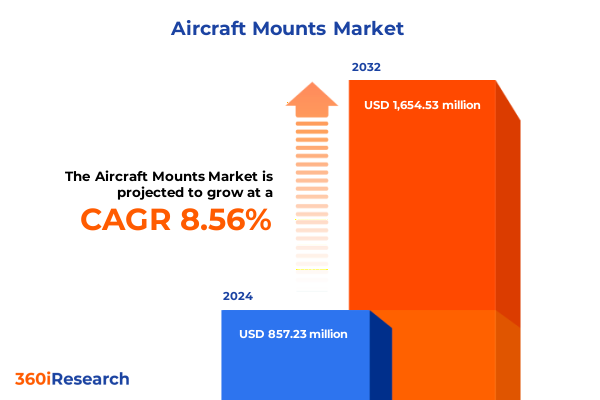

The Aircraft Mounts Market size was estimated at USD 924.25 million in 2025 and expected to reach USD 1,003.13 million in 2026, at a CAGR of 8.67% to reach USD 1,654.52 million by 2032.

Unlocking the Future of Aircraft Mounts Through Innovative Design, Enhanced Durability, and Sophisticated Integration Across Aviation Sectors

The aircraft mounts market represents a cornerstone of aviation engineering, underpinning the structural integrity and operational reliability of modern aircraft. These precision components bear the critical task of affixing engines, avionics, and other mission-critical systems to the airframe, while simultaneously mitigating vibration and distributing mechanical loads. Across commercial airliners, cargo transports, general aviation platforms, and military fleets, mounts play a pivotal role in enhancing safety, passenger comfort, and airframe longevity. In recent years, accelerated production timelines and evolving aircraft architectures have elevated the technical demands placed upon mount manufacturers, pushing innovation in design and materials.

As industry participants strive to strike the optimal balance between durability and weight savings, market stakeholders are investing heavily in lightweight alloys, advanced composites, and vibration-isolation technologies. This push is fueled by airline commitments to reduce fuel burn, regulatory mandates for emissions reduction, and heightened expectations for reliability in high-duty-cycle passenger jets. Moreover, the emergence of new propulsion systems-such as electric and hybrid-electric powerplants-has created fresh design challenges, necessitating mounts that can accommodate novel motor geometries and thermal profiles. Consequently, R&D efforts are intensifying around adaptive configurations, material optimization, and integration of sensor‐based monitoring capabilities to anticipate maintenance needs and extend service intervals. Transitioning to these next-generation solutions is imperative for mount providers aiming to capitalize on the surge in aircraft production rates, exemplified by Airbus and Boeing’s exploration of thermoplastic composites to enable ambitious output targets of up to 100 jets per month.

How Digitalization, Sustainability Mandates, and Evolving Aircraft Architectures Are Reshaping the Aircraft Mounts Landscape Dramatically

The landscape for aircraft mounts is undergoing a profound transformation driven by digitalization, sustainability imperatives, and rapid advancements in materials science. Engine manufacturers and tier-1 suppliers are embracing digital twins and predictive analytics to refine mount designs before physical prototypes are built. By creating virtual replicas of mount assemblies and subjecting them to simulated flight profiles, engineers can forecast fatigue life, pinpoint stress concentrations, and optimize isolation characteristics in a fraction of the time required for traditional testing. This digital engineering approach not only accelerates validation cycles but also enables continuous monitoring of in-service assets, thereby unlocking maintenance strategies that shift from reactive inspections to proactive, data-driven servicing.

Simultaneously, aerospace OEMs are reevaluating long–standing material choices as weight reduction and sustainability goals intensify. Recent reports highlight Airbus and Boeing’s pursuit of thermoplastic composites for next-gen narrow-body jets, showcasing the potential to slash curing times, streamline robotic assembly, and deliver structures up to 20 percent lighter than their metallic counterparts. At the same time, aluminum suppliers such as Constellium are advancing high-strength recycled alloys that promise up to a 95 percent energy savings in production versus virgin metal, keeping aluminum in contention alongside emerging composite contenders. These parallel material developments underscore a broader competitive dynamic where aluminum and composites converge to support both traditional and novel aircraft platforms.

Parallel to these technical shifts, environmental regulations and net-zero commitments are reshaping supply chains and design priorities. Governments across Europe, North America, and Asia are rolling out funding programs, tax incentives, and regulatory roadmaps to decarbonize aviation. Notably, the UK has earmarked £250 million for clean-tech R&D, laser manufacturing innovations, and lightweight material projects, signaling a sustained public sector push to underpin aerospace supply-chain resilience and environmental stewardship. As a result, mount manufacturers are under mounting pressure to demonstrate cradle-to-grave sustainability credentials, including recyclability, lower embodied carbon, and lifecycle management services.

