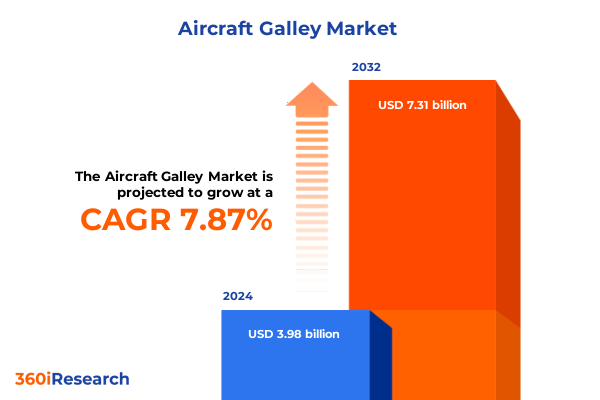

The Aircraft Galley Market size was estimated at USD 4.25 billion in 2025 and expected to reach USD 4.54 billion in 2026, at a CAGR of 8.04% to reach USD 7.31 billion by 2032.

Setting the Stage for Aircraft Galley Market Evolution with Key Drivers Shaping In-Flight Catering Infrastructure and Passenger Experience Innovations

The Aircraft Galley market is experiencing a renaissance driven by the full-scale recovery in global air travel and renewed airline investments in cabin interiors. In 2024, global passenger traffic rebounded to 9.5 billion, surpassing pre-pandemic levels and signaling an era of sustained growth for in-flight service infrastructure. This resurgence has heightened focus on galley performance, reliability, and passenger experience, positioning galleys as critical enablers of operational efficiency and brand differentiation.

As airlines navigate evolving passenger expectations, they are prioritizing galley solutions that blend advanced materials, energy-efficient appliances, and streamlined workflows. Recent industry data indicates that airlines are channeling significant resources into modernizing galleys to support premium economy and business class offerings while optimizing space in economy cabins. This transition underscores the need for galleys that not only meet stringent safety and certification standards but also contribute to sustainability and cost control.

Against this backdrop, the Aircraft Galley market stands at a strategic inflection point. Key drivers such as digital connectivity, lightweight construction, and regulatory pressures for carbon reduction are shaping supplier strategies and airline procurement priorities. The following analysis sets the stage for a detailed exploration of transformative shifts, tariff impacts, segmentation nuances, regional dynamics, and actionable recommendations that will define competitive positioning in the years ahead.

Uncovering Transformative Shifts in Aircraft Galley Solutions Driven by Sustainability, Digital Connectivity, Material Innovation, and Operational Efficiency

Recent advancements in materials science are fundamentally transforming aircraft galley design. Industry leaders are accelerating the adoption of aluminum alloys and composite alternatives to achieve significant weight savings, with aerospace metals analyst CRU projecting 8% annual growth in aluminum consumption for aerospace applications across Europe and North America through 2029. At the same time, manufacturers are pioneering thermoplastic composites and additive manufacturing processes to reduce waste, bolster recyclability, and streamline production cycles, positioning new galley modules at the forefront of sustainable innovation.

Concurrently, smart, connected galleys are redefining operational efficiency in the air. Wireless connectivity solutions now enable real-time monitoring of galley inserts, transmitting diagnostic data to maintenance teams to distinguish unit-level failures from aircraft interface issues. These IoT-enabled systems promise to minimize troubleshooting time, predict component wear, and optimize spare parts inventories across fleets, heralding a new era of data-driven galley management.

Modular flexibility and rapid reconfiguration capabilities are also gaining momentum. Suppliers are embedding plug-and-play interfaces and sensor networks within galley frameworks, allowing airlines to swiftly adjust layouts for varying service levels and route demands. This shift toward agile, mission-adaptive galleys not only accelerates maintenance turnarounds but also enhances crew workflows and passenger satisfaction, elevating galleys from static fixtures to dynamic operational hubs.

Assessing the Cumulative Impact of Escalating United States Steel and Aluminum Tariffs on Aircraft Galley Manufacturing and Supply Chain Complexity

The reinstatement and escalation of U.S. Section 232 tariffs have introduced acute cost pressures on galley component manufacturing. As of March 12, 2025, all country exemptions were rescinded and aluminum duties were raised from 10% to 25%, with steel tariffs increasing from 25% to 50% for imports on or after June 4, 2025. These sweeping measures extend to downstream products, assessing duties based solely on the value of embedded steel and aluminum content, intensifying financial impacts across the supply chain.

