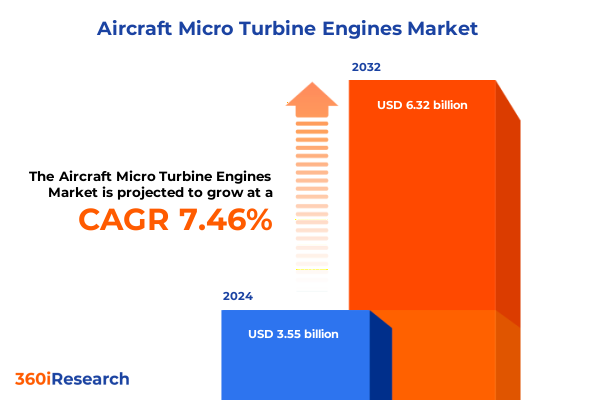

The Aircraft Micro Turbine Engines Market size was estimated at USD 3.81 billion in 2025 and expected to reach USD 4.10 billion in 2026, at a CAGR of 7.47% to reach USD 6.32 billion by 2032.

Exploring the Strategic Importance and Technological Evolution of Aircraft Micro Turbine Engines in Today’s Aerospace Industry Landscape

The field of aircraft micro turbine engines has emerged as a pivotal component of modern aerospace innovation, bridging the gap between compact design and high-performance requirements. As aviation sectors evolve to meet stringent demands for efficiency, reliability, and versatility, micro turbine technology occupies a strategic position in powering unmanned aerial systems, auxiliary power units, and distributed power solutions. The integration of advanced materials, additive manufacturing techniques, and digital twin simulations has accelerated the adoption of these engines across both civil and defense applications.

Against a backdrop of heightened environmental scrutiny and increased demand for decentralized power generation, aircraft micro turbines offer the promise of reduced emissions, simplified maintenance cycles, and scalable deployment. Leading research and development efforts are demonstrating that these compact powerplants can deliver high power-to-weight ratios while accommodating a spectrum of fuel types. As such, micro turbines are set to play an increasingly transformative role in next-generation aviation architectures, driving competitive differentiation and operational resilience.

Assessing the Paradigm-Shifting Technological and Operational Innovations Reshaping Aircraft Micro Turbine Engine Development Globally

Recent years have witnessed transformational shifts in the development lifecycle and operational paradigms of aircraft micro turbine engines. Technological breakthroughs in ceramic matrix composites and single-crystal superalloys have pushed thermal efficiency boundaries, enabling higher turbine inlet temperatures and extended service intervals. Concurrently, the proliferation of digital engineering ecosystems-ranging from computational fluid dynamics to real-time health monitoring-has fostered a data-centric approach, reducing prototyping cycles and expediting certification processes.

Operationally, the advent of flexible fuel combustion systems has broadened the application envelope, allowing seamless switching between gaseous and liquid fuels without compromising performance. This flexibility is now complemented by hybridization strategies, where micro turbines function in concert with battery or hydrogen systems to deliver optimal power density and emissions profiles. Taken together, these advancements are redefining expectations for cost-effective maintenance, lifecycle management, and environmental compliance, propelling micro turbine engines toward broader adoption in unmanned platforms, industrial cogeneration schemes, and auxiliary power roles.

Analyzing the Multifaceted Effects of 2025 United States Tariff Adjustments on the Aircraft Micro Turbine Engine Supply Chain

In response to evolving trade policies and geopolitical tensions, the United States implemented revised tariff structures in early 2025 that impose additional duties on select imported micro turbine components and turbines sourced from key manufacturing hubs. These measures were designed to protect domestic producers and incentivize localized manufacturing; however, they have also introduced complexity across global supply chains. Original equipment manufacturers and aftermarket suppliers are experiencing escalated input costs, leading to recalibrated pricing strategies and renegotiated supplier agreements.

The ripple effect is evident in extended lead times for critical parts, as manufacturers adjust production planning to mitigate duty burdens. Companies are increasingly exploring dual-sourcing models and enhancing vertical integration, seeking to insulate operations from future trade disruptions. While some industry participants have managed to offset tariff-induced cost increases through productivity gains and process automation, the collective impact has underscored the importance of agile procurement practices and robust scenario planning. These adaptations are influencing strategic roadmaps for product development and market expansion in the near term.

