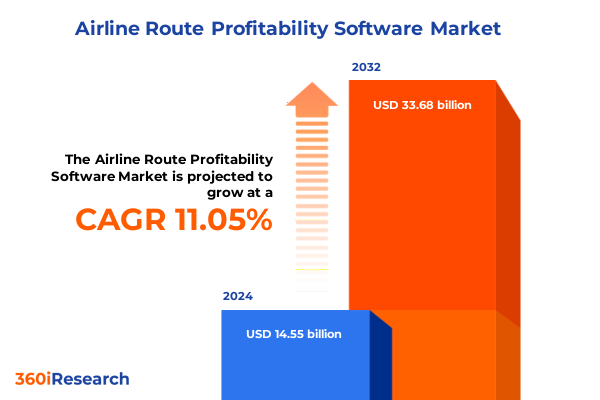

The Airline Route Profitability Software Market size was estimated at USD 16.14 billion in 2025 and expected to reach USD 17.73 billion in 2026, at a CAGR of 11.07% to reach USD 33.68 billion by 2032.

Unlocking the Future of Airline Route Profitability Software Through Comprehensive Industry Perspectives and Strategic Insights

The landscape of commercial aviation has never been more dynamic, challenging airlines to navigate a complex web of cost pressures, regulatory shifts, and fluctuating passenger demand. In this environment, airlines are under relentless pressure to optimize network performance, reduce operational inefficiencies, and maximize profitability on every flight. As a result, the role of advanced route profitability software has evolved from a niche tool into an indispensable strategic asset that empowers carriers to make data-driven decisions with confidence.

Advanced route profitability solutions leverage real-time data integration, predictive analytics, and granular cost-revenue modeling to illuminate the hidden drivers of route performance. By synthesizing information across fuel consumption, crew scheduling, airport fees, and ancillary revenues, these platforms provide a holistic view of route economics that traditional revenue management systems alone cannot deliver. Moreover, the ability to conduct rapid scenario analyses enables decision-makers to respond swiftly to market changes, whether driven by competitive entries, geopolitical events, or shifts in passenger behavior.

As airlines embrace digital transformation, the introduction of cloud-native architectures, machine learning algorithms, and interoperable application programming interfaces (APIs) has set a new standard for route profitability software. This report uncovers the critical capabilities, integration requirements, and organizational imperatives that define market-leading solutions. It establishes a foundational understanding of the technological, economic, and operational factors shaping the future of route profitability, setting the stage for in-depth exploration of transformative trends and actionable strategies throughout this executive summary.

Navigating Transformative Shifts Redefining Airline Route Profitability Solutions in Response to Evolving Technology and Competitive Dynamics

Over the past decade, the airline industry has undergone transformative shifts driven by rapid technological innovation, evolving customer expectations, and intensifying competitive dynamics. Today, artificial intelligence and machine learning stand at the forefront of this evolution, enabling route profitability platforms to process vast data sets, identify complex cost-revenue correlations, and generate prescriptive insights that fuel strategic decision making. Cloud computing has further accelerated this transformation by offering scalable infrastructure and seamless integration with existing revenue management, scheduling, and enterprise resource planning systems.

Simultaneously, the competitive landscape has expanded as nontraditional entrants and technology startups introduce niche offerings focused on specialized analytics, open data standards, and user-centric interfaces. These agile competitors challenge established vendors by delivering modular, API-first solutions that integrate easily with legacy systems. In response, incumbents are forging strategic partnerships and investing in research and development to broaden their product portfolios, emphasizing end-to-end visibility, real-time reporting, and automated scenario planning.

Regulatory changes and sustainability mandates have also redefined operational priorities, compelling airlines to incorporate carbon accounting, slot compliance, and noise restrictions into route evaluation frameworks. As a result, profitability software must now balance traditional financial metrics with environmental and social governance criteria. This convergence of technology, competition, and regulation underscores the need for adaptable, future-proof route profitability platforms that can scale in performance while aligning with emerging industry norms and stakeholder expectations.

