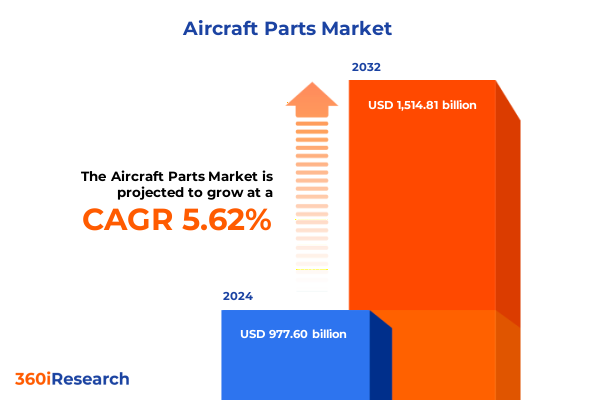

The Aircraft Parts Market size was estimated at USD 1.03 trillion in 2025 and expected to reach USD 1.08 trillion in 2026, at a CAGR of 5.66% to reach USD 1.51 trillion by 2032.

Introduction Framing the Dynamics and Scope of the Global Aircraft Parts Industry with Contextual Market Drivers and Emerging Trends

The global aircraft parts ecosystem plays a pivotal role in ensuring the reliability, safety, and performance of air travel networks around the world. As aircraft fleets expand and aging platforms undergo modernization or retirement, the demand for precision-engineered components has never been more critical. This introduction delves into the core forces shaping this market, including the accelerating pace of technological innovation, evolving regulatory frameworks, and the imperative of robust supply chain resilience in the face of geopolitical and economic uncertainties.

In recent years, advancements in materials science have ushered in lighter, stronger alloys and composite solutions that enhance fuel efficiency and extend service intervals. Furthermore, digital transformation initiatives within maintenance, repair, and overhaul operations are driving a shift toward condition-based monitoring, thereby reducing unplanned downtime and improving safety margins. As a result, stakeholders across the value chain-from Original Equipment Manufacturers responsible for cutting-edge engine parts to MRO providers managing line maintenance-face new challenges in aligning product portfolios with emerging aerospace trends.

Moreover, regulatory authorities continue to refine certification standards and impose stricter environmental and noise compliance benchmarks. Consequently, aircraft operators and parts suppliers alike must navigate a complex matrix of technical approvals, trade restrictions, and sustainability mandates. Against this backdrop, an informed understanding of market dynamics, supplier capabilities, and future outlooks is essential for industry decision-makers seeking to optimize operations and secure competitive advantage.

Exploring the Paradigm Shifts in Aircraft Parts across Technology, Regulation, Sustainability and Supply Chain Reshaping Industry Standards

The aircraft parts industry stands at a crossroads where multiple transformative shifts are converging to redefine product lifecycles and strategic priorities. One of the most prominent changes is the growing integration of predictive diagnostics into avionics and propulsion systems. By leveraging advanced sensor arrays and real-time analytics, operators can transition from scheduled maintenance cycles to condition-based interventions, which not only streamline inventory requirements but also minimize operational disruptions.

In parallel, the growing emphasis on decarbonization has spurred research into alternative materials such as high-performance polymers and advanced composite alloys. These innovations promise significant weight reduction, leading to lower fuel burn and reduced carbon footprints. As aerospace engineers adopt these materials, suppliers must retool manufacturing processes and invest in novel machining techniques to maintain precision tolerances required for critical engine parts and structural components.

Supply chain resilience has also emerged as a defining trend. Recent disruptions-from geopolitical tensions to global health crises-have highlighted the risk of single-source dependencies. Consequently, many operators and distributors are diversifying their vendor bases and exploring near-shoring strategies to secure critical items such as landing gear assemblies and avionics modules. In doing so, the industry is witnessing a shift from cost-centric procurement models to agility-focused frameworks that prioritize lead-time reductions and risk mitigation.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on Aircraft Parts Supply Chains Costs and Strategic Sourcing Decisions

In 2025, the United States government implemented a series of tariffs targeting imported aircraft parts to safeguard domestic producers and stimulate onshore manufacturing. These measures have had far-reaching effects on cost structures, supplier relationships, and sourcing strategies. In particular, many Original Equipment Manufacturers have re-evaluated their global procurement footprints, opting to qualify additional U.S. suppliers or invest in joint ventures that can circumvent tariff barriers while maintaining compliance with stringent quality standards.

