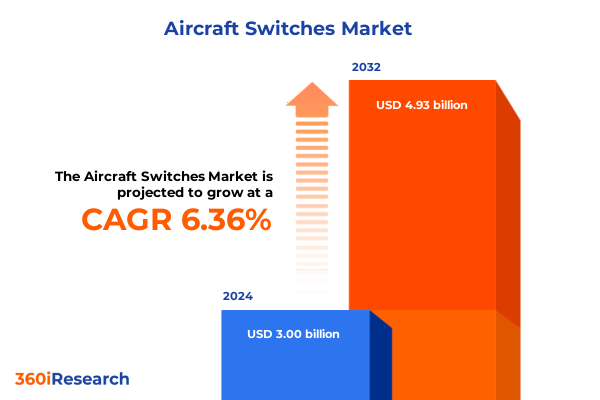

The Aircraft Switches Market size was estimated at USD 3.19 billion in 2025 and expected to reach USD 3.38 billion in 2026, at a CAGR of 6.38% to reach USD 4.93 billion by 2032.

Navigating the Complex and Evolving Ecosystem of Aircraft Switch Technologies Shaping Modern Aviation Systems and Safety Standards

The reliability and precision of switches within aircraft play a pivotal role in ensuring operational safety, system redundancy, and seamless pilot interaction. As modern aviation systems evolve toward greater automation and digital integration, the demands placed on these seemingly simple mechanical components have intensified. No longer mere on-off devices, aircraft switches must now satisfy rigorous standards in electromagnetic compatibility, high cycle life performance, resistance to extreme temperatures, and minimal weight addition. These evolving expectations reflect broader trends in avionics modernization, where cockpit controls, engine management systems, and cabin amenities increasingly rely on high-integrity switching solutions.

In this context, understanding the nuanced advancements in micro toggle designs, solid-state switch architectures, and panel-mount ergonomic layouts is essential for aerospace engineers, OEMs, and procurement teams. The ongoing shift toward network-based electrical systems underscores the need for predictive maintenance capabilities and real-time health monitoring of critical interfaces. As such, stakeholders must navigate a complex interplay of materials science, regulatory frameworks, and cost considerations. This introductory analysis sets the stage for a deeper examination of disruptive forces reshaping switch technology, regional adoption patterns, and strategic imperatives for industry leaders to maintain competitive advantage.

Uncovering the Technological, Operational, and Regulatory Forces Driving Revolutionary Changes in Aircraft Switch Design and Integration

Recent years have witnessed transformative currents redefining how aircraft switch solutions are conceptualized, engineered, and deployed. At the forefront is the rapid miniaturization trend, enabled by advances in solid-state electronics, which allows for more compact, lighter components without compromising durability. This development dovetails with an industry-wide push toward weight reduction and fuel efficiency, where every gram saved contributes to lower operational costs and carbon emissions.

Parallel to physical downsizing is the integration of digital intelligence within switches, facilitating features such as built-in diagnostics, networked status reporting, and software-driven configuration. These enhancements empower maintenance teams with predictive insights, dramatically reducing unscheduled downtimes. Regulatory bodies have also tightened certification paths, mandating comprehensive testing regimes for electromagnetic interference and harsh-environment performance. Supply chain resilience has emerged as another critical factor, as recent global disruptions highlighted the strategic vulnerability of single-source component strategies. Together, these forces have catalyzed a new era of collaboration between switch manufacturers, avionics integrators, and materials suppliers, fostering holistic solutions that address reliability, regulatory compliance, and digital augmentation.

Examining the Far-Reaching Consequences of 2025 United States Tariff Policies on the Global Aircraft Switch Supply Chain and Cost Structures

In 2025, the United States enacted a series of tariff escalations targeting imported electrical and electronic components, including key switch assemblies sourced from traditional manufacturing hubs. These measures, aimed at bolstering local production and reducing reliance on foreign supply, have produced a cumulative effect on input costs, lead times, and sourcing strategies. For original equipment manufacturers and maintenance providers, the higher duties on rotary, rocker, and toggle switch imports have necessitated renegotiation of supplier contracts and reevaluation of total cost models.

The ripple effects extend beyond raw pricing. Faced with elevated tariff barriers, several switch vendors have shifted assembly operations to North American facilities, accelerating near-shoring initiatives and forging new partnerships with domestic PCB and cable mount specialists. While these adaptations have partially mitigated duty burdens, initial capital investments and certification cycles have introduced temporary capacity constraints. Moreover, the reconfigured supply chain has prompted a reexamination of inventory policies, as firms balance the trade-off between tariff savings and the carrying costs of localized warehousing. In summation, the US tariff landscape in 2025 has acted as both catalyst and challenge, prompting strategic realignments that will reverberate through the aircraft switch market in the coming years.

