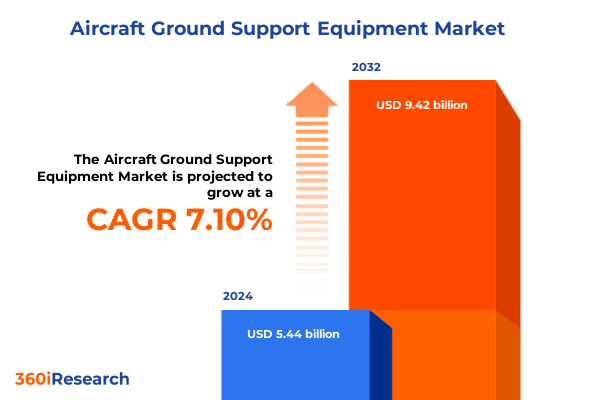

The Aircraft Ground Support Equipment Market size was estimated at USD 5.80 billion in 2025 and expected to reach USD 6.18 billion in 2026, at a CAGR of 7.17% to reach USD 9.42 billion by 2032.

Setting the Stage for Transformation in Aircraft Ground Support Equipment with Emerging Technologies, Sustainable Practices, and Operational Excellence

Ground support equipment underpins every critical phase of aircraft turnaround, ensuring that planes depart on time with safety and efficiency at the forefront. These systems encompass everything from power units that fuel aircraft to specialized vehicles that manage baggage, cargo, and passenger boarding operations. Without robust GSE, airports would struggle to maintain rapid aircraft servicing, leading to delays, operational bottlenecks, and elevated costs. The essential nature of this equipment places ground support services at the heart of airport performance, with stakeholders across airlines, ground handlers, and regulatory bodies collaborating to continuously refine these assets in response to evolving demands

Amid rising global air traffic and ambitious sustainability targets, airports and operators are under pressure to optimize equipment lifecycles and adopt greener solutions. The drive to minimize carbon footprints has accelerated the transition from traditional diesel powertrains to electric and hybrid platforms. Simultaneously, digital transformation initiatives-powered by real-time sensor data and remote diagnostics-are redefining maintenance paradigms and enabling predictive interventions that reduce unplanned downtime. These converging forces have set the stage for a new era in which ground support equipment must deliver operational excellence, environmental performance, and technological adaptability.

Navigating a Paradigm Shift in Aircraft Ground Support Equipment through Electrification, Automation, Digitalization, and Sustainability Initiatives

The aircraft ground support segment is experiencing a fundamental paradigm shift driven by electrification, automation, and digitalization. Electric and hybrid power units are rapidly displacing diesel systems as airports worldwide intensify efforts to meet stringent emission standards. Zero-emission belt loaders, towbarless tractors, and GPUs equipped with regenerative braking not only cut greenhouse gas emissions but also lower operational noise, enhancing ramp safety and community relations.

Concurrently, the integration of IoT sensors and artificial intelligence is ushering in smart ground fleets capable of self-diagnosing maintenance needs. Telemetry data streams enable remote monitoring and predictive maintenance, forecasting component wear and scheduling service interventions before failures occur. This shift from reactive to proactive maintenance regimes is streamlining inventory management and maximizing equipment availability, which in turn drives airport throughput and passenger satisfaction.

Automation advances are equally transformative. Semi-autonomous pushback tractors and automated baggage handling systems are optimizing labor deployment while reducing safety incidents caused by human error. Modular equipment architectures and scalable platforms further empower operators to customize GSE fleets to specific operational profiles-from major international hubs to space-constrained regional airports. Together, these innovations are reshaping airport ground operations into a cohesive, data-driven ecosystem that prioritizes efficiency, resilience, and sustainability.

Examining the Cumulative Effects of 2025 United States Steel and Aluminum Tariffs on Aircraft Ground Support Equipment Manufacturing and Supply Chains

Effective March 12, 2025, the United States implemented a 25% tariff on all steel and aluminum imports, extending Levies to derivative steel and aluminum products used across manufacturing supply chains. Aircraft ground support equipment relies heavily on these metals for structural frames, towing components, and power unit housings, making GSE producers particularly vulnerable to raw material cost inflation.

Beyond core metals, tariffs on mechanical and electronic parts have disrupted established sourcing strategies. Manufacturers have encountered prolonged lead times for hydraulic pumps, chassis subassemblies, and high-capacity battery packs-key components in both traditional and next-generation GSE. To mitigate exposure, many firms have accelerated efforts to localize production or shift procurement toward tariff-exempt regions, though these adjustments have introduced logistical complexities and short-term capacity constraints.

The accumulated tariff burden has compelled ground support equipment providers to reevaluate supply chain models, embedding geopolitical risk assessments into capital planning and procurement protocols. Nearshoring initiatives in Latin America and Southeastern Asia are gaining traction, offering alternative manufacturing hubs outside the reach of U.S. import levies. While such moves promise greater long-term resilience, initial investments in tooling and infrastructure have weighed on cash flows and delayed product rollouts. Ultimately, the cumulative impact of 2025 tariffs has reinforced the importance of diversified supply bases and strategic flexibility in a rapidly changing trade environment.

