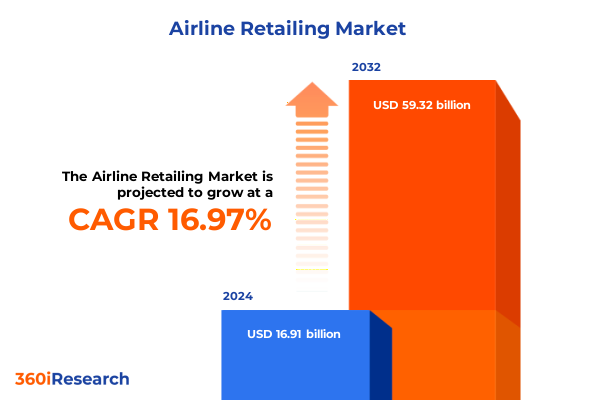

The Airline Retailing Market size was estimated at USD 19.72 billion in 2025 and expected to reach USD 22.99 billion in 2026, at a CAGR of 17.03% to reach USD 59.32 billion by 2032.

Exploring the Evolutionary Forces Redefining Airline Retailing Strategies Across Passenger Engagement Touchpoints and Revenue Streams

The airline retailing landscape has undergone a profound transformation, evolving not only as a revenue augmentation mechanism but also as a central pillar of passenger engagement. In recent years, the convergence of digital platforms, customer experience imperatives, and ancillary service innovation has elevated airline retailing from a supplementary offering to a strategic imperative. This shift has been driven by consumer demand for seamless journey experiences and by competitive pressures that reward airlines able to deliver highly personalized, context-aware propositions.

Against this backdrop, industry stakeholders are navigating a complex web of technological adoption cycles, changing traveler demographics, and external forces such as regulatory actions and trade policies. Consequently, airline operators are diversifying their retail architectures to integrate dynamic pricing engines, mobile-first commerce environments, and loyalty ecosystem enhancements. As a result, the sector is experiencing an era of hyper-segmentation, with carriers tailoring their in-flight meals, baggage fee structures, branded merchandise assortments, and priority boarding options to ever more specific passenger personas.

This executive summary synthesizes the key trends, strategic inflection points, and market drivers shaping the airline retailing domain. It highlights critical shifts in product portfolios, buyer behaviors, and channel ecosystems, while also exploring the impact of new United States tariffs enacted in 2025. By examining segmentation insights, regional nuances, and major competitive maneuvers, the following sections provide industry leaders with a robust framework for decision-making in a rapidly evolving marketplace.

Examining the Transformative Convergence of Digital Innovation and Customer-Centric Retailing That Is Revolutionizing Airline Revenue Management and Offer Personalization

Airline retailing is experiencing transformative shifts as industry players leverage emerging technologies to foster seamless, omnichannel commerce experiences. Artificial intelligence-driven personalization engines are now central to delivering contextually relevant offers, with real-time data streams enabling airlines to tailor ancillary services such as seat upgrades, in-flight entertainment packages, and priority boarding options based on passenger history and situational factors. Moreover, the adoption of unified commerce frameworks is blurring the lines between pre-purchase, on-trip, and post-trip interactions, thereby enhancing lifetime traveler value and boosting ancillary revenue streams.

In addition, the proliferation of cloud-native platforms has catalyzed rapid innovation cycles, allowing carriers to deploy modular retail applications that integrate smoothly with global distribution systems, mobile applications, and airport kiosks. Furthermore, partnerships between airlines and technology providers are fostering co-creation models, where machine learning and predictive analytics are harnessed to optimize merchandising assortments and dynamic pricing strategies. As a result, the industry is moving away from one-size-fits-all offerings toward adaptive storefronts that respond to individual traveler preferences.

Transitioning from legacy reservation systems, carriers are increasingly investing in new retailing protocols and API-first architectures to ensure scalability and flexibility. Consequently, these technological underpinnings are facilitating advanced payment mechanisms, loyalty currency conversions, and virtual wallet integrations, all of which are pivotal in meeting modern passenger expectations and driving competitive differentiation.

