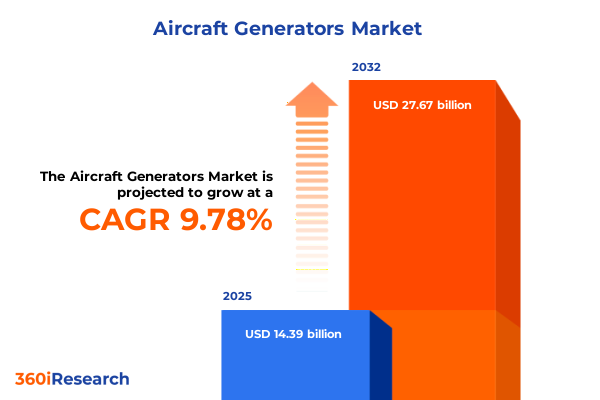

The Aircraft Generators Market size was estimated at USD 14.39 billion in 2025 and expected to reach USD 15.57 billion in 2026, at a CAGR of 9.78% to reach USD 27.67 billion by 2032.

Unleashing Aircraft Generators as the Critical Backbone of Modern Aviation Power Systems in a Rapidly Evolving Aerospace Environment

Aircraft generators serve as the on-board power units responsible for converting mechanical energy from the engine or auxiliary power unit into the electrical energy that sustains critical aircraft functions. From powering avionics suites and lighting systems to supporting environmental controls and flight-critical components, generators are the unsung heroes that ensure continuous operation throughout every phase of flight. As industry trends shift toward greater electrification and the adoption of more electric aircraft architectures, the demands on generator systems have intensified, requiring enhancements in power density, efficiency, and reliability.

In today’s aerospace landscape, operators face mounting pressure to reduce lifecycle costs and environmental footprints, prompting original equipment manufacturers and suppliers to integrate advanced materials, optimized thermal management, and digital monitoring platforms into next-generation designs. These evolving expectations coincide with stringent regulatory frameworks governing safety, emissions, and noise, elevating the role of the generator from a mere support system to a strategic enabler of both performance and sustainability.

Against this backdrop, stakeholders across the aviation ecosystem-airlines, defense organizations, business jet operators, and maintenance providers-are seeking robust power solutions that can adapt to diverse applications and regulatory environments. Generators must now deliver higher continuous power outputs while occupying minimal space and weight, leading to a surge in research initiatives focused on permanent magnet synchronous machines, smart sensors, and integrated power electronics. This introduction sets the stage for an in-depth exploration of industry transformations, tariff challenges, segmentation dynamics, regional insights, and strategic imperatives shaping the future of aircraft generators.

How Emerging Technologies and Electrification Trends Are Transforming Aircraft Generator Design Reliability and Performance in Global Fleets

Aircraft generator technology is undergoing a profound transformation driven by the electrification of propulsion systems, the proliferation of digital controls, and breakthroughs in material science. Traditional brush-type designs are increasingly being replaced by brushless architectures and permanent magnet generators, which offer higher efficiency, reduced maintenance requirements, and improved power-to-weight ratios. Ongoing advancements in rare-earth magnet compositions are enabling manufacturers to push continuous power densities beyond historical limits, while integrated power electronics facilitate real-time voltage regulation and enhanced system stability.

Moreover, the concept of More Electric Aircraft (MEA) has transitioned from theoretical discourse to tangible program implementations, as evidenced by recent demonstrator projects in both commercial and military sectors. High-performance permanent magnet synchronous machines tested by Honeywell, capable of producing up to 1 megawatt at peak power with efficiencies approaching 97 percent, exemplify the potential for next-generation generators to integrate seamlessly with auxiliary power units and hybrid-electric propulsion systems. At the same time, leading suppliers such as Collins Aerospace have unveiled scalable families of power-dense electric motors and generators, underscoring the industry’s commitment to standardizing modular architectures that can serve platforms ranging from unmanned aerial vehicles to regional airliners.

The convergence of sensor-enabled monitoring and predictive analytics further amplifies the transformative shift, enabling condition-based maintenance frameworks that can preempt failures and optimize lifecycle expenditures. By leveraging data-driven insights, operators can tailor maintenance schedules to actual usage profiles, reducing unscheduled downtime and enhancing fleet readiness. This shift toward digital certification and virtual testing environments is shortening development cycles and accelerating the deployment of advanced generator systems across global fleets.

