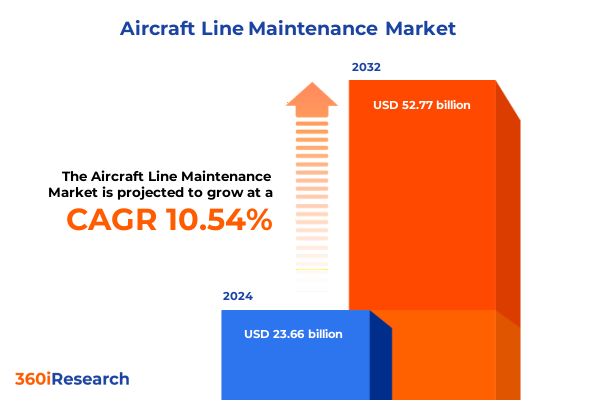

The Aircraft Line Maintenance Market size was estimated at USD 25.66 billion in 2025 and expected to reach USD 27.83 billion in 2026, at a CAGR of 10.84% to reach USD 52.77 billion by 2032.

Navigating the Complexities of Aircraft Line Maintenance in the Modern Aviation Landscape with Strategic Foresight Operational Excellence and Proactive Maintenance Innovations

Aircraft line maintenance stands at the intersection of operational reliability and regulatory compliance, demanding a nuanced understanding of operational protocols, safety standards, and emerging technological trends. In recent years, service providers have been challenged to balance rapid turnaround times with stringent quality controls, making the pursuit of operational excellence a top priority for stakeholders across the aviation spectrum. As airlines strive to minimize downtime, maintenance teams are innovating processes that integrate predictive analytics and remote diagnostics, reshaping traditional approaches to line checks.

Against this backdrop, unscheduled interventions triggered by component failures or unexpected wear-and-tear are being tackled with enhanced agility, while scheduled maintenance continues to leverage process automation for standardized inspections. Across the ecosystem, multifaceted coordination among airframe specialists, avionics engineers, and engine technicians is crucial in meeting the demands of diverse end users, such as national carriers needing high-volume line checks and business aviation operators requiring bespoke service levels. Consequently, this introduction sets the stage for exploring the latest transformations in line maintenance, revealing how industry leaders are forging resilient operations, optimizing resource allocation, and unlocking new value through data-driven decision making

Uncovering the Transformative Shifts Reshaping Aircraft Line Maintenance through Digitalization Sustainability Initiatives and Evolving Regulatory Frameworks

The landscape of aircraft line maintenance is undergoing a profound metamorphosis driven by digital transformation, evolving sustainability mandates, and a tightening regulatory environment. Digitalization is at the forefront, as maintenance providers deploy advanced sensor networks and cloud-based platforms to monitor component health in real time. This shift enables predictive and condition-based maintenance models, reducing turnaround times and optimizing spare parts utilization. Concurrently, environmental concerns are compelling operators to adopt eco-friendly practices, such as water-based cleaning agents and waste reduction protocols, enhancing operational sustainability without compromising safety.

Meanwhile, regulatory bodies worldwide are enforcing stricter guidelines, elevating documentation standards and auditing requirements. These changes necessitate robust compliance frameworks and continuous training programs for line maintenance personnel. As a result, industry participants are forging partnerships with technology vendors and academic institutions to develop next-generation inspection tools, including augmented reality glasses for technicians and artificial intelligence-driven defect detection. These collaborative efforts not only accelerate fault diagnosis but also foster a culture of continuous improvement, where cross-functional teams analyze performance data to refine maintenance procedures and drive service innovation. Ultimately, these transformative shifts underscore the industry’s commitment to resilience, efficiency, and environmental stewardship, paving the way for a more agile and sustainable future in aircraft line maintenance

Analyzing the Cumulative Impact of United States Tariffs on Aircraft Line Maintenance Supply Chains Service Costs and Competitive Dynamics in 2025

United States trade policy in 2025 has introduced a series of tariff adjustments that ripple through the aircraft line maintenance supply chain, affecting cost structures and service strategies. Increased duties on imported spare parts, particularly high-value components such as auxiliary power units and sophisticated avionics modules, have prompted maintenance providers to reassess sourcing strategies. Many are now forging long-term procurement agreements with domestic manufacturers to mitigate exposure to fluctuating import levies, thereby ensuring continuity of supply and price stability.

In parallel, the higher cost of landing gear components and structural assemblies under new tariff regimes is compelling service operators to extend component lifecycles through enhanced refurbishment and rebuild programs. This trend is closely tied to the growing emphasis on circular economy principles, as providers invest in advanced nondestructive testing equipment and develop in-house capabilities for remanufacturing critical parts. Furthermore, unscheduled maintenance suddenly carries a premium, driving airlines to refine their predictive maintenance models and inventory management processes.