Analyzing the Far-Reaching Consequences of Newly Implemented US Tariffs in 2025 on Airline Ancillary Offerings Supply Chains and Cost Structures

The introduction of new US tariffs in 2025 has exerted pressure on cost structures throughout the airline retailing value chain. Tariffs imposed on imported components used in in-flight entertainment hardware, cabin provisioning equipment, and duty-free merchandise logistics have increased input costs for both carriers and their retail partners. Consequently, airlines are reassessing sourcing strategies for ancillary product offerings, exploring domestic suppliers for proprietary branded merchandise, and renegotiating contracts with global distribution system partners to absorb or offset tariff-related expenses.

Moreover, these tariffs have introduced complexity into multi-currency pricing and dynamic fare engines, as cost-reflective adjustments must now account for additional import duties when calculating bundled service packages. In response, airlines are implementing advanced financial modeling tools to simulate the cumulative impact of tariff fluctuations on baggage fee revenues, branded meal kit margins, and onboard retail sales. This enhanced analytical capability supports more granular profit-and-loss forecasting and informs strategic decisions on merchandise categorization, inventory management, and promotional discounting.

In parallel, some airlines have begun to explore long-term hedging mechanisms and cross-border supply agreements that minimize exposure to future tariff escalations. By diversifying vendor networks and regionalizing procurement strategies, carriers can maintain competitive price positioning for consumers while safeguarding ancillary revenue growth amid an increasingly protectionist trade environment.

Deciphering Multifaceted Segmentation Trends Illuminating How Distinct Product Types Buyer Profiles and Channel Preferences Shape Airline Retail Performance

A nuanced understanding of segmentation dynamics is vital to maximizing ancillary revenues and optimizing product portfolios. When examining product types, airlines are balancing traditional revenue pillars like baggage fees and in-flight meals with emerging opportunities in branded merchandise and duty-free retail. Within the ancillary services spectrum, priority boarding and seat selection upgrades are now benchmark offerings, yet carriers are differentiating more effectively by bundling these services with on-board entertainment access. At the same time, the resale potential of duty-free goods and exclusive travel-themed merchandise is being expanded through targeted cross-sell initiatives at the checkout stage.

Turning to buyer profiles, it is evident that business travelers, frequent flyers, and leisure passengers each exhibit distinct purchasing behaviors. Business travelers increasingly demand corporate prepaid solutions and streamlined self-service channels, whereas members of loyalty programs expect tiered benefits and experiential rewards that align with frequent-flyer status. Meanwhile, leisure travelers show heightened sensitivity to package deals that bundle seats, meals, and ground transportation, favoring promotional bundles that offer perceived added value.

Lastly, an in-depth look at distribution channels reveals divergent engagement and conversion trajectories. Direct channels such as airline websites, airport kiosks, and mobile applications facilitate the highest level of personalization and data capture, empowering carriers to curate offerings with precision. Conversely, indirect channels including global distribution systems, online travel agencies, and travel management companies deliver broad market reach and incremental customer segments that might otherwise remain untapped. By calibrating channel-specific merchandising rules and dynamic pricing thresholds, airlines can align distribution costs with yield management objectives and reinforce brand consistency across all touchpoints.

This comprehensive research report categorizes the Airline Retailing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Buyer Type

- Channel

- Application

Unearthing Regional Variations in Consumer Behaviors Operational Frameworks and Regulatory Environments That Influence Airline Retailing Across the Americas EMEA and Asia Pacific

Regional market dynamics are molding the strategic approaches of airlines in unique ways. In the Americas, carriers are leveraging their strong digital infrastructure to pilot advanced ancillary models, deploying data-driven personalization throughout the booking funnel and expanding loyalty partnerships with retail and hospitality brands. This region’s robust credit card ecosystem and high smartphone penetration have accelerated the adoption of mobile wallets and touchless transactions, significantly boosting conversion rates for in-flight retail promotions.

