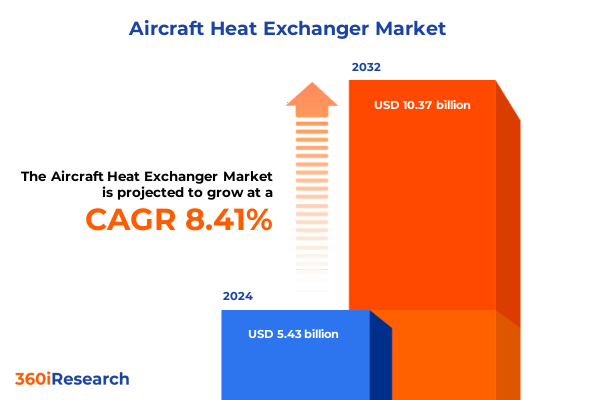

The Aircraft Heat Exchanger Market size was estimated at USD 5.86 billion in 2025 and expected to reach USD 6.32 billion in 2026, at a CAGR of 8.49% to reach USD 10.37 billion by 2032.

Unveiling the Strategic Importance of Next-Generation Heat Exchangers in Aircraft Thermal Management for Enhanced Performance and Reliability

As modern aircraft systems grow increasingly complex, thermal management emerges as a critical enabler of reliable, efficient, and safe operations. Heat exchangers, which transfer thermal energy between various aircraft subsystems-ranging from engine lubrication circuits to environmental control systems-play a pivotal role in maintaining optimal operating temperatures under diverse flight conditions. Without robust thermal management, components risk accelerated wear, performance degradation, and safety vulnerabilities.

Rapid expansion in global air traffic has intensified the demand for advanced heat exchanger technologies. The rise of low-cost carriers and increasing disposable incomes worldwide have driven airlines to expand fleets, thereby heightening the need for reliable cooling solutions in both new-build aircraft and legacy airframes. Furthermore, stringent international environmental regulations aimed at reducing aircraft emissions have underscored the importance of lightweight, fuel-efficient designs. By enhancing thermal efficiency, modern heat exchangers contribute directly to fuel savings and lower carbon footprints, aligning aerospace objectives with global sustainability targets.

Against this backdrop, the aircraft heat exchanger market has evolved from conventional designs to a landscape defined by technological convergence, regulatory complexity, and rising aftermarket service requirements. As demand grows for both OEM solutions and lifecycle support, stakeholders must navigate intricate supply chains, tariff environments, and performance benchmarks. The ensuing sections of this executive summary explore the transformative forces shaping this market, the impact of U.S. tariffs in 2025, and strategic recommendations poised to steer industry leaders toward sustained competitive advantage.

How Disruptive Technologies and Sustainability Imperatives Are Revolutionizing Aircraft Heat Exchanger Design and Operation

The aircraft heat exchanger sector is being revolutionized by a wave of disruptive technologies and shifting operational imperatives. Additive manufacturing techniques, particularly laser-powder bed fusion processes, are enabling the fabrication of highly complex internal geometries that were previously unattainable with conventional machining. These topologically optimized designs yield substantial reductions in weight while enhancing heat transfer efficiency, laying the groundwork for the next generation of thermal management components.

Concurrently, the integration of digital twin and computational fluid dynamics (CFD) simulations into the product development lifecycle has emerged as a best practice. By leveraging real-time data and virtual modeling, engineers can predict performance under varied flight profiles, identify potential failure modes, and optimize maintenance schedules before physical prototypes are built. This digital convergence not only accelerates time-to-market but also underpins proactive health-management strategies essential for modern aviation operations.

Advanced materials are also reshaping the landscape. Beyond traditional aluminum alloys, aerospace-grade titanium and high-strength stainless steels are increasingly employed for their superior temperature resistance and corrosion performance. Composite metal matrix materials and multi-material assemblies are gaining traction, driven by a need to balance structural integrity with weight constraints. Moreover, the push toward sustainable aviation has spurred collaborations between OEMs and material specialists to develop eco-friendly coatings and surface treatments that enhance exchanger longevity and recyclability.

These transformative shifts highlight a market in dynamic flux, where innovation cycles are shortening and cross-industry partnerships-spanning software, materials, and additive manufacturing-are becoming indispensable. Industry participants that align their R&D investments with these emerging trends will be best positioned to capture growth and lead in performance differentiation.