Unveiling Critical Market Segmentation Insights Shaping Demand across Equipment Types, Power Sources, End Users, Distribution Channels, and Platform Configurations

Insights into market segmentation reveal the complex interplay between equipment functionality, energy sources, end-user requirements, distribution strategies, and platform mobility. Within the realm of equipment types, the market spans baggage handling systems-ranging from manual conveyors to fully automated robotic arrays-through cargo loaders that include belt, container, and high-loader configurations, as well as catering trucks offered in refrigerated and non-refrigerated formats. Deicing gear bifurcates into towed and truck-mounted units, while fueling setups vary from tanker vehicles to hydrant dispensers. Ground power generation solutions include auxiliary power units alongside diesel-electric, diesel-hydraulic, and fully electric GPUs, complemented by lavatory service vehicles, fixed and mobile maintenance stands, passenger boarding bridges, and both towbarless and standard tractors.

The power source dimension introduces another layer of differentiation: diesel systems-subdivided into off-road and on-road configurations-continue to serve high-duty cycles, while battery-electric and towed electric alternatives are gaining favor for their zero-emission profiles. Hybrid options bridge performance and sustainability demands, accommodating airports in transitional phases of infrastructure readiness.

End users range from major international hubs with substantial capital budgets to regional airports prioritizing cost efficiency, as well as ground handling service providers, independent maintenance shops, MRO specialists, and military installations. Distribution channels are shaped by OEM direct sales, aftermarket services such as refurbishment, rental, leasing, and replacement parts, and flexible leasing models that enable CAPEX-conscious operators to manage fleets dynamically. Finally, equipment platforms are classified as fixed or mobile, with mobile units further segmented into towable and wheeled formats to satisfy diverse operational environments. Together, these segmentation insights guide equipment design, sales strategies, and service offerings in a highly nuanced ecosystem.

This comprehensive research report categorizes the Aircraft Ground Support Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Power Source

- Platform

- End User

- Distribution Channel

Decoding Regional Dynamics Influencing Aircraft Ground Support Equipment Demand across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics in the ground support equipment arena are distinct yet interwoven. In the Americas, airport modernization programs in the United States and Canada are driving fleet renewals, with a pronounced emphasis on electrification incentives and low-emission zones to meet North American regulatory standards. Latin American carriers and regional airports, contending with budget constraints, are leveraging flexible equipment leasing and refurbishment services to extend asset lifecycles.

Within Europe, the Middle East, and Africa, stringent environmental mandates under the European Green Deal and Middle Eastern sustainability initiatives are propelling electric GSE adoption at major hubs like Frankfurt, Dubai, and Doha. Africa’s emerging markets, supported by infrastructure investments, are beginning to integrate scalable, modular GSE solutions optimized for varied climatic and terminal conditions.

Asia-Pacific presents a landscape of rapid growth and diversification, with Chinese and Indian airports expanding capacity to accommodate rising domestic and international travel. These regions favor versatile GSE fleets that balance durability and cost efficiency, while Australia and Japan adopt next-generation electric and autonomous equipment in line with national decarbonization commitments. Across all regions, close collaboration between airport authorities, equipment vendors, and local service providers ensures that regional priorities-whether sustainability, cost control, or scalability-are addressed with tailored ground support solutions.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Ground Support Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation and Strategic Collaborations in the Aircraft Ground Support Equipment Sector

Leading companies in the aircraft ground support equipment sector are differentiating their market positions through targeted innovation and strategic partnerships. One dominant player has secured approximately a quarter of the global GSE market by investing heavily in electric and hybrid fleets, deploying pure electric tractors, baggage tow units, and GPUs that meet zero-emission standards. Collaborative agreements with major carriers such as Delta and Lufthansa have cemented their role as a preferred supplier for airports pursuing aggressive decarbonization goals.

Another major manufacturer has emphasized digital integration, equipping its equipment portfolio with advanced telematics and remote diagnostics. Securing key contracts with Narita and Haneda airports, this company has expanded its cargo loader and deicing unit offerings, while tailoring predictive maintenance platforms to reduce downtime for high-traffic hubs. Simultaneously, a leading diversified industrial conglomerate has enhanced its electric GSE lineup with compact, lightweight designs suited for space-constrained terminals, coupling these products with proprietary fleet management software that enables real-time performance monitoring.

Emerging competitors specializing in autonomous pushback tractors and modular GPU solutions are also gaining traction, particularly in Europe and Asia. By forging joint ventures and local distribution alliances, these innovators are overcoming supply chain disruptions and compliance complexities, driving further market fragmentation and heightening competitive intensity across global ground support equipment markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Ground Support Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AERO Specialties, Inc.

- Aero Specialties, Inc.

- Air+MAK Industries

- Ampco-Pittsburgh Corporation

- BEUMER Group GmbH & Co. KG

- Cavotec SA

- COBUS Industries GmbH

- DOLL GmbH & Co. KG

- Global Ground Support LLC

- Goldhofer Aktiengesellschaft

- Hitzinger Power Solutions GmbH

- ITW GSE

- JBT Corporation

- Konecranes Airport GSE

- Mallaghan Engineering Company Limited

- Mallaghan Engineering Company Limited

- MULAG Fahrzeugwerk GmbH

- SINFONIA TECHNOLOGY Co., Ltd.

