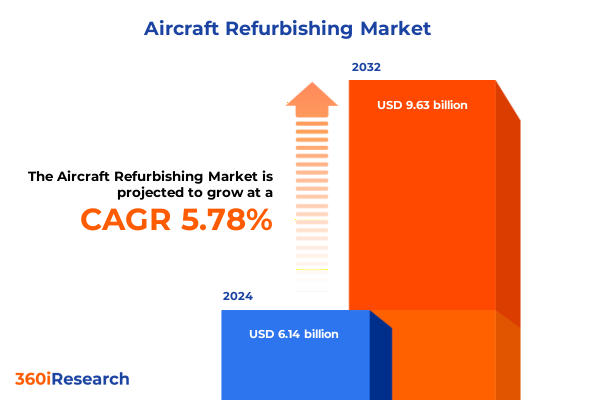

The Aircraft Refurbishing Market size was estimated at USD 6.49 billion in 2025 and expected to reach USD 6.84 billion in 2026, at a CAGR of 5.78% to reach USD 9.63 billion by 2032.

Understanding the Evolving Dynamics of Aircraft Refurbishment and Its Role in Extending Asset Life and Enhancing Operational Efficiency

Aircraft refurbishment has become an essential strategy for operators aiming to extend asset life, enhance passenger experience, and optimize lifecycle costs. With airlines and lessors under growing pressure to maintain aging fleets and satisfy evolving regulatory requirements, refurbishing initiatives have shifted from optional upgrades to core operational imperatives. This analysis sets out to illuminate the critical drivers, emerging trends, and practical considerations that underpin successful refurbishment programs. By unveiling key market dynamics across technology adoption, supply chain resilience, and regulatory shifts, this introduction lays the groundwork for an in-depth exploration of how refurbishing strategies can create sustainable value across stakeholder groups.

Moreover, the scope encompasses a broad spectrum of service offerings, from avionics enhancements to structural repairs, and examines how these functions intersect with diverse aircraft platforms and end-user segments. Drawing upon expert interviews, primary industry insights, and comprehensive secondary research, the introduction clarifies the methodology and objectives that guide subsequent sections. Consequently, readers will gain a clear understanding of the analytical framework and the intended applications for decision makers seeking to refine their maintenance, repair, and overhaul strategies.

How Technological Disruption and Sustainability Initiatives Are Reshaping the Aircraft Refurbishment Landscape at a Transformative Pace

The aircraft refurbishing landscape is undergoing a profound transformation driven by digitalization, sustainability mandates, and shifting customer expectations. Advanced digital twins now enable real-time monitoring of system health, permitting predictive maintenance regimes that limit unscheduled downtimes. At the same time, emerging materials-such as bio-based composites and lightweight alloys-are disrupting conventional repainting and cabin modification processes by offering both performance and environmental benefits. Consequently, operators can achieve faster turnarounds while reducing carbon footprints, aligning maintenance initiatives with broader decarbonization goals.

Furthermore, regulatory bodies are increasingly harmonizing standards for noise reduction, emissions, and safety certifications, prompting service providers to adopt more rigorous compliance management systems. Digital platforms are streamlining parts traceability and workflow scheduling, while augmented reality tools are enhancing technician training and on-site support. These cumulative shifts are redefining competitive boundaries, as providers that integrate next-generation automation and sustainability protocols position themselves at the forefront of a market that demands both technological excellence and environmental stewardship.

Assessing the Rippling Effects of Newly Imposed United States Tariffs on Aircraft Refurbishing Operations and Supply Chains

In 2025, the introduction of new U.S. tariffs on imported aerospace materials and critical components has reverberated throughout the refurbishing ecosystem. Tariffs on high-grade alloys, avionics modules, and specialized coatings have elevated procurement costs for both major maintenance, repair, and overhaul facilities and independent service providers. This shift has forced operators to revisit long-standing supplier relationships and to explore nearshoring or domestic sourcing alternatives. As a result, inventory carrying costs have increased, prompting a reevaluation of just-in-time inventory strategies in favor of buffer stocking models that account for duty fluctuations and geopolitical risk.

Moreover, supply chain lead times have lengthened, as global manufacturers adjust production schedules to mitigate tariff impacts. In practice, this has heightened the importance of collaborative planning between airlines and MRO partners to secure critical parts ahead of peak maintenance windows. Consequently, organizations leveraging strategic partnerships with domestic fabricators or diversified supplier networks have been better positioned to navigate this policy environment. Ultimately, the cumulative effect of 2025 tariff adjustments underscores the need for agile sourcing strategies and robust risk management frameworks to sustain program profitability.