Examining the Compounded Consequences of Escalating U.S. Steel and Aluminum Tariffs on Aircraft Mounts Supply Chains and Cost Structures

Since 2018, U.S. policymakers have leveraged national security and trade instruments to impose tariffs on metals and strategic imports, with cascading implications for the aircraft mounts sector. Initially introduced under Section 232 of the Trade Expansion Act of 1962, steel and aluminum tariffs set the stage for a robust import duty framework intended to protect domestic metal producers. However, a February 2025 proclamation by the President terminated all alternative arrangements and reinstituted a uniform 25 percent tariff on steel, aluminum, and their downstream derivatives, effective as of March 12, 2025. These measures effectively closed longstanding exemptions for major trading partners, including Canada, the EU, and Australia, and broadened the tariff base to cover specialty alloys critical to mount manufacturing.

In a further escalation on June 3, 2025, a follow-up proclamation elevated steel and aluminum tariffs from 25 to 50 percent, stipulating carve-outs for U.K. imports tied to the pending U.S.-U.K. Economic Prosperity Deal. Simultaneously, Section 301 tariffs on Chinese imports remain at 25 percent for most aerospace entries, with targeted increases applied to technology-intensive goods such as semiconductors, aircraft parts, and polysilicon. The cumulative effect of these layered duties has already inflicted a $125 million headwind for major aerospace suppliers in early 2025, with the total 2025 tariff impact anticipated to reach approximately $500 million across the defense and civil aerospace segments.

This confluence of protective measures has fundamentally altered cost structures for mount assemblers. With raw material input prices surging, manufacturers face compression in gross margins unless they can pass rising costs through to OEM partners or end users. At the same time, sourcing strategies are shifting toward near-sourcing and alternative alloy suppliers, while MRO providers are reevaluating repair criteria to mitigate the compounding duty burden. As a result, industry participants are exploring vertical integration, supplier partnerships, and cross-border joint ventures to stabilize supply chains and navigate the complex tariff environment.

Unveiling Deep Market Segmentation Insights From Type to Material Composition and Application Dynamics Informing Tailored Strategy Formulation

The aircraft mounts market can be dissected through multiple lenses that reveal distinct competitive arenas and customer needs. A detailed analysis by type uncovers three principal categories: adjustable mounts engineered for fine-tuning and alignment flexibility; fixed mounts that prioritize robust load transfer and structural simplicity; and vibration isolation mounts, each designed to attenuate shock and oscillation frequencies. Vibration isolation options are further classified into elastomeric mounts, which leverage natural rubber or synthetic neoprene compounds for damping; metal spring mounts offering high-cycle fatigue resistance; and pneumatic mounts optimized for heavy-duty shock absorption under variable loads.

A material-centric perspective offers additional clarity, as mount producers draw from composite, metal, and rubber portfolios. Composite mounts incorporate carbon fiber or glass fiber to achieve a high stiffness-to-weight ratio, making them ideal for weight-sensitive applications. Metal mounts-fabricated from aluminum alloys, various steels, or specialty titanium-deliver exceptional strength, thermal stability, and known fatigue characteristics. Rubber mounts exploit the inherent damping of natural rubber and neoprene to shield sensitive avionics and propulsion systems from vibration damage.

End-use segmentation sheds light on adoption patterns across commercial, general aviation, and military markets. Within the commercial sector, mounts for airliners and cargo aircraft demand streamlined designs that align with rapid turnaround cycles and high-frequency flight schedules. The general aviation arena, spanning piston-powered aircraft, private jets, and turboprops, prioritizes ease of maintenance, aftermarket compatibility, and cost efficiency. Military applications cover fighter jets, attack helicopters, and transport platforms, where mission-critical vibration isolation and stealth-compatible designs take precedence.

Lastly, distribution channels span traditional aftermarket networks-where parts and services flow through MRO specialists, OEM service centers, and authorized dealers-and online platforms, which are gaining traction for off-the-shelf purchases, direct-to-customer configurations, and rapid replenishment offerings.

This comprehensive research report categorizes the Aircraft Mounts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Distribution Channel

- Application

Mapping Key Regional Trends and Drivers in the Americas, EMEA, and Asia-Pacific Uncovering Growth Pockets and Competitive Dynamics in Aircraft Mounts

Regionally, distinct trends and strategic priorities emerge in the Americas, EMEA, and Asia-Pacific. In the Americas, North American airlines and defense programs are driving sustained demand for high-reliability mounts that meet stringent FAA and DoD certification standards. The United States continues to lead investment in next-generation mount technologies, underpinned by government-backed R&D initiatives and robust aerospace manufacturing ecosystems in Washington, Georgia, and Texas. In parallel, Latin American carriers are pursuing fleet modernization to improve regional connectivity, creating growth prospects for aftermarket and retrofit mount services.