Delving into Critical Market Segmentation Dimensions Revealing Opportunities and Challenges Across Diverse Aircraft Switch Types and Applications

A thorough understanding of the aircraft switch market emerges when segmenting by switch type, revealing distinct performance requirements and application niches across micro toggles engineered for space-constrained avionics racks, push button modules offering defined tactile feedback, rocker switches designed for high cycle life in cockpit consoles, rotary actuators providing multi-position control, slide units optimized for linear adjustment tasks, and classic toggle configurations that remain favored for critical fail-safe operations. Beyond mechanical form, the evolution from traditional electromechanical actuation to fully electronic sensor-based interfaces and the burgeoning adoption of solid-state switching solutions underscore divergent paths toward reliability and digital integration. Mounting preferences further differentiate offerings, with cable mount variants facilitating remote installation in avionics bays, panel mount assemblies prioritizing ergonomic access in flight decks, and PCB mount formats supporting compact instrument clusters.

End-use segmentation casts light on specialized demands, where large and midsize business jets emphasize lightweight, high-cycle components; major and regional commercial airlines require seamless standardization for fleet interoperability; attack, transport, and utility helicopters prioritize ruggedization against vibration; fighter and transport military aircraft mandate compliance with stringent MIL-STD specifications; and both combat and reconnaissance UAVs lean toward minimal power consumption and extended endurance. Application-level insights reveal that avionics systems drive innovation in low-contact resistance and EMI suppression, cabin systems focus on user comfort and intuitive control, cockpit controls demand precision haptics and redundancy, engine controls require extreme temperature resilience, and landing gear interfaces necessitate foolproof mechanical retention. Finally, voltage rating distinctions between high, medium, and low classes inform insulation strategies and circuit protection schemes, illustrating the multifaceted considerations that define segmentation-driven product roadmaps.

This comprehensive research report categorizes the Aircraft Switches market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Switch Type

- Technology

- Mounting Type

- Voltage Rating

- End Use

- Application

Analyzing Regional Dynamics Highlighting How the Americas, Europe Middle East and Africa, and Asia-Pacific Markets Are Shaping Aircraft Switch Demand

Regional dynamics exert a profound influence on the trajectory of aircraft switch adoption and innovation. In the Americas, the concentration of commercial OEMs and a vibrant business jet sector drive robust demand for advanced switch solutions tailored to next-generation cockpit architectures. North American manufacturing clusters have leveraged tariff-induced incentives to expand capacity for both electromechanical and solid-state products, reinforcing the region’s leadership in aviation components. Meanwhile, Latin American carriers are modernizing fleets, placing premium on reliable switches that simplify maintenance and lower lifecycle costs.

Across Europe Middle East and Africa, the interplay of well-established commercial hubs, defense procurements, and emerging low-cost carriers shapes a diverse requirements landscape. European certification regimes emphasize stringent environmental and safety standards, prompting local suppliers to invest in extensive test laboratories. In the Middle East, heavy investment in flagship airports and luxury business jet programs fuels appetite for high-end cabin and cockpit controls, whereas Africa’s nascent charter and regional air services increasingly prioritize durable, low-maintenance designs.

Asia-Pacific stands out as the fastest-growing market, propelled by burgeoning commercial fleets, a surge in helicopter tourism services, and government initiatives to bolster domestic defense manufacturing. Regional manufacturers are rapidly climbing the value chain, integrating smart diagnostics and predictive health monitoring into switch platforms. Additionally, cross-border trade agreements are facilitating technology transfer, enabling APAC firms to collaborate on solid-state switch innovation with established Western and Japanese collaborators.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Switches market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Demonstrating Innovation Strategic Partnerships and Competitive Positioning in the Aircraft Switch Sector

Several companies have established leading positions in the aircraft switch domain through a combination of technological innovation, strategic alliances, and focused investments in certification and manufacturing excellence. Global diversified electronics suppliers have expanded their aerospace portfolios by acquiring boutique switch specialists, enabling integrated solutions for cockpit and cabin systems. At the same time, niche vendors with deep expertise in MIL-STD testing have cemented their standing within military and defense procurement cycles, often collaborating directly with prime contractors on custom switch assemblies.

International partnerships have become a hallmark of competitive strategy, with some firms co-developing solid-state switching platforms that leverage proprietary sensor technology and embedded diagnostics. Investment in additive manufacturing has also surfaced as a differentiator, allowing rapid prototyping of ergonomic switch housings and complex mounting brackets. Companies demonstrating end-to-end supply chain resilience-by combining US-based assembly lines with offshore component sourcing and in-house certification capabilities-have emerged as preferred suppliers for large airline groups and defense ministries. This convergence of digital transformation, supply chain optimization, and subjected regulatory compliance underscores the multifaceted nature of leadership in this specialized market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Switches market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK Inc

