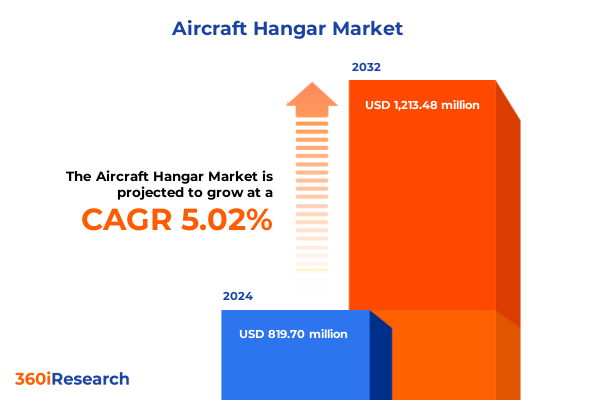

The Aircraft Hangar Market size was estimated at USD 819.70 million in 2024 and expected to reach USD 858.07 million in 2025, at a CAGR of 5.02% to reach USD 1,213.48 million by 2032.

Setting the Stage for Comprehensive Understanding of Hangar Infrastructure Evolution and Its Crucial Role in Aviation Asset Lifecycle Management

Aircraft hangars serve as critical infrastructure assets that safeguard and maintain aviation assets, yet their strategic value is often underappreciated in broader industry discourse. These bespoke facilities provide essential protection against environmental hazards and enable maintenance, repair, and storage operations that ensure the safety, reliability, and longevity of aircraft fleets of all sizes. As airlines expand networks, governments upgrade defense readiness, and private owners increase their fleets, the demand for agile, resilient hangar solutions continues to mount.

Over the past decade, the aviation sector has undergone significant transformation driven by evolving regulatory frameworks, technological advancements, and shifting operator expectations. Hangar developers and operators have responded by innovating in construction materials, design flexibility, and service integration to meet the diverse requirements of commercial carriers, military agencies, maintenance repair and overhaul (MRO) providers, and private operators. This introduction frames the subsequent analysis by highlighting the foundational role hangars play in modern aviation supply chains and the pivotal forces steering market evolution.

Revolutionary Digital Twin Integration and AI-Driven Diagnostics Are Redefining Aircraft Hangar Maintenance and Operational Efficiency

The landscape of aircraft hangar deployment has been fundamentally reshaped by the convergence of digital transformation and automation. Leading defense and aerospace technology firms are pioneering extended reality solutions that create high-fidelity digital twins of aircraft, enabling technicians to diagnose structural anomalies remotely with unprecedented accuracy and speed. This shift toward virtual simulation not only accelerates maintenance turnarounds but also enhances operational agility by allowing dispersed teams to collaborate on inspections in real time.

In tandem with immersive visualization, the integration of Internet of Things (IoT) sensors and advanced analytics platforms is revolutionizing predictive maintenance protocols. Connected devices embedded in key hangar systems continuously relay data that feed AI-driven diagnostic models, facilitating condition-based interventions that minimize unscheduled downtime. As a result, maintenance schedules are becoming increasingly dynamic and data-centric, fostering leaner inventories and streamlined workflows across global hangar networks.

However, the full benefits of these innovations hinge on addressing a critical talent gap within the MRO workforce. Industry projections indicate a significant shortfall of digitally proficient technicians capable of leveraging AI and predictive analytics in day-to-day operations. Without targeted investment in upskilling programs and collaborative training partnerships, companies risk underutilizing cutting-edge technologies and foregoing potential efficiency gains. Bridging this skills divide through robust curriculum enhancements and experiential learning initiatives remains a strategic imperative for unlocking the transformative promise of the smart hangar environment.

Navigating Elevated Steel and Aluminum Tariffs Amid Complex Compliance Requirements and Strategic Procurement Adjustments

In 2025, U.S. trade policy introduced sweeping increases in Section 232 tariffs on steel and aluminum, profoundly impacting hangar construction costs. Effective March 12, the tariff on steel and aluminum imports from previously exempt countries surged to 25%, while subsequent proclamations raised duties to 50%, excluding only those materials melted or cast domestically. These measures aim to bolster national metal industries but have translated into higher raw material expenses for hangar fabricators and limited supplier options.

