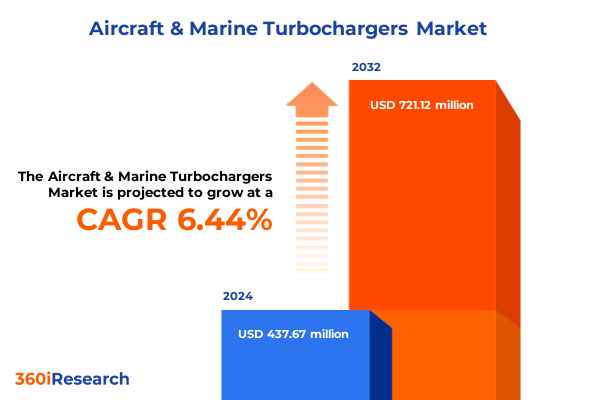

The Aircraft & Marine Turbochargers Market size was estimated at USD 459.26 million in 2025 and expected to reach USD 487.02 million in 2026, at a CAGR of 6.65% to reach USD 721.12 million by 2032.

Setting the Stage for Tomorrow’s Flight and Maritime Efficiency with Advanced Turbocharging Solutions Shaping Aerospace and Naval Industries

The aerospace and maritime sectors have entered an era where efficiency, reliability, and sustainability are no longer optional but fundamental imperatives. Advances in turbocharger design and integration have transformed engines into pinnacles of performance, enabling aircraft to achieve higher altitudes with reduced fuel consumption and marine vessels to extend their operational range while minimizing environmental impact. This report sets the stage for a thorough examination of how turbocharging innovations are redefining competitive dynamics, forging pathways for original equipment manufacturers and aftermarket suppliers alike to deliver unprecedented value to operators.

As the industry grapples with tightening emissions regulations, volatile fuel prices, and evolving customer expectations, turbocharging has emerged as a strategic lever for unlocking next-generation propulsion capabilities. In aircraft applications ranging from regional jets to wide-body airliners, adaptive turbocharger architectures are delivering tailored performance enhancements, while in marine settings, variable geometry systems are optimizing power delivery across diverse vessel classes. These developments herald a new chapter in engine optimization, where real-time diagnostics and predictive maintenance converge to drive cost efficiencies and support lifecycle management strategies.

This introduction lays the foundation for a multi-dimensional exploration of the aircraft and marine turbocharger landscape, highlighting pivotal trends, regulatory catalysts, and competitive benchmarks that industry stakeholders must understand to thrive. By weaving together technological insights and market dynamics, the report provides an executive synthesis designed to inform strategic planning, investment prioritization, and long-term innovation roadmaps.

Navigating the Winds of Change and Waves of Innovation Reshaping Aircraft and Marine Turbocharger Technologies for a More Sustainable Future

In recent years, breakthroughs in additive manufacturing have empowered turbocharger producers to iterate complex impeller geometries that were previously unattainable using conventional casting techniques. These advancements enable the creation of lighter, more thermally efficient components that deliver higher boost pressures while mitigating the risk of thermal fatigue. Meanwhile, the integration of smart sensors and on-board analytics has accelerated the shift toward condition-based maintenance models, enabling operators to transition from calendar-based servicing to predictive interventions that minimize unplanned downtime and service costs.

Concurrently, the convergence of electrification and turbocharging has given rise to hybrid boost systems that can adapt performance characteristics on demand. Electrically assisted turbochargers are now capable of supplementing low-speed torque, thereby eliminating turbo lag and enhancing fuel economy across the full operating envelope. The emergence of these systems underscores a broader industry pivot toward electrified powertrains, challenging OEMs and suppliers to develop seamless integration protocols and robust control algorithms.

Environmental imperatives have also driven transformative shifts in the market. Stricter emissions standards from international organizations have prompted the development of low-NOx ceramic coatings and sulfur-resistant alloys, ensuring turbocharging solutions remain compliant with a tightening regulatory landscape. These technological leaps are not simply incremental improvements; they represent a fundamental reimagining of turbocharging architectures, positioning the industry at the nexus of performance, efficiency, and environmental stewardship.