- Applied Avionics Inc

- Astronics Corporation

- Barantech

- C&K COMPONENTS LLC

- Control Products Inc

- Curtiss-Wright Corporation

- Cygnet Aerospace Corp

- Diehl Stiftung & Co KG

- Eaton Corporation plc

- Electro-Mech Components Inc

- Honeywell International Inc

- Hydra-Electric Company

- ITT Inc

- Meggitt PLC

- Oxley Group

- Parker-Hannifin Corporation

- RTX Corporation

- Safran SA

- Schurter Holding AG

- Sensata Technologies Inc

- TE Connectivity Corporation

- TransDigm Group Inc

- Unison Industries LLC

- Vishay Intertechnology Inc

Strategic Actions and Best Practices Industry Leaders Must Adopt to Capitalize on Emerging Trends and Navigate Volatility in Aircraft Switch Markets

To thrive amid accelerating technological shifts and evolving regulatory mandates, industry leaders must adopt a multifaceted strategic approach. Prioritizing diversification of the supply base is critical; by balancing domestic assembly capabilities with vetted international component partners, firms can mitigate tariff exposure and supply disruptions. Concurrently, accelerating investment in solid-state and electronic switch platforms will align product roadmaps with broader avionics modernization trends, unlocking opportunities for embedded health monitoring and digital integration.

Elevating collaboration with certification bodies and end-users is equally essential. Early engagement in specification development and co-validation programs can streamline time-to-market and ensure alignment with emerging standards. Moreover, integrating digital twin methodologies into design and qualification workflows offers predictive validation of mechanical wear and electrical performance, reducing cycle times and cost overruns. Lastly, companies should explore service-based models-such as condition-based maintenance contracts-capitalizing on built-in diagnostics to deliver recurring revenue while enhancing fleet reliability for operators. Through these actions, industry participants can secure competitive differentiation and resilience in the face of ongoing market volatility.

Comprehensive Research Framework Combining Qualitative and Quantitative Approaches to Deliver Rigorous Insights into Aircraft Switch Market Dynamics

This research employs a rigorous mixed-methodology framework to ensure both breadth and depth of insights into the aircraft switch market. The process commenced with an extensive literature review of regulatory filings, aerospace technical journals, and public announcements from leading OEMs and switch manufacturers. Primary research involved in-depth interviews with design engineers, procurement executives, and certification specialists across commercial, business, military, and unmanned aviation segments to capture firsthand perspectives on performance requirements and sourcing strategies.

Quantitative analysis included the compilation and validation of segment-level data across switch type, technology, mounting configuration, end usage, application and voltage categories. Triangulation was achieved by cross-referencing supplier shipment data, customs and trade statistics, and maintenance service logs. To refine regional insights, the methodology incorporated localized expert panels in the Americas, Europe Middle East and Africa, and Asia-Pacific, ensuring nuanced understanding of certification regimes and market drivers. Data quality controls and iterative review with industry thought leaders underpin the credibility of findings, delivering a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Switches market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Switches Market, by Switch Type

- Aircraft Switches Market, by Technology

- Aircraft Switches Market, by Mounting Type

- Aircraft Switches Market, by Voltage Rating

- Aircraft Switches Market, by End Use

- Aircraft Switches Market, by Application

- Aircraft Switches Market, by Region

- Aircraft Switches Market, by Group

- Aircraft Switches Market, by Country

- United States Aircraft Switches Market

- China Aircraft Switches Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Core Insights and Forward-Looking Perspectives to Empower Decision Makers in Steering the Future of Aircraft Switch Technologies

The intricate interplay of technological evolution, geopolitical influences, and shifting end-user demands has positioned aircraft switches as a microcosm of broader trends in aerospace innovation. As the industry embraces digitalization, reliability requirements have moved beyond mechanical endurance to encompass smart diagnostics and networked performance monitoring. Simultaneously, regulatory landscapes and tariff policies have prompted strategic realignments in supply chains, underscoring the importance of resilience and agility.

Through detailed segmentation and regional analyses, it is clear that diverse customer profiles-from major airlines and business jet operators to military programs and unmanned platforms-drive varying priorities in form factor, functionality, and integration capabilities. Leading companies have responded with targeted investments in certification, manufacturing flexibility, and collaborative development models. For decision makers, the imperative is twofold: leverage the insights distilled here to refine product portfolios and operational strategies, and remain vigilant to emergent shifts in materials science, digital integration, and trade policy. By adopting a proactive posture, stakeholders can convert market complexities into sources of competitive advantage.

Secure Your Competitive Edge by Partnering with Ketan Rohom to Access the Definitive Market Research Report on Aircraft Switch Industry Trends

To explore the most comprehensive insights into aircraft switch innovations and market dynamics, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, for a personalized consultation. Ketan brings extensive expertise in aviation components and can guide you through the report’s key findings, ensuring you extract maximum value for your strategic initiatives. Reach out today to secure early access to detailed regional analyses, in-depth company profiles, and actionable forecasts that will empower your organization’s next moves. Partnering with Ketan ensures you stay ahead of transformative trends and competitive shifts driving the aircraft switch sector.

- How big is the Aircraft Switches Market?

- What is the Aircraft Switches Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?