Navigating the Complexities of United States Tariffs and Their Far-Reaching Effects on the Aircraft Heat Exchanger Supply Chain

In 2025, a series of U.S. tariff actions targeting imported aerospace components and raw materials has had significant repercussions for the aircraft heat exchanger supply chain. Levies on specialty alloys and copper inputs have increased production costs, compelling manufacturers to reassess sourcing strategies and pricing models. GE Aerospace’s CEO Larry Culp has publicly advocated for reinstating a tariff-free regime to restore supply chain stability, warning that tariff-related expenses could exceed $500 million in the year ahead.

In parallel, potential tariffs on components sourced from Canada and Mexico prompted several tier-1 suppliers to relocate critical inventory and manufacturing capacity to the United States. Reuters reported that aerospace parts supplier Optima Aero proactively built domestic buffer stocks to hedge against a proposed 25 percent tariff, illustrating the pervasive uncertainty permeating the sector. Consequently, long-term agreements now often include built-in tariff surcharges or value-based clauses to stabilize cost exposure and maintain competitive pricing for OEMs and aftermarket providers.

Despite these headwinds, the industry has responded with resilience by diversifying procurement networks, forging new alliances with non-U.S. trading partners, and accelerating reshoring initiatives. Collaborative supply-chain frameworks-wherein material suppliers and heat exchanger manufacturers co-invest in volume-discount arrangements-have emerged as an effective counterbalance to tariff pressures. These adaptive measures not only mitigate lead-time volatility but also reinforce supply-chain transparency, empowering stakeholders to navigate an increasingly complex regulatory environment.

Unlocking Market Dynamics Through Type, Material, Flow, End-User, Sales Channel, and Application Segmentation Insights

The aircraft heat exchanger market can be understood through multiple segmentation lenses that reveal distinct demand drivers and competitive dynamics. By type, the market encompasses air-cooled, plate, and shell-and-tube exchangers, each tailored for unique performance profiles. Air-cooled units, available in forced-draft and induced-draft variants, are prized for compactness in environmental control systems. Plate exchangers, delivered as brazed, gasketed, or welded assemblies, offer high thermal efficiency in engine and hydraulic cooling applications. Shell-and-tube configurations, featuring straight-tube and U-tube designs, remain a mainstay for high-pressure lubrication and fuel-oil cooling circuits.

Material segmentation underscores the influence of aluminum in weight-sensitive installations, copper in high-conductivity applications, and stainless steel for corrosion resilience under extreme temperatures. Titanium is emerging in niche, high-temperature zones, reflecting a premium performance tier.

Segmentation by flow configuration-counter, cross, and parallel-aligns exchanger design with thermal gradients and space constraints, optimizing performance across avionics, power generation, and hybrid propulsion systems. End-user segmentation captures demand across aerospace OEMs, industrial platforms, marine vessels, and power generation facilities, highlighting cross-sectoral applicability.

Sales channel segmentation differentiates between aftermarket services-driven by aging fleet maintenance and rapid-response repairs-and OEM partnerships, where integrated thermal management solutions form part of new-aircraft builds. Finally, application segmentation spans avionics and electronics cooling, engine system thermal management, environmental control subsystems-including cabin temperature and pressure management-and hydraulic system cooling, illustrating the breadth of thermal challenges addressed by modern heat exchangers.

This comprehensive research report categorizes the Aircraft Heat Exchanger market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Flow Configuration

- Application

- End-User

- Sales Channel

Examining Regional Variations in Aircraft Heat Exchanger Demand and Innovation Across Key Global Markets

North America remains a powerhouse in the aircraft heat exchanger market, bolstered by a robust domestic aerospace industry and substantial defense spending. The United States, in particular, drives demand for advanced thermal management solutions in both commercial and military platforms. Home to key R&D centers and leading OEMs, this region prioritizes regulatory compliance, operational reliability, and service network expansion-supported by well-developed supply chains and manufacturing ecosystems.

Europe, characterized by stringent environmental regulations and a strong aerospace heritage, continues to emphasize high-efficiency heat exchanger designs. Regulatory frameworks such as the EU Emissions Trading System (EU ETS) and Clean Aviation Partnership fuel investments in sustainable materials and low-emissions thermal management solutions. This regulatory environment has fostered collaboration among national research institutions, leading OEMs, and specialized suppliers to co-develop next-generation heat exchanger technologies.