Assessing the Cumulative Impact of Recent United States Tariffs on Airline Route Profitability and Strategic Software Deployment in 2025

In 2025, newly implemented United States tariffs on aircraft components, avionics systems, and maintenance equipment have introduced additional layers of cost and complexity to airline operations. Carriers reliant on imported parts face elevated procurement expenses, prompting finance and operations teams to reevaluate route cost structures in unprecedented detail. The pass-through of these tariffs to overall operating costs has underscored the importance of real-time cost monitoring within route profitability platforms.

Beyond direct procurement impacts, the tariffs have triggered ripple effects across maintenance schedules and supply chain resilience. Airlines with robust inventory management modules embedded in their profitability software gain an advantage by anticipating potential delays or cost overruns. This enhanced visibility into spare parts availability and alternate sourcing options enables more accurate forecasting of route performance under fluctuating cost conditions.

Furthermore, the 2025 tariff initiatives have spurred carriers to adopt dynamic pricing strategies more aggressively, leveraging integrated route profitability data to adjust fares in near real-time based on shifting operating costs. This approach mitigates margin erosion while maintaining competitive cabin pricing. In parallel, software solutions that incorporate tariff data feeds and customizable cost drivers allow airlines to simulate multiple scenarios, from short-term tactical adjustments to long-term network planning, ensuring informed decision making amid evolving economic headwinds.

Unveiling Key Segmentation Insights Shaping Airline Route Profitability Software Across Diverse Service Classes Flight Durations and Customer Preferences

Airline route profitability software must accommodate diverse operational scenarios by providing tailored insights across multiple dimensions of airline activity. When evaluating performance based on service class, it becomes essential to recognize that business, economy, first, and premium economy cabins each yield distinct revenue streams and cost profiles. A sophisticated platform disaggregates these classes to highlight margin variability and identify underperforming segments.

Flight duration segmentation further refines network analysis, as the economics of long haul, medium haul, and short haul routes differ substantially in terms of fuel consumption, crew utilization, and passenger demand patterns. By modeling each flight duration category independently, carriers can prioritize resource allocation and schedule adjustments for maximum yield.

Similarly, customer type influences demand elasticity and booking behavior; business travelers often value schedule reliability and flexibility, group bookings require block space optimization, leisure travel follows seasonal fluctuations, and VFR passengers exhibit unique booking windows. Incorporating direct, global distribution system, and online travel agency channels into a unified revenue funnel offers visibility into distribution costs and channel performance.

Underpinning these revenue considerations are aircraft type choices-narrow body jets for high-frequency regional routes, regional jets for point-to-point services, and wide body aircraft for intercontinental networks-that impact fuel consumption, maintenance cycles, and airport handling fees. Fare type differentiation between non-refundable and refundable inventory reveals consumer tolerance for flexibility versus cost savings, while booking window analysis-capturing patterns under 15 days, between 15 to 30 days, and over 30 days ahead of departure-uncovers pricing and promotion optimization opportunities. Finally, ancillary service revenue from baggage fees, food and beverage offerings, inflight entertainment packages, and seat selection upgrades must be integrated to present a holistic view of route profitability.

This comprehensive research report categorizes the Airline Route Profitability Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Class

- Flight Duration

- Customer Type

- Booking Window

- Ancillary Service

- Application

- Deployment Mode

Delivering Critical Regional Insights Into Airline Route Profitability Software Adoption Trends and Performance Across Major Global Territories

Regional dynamics play a pivotal role in shaping airline route profitability strategies, with each geography presenting distinct market characteristics and operational challenges. In the Americas, carriers benefit from a mature domestic network, high frequency point-to-point services, and early adoption of digital sales channels. The abundance of secondary airports and liberal bilateral agreements has fostered competitive pricing and spurred the integration of advanced profitability analytics to sustain margins in an environment of aggressive fare competition.

