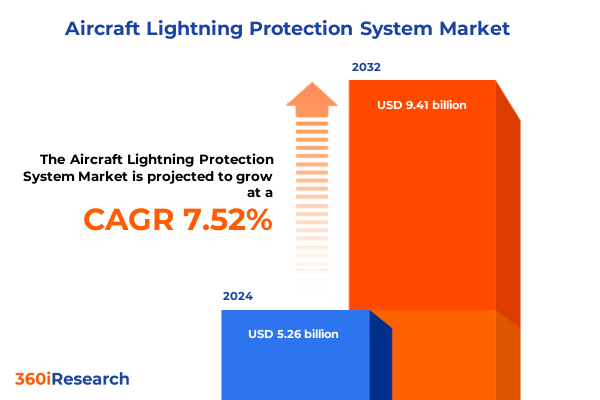

The Aircraft Lightning Protection System Market size was estimated at USD 5.66 billion in 2025 and expected to reach USD 6.05 billion in 2026, at a CAGR of 7.52% to reach USD 9.41 billion by 2032.

Navigating the Critical Role of Advanced Lightning Protection Systems in Ensuring Aircraft Safety and Structural Integrity around the Globe

Aircraft operate in an environment where the interaction with atmospheric electricity is an unavoidable reality. Lightning strikes represent one of the most significant natural hazards faced by airborne platforms, posing potential threats to structural integrity avionics performance and passenger safety. The composite materials and advanced electronics that define modern fleets, while enhancing fuel efficiency and cabin comfort, introduce new vulnerabilities that must be addressed with robust lightning protection strategies. Consequently, lightning protection systems have evolved into integral components of aircraft design, harmonizing conductive paths, dissipation mechanisms and surge suppression elements to ensure uninterrupted functionality.

In the current aviation ecosystem, stringent safety standards and certification requirements drive continuous innovation in protection technologies. Industry stakeholders-from airframers to tier-one suppliers-must navigate a complex regulatory matrix that spans major certification authorities. At the same time, emerging applications such as unmanned aerial vehicles and business jets impose unique design constraints, accelerating the need for flexible and lightweight solutions.

Therefore, understanding the historical context, engineering fundamentals and cross-functional integration challenges is essential for decision-makers seeking to enhance aircraft resilience. This executive summary distills crucial strategic insights on market dynamics, regulatory shifts, tariff impacts and regional considerations that collectively shape the future of aircraft lightning protection systems worldwide.

Unpacking the Technological and Regulatory Paradigm Shifts Driving Innovation in Aircraft Lightning Protection Systems Worldwide

The landscape of aircraft lightning protection is undergoing transformative shifts driven by converging technological breakthroughs and evolving regulatory expectations. Advances in composite airframe construction mandate innovative dissipation approaches, as traditional metallic skin conduction paths become insufficient. Furthermore, developments in active protection schemes leveraging real-time detection and discharge mechanisms are gaining traction alongside established passive methodologies that rely on static wicks and bonding jumpers.

Moreover, regulatory bodies have introduced updated certification protocols emphasizing full-scale testing under representative environmental conditions and enhanced inspection requirements. These changes compel suppliers and airframers to invest in rigorous simulation tools, high-fidelity instrumentation and collaborative testing consortia to validate system efficacy. Concurrently, the rise of strategic unmanned aerial platforms has prompted tailored protection frameworks that balance weight constraints against performance demands.

In addition, digital twins and predictive maintenance platforms are being integrated with lightning protection architectures to enable condition-based inspections and data-driven optimization. This convergence of smart data analytics, novel materials such as conductive meshes and paints, and modular component design underscores the industry’s commitment to proactive risk mitigation. As a result, stakeholders must adapt to an environment where agility, cross-disciplinary collaboration and forward-looking R&D investments are central to capturing competitive advantage.