Unveiling Critical Segmentation Insights That Illuminate Diverse Service Offerings and Customer Profiles in the Aircraft Refurbishing Market

A nuanced understanding of market segmentation provides crucial clarity on service demand and resource allocation. When analyzing refurbishment types, avionics upgrades and cabin refurbishments are often at the forefront of operator budgets, driven by passenger expectations for connectivity and comfort, while exterior painting, structural repairs, and both scheduled and unscheduled maintenance maintain regulatory airworthiness. Scheduled maintenance spans A checks through D checks, each escalating in complexity and downtime requirements. In contrast, unscheduled maintenance primarily addresses engine and hydraulic system repairs, where rapid turnaround is essential to minimize revenue-generating asset downtime.

Segmenting by aircraft type further refines strategic focus, as business jets and military aircraft operators typically prioritize bespoke cabin modifications or mission-specific structural enhancements, whereas narrow body, regional jet, and wide body fleets demand standardized, volume-driven service packages. End users ranging from commercial airlines to military aerial refueling and fighter jet operators, as well as corporate and fractional private operators, exhibit distinct maintenance cadences and customization preferences. Service providers themselves-whether independent specialists, integrated MRO networks, or original equipment manufacturers-deploy differentiated capabilities. Finally, component-level segmentation highlights the rising importance of galley systems, seating upgrades, lavatory modernizations, and advanced inflight entertainment systems, with a notable focus on audio, video, and connectivity enhancements. Age segmentation of aircraft, from under five years up through over fifteen years, further influences refurbishment priorities by balancing modern certification requirements against legacy system constraints.

This comprehensive research report categorizes the Aircraft Refurbishing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Refurbishment Type

- Aircraft Type

- Service Provider Type

- Component Type

- Aircraft Age Group

- End User Type

Key Regional Contrasts and Growth Drivers Highlighted Across the Americas Europe Middle East Africa and Asia Pacific Aircraft Refurbishing Markets

Regional market dynamics reveal distinctive growth drivers and operational priorities across global geographies. In the Americas, a legacy fleet requiring cabin modernization coexists with emerging low-cost carriers seeking cost-effective paint and maintenance solutions. Regulatory authorities in North America emphasize stringent safety audits, compelling service providers to invest in advanced quality management systems. Meanwhile, Latin American markets present opportunities for capacity expansion, even as infrastructure limitations and policy uncertainty pose intermittent challenges.

In Europe, Middle East, and Africa, hubs such as Frankfurt and Dubai act as innovation centers for sustainable materials and digital maintenance platforms, driven by strict emissions targets and collaborative industry initiatives. African markets, though nascent, are increasingly receptive to third-party MRO partnerships, aided by regulatory harmonization efforts. Conversely, Asia-Pacific regions are experiencing rapid fleet growth, with national carriers investing heavily in next-generation cabins and avionics retrofits. Regulatory alignment across jurisdictions like India, China, and Southeast Asia is improving parts certification processes, enabling faster program rollouts and reinforcing the region’s strategic importance for global refurbishing networks.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Refurbishing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Analyzing Their Strategic Initiatives to Stay Competitive in the Aircraft Refurbishing Ecosystem

Leading companies in the aircraft refurbishing sector are pursuing multifaceted growth strategies to secure market share and drive profitability. Major MRO operators have forged alliances with avionics manufacturers to deliver turnkey upgrade packages, while independent service providers focus on niche capabilities such as composite structural repairs and specialized painting finishes. OEMs have increasingly expanded aftermarket offerings, leveraging original design data to streamline certification and reduce part interchangeability concerns. Concurrently, several market participants are investing in digital platforms that integrate scheduling, parts ordering, and technician certification records to enhance operational transparency and client satisfaction.

In addition, industry leaders are prioritizing talent development initiatives, establishing technical academies and apprenticeship programs to overcome skilled labor shortages. Strategic joint ventures are emerging as a preferred model for entering new geographic regions, enabling rapid market access without extensive capital investment. Finally, environmental sustainability commitments are being formalized through public targets for waste reduction and energy efficiency, setting the stage for next-generation refurbishing standards that align corporate responsibility with operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Refurbishing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAR Corp.

- Aero Cabin Solutions

- Aircraft Cabin Modification GmbH

- AMAC Aerospace Inc.

- Bombardier Inc.

- Dassault Falcon Jet Corporation

- Diehl Stiftung & Co. KG

- Duncan Aviation Inc.

- Embraer S.A.

- FACC AG

- GDC Technics, LLC

- GKN Aerospace Services Limited

- HAECO Group

- Hong Kong Aircraft Engineering Company Limited

- JAMCO Corporation

- Jet Aviation AG

- Lufthansa Technik AG

- SIA Engineering Company Limited

- SR Technics Switzerland Ltd.

- StandardAero Inc.