Over in Europe, Middle East, and Africa (EMEA), a dynamic interplay of legacy fleet upgrades and low-cost carrier expansions defines the mount market. European regulatory bodies are enforcing increasingly stringent vibration and emissions standards, prompting tier-1 suppliers to field advanced isolation mounts. The Middle East is witnessing a surge in ultra-long-range airliner orders, undergirding demand for mounts tailored to widebody platforms. Meanwhile, Africa’s airline sector is modernizing with narrow-body jets, opening opportunities for cost-effective fixed mounts and local assembly partnerships.

Asia-Pacific presents perhaps the most transformative backdrop, as China, India, and Southeast Asian nations ramp up both commercial and defense aircraft production. Chinese OEMs are supplementing indigenous designs with imported mount technology, while India’s emerging aerospace supply chain is investing in domestic vibration control expertise. Across the region, government-led infrastructure investments and air traffic liberalization are fueling fleet expansions, leading manufacturers to cultivate joint ventures and technology transfer agreements. This collaborative landscape is primed for mounts that offer scalable performance, material innovation, and lifecycle support.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Mounts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Aircraft Mounts Manufacturers and Innovators Spotlighting Strategic Alliances, Product Differentiation, and Operational Excellence

Within the competitive sphere of aircraft mounts, a set of leading players is defining the market through product innovation, strategic alliances, and service capabilities. Lord Corporation has distinguished itself with advanced elastomeric isolation mounts that incorporate embedded health-monitoring sensors, enabling real-time performance diagnostics and predictive maintenance for major commercial and defense OEMs. Parker Hannifin, leveraging its global fluid power network, has integrated vibration control solutions with hydraulic and pneumatic actuation systems, broadening its footprint in rotary-wing applications and unmanned aerial platforms.

Hutchinson, a specialist in vibration-control elastomers, has forged partnerships with aerospace OEMs to co-develop custom mounts that satisfy niche requirements in large-engine pylons and nacelle attachments. The company’s investment in continuous-fiber composite reinforcement has elevated its mounts’ stiffness-to-weight profile, catering to both widebody transport jets and regional turboprops. Moog and Freudenberg Sealing Technologies are also expanding their product portfolios through joint ventures and licensing agreements, optimizing supply chains to deliver just-in-time mount assemblies at key production hubs in the U.S., Europe, and Asia.

Meanwhile, smaller innovators and system integrators are gaining traction by offering modular mount blocks designed for rapid reconfiguration and field servicing. These solution providers emphasize end-to-end lifecycle support, including engineering consulting, certification assistance, and repair facility management. As market participants navigate raw material volatility and regulatory complexity, strategic collaboration among these top-tier and niche companies will be critical in sustaining innovation pipelines and establishing resilient global footprints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Mounts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AirLoc Ltd.

- BAE Systems plc

- Cadence Aerospace, Inc.

- Collins Aerospace, Inc.

- Eaton Corporation plc

- GKN Aerospace Services Limited

- GMT Rubber-Metal-Technic Ltd.

- Honeywell International Inc.

- Hutchinson S.A.

- MAYDAY Manufacturing, Inc.

- Meeker Aviation, Inc.

- Meggitt plc

- Moog Inc.

- Parker-Hannifin Corporation

- Safran S.A.

- Shock Tech, Inc.

- Singapore Aerospace Manufacturing Pte. Ltd.

- The VMC Group, Inc.

- TransDigm Group Incorporated

- Trelleborg AB

Actionable Recommendations Enabling Industry Leaders to Overcome Challenges, Embrace Innovation, and Pursue Growth in the Aircraft Mounts Domain

To thrive in a landscape marked by rapid technological shifts and evolving trade policies, industry leaders should prioritize a set of tangible actions. First, embedding digital engineering capabilities-such as simulation-driven design and digital twins-will accelerate time to market, improve product reliability, and reduce certification cycles. Investing in sensor integration and data analytics for mounts can unlock new service offerings, transforming maintenance contracts from fixed-interval schedules to condition-based, performance-guaranteed models. This, in turn, fosters closer partnerships with airlines, MRO providers, and defense customers.

Second, pursuing material diversification is paramount. By expanding composite-based mount lines alongside advanced aluminum and titanium alloys, companies can address a broader spectrum of weight-sensitivity and cost-effectiveness requirements. Firms should work in concert with metal and polymer suppliers to co-innovate recyclable, low-carbon materials that anticipate tightening emissions and sustainability regulations. Parallel to material research, establishing regional alloy processing facilities can mitigate tariff exposure and reinforce near-sourcing strategies.