Assessing the Ripple Effects of 2025 United States Tariffs on Global Aircraft and Marine Turbocharger Supply Chains and Competitive Dynamics

In early 2025, the United States government implemented a series of tariffs targeting imported turbocharger components and subassemblies. These measures were designed to protect domestic manufacturers and stimulate local production capabilities, but they also introduced a new layer of complexity for global supply chains. As input costs rose, OEMs and tier-one suppliers were compelled to reassess their sourcing strategies, leading to a recalibration of logistics networks and a renewed focus on nearshoring opportunities.

The imposition of tariffs has not been uniform in its impact. While large turbocharger cores and precision-machined housings experienced steep duty increases, certain aftermarket spares were either exempt or subject to reduced rates, shifting relative price dynamics between original and replacement components. This divergence has influenced buyer behavior, with many operators deferring full assemblies in favor of localized remanufacturing and component swapping. Consequently, service centers in the United States have experienced an uptick in demand, investing in enhanced machining capabilities and certifications to capitalize on the changed landscape.

Beyond the direct financial implications, the tariff regime catalyzed strategic alliances between domestic foundries and engineering firms to co-develop advanced alloys and machining processes. By pooling resources, these partnerships have accelerated R&D cycles and reduced time-to-market for next-generation turbochargers. Nevertheless, the added compliance burden and administrative overhead have underscored the importance of transparent tariff classification and proactive trade policy intelligence for all industry participants.

Unveiling Critical Insights from Multifaceted Segmentation Approaches Across Applications, Turbocharger Types, Actuation Technologies, and End-User Channels

The multifaceted nature of the aircraft and marine turbocharger market demands analysis through a lens of application diversity, turbocharger design, actuation approach, and buyer profiles. Commercial aircraft applications, ranging from regional jets to wide-body airliners, reveal demand for variable geometry turbochargers that balance power output with stringent weight requirements. In contrast, commercial marine segments such as bulk carriers and tankers favor fixed geometry designs for their proven durability under continuous load cycles. Military platforms, spanning fighter jets and transport aircraft, present unique performance envelopes that necessitate electrically assisted systems capable of rapid transient response. Recreational vessels and yachts prioritize lightweight assemblies that complement luxury and efficiency aspirations.

When examining turbocharger typologies, fixed geometry units dominate cost-sensitive fleets, while emergent variable geometry and electrically assisted variants gain traction where operational flexibility is paramount. Variable geometry solutions deliver adaptive boost control across varying altitudes and speeds, offering pilots and marine operators a refined throttle response. Electrically assisted architectures further elevate turbocharger performance by virtually eliminating lag, which proves critical in tactical military missions and high-speed maritime operations.

Actuation technology introduces another layer of differentiation, with electric systems providing precise, software-driven control for advanced boost management. Hydraulic actuators, long valued for their robustness in harsh engine environments, maintain relevance in heavy-duty marine applications. Pneumatic actuation, leveraging compressed air to position vanes, remains a cost-effective solution for segments where weight and system complexity are secondary priorities. Finally, end-user channels reveal that the aftermarket continues to expand through remanufacturing programs and service agreements, while OEM partnerships drive co-development of bespoke solutions under long-term supply contracts.

This comprehensive research report categorizes the Aircraft & Marine Turbochargers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Turbocharger Type

- Actuation Technology

- Application

- End-User

Exploring Regional Dynamics Influencing Aircraft and Marine Turbocharger Adoption in the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional dynamics play an instrumental role in shaping turbocharger strategy, with each major geography exhibiting distinct demand drivers and regulatory frameworks. In the Americas, the United States market leads adoption of electrically assisted and variable geometry systems, leveraging a mature aviation infrastructure and aggressive emissions targets. Latin American marine fleets, meanwhile, prioritize cost containment and rely heavily on established fixed geometry designs for bulk carriers and container ships, with gradual migrations toward mid‐life upgrades as available budgets allow.

Across Europe, Middle East and Africa, advanced environmental mandates and growing defense allocations have fostered robust interest in hybrid boost solutions for both aircraft and naval applications. European industries pursue next‐generation ceramic coatings and lightweight composites to meet Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) guidelines, while Gulf Cooperation Council navies invest in high‐power turbochargers to enhance maneuverability in littoral zones. African operators, constrained by budget and infrastructure considerations, continue to extend asset lifecycles via remanufacturing partnerships and aftermarket service contracts.

