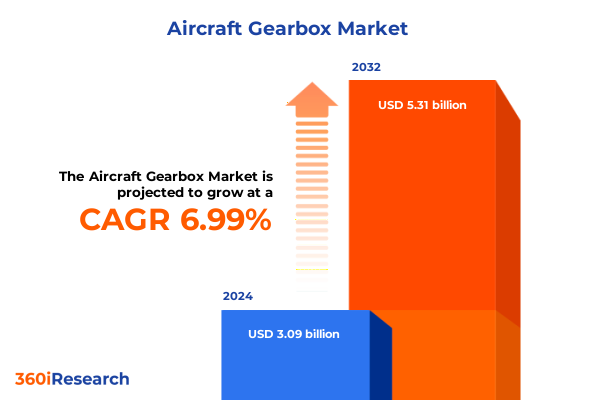

The Aircraft Gearbox Market size was estimated at USD 3.31 billion in 2025 and expected to reach USD 3.54 billion in 2026, at a CAGR of 7.00% to reach USD 5.31 billion by 2032.

Comprehensive Overview of the Aircraft Gearbox Market’s Role in Enhancing Aeronautical Performance, Durability, and Reliability Across Modern Airframe Platforms

The aircraft gearbox serves as the heartbeat of every propulsion system, translating power from the engine into controlled rotational motion that drives propellers, fan assemblies, and accessory systems. Its intricate network of planetary, bevel, spur, and helical gears must operate under extreme temperatures, variable loads, and stringent safety standards, making reliability and precision paramount. As modern aviation demands higher thrust-to-weight ratios, reduced emissions, and longer operational lifespans, the design and manufacture of gearboxes have evolved into a complex interplay of advanced materials, precision machining, and robust testing regimes.

In this context, industry stakeholders are challenged to balance performance requirements with cost efficiency, maintenance predictability, and environmental considerations. Supply chains have become increasingly global, with critical components sourced from specialized suppliers across Europe, North America, and Asia-Pacific. At the same time, service providers and OEMs collaborate to develop aftermarket solutions that extend component life, minimize downtime, and ensure regulatory compliance. This introduction sets the stage for a comprehensive exploration of technological breakthroughs, tariff impacts, segmentation dynamics, and strategic imperatives that define the contemporary gearbox market.

Exploring Technological Advances and Sustainable Initiatives Revolutionizing Gearbox Design, Manufacturing, and Lifecycle Management Strategies in Aviation

In recent years, transformative advances have reshaped gearbox engineering from the ground up. Additive manufacturing techniques now enable lighter, topology-optimized components that retain structural integrity under cyclical loading. Computational design tools leverage digital twins to simulate gear interactions, thermal behavior, and lubricant performance in real-time, allowing engineers to iterate rapidly. Parallel to these technical breakthroughs, sustainability initiatives are pushing manufacturers to adopt recyclable composites and high-efficiency lubricants that reduce environmental impact without compromising reliability.

Moreover, predictive maintenance strategies driven by embedded sensors and machine-learning algorithms have transitioned from theory to practice. Flight fleet data streams, combined with advanced analytics, empower operators to forecast wear patterns, schedule interventions proactively, and avoid unplanned groundings. In addition, collaborative platforms are emerging, enabling cross-organizational data sharing that accelerates innovation cycles and harmonizes component standards. These systemic shifts underscore how technological and operational paradigms are converging to revolutionize design philosophies and lifecycle management approaches within the gearbox domain.

Analytical Examination of the Cumulative Effects of 2025 United States Tariffs on Gearbox Cost Structures, Supply Chains, and Global Aerospace Competitiveness

The imposition of new United States tariffs in 2025 has generated significant ripples across the global gearbox supply chain. Increased duties on imported raw materials and critical subassemblies have elevated production costs for OEMs and their tier-one partners. In response, procurement teams are recalibrating sourcing strategies, seeking alternative suppliers in tariff-neutral jurisdictions, and renegotiating long-term contracts to mitigate financial exposure. These adjustments have created both challenges and opportunities, compelling stakeholders to weigh near-term cost pressures against strategic supply chain resilience.

At the same time, domestic manufacturing capacity in the United States has seen renewed investment, driven by incentives to onshore critical capabilities. This trend has sparked partnerships between traditional gear specialists and advanced materials firms, catalyzing innovation in high-performance steels and composite reinforcements. However, tighter supply has occasionally strained delivery timelines, prompting operators to refine inventory management protocols and explore aftermarket extension programs. Collectively, these dynamics illustrate the far-reaching cumulative impact of trade policy shifts on cost structures, delivery reliability, and competitive positioning within the aerospace gearbox market.