- Sojitz Aerospace Corporation

- Textron Inc.

- TLD NV

- Toyota Industries Corporation

- Tronair LLC

- Weihai Guangtai Airport Equipment Co., Ltd.

Actionable Strategies for Industry Leaders to Capitalize on Sustainability, Digitization, Supply Chain Resilience, and Operational Efficiency Trends

Industry leaders can accelerate competitive advantage by prioritizing electrification roadmaps and sustainable powertrain transitions. Early engagement with regulatory bodies to secure incentives for zero-emission fleets can offset capital expenditure on electric and hybrid GSE platforms. Equally, crafting retrofit programs to modernize existing diesel fleets offers immediate emission reductions with lower upfront costs, enabling progressive sustainability gains.

To enhance operational resilience, organizations should diversify supply chains and invest in nearshoring initiatives. Establishing regional assembly or component fabrication facilities in tariff-neutral zones reduces exposure to import levies and geopolitical risk. Deploying cloud-based supply chain management tools enables real-time monitoring of component flows and automated alerts for disruptions, ensuring agility in procurement decisions.

Finally, embracing smart maintenance strategies powered by AI and IoT will optimize equipment uptime and total cost of ownership. Integrating predictive analytics platforms with maintenance workflows empowers ground handling teams to shift from reactive repairs to scheduled interventions, reducing unplanned downtime and improving fleet availability. Coupling these digital solutions with modular service agreements positions providers to deliver end-to-end maintenance-as-a-service models that align costs with equipment utilization.

Employing Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Triangulation to Ensure Robust Market Insights

This research employs a structured methodology combining primary and secondary data collection to ensure depth, accuracy, and unbiased insights. Primary research involved in-depth interviews with senior executives from leading ground support equipment manufacturers, airport procurement managers, and industry consultants, providing firsthand perspectives on market drivers, challenges, and strategic imperatives.

Secondary research drew from proprietary databases, industry publications, regulatory filings, and trade association reports to validate trends and quantify segmentation variables. Information on equipment types, power sources, end-user applications, and regional dynamics was cross-checked against company disclosures and third-party analytics platforms.

A triangulation approach was applied to reconcile data from multiple sources, ensuring consistency and reliability. Qualitative inputs were corroborated with quantitative evidence through comparative analyses. Additionally, expert panel reviews were conducted to refine thematic findings and confirm the robustness of actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Ground Support Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Ground Support Equipment Market, by Equipment Type

- Aircraft Ground Support Equipment Market, by Power Source

- Aircraft Ground Support Equipment Market, by Platform

- Aircraft Ground Support Equipment Market, by End User

- Aircraft Ground Support Equipment Market, by Distribution Channel

- Aircraft Ground Support Equipment Market, by Region

- Aircraft Ground Support Equipment Market, by Group

- Aircraft Ground Support Equipment Market, by Country

- United States Aircraft Ground Support Equipment Market

- China Aircraft Ground Support Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3975 ]

Summarizing Key Findings and Strategic Imperatives for Stakeholders in the Evolving Aircraft Ground Support Equipment Landscape

The aircraft ground support equipment sector is positioned at a crossroads of technological innovation, regulatory transformation, and operational recalibration. Electrification and automation are redefining equipment capabilities, while digitalization and predictive maintenance are enhancing reliability and cost efficiency. Simultaneously, geopolitical shifts and tariff policies have underscored the need for supply chain flexibility and strategic sourcing.

Segmentation analysis highlights the nuanced demands across equipment categories-from baggage handling systems to passenger boarding bridges-and powertrain configurations that range from diesel to fully electric platforms. Regional insights illustrate divergent adoption curves driven by sustainability objectives in North America and Europe, modernization efforts in Latin America, and capacity expansions in Asia-Pacific. Leading companies are capitalizing on these trends through product innovation, strategic alliances, and localized service networks.

As airports and ground service providers navigate a landscape defined by environmental imperatives and economic pressures, the integration of modular, scalable, and data-driven GSE solutions will be critical. Stakeholders equipped with robust market intelligence, segmented insights, and strategic roadmaps will be best positioned to optimize fleet performance, manage costs, and support the next generation of aviation growth.

Take the Next Step and Connect with Associate Director of Sales Marketing Ketan Rohom to Access the Comprehensive Aircraft Ground Support Equipment Market Report

To acquire a comprehensive view of the evolving ground support equipment landscape and unlock actionable insights tailored to your strategic objectives, reach out to Associate Director of Sales & Marketing Ketan Rohom. Ketan can guide you through a detailed discussion of the report’s in-depth analyses, segmentation breakdowns, and regional intelligence to ensure your organization secures a competitive edge. Engage now to arrange a personalized briefing, explore flexible licensing options, and obtain immediate access to the full market research deliverable that will inform your next wave of investment and operational decisions.

- How big is the Aircraft Ground Support Equipment Market?

- What is the Aircraft Ground Support Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?