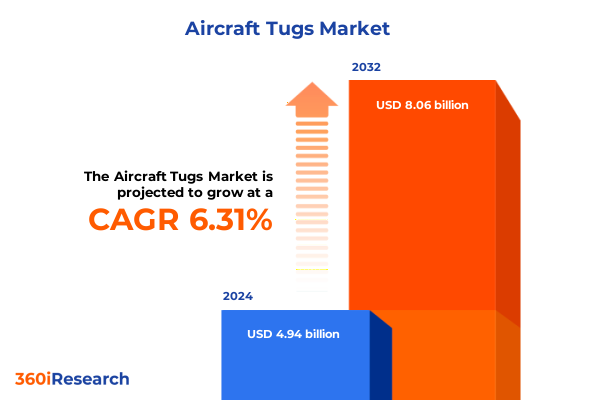

The Aircraft Tugs Market size was estimated at USD 5.26 billion in 2025 and expected to reach USD 5.56 billion in 2026, at a CAGR of 6.29% to reach USD 8.06 billion by 2032.

Navigating the Evolving World of Aircraft Tugs Where Efficiency, Safety, and Sustainability Drive Ground Support Excellence

Aircraft tugs serve as the unsung heroes of airport ground operations, seamlessly bridging the gap between runway logistics and terminal efficiency. Day in and day out, these specialized vehicles bear the weight of critical turnarounds, ensuring that every departure and arrival proceeds on schedule. As the aviation industry rebounds from recent disruptions, ground support equipment has emerged as a focal point for operational resilience and cost containment. Modern tugs must balance robust performance with precision handling, all while meeting stringent safety and environmental requirements

Against a backdrop of accelerating traffic growth and tightening margins, stakeholders are demanding equipment that not only moves aircraft but also optimizes resource utilization. Fuel costs, labor constraints, and sustainability targets have converged to place unprecedented importance on tug reliability and lifecycle management. Airports and ground handling companies alike recognize that efficient pushback and towing capabilities are key differentiators in a highly competitive market, underpinning broader ambitions for digitalization and green operations

Unprecedented Technological and Operational Transformations Reshaping the Global Aircraft Tug Landscape and Industry Practices

The rise of electrification has redefined expectations for ground support machinery, with electric and hybrid tugs swiftly replacing traditional diesel models at major airports worldwide. Advances in battery chemistry have extended operational runtimes and slashed charging intervals, allowing fleets to operate without midday refueling breaks. Electrified tractors not only reduce carbon emissions on the apron but also deliver lower noise and maintenance costs, reinforcing airport commitments to community-friendly operations

Alongside cleaner powertrains, automation has begun to permeate tug functionality. Autonomous pushback prototypes equipped with AI-driven guidance systems can execute precise maneuvers with minimal human intervention. Trials at leading hubs have demonstrated that remotely operated and self-driving tugs can cut turnaround times and enhance safety by eliminating cockpit blind spots. These innovations are setting new standards for ground handling efficiency and reliability across high-density terminals

Moreover, the integration of digital technologies-from IoT-enabled telematics to predictive maintenance algorithms-is ushering in an era of data-driven decision making. Real-time tracking of vehicle health, battery status, and operational metrics empowers fleet managers to anticipate service needs before breakdowns occur. This convergence of smart engineering and analytics is transforming tugs into connected assets, integral to streamlined ground operations and cost-effective asset utilization

Assessing the Escalating Burden of United States Steel and Aluminum Tariffs on Aircraft Tug Manufacturing and Operations

In early 2025, the United States reinstated across-the-board 25 percent tariffs on imported steel and aluminum under Section 232, closing previous exemptions and product-specific exclusions. These measures, effective March 12, elevated input costs for any equipment containing foreign steel or aluminum, including frames, chassis, and body panels for aircraft tugs. The removal of negotiated quotas with allies signaled a renewed emphasis on domestic metal production, but also a notable cost burden for global manufacturers relying on specialized alloys

Further intensifying these pressures, a June proclamation raised steel and aluminum tariff rates from 25 percent to 50 percent, applying to both raw materials and the metallic content of derivative articles. This escalation, which took effect on June 4, 2025, compounded procurement challenges and compelled sourcing teams to reevaluate global supply chains. Countries with longstanding exemptions, such as the United Kingdom, faced differentiated rates only for a brief transitional period pending broader trade agreements