Across Europe, the Middle East & Africa, the network complexity increases as carriers navigate slot restrictions at congested hub airports, multi-jurisdictional regulatory frameworks, and a diverse mix of legacy and low-cost business models. Route profitability software in this region must accommodate stringent environmental regulations, carbon offset programs, and variable airport charges, while also supporting hub-and-spoke optimization for connecting traffic flows.

In the Asia-Pacific region, rapid market liberalization, fleet expansion, and emerging long-haul demand have created fertile ground for profitability tools that can scale with hybrid networks blending narrow body intra-regional services and wide body intercontinental flights. Infrastructure constraints in secondary markets, coupled with variable fare regulations, require adaptive scenario planning and real-time response capabilities within software platforms. The convergence of these regional nuances underscores the imperative for adaptable solutions that align with localized operational imperatives and commercial objectives.

This comprehensive research report examines key regions that drive the evolution of the Airline Route Profitability Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Pioneering Innovations and Strategic Partnerships in Airline Route Profitability Software Development

The airline route profitability software market is characterized by a diverse ecosystem of established technology vendors and innovative challengers, each contributing unique strengths to industry advancements. Leading providers differentiate themselves through integrated suites that offer end-to-end visibility-from granular cost capture and detailed revenue attribution to scenario simulation and executive reporting. Their platforms often feature robust data connectors, facilitating seamless integration with passenger service systems, revenue management engines, and financial ledgers.

Emerging technology firms have carved out niche positions by focusing on specialized capabilities such as real-time operational adjustments, intuitive user interfaces designed for rapid scenario creation, and advanced machine learning modules that automatically calibrate key performance drivers. Strategic partnerships between incumbent vendors and aviation consultants have further enhanced solution depth, combining domain expertise with cutting-edge analytics to deliver prescriptive recommendations aligned with carrier objectives.

Moreover, select airlines have begun collaborating directly with software developers to co-create bespoke tools that reflect specific network characteristics, fleet compositions, and customer profiles. This trend underscores the growing demand for customization, driving vendors to adopt modular architectures, open APIs, and cloud-native deployments. As a result, the competitive landscape continues to evolve, pushing companies to innovate around data orchestration, automated insights generation, and user experience excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airline Route Profitability Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A-ICE

- Accenture plc

- Aeronomics

- Aeroscan

- Aims International BV

- Airline Intelligence Systems Ltd.

- Amadeus IT Group SA

- Aviareps AG

- AviIT GmbH

- Aviotech

- AviSys Solutions

- FlightPath3

- IBM Corporation

- Lufthansa Systems GmbH & Co. KG

- Oracle Corporation

- PROS Holdings, Inc.

- RDC Aviation Ltd.

- Sabre Corporation

- SAP SE

- The Boeing Company

Implementing Actionable Recommendations to Optimize Airline Route Profitability Software Strategies and Drive Sustainable Competitive Advantages

To capitalize on the potential of route profitability software, industry leaders should prioritize the development of a unified data foundation that integrates cost, revenue, and operational information in near real-time. Establishing a centralized data lake, combined with standardized data governance protocols, lays the groundwork for accurate profitability modeling and rapid scenario evaluation. Leadership teams must champion this initiative to break down internal silos and ensure cross-functional alignment on data quality and accessibility.

Furthermore, airline executives should invest in advanced analytics capabilities, particularly machine learning algorithms that can detect emerging demand patterns, flag cost anomalies, and recommend network adjustments proactively. Embedding these capabilities into user workflows through intuitive dashboards empowers commercial planners and network strategists to act decisively without relying on manual data reconciliation.

Selecting software solutions that offer open APIs and flexible configuration options is essential to future-proof technology investments. This approach enables carriers to integrate profitability modules with evolving revenue management, crew planning, and sustainability reporting systems. Additionally, fostering a culture of continuous improvement through regular upskilling of analytics teams will ensure that organizations fully leverage the insights generated by these platforms.

Finally, forging strategic partnerships with external experts-such as aviation consultants, data scientists, and system integrators-can accelerate implementation timelines and embed best practices. Leaders who adopt a phased rollout approach, combining quick-win pilots with long-term optimization roadmaps, will realize measurable improvements in route economics while maintaining organizational agility.