Examining the Cumulative Impact of United States Tariffs in 2025 on Aircraft Generator Supply Chains Costs and Operational Efficiency

The reintroduction and escalation of U.S. tariffs in 2025 have exerted widespread repercussions on aircraft generator supply chains, compelling manufacturers and service providers to reassess cost structures. Tariffs imposed on imported aluminum and steel were doubled to a 50 percent levy, while a 10 percent duty on certain aerospace components has disrupted the long-standing duty-free regime established under the 1979 Civil Aircraft Agreement. These measures have led to substantial additional expenses for major aerospace suppliers. RTX, for instance, reported a hit of $125 million in 2024 and anticipates a total tariff-related impact of half a billion dollars in 2025, reflected in its downward revision of adjusted earnings forecasts.

Concurrent with RTX’s experience, industry-wide cost pressures have prompted both suppliers and airframers to explore pass-through strategies-ranging from direct price increases to contractual adjustments-thereby transferring some of the burden to airline customers. The industry’s heavy reliance on global supply chains has amplified the effect on maintenance, repair, and overhaul (MRO) operations, where even minor cost escalations on critical replacement parts can translate into substantial service bill increases. Executives from leading carriers and parts suppliers have petitioned the administration for carve-out exemptions, emphasizing that abrupt shifts in trade policy threaten jobs, safety, and the competitiveness of the U.S. aviation sector.

Furthermore, U.S. tariff actions have reverberated internationally. Embraer has cautioned that a threatened 50 percent duty on Brazilian-made executive jets and regional aircraft could impose an extra $9 million in costs per plane sold to U.S. customers, jeopardizing vital assembly facilities and long-term procurement plans. The resulting uncertainty has delayed purchase decisions, strained OEM-supplier relationships, and underscored the fragility of a highly integrated global ecosystem. Against this backdrop, stakeholders are actively evaluating supply chain diversification, local content strategies, and inventory buffering to mitigate the evolving tariff landscape.

Gleaning Key Segmentation Insights Highlighting Distinct Application Types Generator Technologies Sales Channels and End User Implications

The aircraft generator market spans a diverse range of applications, encompassing business jets-further subdivided into large jets, light jets, and midsize jets-as well as commercial airliners configured as narrow or wide body, helicopters, military platforms, and regional turboprops. Within these application categories, power and performance requirements vary dramatically, driving design differentiation and aftermarket support strategies. Generators serving high-end business jets prioritize compact form factors and low acoustic signatures, while units for commercial wide-body fleets emphasize sustained high-power delivery and extended maintenance intervals.

Generator type also plays a crucial role in market segmentation. Brushless machines maintain a solid presence due to established certification pedigrees and lower initial costs. However, permanent magnet generators (PMGs) are gaining traction for their superior efficiency and reduced life-cycle maintenance expenses, especially in new aircraft platforms pursuing enhanced electrical architectures. Sales channels fall into two distinct streams: original equipment manufacturer (OEM) deliveries tied directly to airframe production, and aftermarket sales driven by MRO requirements and fleet upgrades. Each channel demands tailored service offerings, with aftermarket providers emphasizing rapid spares availability and turnkey installation services to minimize aircraft downtime.

End users-from global airlines and charter operators to corporate flight departments and defense agencies-exhibit distinct procurement priorities. Commercial carriers seek high reliability and streamlined operational support, whereas defense customers often require ruggedized packaging, redundancy features, and integration with mission-specific power systems. Corporate operators focus on total cost of ownership and flexible maintenance agreements, while charter companies balance cost competitiveness with rapid-turnaround capabilities.

Additional segmentation layers include cooling methodology-where air-cooled designs offer simplified maintenance in remote operations and liquid-cooled systems deliver enhanced thermal management for high-density power units-as well as power rating categories ranging from units up to 40 kVA for small platforms to those exceeding 60 kVA for larger aircraft. Mounting configurations may be integrated into auxiliary power units or supplied as standalone modules, and technological orientation splits between conventional architectures and advanced systems incorporating smart sensors, digital controls, and integrated fault management capabilities.

This comprehensive research report categorizes the Aircraft Generators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Generator Type

- Cooling Method

- Power Rating

- Mounting Configuration

- Technology

- Sales Channel

- Application

- End User

Deciphering Key Regional Insights by Analyzing Market Drivers and Competitive Dynamics across Americas Europe Middle East Africa and Asia-Pacific

In the Americas, the aircraft generator market is anchored by a robust aerospace manufacturing ecosystem that includes major OEMs, engine makers, and a comprehensive MRO infrastructure. North American demand is driven by both commercial growth among legacy carriers and expansion of regional and charter operations. Defense sector procurement remains a significant contributor, with domestic programs emphasizing indigenously sourced components to meet stringent security requirements. The U.S. maintains a leadership role in generator R&D, supported by collaborative initiatives between government agencies and industry partners to advance electrification and digital integration efforts.