Manufacturers have already reported significant tariff-related hits, with one leading aerospace supplier projecting a $500 million impact in 2025 due to steel and aluminum levies. These duties have contributed to revised cost structures, extended lead times, and strategic reassessments of regional assembly footprints. As a result, original equipment manufacturers and component suppliers are exploring nearshoring and vertical integration to mitigate ongoing tariff volatility and safeguard margins

Illuminating Critical Segmentation Dynamics Across Product Types Power Sources Weight Capacities and End User Applications

The market for towbar and towbarless tugs diverges along operational priorities, with traditional towbar tractors offering proven versatility for cargo and narrowbody aircraft, while towbarless models excel in rapid aircraft engagement and reduced nose gear wear. Towbarless designs have surged in adoption at high-density terminals due to their streamlined pushback procedures, which minimize aircraft stress and enhance gate throughput rates

Diesel-powered tugs continue to hold sway in regions where charging infrastructure is nascent, but electric counterparts are rapidly gaining ground thanks to lower total cost of ownership and alignment with environmental mandates. Hybrid solutions are emerging as a bridge technology, marrying combustion engines with electric drives to extend operational range at large airports and reduce overall fuel consumption during peak activity

Weight capacity segmentation caters to diverse fleet requirements, from lightweight units serving private jets and regional turboprops to heavy-duty models capable of towing widebody and cargo aircraft exceeding 260,000 pounds. Manufacturers adjust chassis design, traction systems, and powertrain specifications to match these capacity bands, ensuring that ground handlers can optimize their equipment investment based on the specific aircraft types in their fleet

End users range from airport operators seeking integrated fleet fleets for consistent terminal operations to specialized ground handling companies that may manage in-house fleets or contract with third-party providers. Military and OEM customers demand tailored specifications for unique applications, such as austere environment durability or integration with aircraft manufacturer service networks. Ground handling firms, whether embedded within airlines or operating independently, leverage segmentation insights to align tug procurement with operational, strategic, and service-level objectives

This comprehensive research report categorizes the Aircraft Tugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Weight Capacity

- End User

Unearthing Region-Specific Impacts and Opportunities Across Americas EMEA and Asia-Pacific in the Aircraft Tug Ecosystem

In the Americas, the United States and Canada have spearheaded the shift toward zero-emission ground fleets, buoyed by federal and provincial incentive programs that underwrite electric tug acquisitions and charging infrastructure installations. Leading hubs, including Los Angeles and Toronto Pearson, have reported that over half of their GSE inventories now run on battery power, reflecting regional commitments to improve air quality and achieve net-zero energy goals by mid-century

Europe, Middle East, and Africa present a tapestry of regulatory and market drivers. European Union airports are racing to meet Fit for 55 targets, deploying electrified and hybrid tugs alongside trials of hybrid-electric pushback systems under initiatives like HERON. Gulf carriers are investing heavily in bespoke ground fleets to support expanding network capacities, while African airports are prioritizing modular, scalable equipment that can be retrofitted for electrification as infrastructure matures

Asia-Pacific remains the fastest-growing region, with airports in China and India integrating smart GSE solutions amid rapid fleet expansion. Government modernization schemes and public–private partnerships have accelerated the procurement of electric and semi-autonomous tugs, with emerging markets in Southeast Asia adopting cost-effective retrofit programs to upgrade existing diesel fleets. This region’s emphasis on agility and scaling aligns with its broader infrastructure development trajectory

This comprehensive research report examines key regions that drive the evolution of the Aircraft Tugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Innovation-Driven Players Steering the Aircraft Tug Market Toward Competitive Distinction

The competitive landscape is anchored by established players and innovative newcomers alike. Leading OEMs such as TLD Group and Lektro (a Textron Company) have expanded their electric towbarless tractor portfolios, targeting high-capacity applications at major international airports. Eagle Tugs continues to differentiate through its all-wheel-drive mid-operator tractors, while Goldhofer and its subsidiary Schopf deliver heavy-duty solutions for the world’s largest aircraft, including the A380 and Antonov freighters

At the same time, remote-controlled electric specialists like Mototok and TowFLEXX have captured niche segments in business aviation and FBO environments, offering compact, user-friendly platforms. Kalmar Motor’s hybrid models integrate advanced battery systems with traditional drivetrains to address long-range towing needs, while OEMs broaden service offerings through digital platforms and telematics partnerships to support predictive maintenance and fleet optimization

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Tugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aero Mobile Products

- Airtug LLC

- Aviaco GSE

- Bradshaw Electric Vehicles

- Charlatte America

- DJ Products Inc.