In-Depth Analysis of Segmentation Trends Spanning Installation Types, Aircraft Categories, Material Usage, and Gear Configurations Shaping Market Dynamics

Installation type has emerged as a defining axis of value creation, with original equipment applications prioritizing integration efficiency and performance validation, while aftermarket services focus on maintenance-repair-overhaul and replacement parts that optimize lifecycle costs. Commercial aircraft platforms demand high-volume consistency and extended maintenance intervals, whereas general aviation and military segments require customization, rapid deployment, and enhanced durability under diverse operational scenarios. Material selection further refines these strategies, as aluminum alloys offer weight savings, composites deliver fatigue resistance, and steel alloys provide unmatched strength for high-torque configurations.

Within these material frameworks, gear types play a pivotal role in balancing load distribution and noise attenuation. Bevel and helical gears are favored for mainshaft assemblies requiring smooth power transfer and vibration control, while spur gears serve lightweight accessory drives with straightforward manufacturability. Planetary systems, on the other hand, support high-reduction ratio designs in turboprop and turboshaft engines by offering compact packaging and balanced torque distribution. These segmentation insights reveal how interdependent design choices guide strategic investment decisions, ensuring that each configuration aligns with platform requirements and regulatory expectations.

This comprehensive research report categorizes the Aircraft Gearbox market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Gear Type

- Installation Type

- Aircraft Type

Strategic Regional Intelligence Highlighting Growth Drivers, Infrastructure Developments, and Regulatory Environments Across the Americas, EMEA, and Asia-Pacific

Geographic hotspots for gearbox demand reflect broader aerospace industry patterns, beginning with the Americas where established airlines, defense contractors, and MRO hubs sustain steady aftermarket volumes. The United States remains the largest single national market, supported by extensive military modernization programs and a dense commercial fleet. Meanwhile, Latin American carriers have initiated fleet renewals that boost demand for replacement assemblies and upgrade kits. Transitioning eastward, Europe maintains strong OEM partnerships and compliance with stringent environmental mandates, while the Middle East continues to invest in large-scale airport expansions and air force enhancements.

In Asia-Pacific, rapid economic growth and fleet modernization in China, India, and Southeast Asia are driving robust adoption rates. Regional players are investing heavily in domestic gearbox production capabilities to reduce import reliance, and joint ventures between local firms and established manufacturers are proliferating. Additionally, Asia-Pacific MRO centers are emerging as global service hubs, leveraging cost advantages and proximity to growing operator bases. The interplay between established Western markets and dynamic Asia-Pacific growth corridors illustrates the multifaceted regional intelligence critical for prioritizing strategic initiatives and resource allocation.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Gearbox market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Gearbox Manufacturers and Technology Innovators with Strategic Partnerships, R&D Focus, and Operational Excellence Driving Competitive Edge

Key participants in the gearbox ecosystem have intensified investments in research and development, forging partnerships that enhance material science breakthroughs and digital engineering capabilities. Legacy equipment manufacturers are collaborating with aerospace primes to integrate advanced monitoring systems directly into gearbox assemblies, while specialized tier-one suppliers are developing modular designs that expedite both initial certification and aftermarket upgrades. These strategic alliances not only accelerate product lifecycles but also foster knowledge transfer across distinct segments of the supply chain.

Several companies have also prioritized operational excellence by adopting lean manufacturing and just-in-time inventory systems, thereby reducing lead times and improving responsiveness to fluctuating demand. Concurrently, joint ventures between defense integrators and commercial gear specialists have expanded defense-grade gearbox portfolios, catering to stringent military specifications for torque resilience, electromagnetic interference shielding, and rapid field maintenance. These concerted efforts demonstrate how market leaders leverage innovation, partnership, and process optimization to sustain competitive advantage in a technically demanding arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Gearbox market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Diehl Stiftung & Co. KG

- General Electric Company

- Honeywell International Inc.

- JAMCO Corporation

- Liebherr-International AG

- Meggitt PLC

- MTU Aero Engines AG

- Rolls-Royce Holdings plc

- RTX Corporation

- SAFRAN S.A.

- Textron Aviation Inc.