Consequently, the tariff landscape is not merely a challenge but a catalyst for strategic shifts, encouraging the industry to innovate around cost containment, strengthen local supplier ecosystems, and adopt lifecycle-centric maintenance philosophies. This cumulative impact is reshaping competitive dynamics, ultimately fostering a more self-reliant and resilient aircraft line maintenance environment in the United States

In-Depth Segmentation Insights Revealing How Maintenance Type Component Specialization and End User Profiles Influence Operational Priorities and Service Demand

Understanding the diversity of maintenance operations requires a nuanced exploration of how maintenance type, component specialization, and end user profile intersect to shape service demand and operational focus. Providers specializing in scheduled line checks have traditionally prioritized process standardization and workforce planning to support the routine inspections dictated by regulatory intervals. In contrast, unscheduled repair services demand a high degree of operational flexibility, rapid diagnostic protocols, and dynamic spare parts availability to address unexpected malfunctions.

At the component level, distinctions among airframe and structural inspections, auxiliary power unit servicing, avionics and instrumentation calibration, engine borescope inspections, and landing gear wheel checks create specialized workflows. Each category necessitates unique technical skill sets, tooling requirements, and turnaround benchmarks. Meanwhile, end user segmentation further refines service priorities: commercial airlines, whether low cost or national carriers, require rapid throughput to maximize aircraft utilization, while freight operators emphasize robust component reliability to ensure mission-critical cargo operations. In addition, business aviation clients, including both corporate flight departments and private charter operators, demand personalized maintenance scheduling and discreet service protocols, whereas government and defense end users focus on security compliance and mission readiness.

These layered segmentation insights reveal the intricate mosaic of demand drivers, underscoring the importance of tailored service models that align maintenance capabilities with the precise expectations of each customer category

This comprehensive research report categorizes the Aircraft Line Maintenance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Maintenance Type

- End User

Comprehensive Regional Insights Highlighting Divergent Growth Drivers Service Models and Strategic Partnerships across Americas EMEA and Asia-Pacific Markets

Regional variations play a pivotal role in defining the competitive contours of the global aircraft line maintenance market, reflecting differences in airline fleet composition, regulatory regimes, and infrastructure maturity. In the Americas, a mix of full-service and low cost carriers has spurred investment in rapid turn maintenance hubs across major airline networks, while robust domestic manufacturing capabilities have strengthened local supply chains. This environment fosters an innovative approach to component refurbishment and advanced diagnostic tools, supported by collaborative research initiatives among industry associations.

Conversely, in Europe, the Middle East, and Africa, diverse regulatory frameworks and cross-border operational agreements necessitate harmonized maintenance standards and interoperable quality systems. The presence of national carriers with extensive long-haul fleets has elevated demand for high-capacity line maintenance facilities and strategic partnerships with original equipment manufacturers for component repair programs. Additionally, the region’s focus on reducing carbon footprints has accelerated the adoption of sustainable materials and energy-efficient workshop designs.

Meanwhile, the Asia-Pacific region is marked by rapid fleet expansion and rising passenger traffic, driving the proliferation of greenfield maintenance centers in emerging economies. Strong government support for aviation infrastructure development has enabled local providers to secure state-of-the-art tooling and training capabilities. As a result, regional players are increasingly competitive on turnaround speed and cost efficiency, positioning Asia-Pacific as a dynamic growth engine in global aircraft line maintenance

This comprehensive research report examines key regions that drive the evolution of the Aircraft Line Maintenance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights into Leading Aircraft Line Maintenance Providers Emphasizing Strategic Partnerships Technological Investments and Market Positioning

A survey of leading maintenance providers reveals a strategic focus on technology integration, alliance formation, and capability expansion. Major independent service organizations are investing heavily in digital platforms that unify maintenance records, facilitate real-time communication across teams, and enable advanced analytics to predict component failures before they occur. Simultaneously, airframe manufacturers and engine OEMs are extending their aftermarket footprints through joint ventures and exclusive service agreements, thereby strengthening their positions in the lucrative line maintenance segment.

Moreover, emerging players are distinguishing themselves by offering niche expertise in areas such as data-driven avionics calibration and rapid turnaround auxiliary power unit services. These specialists leverage modular workshop layouts and mobile service units to meet on-site demands, catering to clients who require flexibility and minimal aircraft downtime. In addition, strategic acquisitions have become a prominent growth lever, with established service groups acquiring regional MRO firms to gain market access and diversify their component repair portfolios. These strategic maneuvers not only enhance geographic reach but also enable the pooling of intellectual property and specialized tooling resources, reinforcing competitive differentiation in an increasingly consolidated marketplace

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Line Maintenance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAR Corp.

- Air France Industries KLM Engineering & Maintenance

- Beijing Aircraft Maintenance Engineering Co., Ltd.

- British Airways Engineering Limited

- Delta TechOps

- FL Technics UAB

- Hong Kong Aircraft Engineering Company Limited

- Lufthansa Technik AG

- MTU Maintenance Hannover GmbH

- Nayak Aero GmbH

- SIA Engineering Company Limited

- SR Technics Ltd

- ST Engineering Aerospace Ltd

- STS Aviation Group, LLC

- Turkish Technic Inc.