Actionable Strategic Recommendations to Empower Industry Leaders to Capitalize on Emerging Trends and Navigate Complex Market Challenges

To pilot successful refurbishment programs in a complex market environment, industry leaders should adopt integrated strategies that synchronize digital, operational, and organizational capabilities. First, implementing digital twin ecosystems will allow real‐time asset monitoring and predictive maintenance scheduling, reducing downtime and optimizing part replacement cycles. At the same time, partnering with materials science experts to deploy eco-friendly coatings and composites can differentiate service offerings and satisfy emerging sustainability regulations. By establishing clear supplier performance metrics and diversifying sourcing across both domestic and international vendors, service providers can insulate programs from tariff volatility and logistical disruptions.

Furthermore, developing end-to-end customer experiences-encompassing initial assessment, design visualization, project execution, and post-refurbishment support-will elevate client retention and unlock cross-sell opportunities. Investing in workforce training through virtual reality simulations and certification pathways ensures that technicians remain adept at handling advanced avionics, structural composites, and emerging powertrain technologies. Finally, engaging proactively with regulatory authorities and industry consortia will facilitate early adoption of new standards and foster a collaborative approach to innovation, positioning leaders at the vanguard of the evolving aircraft refurbishing market.

Mapping the Rigorous Research Methodology Underpinning This Analysis to Ensure Robustness Accuracy and Comprehensive Market Understanding

This analysis synthesizes insights from a rigorous, multi-tiered research approach designed to ensure robustness and reliability. Primary research was conducted through in-depth interviews with senior executives across airlines, MRO facilities, OEMs, and component suppliers, capturing first-hand perspectives on operational challenges and strategic priorities. These conversations were complemented by site visits to leading maintenance centers and technology incubators, providing direct observation of best practices in digital maintenance applications and sustainable materials processing.

Secondary research encompassed systematic reviews of industry white papers, regulatory filings, technical journals, and supply chain impact assessments. Quantitative data was extracted from public financial statements, trade association publications, and certification registries, then subjected to rigorous validation processes, including data triangulation and outlier analysis. The combination of qualitative insights and quantitative verification ensures that findings are grounded in real-world evidence. Throughout the research process, ethical and confidentiality standards were rigorously maintained to protect competitive intelligence and proprietary information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Refurbishing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Refurbishing Market, by Refurbishment Type

- Aircraft Refurbishing Market, by Aircraft Type

- Aircraft Refurbishing Market, by Service Provider Type

- Aircraft Refurbishing Market, by Component Type

- Aircraft Refurbishing Market, by Aircraft Age Group

- Aircraft Refurbishing Market, by End User Type

- Aircraft Refurbishing Market, by Region

- Aircraft Refurbishing Market, by Group

- Aircraft Refurbishing Market, by Country

- United States Aircraft Refurbishing Market

- China Aircraft Refurbishing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Drawing Conclusive Perspectives on Future Directions Challenges and Opportunities within the Aircraft Refurbishing Sector

In synthesizing the key findings, it becomes clear that aircraft refurbishing has transcended its traditional role, evolving into a strategic enabler for fleet optimization, passenger satisfaction, and environmental stewardship. Technological innovations such as digital twins and sustainable materials are redefining service delivery models, while new tariff regimes underscore the necessity of supply chain agility. Segmentation insights reveal that tailored solutions-from avionics upgrades to specialized structural repairs-must be aligned with aircraft type, age, and end-user profiles to maximize impact.

Regional nuances and competitive landscapes further illustrate how market participants can leverage unique strengths, whether through digital platform leadership in Europe, capacity expansion in the Americas, or rapid fleet modernization in Asia Pacific. Ultimately, organizations that integrate leading practices, embrace sustainability, and invest in digital and human capital will emerge as market frontrunners. This conclusion serves as both a reflection on current realities and a roadmap for navigating the continuous evolution of the aircraft refurbishing ecosystem.

Engage with Ketan Rohom To Access the Full Aircraft Refurbishing Market Research Report and Accelerate Your Strategic Decision Making

If you would like to gain immediate access to the full-depth analysis, customized insights, and data tables driving this report, Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through the next steps. By connecting directly with Ketan, you will receive tailored recommendations on which modules best align with your strategic objectives. During your consultation, you will explore detailed case studies, proprietary methodologies, and implementation roadmaps designed to accelerate your decision making and deliver measurable returns on investment.

Take advantage of this opportunity to secure comprehensive, actionable intelligence that can inform capital allocation, vendor selection, and program prioritization. Ketan’s expertise in orchestrating data-driven conversations ensures that every aspect of the aircraft refurbishing market is translated into clear, executable strategies. Reach out today to schedule a confidential briefing and secure your competitive advantage before market dynamics evolve further.

- How big is the Aircraft Refurbishing Market?

- What is the Aircraft Refurbishing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?