- Douglas Equipment

- Eagle Tugs

- Flyer-Tugs

- Global Ground Support LLC

- Goldhofer AG

- Harlan Global Manufacturing

- JBT AeroTech

- Kalmar Motor AB

- LEKTRO Inc.

- Lektro Tug Company

- Mototok International GmbH

- NMC-Wollard

- TLD Group

- TowFLEXX GmbH

- Tronair Inc.

- TUG Manufacturing Corporation

Actionable Strategies for Industry Leaders to Capitalize on Innovation Sustain Competitiveness and Navigate Regulatory Complexity

Industry leaders should prioritize accelerated electrification roadmaps by collaborating with energy providers to expand charging networks and leverage government decarbonization grants. Such partnerships can help stabilize total cost of ownership calculations and support fleet replacement cycles without undermining cash flow. Moreover, integrating battery leasing models can minimize upfront capital requirements while maximizing uptime through guaranteed replacement services

To counteract tariff volatility, procurement teams must diversify their supplier base by qualifying alternative domestic and nearshore metal fabricators and component assemblers. Establishing strategic alliances with steel and aluminum mills under long-term contracts can secure price stability, while in-house alloy blending capabilities may reduce exposure to universal ad valorem duties. These steps will improve resilience against further trade policy shifts

Finally, embracing data-driven fleet management tools will be critical for predictive maintenance and resource allocation. Implementing IoT-enabled telematics and AI-based health monitoring can uncover hidden cost savings, reduce unplanned downtime, and optimize asset deployment. By viewing each tug as a connected node within an integrated ground operations network, organizations can unlock new efficiencies and maintain a competitive edge

Transparent Research Methodology Combining Primary Interviews Secondary Data and Rigorous Analytical Frameworks for Robust Insights

Our analysis employed a dual-track research design, blending primary interviews with industry experts-including ground handling managers, maintenance supervisors, and OEM executives-with extensive secondary data collation. Primary insights were gathered via structured consultations at leading airports across North America, Europe, and Asia-Pacific, providing frontline perspectives on electrification, automation, and procurement challenges

Secondary research encompassed an exhaustive review of government policy documentation, trade associations, white papers, and technical briefings, ensuring that tariff developments and regulatory changes were captured in real time. Proprietary databases were leveraged to triangulate company financials and capital expenditure plans, while patent filings and product release notes provided visibility into emerging technology roadmaps

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Tugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Tugs Market, by Product Type

- Aircraft Tugs Market, by Power Source

- Aircraft Tugs Market, by Weight Capacity

- Aircraft Tugs Market, by End User

- Aircraft Tugs Market, by Region

- Aircraft Tugs Market, by Group

- Aircraft Tugs Market, by Country

- United States Aircraft Tugs Market

- China Aircraft Tugs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Insights to Conclude on the Future Trajectory of the Aircraft Tug Market Amid Global Pressures and Opportunities

The convergence of electrification, automation, and trade policy shifts is redefining the economics of aircraft ground support. As tariff rates on steel and aluminum continue to reshape input costs, electrified and autonomous tug platforms are emerging as strategic imperatives for airports and handling companies seeking to balance operational efficiency with environmental stewardship. Those that invest early in connected asset ecosystems will be best positioned to capitalize on process improvements and cost reductions

Looking ahead, the integration of AI-driven analytics and predictive maintenance will unlock new levels of reliability, while regional supply chain realignments will influence manufacturing footprints. By synthesizing segmentation insights and regional dynamics, stakeholders can tailor their fleet strategies to meet evolving aircraft types and mission requirements. In this fluid landscape, agility and foresight remain the cornerstones of competitive advantage in the aircraft tug market

Connect with Ketan Rohom to Secure Your Comprehensive Aircraft Tug Market Report and Empower Strategic Decision Making

Don't miss the opportunity to deepen your understanding of the dynamic aircraft tug market with comprehensive analysis and actionable insights tailored for strategic decision making. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full report and position your organization at the forefront of innovation in ground support solutions. Empower your team with the data and recommendations needed to navigate evolving regulatory landscapes, capitalize on electrification trends, and mitigate tariff-related risks effectively

- How big is the Aircraft Tugs Market?

- What is the Aircraft Tugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?