufacturers

Leading stakeholders in the flight control system domain are forging strategic alliances, acquiring niche software providers, and investing in digital capabilities to solidify their competitive edge. Notable industry names have expanded their portfolios through targeted acquisitions of sensor and actuator specialists, while also deepening collaborations with avionics integrators to co-develop next-generation platforms. Furthermore, partnerships with technology startups are enabling the rapid integration of machine learning-driven predictive maintenance modules, enhancing system uptime and reducing life-cycle costs.

In addition to horizontal integrations, major manufacturers are leveraging their global footprints to establish center-of-excellence facilities that facilitate cross-disciplinary R&D in control laws, cybersecurity, and human-machine interface advancements. These initiatives are complemented by close engagements with regulatory bodies to align certification pathways and expedite time-to-market for novel architectures. As a result, both incumbents and emerging players are prioritizing interoperability and software-defined controls to capture opportunities across fixed wing, rotary wing, and unmanned aerial segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Flight Control System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- AMAZILIA AEROSPACE GMBH

- Astronics Corporation

- BAE Systems PLC

- Curtiss-Wright Corporation

- Daedalean AG

- Dassault Aviation SA

- Eaton Corporation PLC

- Elbit Systems Ltd.

- Garmin Ltd.

- General Dynamics Mission Systems Inc.

- General Electric Company

- Honeywell International Inc.

- Leonardo S.p.A.

- Liebherr-International AG

- Lockheed Martin Corporation

- Mecaer Aviation Group, Inc.

- Moog Inc.

- Nabtesco Corporation

- Parker Hannifin Corporation

- RTX Corporation

- Saab AB

- Safran S.A.

- Skyryse, Inc.

- Thales Group

- The Boeing Company

- Woodward, Inc.

Proposing Tactical Roadmaps, Investment Priorities, and Collaborative Strategies to Enhance Flight Control System Innovation, Compliance, and Operational Resilience

Industry decision-makers should consider a series of targeted actions to navigate evolving market dynamics and capitalize on technological advancements. Prioritizing investments in digital twin and virtual validation platforms will enable rapid prototyping of control architectures, reducing certification timelines and improving resilience against hardware anomalies. Simultaneously, diversifying supply chains through regional manufacturing hubs and strategic alliances can offset tariff impacts and strengthen overall continuity.

Moreover, embracing open architecture standards and collaborating with niche software incubators will accelerate the integration of artificial intelligence and predictive analytics into control loops, unlocking new levels of performance optimization. Aligning product roadmaps with emerging regulatory frameworks and sustainability mandates will ensure long-term compliance and environmental stewardship. By integrating these initiatives into a cohesive roadmap, industry leaders can reinforce their market positioning, mitigate risks, and drive sustained innovation across the flight control system ecosystem.

Detailing the Rigorous Research Methodology Combining Quantitative Analysis, Primary Interviews, and Secondary Source Validation to Ensure Data Integrity

The research underpinning this analysis integrates a rigorous methodology that blends quantitative data evaluation with qualitative primary engagements and comprehensive secondary validation. Initially, extensive interviews were conducted with engineering leaders at OEMs, tier-one suppliers, regulatory agency representatives, and system integrators to capture firsthand insights into technological priorities and procurement challenges. These exchanges were augmented by a detailed review of patent filings, technical conference proceedings, and certification documentation to map the trajectory of control system innovations.

Quantitative analysis was applied to publicly accessible financial reports, trade statistics, and component shipment data to identify macro-level trends and regional adoption patterns. Secondary sources-including regulatory guidance publications, white papers from industry associations, and academic journals-provided context for benchmarking best practices in safety, reliability, and human-machine interface design. Finally, an expert validation panel comprising veteran aerospace engineers and policy advisors reviewed the findings to ensure accuracy, relevance, and strategic alignment with current and anticipated market shifts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Flight Control System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Flight Control System Market, by System Type

- Aircraft Flight Control System Market, by Component

- Aircraft Flight Control System Market, by Platform

- Aircraft Flight Control System Market, by Fitment

- Aircraft Flight Control System Market, by Actuation Technology

- Aircraft Flight Control System Market, by Application

- Aircraft Flight Control System Market, by End User

- Aircraft Flight Control System Market, by Sales Channel

- Aircraft Flight Control System Market, by Region

- Aircraft Flight Control System Market, by Group

- Aircraft Flight Control System Market, by Country

- United States Aircraft Flight Control System Market

- China Aircraft Flight Control System Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Synthesizing Key Market Learnings and Strategic Imperatives Underpinning the Future Trajectory of Aircraft Flight Control Systems in Modern Aviation

In synthesizing the breadth of insights presented, several overarching themes emerge: the convergence of digital and analog disciplines in flight control design, the catalytic role of regulatory and tariff environments in shaping supply chains, and the critical influence of segmentation factors across components, platforms, and end users. Collectively, these dynamics underscore the imperative for agile, data-driven strategies that can respond to rapid technological evolution and geopolitical contingencies.

Strategic investment in open-architecture controls, coupled with robust validation frameworks and regional manufacturing diversification, will be essential for organizations seeking to maintain a leadership position. As the aviation industry continues to embrace automation, autonomy, and predictive maintenance, the ability to integrate software-defined controls with hardware reliability will define the next frontier of performance and safety. Ultimately, the insights detailed herein provide a foundation for informed, proactive decision-making that aligns with both current operational demands and the longer-term vision for flight control system innovation.

Engage with Ketan Rohom to Secure Comprehensive Insights, Customized Briefings, and Strategic Support for Optimizing Flight Control System Decision-Making Today

For a comprehensive understanding of the evolving dynamics in the aircraft flight control system arena and to explore tailored insights that align with your organization’s strategic objectives, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. This engagement will grant you access to customized executive briefings, supplementary data deep dives, and strategic consultations designed to empower your decision-making process.

By liaising directly with Ketan Rohom, you will gain clarity on emerging technological trends, regulatory shifts, and best practices for navigating complex supply chain and tariff environments. Our collaboration model ensures that you receive precise recommendations calibrated to your unique operational context, whether you are seeking to optimize component sourcing strategies, accelerate digital transformation initiatives, or strengthen partnerships across the aviation value chain.

Take the next step toward actionable intelligence and strategic foresight by reaching out to Ketan Rohom to secure your copy of the full market research report. Leverage this opportunity to reinforce your competitive positioning, guide investment priorities, and unlock growth avenues in the rapidly advancing flight control system market.

- How big is the Aircraft Flight Control System Market?

- What is the Aircraft Flight Control System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?