Across Europe, the Middle East, and Africa, airlines are navigating a complex regulatory framework that influences cross-border duty-free allowances and consumer protection mandates. This environment has driven the emergence of sophisticated loyalty coalitions that integrate multiple carriers, rail operators, and hotel chains, thereby creating expansive retail ecosystems. In addition, boutique carriers in the Middle East have achieved differentiation through luxury-focused onboard boutiques and curated destination experiences that leverage regional craftsmanship and high-end duty-free assortments.

Meanwhile, Asia-Pacific markets are characterized by exponential passenger demand growth and a mobile-first commerce mindset. Low-cost carriers in this region have been particularly adept at unbundling services, offering micro-upgrades such as digital comfort kits and streaming entertainment passes. Furthermore, regional partnerships between airlines and e-commerce platforms have accelerated the rollout of innovative retail merchandise, from personalized travel gadgets to destination-inspired collectibles, effectively capitalizing on the region’s propensity for social media-driven purchases.

This comprehensive research report examines key regions that drive the evolution of the Airline Retailing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Airlines and Technology Providers Showcasing Strategic Alliances Innovation Trajectories and Competitive Differentiators in Contemporary Airline Retailing

The competitive landscape is marked by a diverse array of airlines and technology providers driving retailing innovation. Leading network carriers are partnering with retail technology firms to co-develop AI-powered offer engines that predict ancillary purchase intent and optimize seat allocation strategies. Some airlines have established in-house digital subsidiaries to incubate mobile checkout experiences, while others rely on established distribution system providers to manage complex merchandising catalogs and financial settlements.

Additionally, several global and regional low-cost carriers have partnered with specialized merchandisers to curate capsule collections of branded travel accessories and duty-free goods, thereby transforming aircraft cabins into pop-up retail environments. At the same time, established carriers are collaborating with fintech firms to integrate embedded payment solutions and loyalty-currency conversions directly at the point of sale. These strategic alliances underscore a broader industry trend toward platform-based ecosystems, where airline retailing is no longer siloed but fully integrated into enterprise digital transformation agendas.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airline Retailing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accelya

- Amadeus IT Group, S.A.

- ATPCO, Inc.

- Coforge Limited

- Datalex plc

- Deutsche Lufthansa AG

- JR Technologies

- Navitaire LLC

- PROS Holdings, Inc.

- Sabre Corporation

- SITA

- TPConnects

- Travelport Worldwide Limited

- Verteil Technologies

Implementing Actionable Strategies to Enhance Ancillary Revenue Expand Market Reach and Foster Sustainable Growth Amidst Intensifying Competitive and Regulatory Pressures

Industry leaders must prioritize the development of unified commerce strategies that break down silos between reservation systems, onboard point-of-sale terminals, and post-trip marketing channels. By adopting a single source of customer truth and leveraging real-time inventory visibility, airlines can deliver frictionless offer orchestration, ensuring that ancillary suggestions are dynamically tailored to the traveler’s journey stage and loyalty status. Moreover, establishing open API frameworks will facilitate seamless integration with third-party service providers, enabling rapid roll-out of new retail experiments.

Simultaneously, airlines should invest in next-generation personalization capabilities that extend beyond rudimentary segmentation, harnessing machine learning models to anticipate traveler needs and optimize cross-sell sequences. This investment will require a concerted data governance approach to unify disparate data sources and maintain compliance with evolving privacy regulations. Furthermore, carriers are advised to diversify supply chains to mitigate exposure to tariff shocks, exploring near-shore manufacturing partnerships and joint-venture procurement arrangements for high-value merchandise categories.

Finally, cultivating strategic partnerships with ancillary specialists, retail management platforms, and loyalty coalition networks will be essential to expanding market reach and deepening customer engagement. Such collaborations can accelerate time to market for novel retail concepts and enable airlines to tap into adjacent consumer segments. By piloting modular retail pilots in select markets and iterating based on measured performance KPIs, industry leaders can methodically scale successful initiatives and maintain a competitive edge.