Analyzing the Broad Economic and Supply Chain Repercussions of 2025 United States Tariffs on Aircraft Lightning Protection Components

The introduction of new United States tariffs on a range of materials and electronic components in early 2025 has triggered significant supply chain recalibrations for lightning protection system manufacturers. At the heart of these measures are levies on certain metallic meshes, surge protection devices and specialized coatings that form the backbone of passive and active dissipation systems. Consequently, original equipment manufacturers and aftermarket providers have encountered elevated input costs, leading to strategic sourcing reviews and an accelerated shift toward domestic supplier networks.

Furthermore, the imposition of tariffs has underscored the importance of supply chain resilience. Many industry players have expanded dual-sourcing agreements and invested in vertical integration initiatives to mitigate exposure to cross-border trade fluctuations. This strategic realignment has fostered closer collaboration between material scientists and procurement teams, driving innovation in alternative conductive paints and composite-integrated protective layers that can be manufactured with fewer tariff-sensitive inputs.

In parallel, cost pressures have prompted a reexamination of life-cycle management and maintenance cycles. Operators are increasingly demanding solutions that offer extended inspection intervals and streamlined retrofitting processes to offset the financial impact of elevated component costs. As the market continues to adapt, stakeholders who leverage supply chain agility and pursue collaborative R&D partnerships are best positioned to navigate the cumulative effects of the 2025 tariff landscape.

Revealing Deep Segmentation Insights That Illuminate the Market Landscape Across Lightning Protection Types Components Platforms Materials and Distribution

A nuanced understanding of market segmentation reveals the intricate dynamics at play across protection types, component categories, platform configurations, material innovations, aircraft classes, installation modalities and distribution channels. In terms of protection philosophy, active lightning protection solutions-designed to detect, direct and neutralize electrical charges-are steadily gaining adoption alongside traditional passive methods that rely on static dissipater wicks and robust bonding jumpers. Transitioning to specific components, the ecosystem spans cables and connectors integral to structural continuity, surge protection devices encompassing gas discharge tubes spark gaps and transient voltage suppressors, as well as advanced static dissipater wicks that enhance charge dispersion.

The landscape further diversifies when considering platform type: fixed wing configurations benefit from established protection architectures while rotary wing applications impose unique challenges related to blade tip dissipation and dynamic structural loads. Concurrently, material selection plays a decisive role, with composite materials prompting embedded conductive meshes and paints, whereas metallic materials such as foils and meshes continue to provide proven conductive paths.

Aircraft type segmentation highlights varied priorities across business jets, commercial airliners, military aircraft and unmanned aerial vehicles, the latter encompassing micro, strategic and tactical platforms each demanding tailored protection footprints. Installation type analysis differentiates original equipment manufacturer integration-focused on seamless design incorporation-from aftermarket solutions emphasizing ease of retrofitting and cost efficiency. Finally, distribution channel considerations delineate direct sales engagements for high-complexity custom systems and distributor networks catering to broader aftermarket demand. Together these segmentation narratives illuminate how each axis shapes competitive positioning, innovation trajectories and value propositions.

This comprehensive research report categorizes the Aircraft Lightning Protection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Protection Type

- Component Type

- Platform Type

- Material Type

- Aircraft Type

- Installation Type

- Distribution Channel

Mapping Regional Growth Trajectories and Strategic Imperatives Across Americas Europe Middle East Africa and Asia Pacific Aviation Markets

Regional analysis underscores distinct growth catalysts and adoption patterns across the Americas, Europe Middle East & Africa and Asia-Pacific aviation markets. In the Americas, the strong presence of established large commercial airliner fleets and a vibrant business jet community fuels steady demand for both OEM and aftermarket lightning protection solutions. The regulatory rigor of North American certification authorities drives high compliance standards and encourages the integration of advanced surge protection and active dissipation technologies. Meanwhile, Latin American markets are increasingly focusing on cost-effective retrofitting programs to support aging regional fleets.

Turning to Europe, Middle East & Africa, the convergence of mature commercial aviation hubs, defense modernization programs and burgeoning Gulf-region airline expansions creates a multifaceted demand profile. European airframers are at the forefront of embedding conductive meshes into composite airframes, while Middle Eastern carriers prioritize turnkey aftermarket upgrades to enhance network reliability. African operators, on the other hand, are gradually adopting standardized bonding jumper and static wick replacements to meet evolving safety regulations.