Aerospace OEMs and interior suppliers have borne the brunt of these elevated tariffs, with Raytheon Technologies reporting a $125 million hit in the current year and projecting a cumulative $500 million cost impact in 2025 due to elevated metal duties. Specifically, aluminum-intensive galley frameworks and stainless-steel fixtures have seen raw material expenses surge, compelling manufacturers to rethink costing, pricing, and contract structures with airlines.

To mitigate these headwinds, stakeholders are accelerating adoption of low-tariff composites and advanced alloys that fall outside Section 232 coverage, while renegotiating supply terms to secure tariff-inclusive pricing. However, the transition to composite-dominant galley architectures must balance weight reduction goals against recyclability and certification timelines, underscoring the complexity of navigating this new tariff landscape.

Revealing Insightful Segmentation Drivers Across End Use, Installation Type, Aircraft Configuration, Materials, and Component Systems for Galley Strategy

The Aircraft Galley market reveals distinct demand pockets when examined through end-use lenses, installation types, aircraft configurations, material selections, and component functionalities. Commercial aviation demands high-throughput galley modules capable of supporting extended haul economies, while military operators prioritize rapidly deployable transportable galleys equipped with vacuum wastewater systems. Private aviation, by contrast, seeks bespoke, luxury-oriented galley suites that harmonize with cabin aesthetics and personalized service flows.

Installation dynamics further segment the market into original equipment manufacturer (OEM) line-fit opportunities and aftermarket retrofit upgrades. OEM galleys must integrate seamlessly with new aircraft delivery timelines and certification protocols, whereas aftermarket providers capitalize on fleet modernization cycles to deliver space-optimizing and technology upgrade packages.

Aircraft type exerts a profound influence on galley footprint and configuration. Business jets leverage compact, premium-grade inserts, whereas regional jets emphasize weight-efficient modularity. Narrow-body carriers balance galley volume with passenger density, and wide-body fleets demand scalable galley islands capable of supporting multi-class meal services.

Material innovations, spanning traditional aluminum and stainless steel to advanced carbon and glass fiber composites, define a continuum of opportunities. Composite inserts deliver transformative weight savings and corrosion resistance, while aluminum alloys retain advantage in cost and recyclability under current tariff regimes. Component-level differentiation-from thermoelectric refrigeration units and compressor-based coolers to waste compaction and advanced food preparation surfaces-further underscores the diversity of supplier specialization within the galley ecosystem.

This comprehensive research report categorizes the Aircraft Galley market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Aircraft Type

- Material

- Installation Type

- End Use

Analyzing Regional Dynamics and Strategic Opportunities in the Aircraft Galley Market for Americas, Europe Middle East & Africa, and Asia-Pacific Demand Drivers

Regional market dynamics reflect both common imperatives and unique drivers across the globe. In the Americas, airlines are leveraging robust fleet expansion and sustainability mandates to upgrade galleys with lightweight, energy-efficient systems that align with North American emissions targets while enhancing passenger service in both full-service and low-cost carrier segments. Meanwhile, in Europe, the Middle East and Africa, stringent environmental regulations and consumer expectations for premium in-flight experiences are catalyzing investments in composite-enhanced, modular galleys that support diverse route profiles and class configurations, bolstering both efficiency and luxury credentials.

Asia-Pacific stands out for its rapid fleet growth, where budget and full-service carriers alike are ordering narrow-body aircraft en masse to meet surging travel demand, particularly in Southeast Asia and India. This fleet surge is driving extensive line-fit and retrofit programs focused on standardizing galley solutions that optimize turnaround times and support high-frequency operations, while navigating supply chain challenges that continue to affect spare parts availability and MRO cycles across the region.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Galley market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Manufacturers Driving Innovation and Expansion in Aircraft Galley Design Through Sustainability and Global Footprint Growth

Leading manufacturers are differentiating through technology leadership, material innovation, and global service networks. Collins Aerospace, a Raytheon Technologies business, has introduced roll-on/roll-off air transportable galley/lavatory units for military cargo aircraft and data-driven connected galley inserts that deliver real-time diagnostics to maintenance teams. Safran Cabin’s MaxFlex line remains the benchmark in narrow-body galley systems, offering pre-certified configurations for the Boeing 737 family with six-month lead times and proven reliability in over 2,000 installations.