Deriving Actionable Insights from Comprehensive Application, Shaft Configuration, Fuel, End User and Distribution Channel Segmentation

A multifaceted segmentation analysis reveals distinct patterns of demand and performance across application areas, shaft configurations, fuel compatibility, end-user profiles, and distribution pathways. When categorizing by application, adoption within aerospace platforms remains high, while automotive integrations are on the rise as manufacturers leverage micro turbines for range extenders in hybrid powertrains. Marine applications continue to benefit from compact, high-efficiency installations, and military end-use prioritizes ruggedized designs for forward operations. Within the oil and gas sector, downstream facilities emphasize reduced emissions in refining processes, midstream operators integrate turbines for pipeline compression, and upstream installations focus on autonomous power generation at remote sites.

Examining engine type distribution uncovers a growing preference for regenerative models, which recapture exhaust heat to improve overall cycle efficiency. Dual shaft systems maintain strong traction where rapid transient response is critical, while single shaft variants offer simplicity and lower maintenance costs. Fuel type segmentation underscores that gaseous fuels-primarily natural gas-dominate stationary power applications, whereas liquid fuels such as jet fuel and diesel retain primacy in airborne and marine environments. End-user analysis highlights that energy and utility companies are the largest adopters, driven by cogeneration demands, followed by government and defense agencies prioritizing operational resilience, and manufacturing firms seeking on-site microgrid integration. Distribution channels reveal an almost even split between direct sales agreements, which facilitate bespoke engineering solutions, and aftermarket support networks that deliver retrofit kits and parts replacement services.

This comprehensive research report categorizes the Aircraft Micro Turbine Engines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Type

- Fuel Type

- Application

- End User

- Distribution Channel

Evaluating Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific in the Aircraft Micro Turbine Engine Sector

Regional dynamics reflect diverse market drivers and regulatory frameworks across the Americas, EMEA, and Asia-Pacific. In the Americas, energy-efficient power solutions and unmanned aerial vehicle proliferation are key growth vectors, supported by government incentives for clean technology adoption. North American manufacturing innovation clusters are accelerating design-to-production cycles, while Latin American offshore energy developments are integrating micro turbines for remote power generation.

Europe, the Middle East, and Africa present a mosaic of opportunity and challenge. Stringent emissions regulations in Europe are catalyzing investment in hydrogen-blended fuel systems, whereas Middle Eastern producers are leveraging micro turbines for distributed power in harsh desert conditions. African infrastructure projects are tapping micro turbine units to address grid instability, particularly in mining and telecommunications installations. Meanwhile, Asia-Pacific is emerging as a powerhouse of demand; robust aerospace R&D in East Asia, combined with expanding offshore drilling and remote megaprojects in Southeast Asia, has driven increased procurement of compact, high-efficiency turbine solutions. Strategic partnerships and joint ventures across these regions are accelerating knowledge transfer and localization efforts.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Micro Turbine Engines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Breakthroughs in Aircraft Micro Turbine Engine Technology

The competitive landscape is shaped by a cadre of technology innovators and strategic integrators. Established aerospace powerplant manufacturers are collaborating with specialty engineering firms to co-develop next-generation combustors and turbine blade coatings optimized for micro turbine geometries. Simultaneously, forward-thinking startups are differentiating through digital-first service models, leveraging predictive maintenance algorithms and machine learning platforms to deliver real-time performance analytics and asset optimization.

New market entrants with deep expertise in additive manufacturing are disrupting traditional supply chains, enabling rapid prototyping and part customization that reduce time-to-market and enhance design flexibility. Strategic alliances between component suppliers and systems integrators are fostering modular architectures, where off-the-shelf micro turbine cores can be configured for diverse operational environments. As a result, incumbents and challengers alike are prioritizing open-architecture control systems, cloud-based monitoring, and cooperative research partnerships to maintain technological leadership and accelerate product roadmap execution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Micro Turbine Engines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroDesignWorks GmbH

- Collins Aerospace by Raytheon Technologies Corporation

- General Electric Company

- Hawk Turbine AB

- Honeywell International Inc.

- IHI Corporation

- Ingenieurbüro CAT, M. Zipperer GmbH

- Jets Munt S.L.

- Kratos Defense & Security Solutions, Inc.

- MDS Aero Support Corporation

- Micro Turbine Technology BV

- MTU Aero Engines AG

- PBS Group. A.s.

- Rolls-Royce PLC

- Safran S.A.