Asia-Pacific is witnessing the fastest growth, propelled by fleet expansions among low-cost carriers, rising defense budgets in key markets, and local manufacturing investments. Countries like China, India, and Japan are scaling up aerospace production capacities, thereby stimulating demand for both OEM supply agreements and aftermarket services. Regional governments are actively courting global suppliers, offering incentives and infrastructure support to establish production hubs.

Middle East & Africa is emerging as a strategic maintenance and overhaul center, with the UAE’s world-class MRO facilities in Dubai and Abu Dhabi serving global carriers. Conversely, local manufacturing in parts of Africa remains challenged by economic volatility, as illustrated by South African provider Kelvion’s struggles amid broader industrial downturns. Nevertheless, strategic investments in digital MRO platforms and training programs are gradually enhancing regional capabilities.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Heat Exchanger market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Positioning of Leading Players in the Aircraft Heat Exchanger Market

GE Aerospace has been at the forefront of advocating for a return to duty-free trade under the 1979 Civil Aircraft Agreement, stressing that zero-duty frameworks historically yielded a $75 billion annual U.S. aerospace trade surplus. Despite not yet experiencing direct shipment disruptions, the company anticipates that tariff-related costs for its LEAP 1A engine joint venture could exceed $500 million in 2025, prompting a tariff surcharge and cost optimization programs to protect profit margins.

Honeywell International’s strategic acquisition of Air Products’ LNG pretreatment business introduces coil-wound heat exchanger and cryogenic expertise into its portfolio, reflecting a clear push to expand capabilities in high-performance heat transfer applications. This move aligns with growing LNG demand and underscores Honeywell’s broader megatrends focus, which includes aviation, energy transition, and process automation.

Safran SA has cautioned that escalating U.S.-China trade tensions could undermine global aerospace growth, especially given China’s role as the world’s second-largest aeronautics market. Safran’s conservative mid-term revenue guidance and emphasis on robust services income streams for its LEAP and CFM 56 engines underscore the company’s dual focus on mitigating geopolitical risks and capitalizing on the aftermarket services business.

Innovative startups, notably Conflux Technology, are forging partnerships with defense majors like General Atomics Aeronautical Systems Inc. to pilot additively manufactured fuel oil heat exchangers for MQ-9B drones. Early proofs of concept achieved under a 2023 memorandum of understanding have set the stage for broader commercialization of 3D-printed thermal solutions in both military and commercial aerospace segments. Similarly, Boeing’s ARPA-E supported projects are demonstrating the promise of AM for thin-walled exchanger geometries that deliver 20–30% performance improvements alongside significant weight reduction.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Heat Exchanger market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Boyd Corporation

- Conflux Technology Pty Ltd.

- Eaton Corporation plc

- Essex Industries, Inc.

- General Electric Company

- General System Engineering Sdn Bhd

- GKN Aerospace Services Limited

- Honeywell International Inc.

- Intergalactic

- Jamco Corporation

- Kawasaki Heavy Industries, Ltd

- Liebherr-International AG

- Mezzo Technologies Inc.

- MSM Aerospace Fabricators Ltd

- Parker-Hannifin Corporation

- RTX Corporation

- SAFRAN SA

- ST Engineering Aerospace Ltd

- Sumitomo Precision Products Co., Ltd.

- TAT Technologies Ltd.

- Triumph Group, Inc.

- Wall Colmonoy Corporation

- Woodward, Inc.

Actionable Strategies for Industry Leaders to Capitalize on Heat Exchanger Innovations and Mitigate Supply Chain Risks

Industry leaders should accelerate investment in additive manufacturing capabilities to remain at the forefront of design innovation. While AM systems for compact, leak-proof features are still maturing, early adopters stand to capture the benefits of lightweight, topologically optimized heat exchangers. Collaboration with research partners and participation in government-sponsored AM initiatives can de-risk development timelines and foster knowledge transfer.