As a result, major aerospace and defense contractors have reported significant profit forecast adjustments and elevated procurement costs. Leading manufacturers disclosed that tariff-related expenses could reach hundreds of millions of dollars in 2025 alone, prompting ripple effects in project timelines and capital allocation. The elevated input costs have also led some organizations to reconsider design specifications and seek alternative materials where feasible to mitigate budget overruns.

Moreover, a niche subset of hangar components, including certain aluminum aircraft parts for non-commercial applications, falls under newly imposed derivative tariffs. Even though most civil aviation parts remain exempt, suppliers and importers must exercise heightened diligence in customs classification and cost-reporting to avoid unexpected duties. This evolving tariff landscape underscores the necessity for hangar project teams to collaborate closely with trade experts and legal advisors to navigate compliance requirements and optimize sourcing strategies effectively.

Unraveling the Complex Overlay of Facility Designs, Functional Roles, and Automation Levels Shaping Hangar Infrastructure Offerings

Hangar market dynamics are shaped by a multifaceted segmentation framework that accommodates diverse operator needs. Facilities designed for commercial aviation emphasize expansive clear-span designs and integrated MRO bays, whereas military specifications prioritize reinforced structures, blast protection, and rapid deployment capabilities. Private aviation operators, conversely, often opt for modular and prefabricated solutions that balance cost efficiency with tailored aesthetics.

Maintenance, repair, and storage functions dictate spatial planning and service offerings within hangar complexes. MRO-focused facilities integrate advanced tooling, real-time data analytics workstations, and quality control labs, while storage-centric installations optimize space utilization with compact nested T-hangar configurations. Some operators blend these functions into mixed-use environments, offering turn-key support services that encompass line maintenance, component overhaul, and after-hours storage.

End users span global airlines managing large fleets, government defense agencies reinforcing readiness, third-party MRO providers delivering specialized technical services, and private owners seeking bespoke hangar solutions. Facility dimensions range from small shelters accommodating light jets to vast structures designed for wide-body aircraft and unmanned aerial systems. Material choice further differentiates offerings, with steel frameworks dominating permanent hangars, fabric shells enabling rapid deployment, and aluminum variants providing corrosion resistance in coastal sites.

Automation sophistication, from manual operations to fully automated systems, distinguishes next-generation hangars. Semi-automated door assemblies and climate control integrations enhance security and operational consistency, while IoT-enabled robotics integration facilitates autonomous inspection routines and equipment repositioning. This layered segmentation ensures that facility developers can align infrastructure investments precisely with end-user requirements and performance objectives.

This comprehensive research report categorizes the Aircraft Hangar market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Construction Material

- Automation Level

- Capacity & Layout

- Construction Type

- Operation Capabilities

- End User

- Application

Contrasting Regional Growth Drivers and Investment Models Fuelling Hangar Infrastructure Expansion Across Global Markets

The Americas region leads in hangar construction driven by robust general aviation penetration, expanding low-cost carrier networks, and strategic defense investments. The U.S. market leverages advanced building codes and financing incentives to modernize legacy hangars, while Latin American carriers pursue network expansion requiring scalable, cost-effective storage solutions. This positive momentum is tempered by regional steel price volatility and infrastructure funding constraints in select markets.

Europe, the Middle East, and Africa exhibit heterogeneous growth patterns influenced by diversified funding models and regulatory landscapes. Western European hubs focus on retrofitting existing hangars with energy-efficient systems and digital maintenance platforms. The Gulf states’ sovereign wealth allocations have fostered state-of-the-art MRO campuses, whereas select African markets emphasize public-private partnerships to upgrade air traffic and support facilities, including hangar complexes.