Actionable Recommendations for Industry Leaders to Optimize Fleet Availability Enhance Service Efficiency and Navigate Regulatory and Trade Complexity

To thrive in the evolving aircraft line maintenance environment, industry leaders should prioritize investments in predictive analytics and condition-based monitoring systems. By integrating advanced sensor data with machine learning algorithms, operators can transition from reactive repairs to proactive maintenance planning, significantly reducing unscheduled maintenance incidents and lowering total life cycle costs. Equally important is the cultivation of resilient supply chains through diversified sourcing strategies. Establishing strategic alliances with domestic and regional component manufacturers will mitigate the risks associated with tariff volatility and international logistics disruptions.

Furthermore, service providers must enhance workforce competencies by developing specialized training programs that encompass digital tooling, nondestructive testing techniques, and sustainability practices. Cross-functional collaboration between maintenance, engineering, and procurement teams can streamline decision-making processes and foster a culture of continuous improvement. Additionally, adopting circular economy principles-such as component remanufacturing partnerships and end-of-life recycling initiatives-will align operational practices with environmental targets and appeal to sustainability-driven customers.

Collectively, these recommendations will empower organizations to optimize fleet availability, achieve operational resilience, and differentiate their service offerings in a competitive market landscape

Robust Research Methodology Underpinning Comprehensive Analysis of Aircraft Line Maintenance Market Dynamics Data Collection and Validation Protocols

This research is grounded in a rigorous methodology that blends primary interviews, secondary data analysis, and expert validation to ensure robust and reliable insights. Primary inputs were gathered through structured interviews with maintenance managers, airline operations directors, and component specialists across diverse geographic regions. These conversations provided firsthand perspectives on operational challenges, technology adoption trends, and supply chain dynamics.

Secondary research encompassed industry white papers, regulatory documentation, and technical standards issued by aviation authorities worldwide. These sources informed the contextual backdrop for tariff analysis, regional regulatory comparisons, and sustainability benchmarks. Quantitative data relating to fleet compositions, maintenance cycles, and component failure rates were synthesized from public databases and supplemented by proprietary industry datasets.

To validate findings, a panel of independent experts in aircraft maintenance and aerospace engineering reviewed the analysis, offering critical feedback on data interpretations and trend extrapolations. This multi-layered research design ensures that conclusions are not only data-driven but also reflective of current operational realities, providing stakeholders with a high degree of confidence in the report’s recommendations and strategic narratives

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Line Maintenance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Line Maintenance Market, by Component

- Aircraft Line Maintenance Market, by Maintenance Type

- Aircraft Line Maintenance Market, by End User

- Aircraft Line Maintenance Market, by Region

- Aircraft Line Maintenance Market, by Group

- Aircraft Line Maintenance Market, by Country

- United States Aircraft Line Maintenance Market

- China Aircraft Line Maintenance Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Strategic Conclusion Summarizing Critical Findings on Industry Trends Operational Shifts and Regulatory Implications for Aircraft Line Maintenance Stakeholders

The synthesis of current trends reveals a clear trajectory toward digitalization, sustainability, and supply chain resilience in aircraft line maintenance. As predictive maintenance platforms become more prevalent, unscheduled service disruptions are expected to decline, while component lifespan extension initiatives will reduce the dependency on imported spare parts. The interplay of United States tariff policies and regional market characteristics underscores the necessity for localized procurement strategies and adaptive pricing models.

Furthermore, the segmentation analysis highlights that providers who tailor their service portfolios to the specific needs of low cost carriers, national airlines, and business aviation operators will achieve higher client retention and operational efficiency. Regional insights suggest that collaborative frameworks among stakeholders in the Americas, Europe, Middle East, Africa, and Asia-Pacific will be instrumental in harmonizing maintenance standards and promoting cross-border innovation.

Ultimately, the industry stands at a pivotal juncture where strategic investments in technology, workforce development, and sustainable practices will determine market leadership. This conclusion invites stakeholders to capitalize on the emerging opportunities detailed in this report and to prepare proactively for the next phase of evolution in aircraft line maintenance

Compelling Call to Action Encouraging Engagement with Expert Analysis and Market Insights Presented by Ketan Rohom to Secure Comprehensive Research Access

This executive summary offers an unprecedented opportunity to access deep industry intelligence through a conversation with Ketan Rohom, Associate Director, Sales & Marketing. Prospective clients are invited to leverage the rigorous analysis and strategic insights encapsulated in this report to drive actionable decisions and gain a competitive edge. By partnering with Ketan Rohom, stakeholders will receive personalized guidance on the most pressing challenges and opportunities in aircraft line maintenance, from supply chain intricacies to technological integration.

Readers are encouraged to reach out directly and initiate a dialogue that will illuminate tailored solutions, unlock hidden market potential, and accelerate strategic initiatives. This call-to-action underscores our commitment to delivering high-value, bespoke research support to executive teams, operational managers, and investment partners. Engage with Ketan Rohom today to transform insights into impactful outcomes and secure the full findings of this comprehensive market research report, empowering your organization to navigate the complexities of aircraft line maintenance with confidence and foresight

- How big is the Aircraft Line Maintenance Market?

- What is the Aircraft Line Maintenance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?