Third, strengthening global distribution networks through targeted alliances and aftermarket service agreements will enhance responsiveness to customer needs. Entities should explore digital commerce platforms for rapid reordering, streamlined logistics, and transparent pricing, while augmenting field service competencies through strategic MRO partnerships. Finally, maintaining active engagement with trade policymakers and industry associations can help shape tariff relief mechanisms and secure exclusion pathways, safeguarding profit margins in an uncertain trade environment.

Robust Research Methodology Combining Rigorous Data Collection, Multisource Validation, and Analytical Frameworks for the Aircraft Mounts Study

The insights presented in this study derive from a rigorous, multi-tiered research approach designed to ensure depth, accuracy, and relevance. Initially, we conducted extensive secondary research by reviewing public regulatory filings, government tariff proclamations, industry association publications, and peer‐reviewed technical papers. This established a foundational understanding of the macroeconomic and policy environment impacting mount manufacturing.

Building upon this, a series of in-depth primary interviews were executed with stakeholders spanning OEM design engineers, procurement specialists, aftermarket service managers, and material suppliers. These discussions provided first-hand perspectives on evolving technical requirements, supply chain challenges, and innovation pipelines. All interviews followed a structured guide to align responses with our segmentation framework and thematic priorities.

Quantitative data collection involved aggregating customs import records, corporate financial disclosures, and aftermarket parts registries. This enabled a granular analysis of tariff incidence, cost pass-through dynamics, and shipment volumes across key regions. Data points were triangulated using statistical cross-validation techniques to ensure consistency, while proprietary algorithms were applied to adjust for known reporting lags and classification discrepancies.

Finally, analytical models-encompassing scenario planning, sensitivity analysis, and competitive benchmarking-were developed to derive actionable insights without engaging in proprietary market sizing or forecasting. A continuous iterative review process among our research and editorial teams upheld methodological integrity and compliance with industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Mounts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Mounts Market, by Type

- Aircraft Mounts Market, by Material

- Aircraft Mounts Market, by Distribution Channel

- Aircraft Mounts Market, by Application

- Aircraft Mounts Market, by Region

- Aircraft Mounts Market, by Group

- Aircraft Mounts Market, by Country

- United States Aircraft Mounts Market

- China Aircraft Mounts Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding Perspectives on the Evolving Aircraft Mounts Domain Highlighting Strategic Imperatives, Resilience and Future Pathways for Stakeholder Success

Drawing together the analyses and insights, the aircraft mounts sector is poised at the intersection of technological innovation and geopolitical complexity. Suppliers that adeptly integrate digital engineering tools, embrace advanced materials, and fortify their supply chains against tariff volatility will be well positioned to capture growth. The evolving regulatory and sustainability landscape adds another layer of strategic imperative, compelling industry participants to pioneer eco-friendly mount solutions and reduce lifecycle carbon footprints.

The segmentation analysis underscores diverse market niches-from adjustable and fixed mounts in commercial airliners to specialized vibration-isolation systems serving military platforms-each with unique performance criteria and economic trade-offs. Regional dynamics further highlight shifting investment patterns, as North America leads on R&D, EMEA focuses on retrofit and certification, and Asia-Pacific emerges as a hub for production scaling and localized partnerships.

In this environment, the competitive playing field is defined by the dual forces of product differentiation and operational resilience. Leading manufacturers are already forging collaborative networks to streamline material access, co-develop bespoke solutions, and refinine aftermarket services. As these strategies mature, the resultant ecosystem will demand heightened agility, cross-functional collaboration, and a relentless focus on value creation.

Ultimately, the future trajectory of the aircraft mounts domain will be shaped by those who can translate technical excellence into strategic advantage, balancing innovation imperatives with the realities of trade policy and sustainability commitments.

Engage Directly With Associate Director Ketan Rohom to Unlock Detailed Aircraft Mounts Market Insights and Empower Your Strategic Decision-Making Today

If you seek to transform your understanding of the aircraft mounts market and secure a competitive edge, now is the time to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. With domain expertise and a keen eye for emerging opportunities, he can guide you through the breadth of our analysis and tailor insights to your strategic objectives. Engaging with Ketan opens the door to a deep dive into critical data, proprietary intelligence, and actionable findings that can refine your business roadmap and catalyze growth. Reach out today to explore custom consultation packages and enterprise licensing options. Let Ketan Rohom equip your team with the knowledge and foresight needed to navigate the dynamic aircraft mounts landscape confidently and drive sustained success.

- How big is the Aircraft Mounts Market?

- What is the Aircraft Mounts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?