In Asia-Pacific, dramatic fleet growth and the rapid deployment of unmanned aerial systems are key drivers for innovative lightning protection architectures. Stakeholders in China and India are investing in domestic manufacturing capabilities for surge protection devices, whereas Southeast Asian markets are forming consortiums to validate testing methodologies under tropical weather conditions. Across all regions, the interplay of fleet composition, regulatory landscapes and strategic defense requirements shapes unique pathways for lightning protection technology adoption.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Lightning Protection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Footprints and Competitive Differentiators of Leading Aircraft Lightning Protection System Providers Globally

Leading participants in the aircraft lightning protection domain are distinguishing themselves through targeted technological investments, strategic partnerships and vertical integration initiatives. Prominent engineering entities have prioritized the development of lightweight conductive coatings and embedded metallic meshes optimized for next-generation composite airframes. In parallel, specialized surge protection device manufacturers have refined gas discharge tubes and transient voltage suppressor designs to achieve faster response times and higher energy absorption capabilities.

Moreover, key system integrators are forging alliances with avionics suppliers to co-develop active lightning protection modules that seamlessly interface with onboard diagnostics and health-monitoring platforms. This collaborative approach not only enhances system-level reliability but also creates opportunities for predictive maintenance services and aftermarket analytics offerings. Additionally, industry leaders are securing intellectual property portfolios encompassing novel bonding jumper configurations and hybrid material treatments to reinforce their competitive moat.

On the distribution front, select providers maintain direct sales channels to deliver customized solutions to major airframers, while others leverage global distributor networks to address diverse aftermarket retrofit requirements. This dual approach enables robust market coverage across distinct customer segments, from defense primes seeking the utmost performance to regional carriers focused on operational cost optimization. Collectively, these strategic initiatives underscore the imperative of balancing innovation with market access to sustain leadership in the lightning protection arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Lightning Protection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- A.P.C.M. LLC

- AEF Solutions Limited

- AMETEK Inc

- Amphenol Corporation

- Astronics Corporation

- Astroseal Products Manufacturing Corp

- Carlisle Companies Inc

- Cobham plc

- Collins Aerospace

- Dayton-Granger Inc

- Dexmet Corporation

- GKN Aerospace

- Henkel AG & Co

- Honeywell International Inc

- Hydra-Electric Company

- L3Harris Technologies Inc

- Microchip Technology Incorporated

- NTS Pittsfield

- Parker Hannifin Corporation

- PPG Industries Inc

- Safran S.A.

- TE Connectivity Ltd

- The Gill Corporation

- Triumph Group Inc

Formulating Strategic Action Plans for Industry Stakeholders to Strengthen Supply Chains Drive Innovation and Foster Collaboration in Lightning Protection

Industry leaders must adopt a multifaceted strategy that harmonizes supply chain resilience, material innovation and collaborative engagement to thrive in the evolving lightning protection landscape. First, companies should diversify procurement channels by establishing dual sourcing arrangements for key materials such as conductive meshes and surge suppression components, thereby minimizing exposure to tariff-driven cost volatility. Concurrently, investing in in-house material science capabilities or forming R&D partnerships with coatings specialists can yield alternative formulations that circumvent tariff impacts while enhancing performance.

Furthermore, stakeholders should accelerate the adoption of digital twin technologies and data-driven predictive maintenance frameworks. By integrating real-time lightning event monitoring with advanced analytics, operators can extend inspection intervals and proactively address emerging wear patterns, reducing life-cycle costs and improving safety margins. In addition, forging cross-functional alliances with avionics and structural specialists will facilitate seamless integration of active dissipation systems, unlocking new revenue streams through value-added service contracts.

Finally, a targeted approach to regional market entry-respecting localized certification standards and fleet compositions-will maximize opportunity capture. Stakeholders can leverage distributor partnerships in emerging markets while retaining direct engagement with flagship clients to pilot next-generation solutions. Executing these recommendations will position industry leaders to navigate regulatory shifts, tariff constraints and technological disruption with confidence.