Europe, the Middle East, and Africa (EMEA) present a diverse landscape characterized by mature markets in Western Europe, rapid fleet modernization in the Gulf states, and evolving requirements across emerging African nations. European OEMs and suppliers often spearhead regulatory harmonization, ensuring that generators meet evolving emissions and noise standards. Meanwhile, operators in the Middle East invest heavily in next-generation wide-body and narrow-body fleets to accommodate rising passenger volumes, creating opportunities for high-reliability, high-power generator solutions. In Africa, burgeoning low-cost carrier networks are generating incremental demand for cost-effective aftermarket services and modular air-cooled generator variants.

Asia-Pacific stands out as the fastest-growing region, underpinned by sustained passenger traffic growth, fleet expansion among low-cost carriers, and rising defense modernization budgets in countries such as India, Japan, and Australia. Local manufacturers are increasingly integrating advanced permanent magnet technologies and collaborating with global suppliers to establish localized production and support hubs. Additionally, government-backed R&D in electric vertical takeoff and landing (eVTOL) concepts and hybrid propulsion demonstrators is accelerating the adoption of modular generator systems tailored for urban air mobility and advanced air mobility use cases.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Generators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Strategic Company Insights by Profiling Leading Aircraft Generator Manufacturers Their Innovations Partnerships and Market Positioning

Industry-leading suppliers continue to refine their portfolio strategies to address evolving customer needs. Honeywell has pioneered power-dense turbo-generators leveraging advanced materials and high-speed rotor technologies, targeting both civil and defense platforms. Collins Aerospace has articulated a clear roadmap toward scalable electric motor and generator families, aiming to standardize interfaces and control systems across multiple aircraft segments. GE Aerospace remains a dominant force in integrated power and propulsion solutions, focusing on digital twin capabilities and on-wing monitoring systems to optimize life-cycle performance.

Consolidated suppliers such as Safran and Thales leverage their deep domain expertise in avionics and power electronics to deliver integrated power generation and distribution packages, with an emphasis on modularity and rapid certification. MTU Aero Engines has invested in research on hybrid-electric propulsion architectures, exploring novel cooling methods and additive manufacturing to reduce part count and assembly complexity. Chinese and South Korean OEMs are also emerging as competitive players, aligning government-funded programs with global supply chain requirements to develop indigenous generator systems.

In the aftermarket, dedicated service specialists and joint ventures between OEMs and third-party MRO providers are forging flexible support models that include performance-based contracts, mobile on-site spares stocking, and predictive maintenance platforms. These collaborative approaches underscore a shift from transactional replacement to holistic life-cycle management, enabling operators to align service costs with actual operational usage and reliability benchmarks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Generators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Ametek, Inc.

- Amphenol Corporation

- ARC Systems, Inc.

- Astronics Corporation

- Calnetix Technologies, LLC

- Denis Ferranti Group

- Diehl Stiftung & Co. KG

- Duryea Technologies

- ePropelled

- General Electric Company

- Honeywell International Inc.

- Meggitt PLC

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- NAASCO

- PBS AEROSPACE Inc.

- Plettenberg Elektromotoren GmbH & Co. KG

- Rolls-Royce PLC

- RTX Corporation

- Safran S.A.

- SINFONIA TECHNOLOGY CO., LTD.

- Skurka Aerospace Inc.

- Thales Group

Actionable Recommendations for Industry Leaders to Enhance Aircraft Generator Competitiveness through Innovation Supply Chain Resilience and Collaboration

Industry leaders should prioritize strategic investment in permanent magnet generator technologies that deliver the highest power density and lowest maintenance requirements, ensuring alignment with electrification roadmaps across civil, defense, and urban air mobility sectors. Parallel to R&D efforts, companies must accelerate digital integration through sensor networks and predictive analytics platforms, enabling condition-based maintenance and minimizing unplanned downtime.

To mitigate the adverse effects of tariff volatility, stakeholders should develop diversified procurement strategies that include multi-sourcing from allied nations, strategic stockpiling of critical materials, and near-shore manufacturing partnerships. Engagement with policy-makers is equally crucial: by articulating the economic impact of tariff measures on the aviation ecosystem, industry consortia can secure targeted exemptions or phased implementations that preserve global competitiveness.