- Stuttgart Engineering Propulsion Technologies

- The Williams Companies, Inc.

- TurbAero

- Turbotech SAS

Implementing Strategic Initiatives and Operational Frameworks to Enhance Competitiveness in the Aircraft Micro Turbine Engine Space

To thrive amid escalating competition and technology shifts, industry leaders should pursue a three-pronged strategy encompassing innovation acceleration, supply chain resilience, and customer-centric service delivery. First, companies must intensify R&D investments in high-temperature materials and advanced combustion techniques, while fostering open innovation ecosystems that bring together academia, startups, and OEM partners. This collaborative approach will shorten development cycles and unlock new performance benchmarks.

Second, enhancing supply chain flexibility through multi-tier sourcing, digital procurement platforms, and nearshoring initiatives will mitigate tariff impacts and logistical bottlenecks. Organizations should map critical component dependencies, establish redundant supplier relationships, and deploy real-time supply chain monitoring tools to anticipate disruptions and maintain production continuity.

Finally, elevating the aftermarket experience by integrating predictive maintenance services and outcome-based contracting will deepen customer loyalty and generate recurring revenue streams. By offering performance guarantees tied to engine availability and life-cycle cost reductions, suppliers can strengthen long-term partnerships with operators in civil aviation, defense, and industrial power generation.

Detailing the Robust Mixed-Method Approach Underpinning the Comprehensive Analysis of Aircraft Micro Turbine Engine Market Trends

This report employs a robust mixed-method research approach that synthesizes primary interviews, expert panel workshops, and exhaustive secondary data analysis. Primary data was collected through in-depth discussions with technical leads at engine manufacturers, system integrators, and end-user organizations spanning commercial airlines, defense agencies, and energy firms. These insights were complemented by structured surveys capturing procurement criteria, performance expectations, and service preferences.

Secondary research incorporated proprietary patent databases, regulatory filings, and technical white papers to map innovation trajectories and identify emerging technology inflection points. Market intelligence was further enriched through case studies of successful micro turbine deployments, cross-referencing project outcomes with operational performance metrics. Rigorous triangulation of qualitative and quantitative inputs ensured the validity and reliability of key findings, while iterative peer reviews by subject matter experts reinforced analytical rigor and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Micro Turbine Engines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Micro Turbine Engines Market, by Engine Type

- Aircraft Micro Turbine Engines Market, by Fuel Type

- Aircraft Micro Turbine Engines Market, by Application

- Aircraft Micro Turbine Engines Market, by End User

- Aircraft Micro Turbine Engines Market, by Distribution Channel

- Aircraft Micro Turbine Engines Market, by Region

- Aircraft Micro Turbine Engines Market, by Group

- Aircraft Micro Turbine Engines Market, by Country

- United States Aircraft Micro Turbine Engines Market

- China Aircraft Micro Turbine Engines Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings to Illuminate the Future Trajectory of the Aircraft Micro Turbine Engine Industry

In synthesizing these findings, it is evident that aircraft micro turbine engines are poised to redefine power solutions across aerospace, defense, and industrial applications. Technological advancements in materials, digital integration, and fuel flexibility are converging to deliver compact, high-performance systems capable of meeting evolving environmental and operational demands. Meanwhile, evolving trade policies and tariff structures have underscored the need for agile supply chain frameworks and strategic procurement practices.

Segmentation analysis highlights differentiated adoption across application areas, shaft configurations, fuel types, end-users, and distribution channels, pointing to tailored growth pathways for both incumbents and new entrants. Regionally, diverse regulatory landscapes and project requirements are shaping localized strategies and collaborative ventures. Ultimately, proactive investment in innovation partnerships, supply network resilience, and customer-oriented service models will determine market leadership and unlock new value creation opportunities in this dynamic sector.

Engage with Associate Director Sales and Marketing to Secure Full-Scale Aircraft Micro Turbine Engine Market Intelligence Report

To explore the full breadth of market intelligence and actionable insights compiled in this comprehensive analysis, we invite you to connect with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise and detailed understanding of aircraft micro turbine engine dynamics can guide you toward making informed strategic decisions tailored to your specific objectives. Reach out today to secure your copy of the complete market research report, gain exclusive access to proprietary data, and unlock the potential that awaits your organization in this rapidly advancing field.

- How big is the Aircraft Micro Turbine Engines Market?

- What is the Aircraft Micro Turbine Engines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?