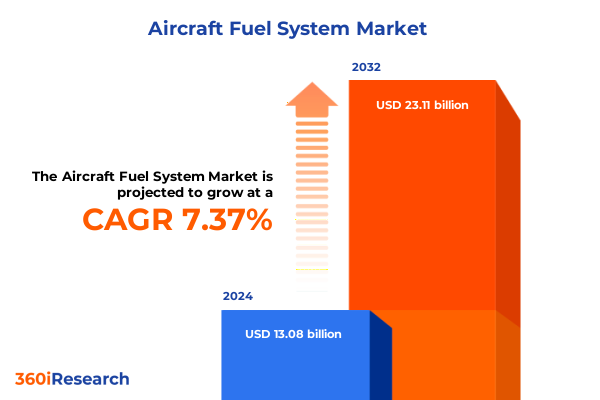

The Aircraft Fuel System Market size was estimated at USD 14.00 billion in 2025 and expected to reach USD 15.00 billion in 2026, at a CAGR of 7.41% to reach USD 23.11 billion by 2032.

Understanding the Critical Role of Aircraft Fuel Systems in Ensuring Operational Efficiency and Safety Amid Global Aviation Dynamics

Aircraft fuel systems serve as the lifeblood of every flight, orchestrating the precise delivery of fuel under demanding conditions to safeguard operational integrity and mission success. From the initial ignition sequence on the runway to the final descent, these systems must reliably manage variable pressures, temperatures, and flow rates without compromising safety or efficiency. As global air traffic expands and environmental mandates intensify, stakeholders across the aerospace value chain are increasingly focused on fuel system robustness, diagnostic capabilities, and adaptability to alternative fuel sources. In response, engineering teams and maintenance operators are continually refining system architectures to balance weight reduction, redundancy protocols, and real-time monitoring.

Exploring How Technological Innovations Regulatory Developments and Sustainability Imperatives Are Reshaping the Aircraft Fuel System Landscape Worldwide

The current landscape of aircraft fuel systems is being fundamentally transformed by converging technological advancements, shifting regulatory requirements, and the widespread commitment to long-term decarbonization goals. Digitalization is a driving force, with embedded sensors and data analytics platforms enabling predictive maintenance and adaptive fuel metering for optimized performance in diverse flight phases. Concurrently, additive manufacturing techniques are empowering designers to produce complex fuel manifold geometries with lighter, more resilient materials, reducing overall system mass without sacrificing reliability. Meanwhile, regulators are tightening standards on fuel tank inerting, leak detection, and certification pathways to accommodate sustainable aviation fuels such as hydrotreated esters and fatty acids. Consequently, industry leaders are forging collaborative ecosystems that integrate OEMs, tier-one suppliers, and technology startups to pilot new architectures that meet both efficiency and environmental benchmarks.

Examining the Multifaceted Impacts of Recent United States Tariff Actions on the Supply Chain Dynamics and Cost Structures in the Aircraft Fuel System Sector

Recent tariff actions implemented by the United States have introduced a new layer of complexity to the supply chain dynamics underpinning aircraft fuel system manufacturing and maintenance. The introduction of additional duties on key raw materials and precision components has prompted procurement teams to reevaluate supplier networks and total landed costs, accelerating the search for alternative domestic and nearshore sources. As a result, some organizations have turned to dual-sourcing strategies that prioritize strategic stockpiling of critical valves, pumps, and filters to buffer against import volatility. In parallel, cross-border collaboration agreements have evolved to include tariff mitigation clauses, enabling original equipment manufacturers and aftermarket service providers to stabilize pricing. Moreover, this shift has intensified dialogue around supply chain transparency, pushing integrators to implement blockchain-enabled traceability platforms that track tariff impacts on each assembly stage from castings to final system integration.