Operational resilience can be further enhanced by redesigning service networks to incorporate modular, air-cooled generator variants for remote operations and liquid-cooled high-power solutions for dense urban routes. Collaborative initiatives between OEMs, MRO providers, and airlines will foster shared risk frameworks, such as power-by-the-hour agreements, aligning incentives around fleet reliability and total cost of ownership.

Finally, forging cross-industry alliances and standardization forums will accelerate the harmonization of certification processes for advanced generator architectures, reducing time to market. A coordinated approach to technology roadmaps and supply chain optimization will position industry leaders to capitalize on emerging opportunities in advanced air mobility and next-generation aircraft programs.

Comprehensive Research Methodology Outlining the Rigorous Approach Employed to Analyze the Aircraft Generator Market and Validate Critical Findings

This research leveraged a hybrid methodology integrating primary and secondary data to deliver comprehensive insights into the aircraft generator landscape. Primary research included structured interviews with senior executives, technical leads, and procurement managers from leading OEMs, MRO providers, airlines, and defense agencies across key regions. These engagements provided firsthand perspectives on technology adoption, procurement challenges, and anticipated regulatory shifts.

Secondary research encompassed an extensive review of publicly available materials, including regulatory filings, white papers, technical standards, press releases, and academic publications. Trade association reports, such as those from aerospace alliances and power system consortiums, were also analyzed to cross-validate market drivers and identify emerging policy trends.

Quantitative analysis was performed using a combination of top-down and bottom-up approaches. Market segmentation was defined by application, generator type, sales channel, end user, cooling method, power rating, mounting configuration, and technology. Each segment was examined qualitatively to identify performance requirements, cost sensitivities, and growth catalysts.

Findings were validated through internal expert reviews and an advisory panel comprising industry veterans with collective expertise in aeropropulsion, electrical power systems, and global trade. This rigorous validation process ensured that insights reflect current market realities and are robust against future uncertainties.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Generators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Generators Market, by Generator Type

- Aircraft Generators Market, by Cooling Method

- Aircraft Generators Market, by Power Rating

- Aircraft Generators Market, by Mounting Configuration

- Aircraft Generators Market, by Technology

- Aircraft Generators Market, by Sales Channel

- Aircraft Generators Market, by Application

- Aircraft Generators Market, by End User

- Aircraft Generators Market, by Region

- Aircraft Generators Market, by Group

- Aircraft Generators Market, by Country

- United States Aircraft Generators Market

- China Aircraft Generators Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Conclusion Summarizing Strategic Imperatives for Stakeholders to Navigate Technological Advances Tariff Pressures and Evolving Market Dynamics

As the aviation industry transitions toward more electric and hybrid architectures, the strategic importance of advanced generator solutions has never been greater. Organizations that successfully integrate high-efficiency permanent magnet technologies, leverage condition-based maintenance, and adopt modular service frameworks will unlock new avenues for performance optimization and cost reduction. Concurrently, the evolving tariff environment underscores the need for agile supply chain strategies and proactive policy engagement to safeguard competitiveness and operational continuity.

Key segmentation insights reveal that diverse applications-from business jets to commercial wide-body fleets-demand tailored generator configurations and support models. Regional dynamics further underscore the necessity for localized production capabilities, flexible service networks, and alignment with government-backed initiatives. Meanwhile, leading companies are carving out competitive advantages through focused R&D, strategic partnerships, and digital integration platforms that enhance reliability and lifecycle management.

Moving forward, industry stakeholders must prioritize collaboration across the value chain, standardize certification pathways for next-generation architectures, and refine business models to align with electrification imperatives. By balancing technological innovation with resilient operational practices, the ecosystem will be well-positioned to meet the challenges and opportunities presented by the next chapter in aviation power systems.

Call to Action Engage with Ketan Rohom Associate Director Sales Marketing to Acquire the Definitive Aircraft Generator Market Research Report

Leverage this comprehensive market research report to enhance strategic decision-making and secure a competitive advantage in the dynamic aircraft generator industry. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss how our in-depth analysis can address your organization’s specific objectives. Engage with industry-leading insights on technological innovations, tariff impacts, segmentation strategies, regional dynamics, and actionable recommendations to drive business growth and operational excellence. Reach out today to acquire the definitive study that will inform your next generation of power system solutions.

- How big is the Aircraft Generators Market?

- What is the Aircraft Generators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?