In Asia-Pacific, rapid fleet expansions among low-cost and full-service carriers generate unprecedented demand for both fixed and transportable hangar solutions. China’s domestic MRO sector is scaling alongside local OEM ambitions, while Southeast Asian economies channel infrastructure grants toward regional airport upgrades. Australia and New Zealand emphasize resilience against natural disasters by deploying modular, fabric-reinforced hangars capable of accelerated assembly and relocation.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Hangar market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Manufacturers Delivering Modular, Custom, and Specialized Hangar Solutions That Address Diverse Operational Needs

Leading hangar manufacturers differentiate through proprietary design methodologies and strategic partnerships. Rubb Building Systems excels in modular, fabric-skinned hangars that offer rapid deployment and decades-long service lifespans, addressing military and remote operations demands. Erect-A-Tube’s legacy in bi-fold door technology underpins its reputation for reliable, light-aviation hangars tailored to private and general aviation segments.

Fulfab stands out for deploying pre-engineered steel and nested T-hangar systems, having supplied over 12,000 units across North America, which underscores its capacity to deliver high-volume, standardized solutions with expedited on-site assembly. REIDsteel’s century-long expertise in heavy steel framing enables bespoke clear-span and cantilevered hangars that accommodate wide-body aircraft and meet stringent military specifications.

Allied Buildings and J&M Steel appeal to clients seeking custom engineered steel structures with integrated project management support. Banyan Steel Arch Systems and BigTop Manufacturing offer semi-permanent fabric structures optimized for harsh climates and swift erection, providing economical alternatives for operators requiring flexible footprint solutions. Each of these companies leverages unique structural innovations to address specific geographies, application profiles, and budgetary considerations, reinforcing the competitive landscape in hangar development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Hangar market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AECOM

- Alaska Structures by AKS Industries, Inc.

- Allied Steel Buildings Inc.

- Anthem Steel Corporation

- Apco Building Systems Inc.

- Aveiro Constructors Limited

- Big Top Manufacturing, Inc.

- BlueScope Steel Limited

- Burns & McDonnell Inc.

- Centrex Construction, Inc.

- Clark Construction Group, LLC

- ClearSpan Fabric Structures, Inc.

- Coastal Steel Structures

- Erect-A-Tube, Inc.

- Fabspace Hangars GmbH

- Foshan Shengbang Steel Structure Co., Ltd

- Fulfab Inc.

- GAPTEK S.L.

- GNB Global Inc.

- Hensel Phelps Construction Co.

- HTS TENTIQ GmbH

- J & M Steel Solutions

- John Reid & Sons (Strucsteel) Ltd.

- Kiewit Corporation

- Norseman Structures

- Nucor Corporation

- Olympia Steel Buildings Systems Corp.

- PCL Constructors Inc.

- Rubb Buildings Ltd. by Zurhaar & Rubb AS

- Singapore Technologies Engineering Ltd.

- Skanska AB

- Springfield Steel Buildings Ltd.

- The Integrity Group

- The Korte Company

- Turner Construction Company by HOCHTIEF Aktiengesellschaft

- Worldwide Steel Buildings

- WSP Global Inc.

Strategic Technology Partnerships, Supplier Diversification, and Modular Design Adoption to Future-Proof Hangar Investments

Industry leaders should prioritize strategic alliances with IoT platforms and robotics integrators to accelerate the adoption of predictive maintenance workflows and autonomous inspection capabilities. Establishing joint development agreements with technology providers can reduce implementation timelines and share R&D costs while ensuring that new systems integrate seamlessly with existing infrastructure.

To mitigate tariff-induced cost pressures, executives are advised to diversify supplier networks by engaging secondary steel and aluminum producers, exploring domestic content exemptions, and leveraging forward contracts to lock in material prices. Early engagement with trade compliance specialists will facilitate accurate duty classification and the identification of cost-recovery mechanisms, such as capital allowances and tariff mitigation programs.