In-Depth Exploration of How Segmentation by Type Component Engine Application and Distribution Drives Innovation in Aircraft Fuel System Solutions

Delineating the market by fuel system type-spanning fuel injected arrangements that optimize precise metering, gravity feed solutions that leverage altitude differentials for simplicity, and pump feed configurations designed for high-pressure turbomachinery-reveals distinct performance trade-offs that inform aircraft design choices. Furthermore, disaggregating by component type such as high-efficiency filters that remove particulate contaminants, reinforced fuel lines engineered for endurance, precision pumps that regulate flow rates, composite tanks that minimize weight, and advanced valves that ensure fail-safe operation highlights where incremental innovation can deliver outsized reliability gains. Insights based on engine type-from piston powerplants that demand consistent low-pressure supply to turbofan, turbojet, and turboprop installations with divergent suction and delivery requirements-underscore how integration with propulsion architectures shapes system complexity. In addition, examining application segments across commercial airliners pursuing fuel savings, military platforms from fighter jets to transport aircraft requiring battlefield resilience, and unmanned aerial vehicles focused on endurance and stealth capabilities provides a nuanced view of evolving requirements. Finally, contrasting distribution channels between aftermarket support services prioritizing uptime and original equipment manufacturers championing design-stage optimization illustrates how value is unlocked at different points along the product lifecycle.

This comprehensive research report categorizes the Aircraft Fuel System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component Type

- Engine Type

- Application

- Distribution

Analyzing Regional Dynamics Across the Americas Europe Middle East Africa and Asia-Pacific to Illuminate Crucial Drivers in Aircraft Fuel System Development

Regional dynamics vary substantially across the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting unique adoption curves and regulatory frameworks for aircraft fuel systems. In the Americas, emphasis on retrofit programs and aftermarket enhancements is driven by aging fleets seeking incremental improvements in efficiency and compliance with stringent domestic environmental legislation. Meanwhile, Europe Middle East & Africa is at the forefront of integrating new certification standards for sustainable aviation fuels and advanced inerting technologies, supported by transcontinental collaborations among airframers and national research consortia. Over in Asia-Pacific, expanding commercial aviation networks and burgeoning defense modernization initiatives are catalyzing investments in scalable fuel system platforms that can accommodate high-volume production and diverse climatic conditions. These regional contrasts underscore the importance of tailored strategies, whether prioritizing cost-effective upgrades, pioneering next-generation architectures, or scaling manufacturing capacity to meet soaring demand.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Fuel System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Approaches and Competitive Strategies of Leading Players Driving Advances in Aircraft Fuel System Technologies and Service Offerings

Leading players in the aircraft fuel system arena are differentiating themselves through a combination of advanced engineering services, integrated digital offerings, and strategic alliance models. Some original equipment suppliers have expanded their footprint into maintenance and repair operations, embedding condition-monitoring software directly into pumps and valves to offer predictive servicing contracts that align incentives for uptime optimization. Other firms have pursued selective acquisitions of specialty filter and seal manufacturers to fortify their value chain and secure proprietary materials expertise. Joint ventures between propulsion system integrators and materials science innovators have given rise to coatings and composites that resist microbial growth in tanks and resist cavitation in high-pressure pumps. In the aftermarket sector, service providers are bundling calibration services, certification support, and parts exchange programs into subscription models that reduce administrative overhead for operators. Collectively, these strategic approaches reflect a broader trend toward offering end-to-end ecosystem solutions that transcend component sales, fostering deeper customer engagement and recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Fuel System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ahlers Aerospace, Inc.

- AMETEK, Inc.

- Avstar Fuel Systems, Inc..

- BAE systems

- Barnes Group Inc.

- CAE Inc.

- Collins Aerospace by RTX Corporation

- Crane Company

- Eaton Corporation PLC

- GKN plc

- Honeywell International Inc.

- HyPoint Inc.,

- JAMCO Corporation

- Meggitt PLC

- Northstar Aerospace.

- Ontic Engineering & Manufacturing UK Ltd.

- Parker-Hannifin Corporation

- Precision Fuel Components, LLC

- Quiet Wing Aerospace LLC

- Safran S.A.

- Secondo Mona S.p.A.

- Senior Aerospace Ketema

- Spirit AeroSystems Inc.

- Textron Inc

- Triumph Group, Inc.