At the same time, Maintenance Repair & Overhaul providers have faced increased expense ratios for parts such as turbine blades, fuselage panels, and avionics components. Given that these items often require rapid replacement to minimize aircraft ground time, the tariff-induced cost escalation has intensified pressure on maintenance budgets. As a result, some operators have accelerated their adoption of aftermarket distribution channels or sought long-term supply contracts to lock in favorable pricing and delivery commitments.

Furthermore, the tariff landscape has stimulated innovation in material substitution and modular design. Component manufacturers are exploring alternative alloy blends and standardized interfaces that can reduce dependence on imported casings, combustion liners, and electrical harness assemblies. Through collaborative R&D efforts, the industry is gradually building a more self-reliant ecosystem that balances the twin objectives of cost containment and performance assurance.

Unveiling Critical Segmentation Insights Spanning Part Types Materials End Users Distribution Channels and Aircraft Categories Driving Market Dynamics

A granular examination of market segments reveals nuanced patterns that are driving the competitive landscape. When viewed through the lens of part type, the market encompasses Airframe Components, Avionics, Electrical & Lighting, Engine Parts, Interiors, and Landing Gear & Braking Systems, with each category further divided into sub-assemblies such as Doors, Fuselage, Windows and Wings for airframes, and Communication Systems, Flight Control Systems, and Navigation Systems for avionics. The complexity of these groupings underscores the importance of specialized manufacturing capabilities and technical accreditation, particularly as suppliers strive to meet diverse performance specifications and regulatory requirements.

Material type segmentation highlights the interplay between cost, weight, and durability. Aluminum Alloys remain foundational due to their favorable strength-to-weight ratio and established supply chains, whereas Composite Materials are gaining traction for mission-critical applications because of their fatigue resistance and potential for complex geometries. Steel Alloys continue to serve in high-stress engine and landing gear components, while Titanium Alloys find prominence where corrosion resistance and high temperature tolerance are imperative.

From the End User perspective, the dichotomy between Maintenance Repair & Overhaul and Original Equipment Manufacturers shapes procurement strategies and service models. MRO providers-spanning Base Maintenance, Line Maintenance, and full Overhaul operations-prioritize availability and cost-effectiveness in routine and unplanned servicing. Meanwhile, OEMs focus on long-lead time fabrication cycles and continuous design enhancements to support new aircraft deliveries and retrofit programs.

Distribution channel analysis uncovers the tension between aftermarket distributors, who offer agility and global logistics networks, and direct sales channels, which foster closer collaboration between manufacturers and end users. Finally, aircraft type segmentation-covering Business Jets, Commercial Aircraft, General Aviation Aircraft, Helicopters, and Military Aircraft-further refines supplier specialization, as each platform demands unique certification, performance benchmarks, and lifecycle support protocols.

This comprehensive research report categorizes the Aircraft Parts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Part Type

- Material Type

- End User

- Distribution Channel

- Aircraft Type

Analyzing Regional Developments Across Americas Europe Middle East Africa and Asia Pacific That Influence the Aircraft Parts Market Trajectories

Regional analysis offers a multidimensional view of demand patterns, regulatory environments, and growth catalysts. In the Americas, a robust fleet expansion-driven by strong economic indicators and domestic MRO growth-has supported increasing aftermarket revenues for engine parts, interior refurbishments, and avionics upgrades. The presence of leading OEMs and a well-developed supplier network has made the region a focal point for emerging technologies and collaborative ventures.

Europe, Middle East & Africa presents a diverse regulatory mosaic that influences procurement strategies and design approvals. In Europe, stringent environmental and noise regulations have prompted accelerated adoption of advanced composite materials and next-generation navigation systems. Meanwhile, the Middle East’s continued investment in aviation infrastructure has driven demand for landing gear overhauls and cabin modernization programs. Across Africa, incremental increases in general aviation and helicopter usage are creating pockets of demand, particularly for durable, cost-effective components suited to challenging operating conditions.