In Asia-Pacific, burgeoning commercial aviation expansion and maritime trade growth underpin the largest addressable market for turbocharger manufacturers. Regional OEMs are increasingly collaborating with technology providers to localize production of variable geometry and electrically assisted models, aiming to reduce lead times and capture value in fast-growing corridors. Meanwhile, governments across Southeast Asia and Australasia are incentivizing green retrofit programs, enabling operators to integrate advanced turbocharging technologies into existing fleets.

This comprehensive research report examines key regions that drive the evolution of the Aircraft & Marine Turbochargers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Driving Innovation and Competitive Differentiation in the Global Aircraft and Marine Turbocharger Sector

The competitive landscape in the global aircraft and marine turbocharger market is defined by a blend of established powertrain specialists and agile engineering innovators. Legacy OEMs continue to leverage decades of thermodynamic expertise and expansive service networks to retain strongholds in both original equipment and aftermarket segments. Their product roadmaps emphasize incremental enhancements in materials engineering and software integration, ensuring compatibility with evolving engine management architectures.

Conversely, niche players are carving market share by focusing on breakthrough technologies such as novel ceramic coatings and hybrid electric integration. They deploy rapid prototyping techniques and maintain lean organizational structures, allowing them to respond swiftly to custom inquiries from defense primes and large cruise line operators. Partnerships between these smaller innovators and major airframe or shipbuilders have emerged as crucial conduits for scaling pilot projects into full production runs.

Strategic acquisitions have also played a significant role in shaping competitive dynamics. Several key players have absorbed specialized actuator firms and sensor technology start-ups to build vertically integrated offerings that address the full turbocharging value chain. These acquisitions not only broaden product portfolios but also reinforce service capabilities, enabling manufacturers to provide end-to-end solutions encompassing design, testing, installation, and long-term maintenance contracts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft & Marine Turbochargers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- BorgWarner Inc.

- Continental Aerospace Technologies GmbH

- Cummins Inc.

- General Electric Company

- Hartzell Engine Technologies, LLC

- Honeywell International Inc.

- IHI Corporation

- Kawasaki Heavy Industries, Ltd.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- Napier Turbochargers Ltd.

- PBS Velká Bíteš, a.s.

- Rolls-Royce plc

Translating Insight into Actionable Strategies for Industry Leaders to Seize Opportunities and Mitigate Risks in Turbocharging Ecosystems

Industry leaders must prioritize strategic investment in advanced materials and digital control systems to stay ahead of regulatory pressures and customer performance expectations. By allocating R&D budgets toward electrically assisted turbochargers and variable geometry designs, companies can cater to both emissions-sensitive aviation markets and power-dense marine applications. Cross-functional collaboration between materials scientists and software engineers should be formalized earlier in the design cycle to accelerate integration timelines and mitigate late-stage development risks.

Additionally, building resilient supply chains through dual‐sourcing strategies and regional production hubs will alleviate tariff uncertainties and enhance responsiveness to market fluctuations. Organizations should evaluate partnerships with regional foundries and machining centers, ensuring proximity to key air travel and maritime corridors. These collaborations can also underpin co-innovation initiatives, whereby localized teams tailor turbocharger configurations to specific climatic and operational conditions.

Lastly, fostering an ecosystem mindset that brings together OEMs, tier-one suppliers, and service providers under comprehensive performance-based contracts will promote shared accountability for lifecycle costs and reliability metrics. By embedding predictive maintenance analytics within service-level agreements, stakeholders can unlock continuous improvement loops, reducing total cost of ownership for end users and reinforcing long-term customer loyalty.

Detailing Rigorous Research Methodologies and Intelligence-Gathering Frameworks Underpinning Comprehensive Market Analysis for Turbocharging Solutions

This analysis rests on a systematic framework combining primary and secondary research methodologies. Initial data collection involved interviews with senior executives at engine OEMs, naval architects, and aftermarket service operators, ensuring direct insights into developmental roadmaps and procurement criteria. These qualitative inputs were supplemented by a comprehensive review of patent filings, technical whitepapers, and regulatory documentation to triangulate technological advancements and compliance milestones.