Detailing the Rigorous Multi-Source Research Framework Combining Expert Interviews Technical Data Analysis and Industry Validation Processes

This research framework was constructed through a rigorous multi-source approach combining secondary data analysis and primary expert validation. Initially, publicly available technical standards, regulatory documents and academic publications were systematically reviewed to establish the foundational engineering and certification context. This was complemented by an in-depth examination of supplier and airframer technical whitepapers, patent filings and product specifications to capture the breadth of emerging protection technologies and material innovations.

Subsequently, qualitative insights were gathered from structured interviews with key stakeholders, including material scientists, test facility engineers, certification experts and procurement executives. These dialogues provided nuanced perspectives on strategic priorities, supply chain challenges and innovation roadmaps. In addition, regional market dynamics were assessed through consultations with local industry associations and regulatory bodies to validate the applicability of global trends across diverse operating environments.

Finally, the findings were synthesized through a collaborative review process involving cross-functional analysts and subject matter experts, ensuring consistency, factual accuracy and relevance. This iterative methodology, grounded in both quantitative evidence and qualitative expertise, underpins the robust insights presented in this report and provides a transparent trail for stakeholders seeking to delve deeper into specific areas of interest.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Lightning Protection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Lightning Protection System Market, by Protection Type

- Aircraft Lightning Protection System Market, by Component Type

- Aircraft Lightning Protection System Market, by Platform Type

- Aircraft Lightning Protection System Market, by Material Type

- Aircraft Lightning Protection System Market, by Aircraft Type

- Aircraft Lightning Protection System Market, by Installation Type

- Aircraft Lightning Protection System Market, by Distribution Channel

- Aircraft Lightning Protection System Market, by Region

- Aircraft Lightning Protection System Market, by Group

- Aircraft Lightning Protection System Market, by Country

- United States Aircraft Lightning Protection System Market

- China Aircraft Lightning Protection System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights and Strategic Imperatives to Guide Decision Makers in Strengthening Aircraft Lightning Protection Strategies

The collective insights presented herein illuminate the critical intersections of technology, regulation and market strategy that define the aircraft lightning protection domain. Advancements in composite materials, active protection schemes and surge suppression devices are reshaping industry expectations, while new tariff regimes and regional fleet expansions present both challenges and opportunities.

Strategic segmentation analysis reveals the nuanced requirements across protection types, components, platforms, materials, aircraft classes, installation modalities and distribution channels. Regional perspectives emphasize tailored entry strategies and certification alignment, whereas company-level examination underscores the value of innovation partnerships and dual-channel market access.

Moving forward, decision-makers must integrate supply chain diversification, digital twin-enabled maintenance and collaborative R&D frameworks into their strategic roadmaps. Embracing these imperatives will not only mitigate emerging risks associated with regulatory and economic shifts but also catalyze new revenue models centered on service offerings and performance guarantees. This synthesis provides a clear pathway for executives to align technical capabilities with market demands, ensuring robust aircraft resilience and sustainable competitive advantage in an increasingly electrified atmospheric environment.

Engage with Ketan Rohom to Unlock In-Depth Insights and Secure Exclusive Access to the Comprehensive Aircraft Lightning Protection System Market Report Today

Engage with Ketan Rohom to unlock in-depth insights on key technological advancements supply chain dynamics and regulatory considerations that shape the aircraft lightning protection system landscape. Discover how leading providers are navigating evolving material science breakthroughs testing protocols and distribution strategies. This comprehensive report offers exclusive access to expert-validated analysis designed to empower procurement teams engineering leaders and senior executives. By securing this research you will gain immediate visibility into innovative protective architectures cost management approaches and competitive positioning frameworks that are essential for driving operational excellence and mitigating risk. Connect directly with Ketan Rohom Associate Director, Sales & Marketing to customize your package, inquire about additional consulting services or schedule a private briefing on critical findings. Act now to capitalize on early adopter advantages and ensure your organization remains at the forefront of lightning protection innovation and regulatory compliance.

- How big is the Aircraft Lightning Protection System Market?

- What is the Aircraft Lightning Protection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?