- Woodward, Inc.

Delivering Practical Recommendations Empowering Industry Leaders to Enhance Operational Efficiency Sustainability and Innovation in the Aircraft Fuel System

Industry leaders can capitalize on emerging opportunities by establishing clear road maps for fuel system modernization anchored in digital transformation, supply chain resilience, and sustainability alignment. One actionable step is to deploy sensor-driven diagnostics across existing fleets to capture performance baselines, which in turn guide targeted upgrades and retrofit prioritization. Simultaneously, organizations should cultivate partnerships with domestic suppliers of advanced alloys and polymer composites to hedge against tariff-induced disruptions and strengthen nearshore manufacturing capabilities. Integrating sustainable aviation fuel compatibility into new system designs will position companies ahead of evolving carbon reduction mandates and unlock first-mover advantages in green retrofit programs. To foster continuous innovation, cross-functional teams comprising engineering, regulatory, and supply chain experts must collaborate on modular architectures that simplify certification pathways. Finally, embedding lifecycle service models that combine preventive maintenance, remote troubleshooting, and parts exchange services will enhance operational readiness and generate recurring value for both OEMs and operators.

Detailing a Rigorous Research Approach Combining Primary and Secondary Collection Analysis and Validation to Secure Integrity of Aircraft Fuel System Insights

This study was underpinned by a rigorous research approach that blended primary and secondary data gathering with robust validation protocols. Primary research included in-depth interviews with senior engineers, procurement directors, and airline maintenance executives to capture firsthand insights on design preferences, regulatory challenges, and aftermarket service expectations. Secondary sources encompassed technical papers, certification guidelines, and supplier catalogs to assemble a comprehensive database of component specifications and system architectures. Collected data underwent multiple rounds of cross-verification through expert review panels, ensuring that conclusions reflect industry realities rather than theoretical models. Advanced analytical techniques, including value chain mapping and qualitative scenario analysis, were applied to distill key themes. Throughout the process, emphasis was placed on transparency, traceability, and methodological rigor to guarantee that the findings are both reliable and actionable for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Fuel System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Fuel System Market, by Type

- Aircraft Fuel System Market, by Component Type

- Aircraft Fuel System Market, by Engine Type

- Aircraft Fuel System Market, by Application

- Aircraft Fuel System Market, by Distribution

- Aircraft Fuel System Market, by Region

- Aircraft Fuel System Market, by Group

- Aircraft Fuel System Market, by Country

- United States Aircraft Fuel System Market

- China Aircraft Fuel System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Key Strategic Takeaways from the Aircraft Fuel System Analysis to Guide Stakeholders in Navigating Future Operational and Technological Challenges

In conclusion, the aircraft fuel system domain is at an inflection point where technological, regulatory, and sustainability imperatives converge to redefine design and operational paradigms. Stakeholders must navigate a complex terrain of tariff shifts, regional regulatory variations, and evolving application requirements while seizing opportunities presented by digital monitoring, advanced materials, and sustainable fuel integration. By understanding segmentation nuances across system types, component specializations, engine platforms, applications, and distribution channels, decision-makers can tailor their strategies to specific performance and reliability goals. Regional insights underscore the necessity of context-aware approaches that address local certification regimes and supply chain landscapes. Ultimately, the companies that proactively invest in end-to-end ecosystem solutions-spanning from design through service delivery-will secure competitive advantage and drive the next era of innovation in aircraft fuel management.

Engage with Expert Associate Director Ketan Rohom to Secure Your Comprehensive Aircraft Fuel System Market Research Report and Drive Smarter Strategic Decisions

To explore deeper customization options or to secure the complete study, reach out today to Associate Director Ketan Rohom. His expert guidance will ensure you receive tailored insights and strategic support to leverage the full breadth of aircraft fuel system analysis. Connect directly with Ketan Rohom to arrange a personalized briefing and obtain instant access to the comprehensive report that will equip your organization for informed decision-making and competitive advantage.

- How big is the Aircraft Fuel System Market?

- What is the Aircraft Fuel System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?