Outlining Rigorous Research Methodology Underpinning Insights in Airline Route Profitability Software Analysis and Data Integrity Measures

The research methodology underpinning this analysis combines rigorous primary and secondary data collection with stringent validation processes to ensure the integrity and reliability of insights. Primary research involved structured interviews and workshops with senior network planners, revenue management executives, and IT leaders from a diverse cross section of global carriers. These engagements focused on current usage patterns, technology requirements, and emerging priorities in route profitability management.

Complementing these qualitative insights, secondary research drew upon publicly available financial disclosures, technology white papers, industry conference presentations, and regulatory filings. This triangulation of sources enables a comprehensive understanding of vendor capabilities, adoption trends, and operational challenges across different regions and airline business models.

Quantitative data were normalized using industry-standard cost categories and revenue attribution frameworks to facilitate apples-to-apples comparisons. Customizable data models were developed to simulate a variety of scenarios reflecting diverse service classes, flight durations, aircraft types, and customer segments. Rigorous data cleansing procedures and peer reviews ensured accuracy, while statistical techniques were applied to identify high-confidence findings and isolate key performance levers.

Overall, this multi-layered approach delivers robust, actionable intelligence that reflects both the strategic imperatives and operational realities of airline route profitability management in an era defined by rapid technological change and evolving market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airline Route Profitability Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airline Route Profitability Software Market, by Service Class

- Airline Route Profitability Software Market, by Flight Duration

- Airline Route Profitability Software Market, by Customer Type

- Airline Route Profitability Software Market, by Booking Window

- Airline Route Profitability Software Market, by Ancillary Service

- Airline Route Profitability Software Market, by Application

- Airline Route Profitability Software Market, by Deployment Mode

- Airline Route Profitability Software Market, by Region

- Airline Route Profitability Software Market, by Group

- Airline Route Profitability Software Market, by Country

- United States Airline Route Profitability Software Market

- China Airline Route Profitability Software Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Concluding Strategic Perspectives on Maximizing the Impact of Airline Route Profitability Software for Informed Decision Making and Sustainable Growth

As the airline industry continues to confront margin pressures, evolving customer expectations, and regulatory complexities, route profitability software emerges as a cornerstone capability for carriers seeking to sustain competitive advantage. The integration of advanced analytics, real-time data orchestration, and scenario planning empowers airlines to uncover hidden opportunities, mitigate cost volatility, and optimize network performance with unprecedented precision.

Looking ahead, the convergence of environmental considerations, digital distribution innovations, and evolving customer segmentation will demand that route profitability platforms remain agile, transparent, and extensible. Carriers that embrace continuous improvement-investing in data infrastructure, cultivating analytics talent, and forging strategic technology partnerships-will be better positioned to navigate industry headwinds and capture new avenues for growth.

Ultimately, software solutions that deliver holistic visibility across service classes, flight durations, customer types, distribution channels, aircraft configurations, fare rules, booking behaviors, and ancillary revenue streams will play a decisive role in defining long-term profitability. By centering decision making on integrated, data-driven insights, airline executives can chart a path toward sustainable network optimization and robust financial performance.

Engaging with Our Associate Director to Secure Comprehensive Airline Route Profitability Software Intelligence for Strategic Business Advancement

For organizations seeking to harness deep insights into airline route profitability and secure a decisive advantage in a competitive marketplace, engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing, offers a personalized pathway to unlocking the full potential of our in-depth market research report. His expertise in tailoring solutions to the specific strategic objectives of airlines and software providers ensures that you receive targeted intelligence aligned with your operational and commercial goals. By connecting with Ketan Rohom, stakeholders gain exclusive access to comprehensive analysis, customized data presentations, and strategic consultation designed to inform critical decisions on software selection, investment prioritization, and partnership opportunities that drive sustainable growth.

- How big is the Airline Route Profitability Software Market?

- What is the Airline Route Profitability Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?