Quantitative validation was achieved through survey panels targeting maintenance managers, fleet operators, and procurement specialists across key geographies and vessel or aircraft classes. Responses were normalized by fleet size and operational hours to establish relative performance benchmarks and service cost profiles. In addition, a supply chain mapping exercise was conducted to identify tier-one and tier-two supplier relationships, tariff classifications, and logistics pathways, providing a holistic view of cost and lead-time implications.

Finally, the research team applied scenario analysis techniques to model the impact of alternate policy outcomes, fuel price sensitivities, and adoption rates for emerging turbocharger architectures. These scenarios informed the strategic recommendations and risk mitigation frameworks presented in this report, offering stakeholders a robust decision-making foundation under varying market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft & Marine Turbochargers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft & Marine Turbochargers Market, by Turbocharger Type

- Aircraft & Marine Turbochargers Market, by Actuation Technology

- Aircraft & Marine Turbochargers Market, by Application

- Aircraft & Marine Turbochargers Market, by End-User

- Aircraft & Marine Turbochargers Market, by Region

- Aircraft & Marine Turbochargers Market, by Group

- Aircraft & Marine Turbochargers Market, by Country

- United States Aircraft & Marine Turbochargers Market

- China Aircraft & Marine Turbochargers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Distilling Strategic Takeaways and Outlook from the Comprehensive Analysis of Global Aircraft and Marine Turbocharger Landscape

The analysis reveals that turbocharger innovation has transcended incremental enhancements to become a pivotal driver of efficiency and environmental compliance in both aerospace and marine sectors. Electrically assisted and variable geometry architectures are rapidly displacing legacy designs, offering a combination of flexibility and performance that aligns with tightening emissions regulations and evolving operator requirements. Regional policy incentives and tariff structures continue to reshape supply chain strategies, emphasizing the need for localized production and service partnerships.

Segmentation insights underscore the importance of tailoring turbocharger solutions to specific application profiles, with commercial airliners, defense platforms, and maritime vessels each demanding unique performance attributes. Meanwhile, competitive dynamics are being reconfigured as established OEMs fortify service networks and agile innovators push the boundaries of materials science and digital control systems. Leaders who integrate these findings into cohesive commercialization roadmaps will be best positioned to capitalize on growth trajectories and defend against cyclical downturns.

Ultimately, this report offers a comprehensive lens through which to view the aircraft and marine turbocharger market, combining empirical data, expert perspectives, and strategic foresight. It equips decision-makers with the contextual understanding needed to align technical development with regulatory frameworks, regional market nuances, and shifting customer priorities. In doing so, it lays the groundwork for sustainable innovation and robust competitive positioning in a dynamic global landscape.

Engage with Ketan Rohom to Unlock In-Depth Market Intelligence and Empower Strategic Decisions with the Most Comprehensive Turbocharger Report Available

For organizations seeking to navigate the complexities of the aircraft and marine turbocharger market with unparalleled confidence, connecting with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, represents the most direct path to securing the actionable insights and strategic intelligence required for decisive investment and operational planning. By reaching out to engage Ketan Rohom, stakeholders can access a suite of tailored advisory services, bespoke data visualizations, and analyst-led consultations designed to align market findings with specific corporate objectives. This engagement will empower decision-makers to translate deep-dive research into targeted growth initiatives, partnership strategies, and technology road maps that drive sustainable competitive advantage.

Each engagement begins with a personalized briefing call to understand unique business challenges, followed by access to the full breadth of the research repository and interactive workshops that bring key findings to life. Whether prioritizing entry into underserved markets or accelerating the adoption of advanced actuation technologies, partnering with Ketan Rohom ensures that senior executives have the guidance and resources necessary to move swiftly from insight to action. Industrial leaders should take this opportunity to bridge the gap between analysis and implementation by contacting Ketan Rohom today to purchase the definitive market research report.

- How big is the Aircraft & Marine Turbochargers Market?

- What is the Aircraft & Marine Turbochargers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?