In the Asia-Pacific region, the rapid fleet growth of commercial and military aircraft is matched by expanding MRO capacities in key hubs. Countries across Southeast Asia and Oceania are upgrading air traffic management and avionic systems, thereby generating demand for sophisticated flight control modules and communication systems. Simultaneously, the rise of business jet ownership in markets such as China and India is fostering niche aftermarket segments for cabin seating systems and galley interiors.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Parts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Highlighting Strategic Initiatives Innovations Collaborations and Competitive Positioning in Aircraft Parts Sector

The competitive arena of aircraft parts is characterized by a blend of established OEM giants, specialized MRO service providers, and agile aftermarket distributors. Leading multinationals leverage global manufacturing footprints and extended product portfolios to cater to a wide range of platforms and regulatory regimes. Their strategic initiatives often include investments in digital twin technologies, additive manufacturing capabilities for rapid prototyping, and collaborative R&D agreements that accelerate the certification of novel materials.

Specialized component manufacturers differentiate themselves through deep technical know-how in niches such as high-temperature turbine blade alloys or precision landing gear strut assemblies. By maintaining rigorous quality management systems and longstanding relationships with airframers, these players secure tier-one supplier status and gain preferential access to design advisories for next-generation platforms. In addition, partnerships between OEMs and MRO networks have become increasingly common, as both sides seek to optimize life-cycle cost through integrated service offerings and predictive maintenance solutions.

Meanwhile, aftermarket distributors are capitalizing on digital logistics platforms and regional warehouse expansions to deliver just-in-time inventory and consolidated procurement solutions. Through dynamic pricing models and value-added services such as kitting and consignment stocking, these firms enhance agility for smaller operators and charter services. The confluence of these strategic moves underscores the importance of synergy between technological leadership, operational excellence, and customer-centric service design.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Parts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A J Walter Aviation Limited

- Aereos, INC.

- BAE Systems PLC

- Bombardier Inc.

- C&L Aviation Group

- Ducommun Incorporated

- Eaton Corporation PLC

- General Electric Company

- GKN Aerospace Services Limited

- Godrej & Boyce Manufacturing Company Limited

- Griffon Aerospace, Inc.

- Hindustan Aeronautics Limited

- Honeywell International Inc.

- Intrex Aerospace

- JAMCO Corporation

- Janicki Industries, Inc.

- Leonardo S.p.A.

- Mahindra Aerospace Private Limited

- Mayday Manufacturing

- Mitsubishi Heavy Industries, Ltd.

- Moog Inc.

- Parker-Hannifin Corporation

- Platform Aerospace

- Polymershapes LA.

- Proponent

- Raytheon Technologies Corporation

- Rolls-Royce Holdings plc

- Safran S.A.

- Senior PLC

- Spirit AeroSystems Inc.

- Tata Advanced Systems Limited

- Textron Inc.

- Thales Group

- The Boeing Company

- Trace-A-Matic Corporation

- Woodward Inc.

Presenting Actionable Recommendations Enabling Industry Leaders to Optimize Operations Foster Innovation and Enhance Resilience in Aircraft Parts Ecosystem

Industry leaders can fortify their market positions by embracing a multi-pronged approach that balances innovation, operational agility, and strategic partnerships. To start, accelerating the adoption of digital platforms for end-to-end visibility can dramatically improve procurement planning and mitigate risks associated with long-lead parts. Proactive use of predictive analytics helps in anticipating component failures and aligning maintenance schedules with real-time aircraft health data.

In parallel, diversifying material portfolios and manufacturing locations reduces exposure to tariff shocks and geopolitical disruptions. Developing modular design architectures that allow for component interchangeability across aircraft types can further enhance production flexibility and reduce inventory carrying costs. At the same time, investing in additive manufacturing and advanced machining technologies offers the potential for on-demand production of complex parts, thus shortening lead times and lowering tooling expenses.