- Walchandnagar Industries Limited

- Woodward, Inc.

- ZF Friedrichshafen AG

Actionable Recommendations for Industry Leaders to Strengthen Supply Chain Resilience, Accelerate Technological Innovation, and Navigate Regulatory Landscapes

Industry leaders should adopt a dual-sourcing strategy for critical components to hedge against supply disruptions and tariff fluctuations. By qualifying suppliers across multiple regions, organizations can ensure continuity of production while maintaining cost discipline. In parallel, investing in digital twin platforms will enable real-time performance monitoring, facilitating predictive maintenance programs that reduce unscheduled downtime and extend service intervals. These platforms also support continuous design improvements by providing empirical data on wear patterns and load distributions.

Sustainability considerations must be embedded in material selection and lubricant formulation, balancing environmental goals with regulatory compliance and lifecycle performance. Companies should collaborate with research institutions to explore recyclable composites and low-viscosity, bio-based oils that meet aircraft certification standards. Furthermore, engaging proactively with regulatory bodies will help shape future standards around emissions, noise abatement, and operational safety. Finally, cultivating aftermarket service networks through authorized training programs and digital collaboration tools can deepen customer relationships and generate recurring revenue streams.

Rigorous Research Methodology Leveraging Multi-Source Primary Interviews, Secondary Data Analysis, and Expert Validation for Robust Gearbox Market Insights

This study combines qualitative and quantitative research techniques to deliver holistic market insights. Primary research included structured interviews with propulsion system engineers, MRO managers, and procurement executives from leading airlines, defense agencies, and component suppliers. These first-hand perspectives informed the understanding of pain points, innovation drivers, and regulatory impacts affecting gearbox design and service.

Secondary research encompassed a thorough review of peer-reviewed journals, industry conference proceedings, regulatory filings, and technical white papers. Data from trade associations and government publications provided context on international trade policies and regional market developments. All findings were subjected to an expert validation workshop, where aerospace consultants and technical specialists reviewed assumptions, cross-checked data points, and refined segment definitions to ensure methodological rigor and credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Gearbox market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Gearbox Market, by Material

- Aircraft Gearbox Market, by Gear Type

- Aircraft Gearbox Market, by Installation Type

- Aircraft Gearbox Market, by Aircraft Type

- Aircraft Gearbox Market, by Region

- Aircraft Gearbox Market, by Group

- Aircraft Gearbox Market, by Country

- United States Aircraft Gearbox Market

- China Aircraft Gearbox Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesis of Core Insights and Strategic Imperatives Highlighting Future Paths for Aircraft Gearbox Innovation and Performance Optimization Trends

The convergence of advanced manufacturing techniques, sustainability imperatives, and predictive maintenance capabilities is steering the gearbox market toward higher performance thresholds and lower total operating costs. Trade policy extensions, such as the 2025 United States tariffs, have prompted supply chain realignments that emphasize onshoring and diversification, reinforcing the importance of strategic procurement planning. Meanwhile, segmentation analyses reveal that tailored solutions across installation types, aircraft categories, materials, and gear configurations underpin value creation for OEMs and MRO providers alike.

Looking forward, stakeholders must embrace collaborative ecosystems that bridge manufacturers, service providers, regulatory bodies, and research institutions. This integrated approach accelerates innovation adoption, ensures compliance with emerging standards, and supports resilient growth in established and developing markets. By synthesizing core insights and embracing strategic imperatives, industry participants can navigate complexity and harness the full potential of gearbox technologies to propel the next generation of aircraft performance.

Inviting Industry Leaders to Connect with Ketan Rohom, Associate Director of Sales & Marketing, for Exclusive Access to Aircraft Gearbox Market Research Report

Engaging with Ketan Rohom presents an opportunity to gain unparalleled clarity on emerging gearbox innovations, regulatory considerations, and regional dynamics. His expertise in sales and marketing strategies tailored to aerospace decision makers ensures that each discussion is both highly relevant and strategically focused. By connecting with him, stakeholders will obtain access to exclusive executive briefings, customizable data tables, and targeted insights that align with organizational priorities. This personalized approach helps streamline the research integration process, accelerate time-to-value, and inform high-impact investments in product development and supply chain optimization. Reach out to Ketan Rohom to secure your comprehensive market research report and elevate your competitive positioning in the aircraft gearbox sector.

- How big is the Aircraft Gearbox Market?

- What is the Aircraft Gearbox Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?