AIM Altitude, under the AVIC Cabin Systems umbrella, has pioneered modular ARCA galley systems focused on hygiene, space efficiency, and sustainability, enabling boxed meal workflows that reduce waste and enhance passenger confidence in post-pandemic operations. Jamco Corporation emphasizes innovative weight-saving galley constructions utilizing honeycomb panel cores and composite inserts to maximize crew workspace and fuel efficiency, serving both OEM and aftermarket channels with tailored forward, mid, and side galley modules. Diehl Aviation’s Smart Galley concept integrates plug-and-play modularity with intelligent energy management and predictive maintenance capabilities, positioning it as a leader in future-ready galley architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Galley market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerolux Ltd.

- Bucher Leichtbau AG

- Causeway Aero

- Collins Aerospace by Raytheon Technologies Corporation

- Diehl Stiftung & Co. KG

- Diethelm Keller Aviation Pte Ltd

- Dynamo Aviation

- ETI Tech, Inc.

- Geven SPA

- Ipeco Holdings Ltd.

- JAMCO Corporation

- Korita Aviation

- Loipart AB

- Parker Hannifin Corporation

- Safran S.A.

- Showa Aircraft Industry Co., Ltd.

- SII Group

- The Boeing Company

- Trelleborg AB

Providing Actionable Recommendations for Industry Leaders to Enhance Aircraft Galley Competitiveness Through Supply Chain Optimizations and Digital Adoption

To navigate the evolving galley landscape, industry leaders should forge deeper co-development partnerships with airlines to tailor lightweight, modular solutions that align with specific route economics and service models. Investing in digital connectivity initiatives-embedding sensors and analytics within galley systems-will enable predictive maintenance regimes that reduce aircraft downtime and spare parts inventories, driving measurable cost savings and reliability gains.

Expanding the blend of carbon and glass fiber composites in galley structures can effectively mitigate exposure to metal tariffs while enhancing weight reduction and recyclability credentials, supporting both cost management and sustainability commitments. Lastly, refining regional sourcing strategies to exploit duty-free zones or negotiate tariff-inclusive supply agreements will strengthen supply chain resilience and insulate progress against future trade policy fluctuations, ensuring uninterrupted delivery of critical galley components.

Outlining Robust Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Expert Validation for Comprehensive Market Insights

This analysis is grounded in a rigorous mixed-methods approach, combining primary interviews with cabin interior engineers, airline procurement executives, and galley MRO specialists. Secondary research drew upon industry white papers, regulatory filings, company disclosures, and leading aerospace publications to assemble a comprehensive database of galley technologies and market drivers.

Data triangulation across multiple sources ensured analytical robustness, while expert validation sessions with select OEM and airline stakeholders refined key insights and strategic imperatives. This methodology delivers a high-fidelity view of market dynamics, risks, and opportunity areas, providing stakeholders with clear, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Galley market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Galley Market, by Component Type

- Aircraft Galley Market, by Aircraft Type

- Aircraft Galley Market, by Material

- Aircraft Galley Market, by Installation Type

- Aircraft Galley Market, by End Use

- Aircraft Galley Market, by Region

- Aircraft Galley Market, by Group

- Aircraft Galley Market, by Country

- United States Aircraft Galley Market

- China Aircraft Galley Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Key Findings on Aircraft Galley Market Dynamics and Strategic Imperatives for Stakeholders Navigating an Evolving In-Flight Service Landscape

The Aircraft Galley market is undergoing a profound transformation, driven by the convergence of sustainability mandates, tariff-induced cost pressures, and the imperative for digital integration. Material innovations-spanning aluminum alloys to advanced composites-are redefining weight and environmental parameters, while smart connectivity solutions are elevating operational efficiency through predictive maintenance and data-driven workflows.

Segmentation analysis reveals a mosaic of opportunity pockets across end use, installation type, aircraft class, materials selection, and component functions. Regional dynamics further underscore the need for tailored strategies in the Americas, EMEA, and Asia-Pacific, each shaped by distinct regulatory, economic, and growth factors. Leading suppliers are leveraging these trends to differentiate through modularity, hygiene-focused systems, and energy-efficient designs.

To maintain competitive advantage, industry participants must embrace collaborative innovation, diversify material portfolios, and optimize sourcing strategies to address tariff volatility. As airlines continue to prioritize passenger experience and operational resilience, galley suppliers that align technology leadership with agile manufacturing and supply chain robustness will emerge as market winners.

Take Action Today by Connecting with Ketan Rohom to Access Exclusive Aircraft Galley Market Insights and Secure Your Comprehensive Industry Report

Ready to elevate your strategic decision-making with comprehensive insights and data-driven analysis of the Aircraft Galley market, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to secure your complete, in-depth industry report and position your organization for success.

- How big is the Aircraft Galley Market?

- What is the Aircraft Galley Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?