Collaborative ventures between OEMs, MRO specialists, and technology firms will remain critical for driving certification of next-generation components. Joint research into sustainable materials and low-emission engine parts can align with increasingly stringent environmental standards while opening new revenue streams. Finally, cultivating long-term relationships through performance-based contracts and integrated service agreements ensures steady aftermarket revenues and deepens customer loyalty.

Detailing a Rigorous Research Methodology Combining Primary Secondary Data Interviews and Analytical Frameworks to Deliver Comprehensive Market Insights

This report employs a structured research methodology that integrates both primary and secondary data to ensure comprehensive market coverage. Primary research involved in-depth interviews with senior executives spanning OEMs, MRO providers, distributors, and regulatory agencies. These conversations provided qualitative insights into strategic priorities, certification challenges, and sourcing constraints.

Secondary research entailed rigorous analysis of industry publications, regulatory filings, patent databases, and technical journals. This phase also included the examination of trade association reports, public financial disclosures, and government trade data to validate supply-chain dynamics and tariff impacts. Data triangulation techniques were applied to reconcile discrepancies and reinforce the accuracy of key findings.

The analytical framework centers on five segmentation dimensions-part type, material type, end user, distribution channel, and aircraft type-allowing for multidimensional insights that reflect real-world decision-making processes. Regional analysis spans the Americas, Europe, Middle East & Africa, and Asia-Pacific, capturing localized regulatory landscapes and growth catalysts. Competitive benchmarking incorporates metrics such as technology investments, collaborative agreements, and market reach, providing a clear view of the strategic positioning of leading participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Parts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Parts Market, by Part Type

- Aircraft Parts Market, by Material Type

- Aircraft Parts Market, by End User

- Aircraft Parts Market, by Distribution Channel

- Aircraft Parts Market, by Aircraft Type

- Aircraft Parts Market, by Region

- Aircraft Parts Market, by Group

- Aircraft Parts Market, by Country

- United States Aircraft Parts Market

- China Aircraft Parts Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Key Findings and Strategic Implications to Provide a Cohesive Perspective on the Evolving Dynamics of the Global Aircraft Parts Market

The findings of this analysis underscore the critical importance of agility and innovation in the aircraft parts industry. Technological advancements in predictive maintenance, advanced materials, and digital supply-chain management are redefining supplier-user relationships and operational paradigms. Concurrently, geopolitical and regulatory shifts-including the implementation of 2025 U.S. tariffs-have stimulated strategic realignments in sourcing and manufacturing footprints.

Segmentation insights reveal that part specialization, material optimization, and channel strategies are fundamental to capturing value across diverse aircraft platforms. Regional variations highlight opportunities for tailored market approaches, from aftermarket expansion in the Americas to capacity building in Asia-Pacific, and bespoke solutions in Europe, Middle East & Africa. Meanwhile, leading companies distinguish themselves through collaborative R&D efforts, digital integration, and performance-oriented service models.

As the industry moves forward, stakeholders who prioritize data-driven decision-making, cross-sector partnerships, and sustainable innovation will be best positioned to navigate uncertainties and capitalize on emerging growth levers. This cohesive perspective offers a roadmap for executives seeking to align strategic initiatives with evolving market dynamics and regulatory imperatives.

Contact Associate Director Ketan Rohom to Access In-Depth Aircraft Parts Market Research Report and Unlock Strategic Growth Opportunities Today

To explore the complete depth of the global Aircraft Parts market, secure your copy of this comprehensive research report by contacting Ketan Rohom. As Associate Director, Sales & Marketing, Ketan can provide tailored insights into the trends, segmentation, and competitive strategies that matter most to your business. Don’t miss out on the opportunity to leverage the latest data, expert analysis, and actionable recommendations to drive strategic decision-making and unlock new growth pathways. Reach out today to discover how this authoritative report can serve as a critical tool for strengthening supply chains, optimizing investments, and staying ahead of regulatory and technological transformations in the aircraft parts ecosystem.

- How big is the Aircraft Parts Market?

- What is the Aircraft Parts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?