Workforce development remains a critical enabler for realizing digital hangar potential. Organizations need to invest in competency frameworks that blend traditional MRO expertise with data analysis and AI-tool proficiency. Collaborative training initiatives with technical institutes and OEMs will help scale up a pipeline of technicians adept at leveraging digital twins and advanced analytics.

Finally, leaders should adopt a modular design philosophy to future-proof hangars against evolving fleet compositions and regulatory mandates. By standardizing modular components and prefabricated elements, companies can accelerate construction schedules, optimize capital deployment, and adapt facilities to changing operational demands with minimal downtime.

Combining Executive Interviews, Industry Data Triangulation, and Expert Validation Workshops to Deliver Rigorous Market Analysis

This analysis draws on a robust blend of primary and secondary research methodologies to ensure comprehensive market understanding. Primary insights were captured through in-depth interviews with industry executives, MRO leaders, and government infrastructure planners, providing firsthand perspectives on operational challenges and investment priorities.

Secondary research encompassed a systematic review of trade publications, regulatory filings, and company announcements to map recent developments in tariffs, technology adoptions, and project financing. Data triangulation techniques were applied to reconcile information across multiple credible sources, ensuring the accuracy of qualitative assessments and competitive profiles.

The segmentation framework and regional insights incorporated inputs from architectural firms, materials suppliers, and aviation associations, enabling a nuanced appreciation of design preferences and regulatory impacts. Validation workshops with subject-matter experts further refined the methodology, ensuring that conclusions reflect real-world constraints and emerging opportunities in hangar infrastructure planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Hangar market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Hangar Market, by Product Type

- Aircraft Hangar Market, by Construction Material

- Aircraft Hangar Market, by Automation Level

- Aircraft Hangar Market, by Capacity & Layout

- Aircraft Hangar Market, by Construction Type

- Aircraft Hangar Market, by Operation Capabilities

- Aircraft Hangar Market, by End User

- Aircraft Hangar Market, by Application

- Aircraft Hangar Market, by Region

- Aircraft Hangar Market, by Group

- Aircraft Hangar Market, by Country

- United States Aircraft Hangar Market

- China Aircraft Hangar Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Synthesizing Strategic Imperatives and Regional Growth Dynamics to Chart the Future Course of Hangar Infrastructure Development

The aircraft hangar sector stands at a crossroads of technological innovation, regulatory complexity, and shifting operator needs. Digital twin implementations and AI-driven analytics are redefining maintenance paradigms, while escalating steel and aluminum tariffs necessitate proactive procurement strategies. Simultaneously, the diverse segmentation landscape-from modular fabric shelters to reinforced military-spec hangars-underscores the importance of tailored solutions that align with distinct end-user requirements.

Regional growth trajectories highlight the Americas’ emphasis on financing incentives, EMEA’s focus on retrofitting and state-backed MRO campuses, and Asia-Pacific’s capacity-driven expansions. Meanwhile, leading manufacturers continue to differentiate through design ingenuity, robust project management, and agile production models. Successful industry players will be those that balance technological foresight with operational pragmatism, leveraging partnerships, workforce development, and modular design to navigate an increasingly complex environment.

As the market evolves, decision-makers must remain vigilant in monitoring policy shifts, embracing digital innovations, and aligning infrastructure investments with broader organizational objectives. The insights presented in this executive summary offer a strategic roadmap for stakeholders to capitalize on emerging opportunities and build resilient, future-ready hangar ecosystems.

Act now to secure detailed market intelligence and personalized advisory support from Ketan Rohom to drive strategic growth and informed decision-making

For organizations seeking a competitive edge in the rapidly evolving aircraft hangar sector, securing the comprehensive market research report is a strategic imperative. Connect with Ketan Rohom, Associate Director, Sales & Marketing, to gain unparalleled insights, customized analysis, and advisory support that will empower your company to navigate emerging trends, regulatory shifts, and technological advances with confidence. Elevate your decision-making process today by partnering with Ketan Rohom to access the detailed findings and actionable intelligence contained within this definitive report.

- How big is the Aircraft Hangar Market?

- What is the Aircraft Hangar Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?