Developing agile sourcing frameworks and tariff mitigation strategies is critical amid ongoing trade uncertainties. Companies should integrate tariff-predictive analytics into procurement workflows, negotiate value-based contracts with suppliers, and explore reshoring opportunities where economically viable. Engaging proactively with policymakers to advocate for duty-free regimes-echoing calls from industry executives-can help secure long-term supply-chain stability.

Expanding aftermarket and MRO service offerings through digital twin monitoring and predictive maintenance platforms will enhance customer loyalty and unlock recurring revenue streams. By leveraging advanced analytics to preempt exchanger fouling, corrosion, and fatigue, providers can optimize repair intervals, minimize downtime, and uphold stringent safety standards. Strategic partnerships with software integrators and MRO networks are essential to scale these service models efficiently.

Outlining a Rigorous Research Framework and Methodological Approach for Comprehensive Aircraft Heat Exchanger Analysis

This research employs a robust mixed-methodology framework, combining comprehensive secondary research with targeted primary interviews. Secondary sources include peer-reviewed literature on additive manufacturing applications in aerospace, relevant tariff notices from governmental agencies, and leading industry publications. Primary insights were gathered through interviews with thermal management engineers, supply-chain executives, and procurement specialists at OEMs and tier-1 suppliers.

Quantitative data collection prioritized operational metrics-such as lead times, material cost variances, and service turnaround times-sourced from company financial disclosures and regulatory filings. Qualitative analysis leveraged case studies of additive manufacturing pilots and reshoring initiatives to contextualize strategic responses to tariff impacts. Continental segmentation insights reflect granular assessment across type, material, and end-use, informed by proprietary interview transcripts and cross-validated against industry benchmarks.

Rigorous data triangulation ensured the reliability of emerging trend analyses, while sensitivity testing evaluated the robustness of strategic recommendations under alternative tariff and regulatory scenarios. Ethical research protocols were maintained throughout, adhering to confidentiality agreements with participating organizations and ensuring unbiased representation of stakeholder viewpoints.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Heat Exchanger market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Heat Exchanger Market, by Type

- Aircraft Heat Exchanger Market, by Material

- Aircraft Heat Exchanger Market, by Flow Configuration

- Aircraft Heat Exchanger Market, by Application

- Aircraft Heat Exchanger Market, by End-User

- Aircraft Heat Exchanger Market, by Sales Channel

- Aircraft Heat Exchanger Market, by Region

- Aircraft Heat Exchanger Market, by Group

- Aircraft Heat Exchanger Market, by Country

- United States Aircraft Heat Exchanger Market

- China Aircraft Heat Exchanger Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Converging Insights to Synthesize Aircraft Heat Exchanger Market Trends, Challenges, and Opportunities for Informed Decisions

The converging forces of advanced materials, additive manufacturing, digital design, and complex trade dynamics define the modern aircraft heat exchanger market. Leaders must balance performance imperatives-such as weight reduction, thermal efficiency, and reliability-with evolving regulatory and tariff landscapes. Flexibility in procurement, networked innovation partnerships, and digital service models have emerged as key differentiators.

Regional nuances underscore this market’s heterogeneity: North America’s scale and defense spending, Europe’s sustainability mandates, Asia-Pacific’s rapid fleet growth, and the Middle East’s MRO focus each demand tailored strategies. Key players ranging from established OEMs to nimble startups are advancing the frontier of heat exchanger technology, embracing convergent engineering approaches to meet future aircraft thermal challenges.

Actionable insights from this report guide decision-makers in R&D investments, supply-chain design, and service network expansion. By adopting proactive tariff monitoring, committing to additive manufacturing, and embedding digital twin capabilities, organizations can anticipate market shifts, unlock new growth avenues, and deliver differentiated value across the lifecycle of both new and in-service aircraft.

Connect with Ketan Rohom to Secure Your Comprehensive Aircraft Heat Exchanger Market Research Report and Gain Actionable Insights Today

Elevate your strategic decision-making with an in-depth, authoritative aircraft heat exchanger market research report designed to inform your next innovation and growth initiative. Reach out to Ketan Rohom, Associate Director, Sales & Marketing to secure immediate access to the comprehensive analysis that will sharpen your competitive edge. Begin leveraging actionable insights today to optimize your thermal management strategies and outpace market trends.

- How big is the Aircraft Heat Exchanger Market?

- What is the Aircraft Heat Exchanger Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?