Detailing Rigorous Research Methodologies Employed to Compile Credible Data Synthesis Qualitative Insights and Quantitative Analyses Underpinning the Airline Retailing Study

This research combines robust secondary and primary investigation techniques to ensure the highest levels of accuracy and relevance. The initial phase involved an exhaustive review of industry publications, regulatory filings, and trade association reports to map the macroeconomic forces and policy developments affecting airline retailing. Concurrently, technology vendor whitepapers and case studies provided insight into emerging platform capabilities, enabling a holistic understanding of available solutions.

To complement these findings, in-depth interviews were conducted with senior executives across network carriers, low-cost operators, and ancillary service suppliers. These conversations yielded qualitative insights on strategic priorities, operational constraints, and innovation roadmaps. Quantitative data was then gathered through anonymous surveys distributed to revenue management, digital transformation, and retail merchandising leaders, facilitating triangulation of perspectives and performance benchmarks.

Data synthesis was underpinned by advanced analytical models that assessed the interplay between pricing dynamics, channel economics, and consumer propensities. The segmentation framework was validated through cluster analysis, ensuring that product, buyer, and channel categorizations align with real-world behaviors. Finally, key findings were stress-tested against multiple market scenarios, including tariff variations and regional demand fluctuations, to gauge resilience and strategic viability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airline Retailing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airline Retailing Market, by Product Type

- Airline Retailing Market, by Buyer Type

- Airline Retailing Market, by Channel

- Airline Retailing Market, by Application

- Airline Retailing Market, by Region

- Airline Retailing Market, by Group

- Airline Retailing Market, by Country

- United States Airline Retailing Market

- China Airline Retailing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights to Project Future Trajectories in Airline Retailing Emphasizing Agility Innovation and Collaboration for Continued Market Leadership

In conclusion, airline retailing has matured into a strategic discipline integral to revenue diversification and passenger satisfaction. Across the globe, carriers are embracing digital architectures, hyper-personalization engines, and strategic alliances to create compelling retail propositions. Regulatory shifts, such as the 2025 US tariffs, have added complexity to cost management and supply chain planning, yet these challenges also present catalysts for operational innovation and supplier relationship optimization.

Segmentation insights reveal that a balanced portfolio of ancillary services, merchandise sales, and travel-related offerings is essential to addressing the unique needs of business travelers, frequent flyers, and leisure passengers. Furthermore, channel optimization across direct and indirect touchpoints remains a critical success factor for driving conversion and maximizing customer lifetime value. Regional nuances underscore the importance of contextualized strategies that reflect local regulatory, technological, and consumer behavior landscapes.

Ultimately, the carriers that will lead the next phase of airline retailing are those that integrate advanced data analytics with agile retail architectures, cultivate cross-industry partnerships, and proactively mitigate external risks through diversified sourcing and flexible pricing strategies. This combination of foresight, innovation, and operational rigor will define competitive leadership in an increasingly complex market.

Engaging with Ketan Rohom to Access In-Depth Market Intelligence and Tailored Strategic Guidance for Maximizing Opportunities in the Airline Retailing Ecosystem

I invite you to engage with Ketan Rohom, the Associate Director of Sales & Marketing, to unlock exclusive insights and strategic recommendations drawn from our comprehensive airline retailing research. By partnering directly, you will gain access to in-depth analysis of emerging consumer behaviors, advanced technological applications, and competitive benchmarking that can accelerate revenue growth and operational efficiency within your organization.

Our research offers a detailed examination of segmentation dynamics, tariff implications, and regional variations, and Ketan is poised to guide you through the report’s findings with a tailored approach to your business objectives. Whether you aim to refine ancillary service offerings, optimize digital channels, or navigate evolving regulatory landscapes, this conversation will equip you with actionable intelligence to make data-driven decisions.

To secure your copy of the full market research report and schedule a personalized consultation, connect with Ketan Rohom today and take the first step toward transforming your airline retail strategy.

- How big is the Airline Retailing Market?

- What is the Airline Retailing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?