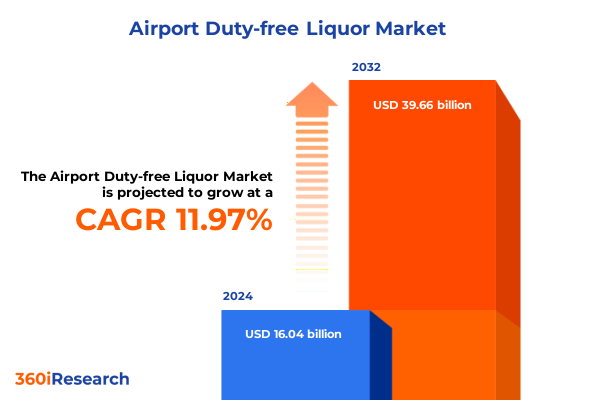

The Airport Duty-free Liquor Market size was estimated at USD 17.93 billion in 2025 and expected to reach USD 19.86 billion in 2026, at a CAGR of 12.00% to reach USD 39.66 billion by 2032.

Navigating the Skies of Change: An Engaging Entry Point into the World of Airport Duty-Free Liquor and Its Strategic Significance

The airport duty-free liquor segment has reemerged as a cornerstone of the global travel retail landscape, bolstered by the rebound in passenger traffic following the pandemic downturn. Travel retail sales were projected to reach approximately $145.9 billion within three years, reflecting the sector’s swift recovery from a 67 percent decline at the height of Covid-19 and fueled by consumer eagerness to capitalize on duty-free pricing and exclusive offerings. As international mobility approaches pre-pandemic levels, airports continue to invest in curated retail environments that cater to evolving traveler expectations, driving heightened engagement in liquor categories where premium and experiential products create a compelling in-terminal journey.

How Disruptive Forces and Emerging Traveler Behaviors Are Redefining and Transforming the Airport Duty-Free Liquor Marketplace in Unprecedented Ways

Underlying the renewed vitality of the airport duty-free liquor market are sweeping shifts that transcend traditional retail models and embed consumer experience at the core. Digital integration through mobile applications enables travelers to explore product portfolios, reserve items for collection, and access virtual tastings that bring the retail showcase to life before disembarking. Concurrently, sustainability has become a strategic imperative, as brands adopt eco-friendly materials and carbon-neutral logistics to resonate with an environmentally aware traveler cohort.

Moreover, the premiumization trend is reshaping assortment planning, with duty-free stores stocking limited-edition releases and artisanal craft items that cannot be found in domestic channels. These exclusive offerings, often presented in collectible gift packs or bespoke packaging, reinforce the perception of airport duty-free liquor as a destination for discovery and indulgence. At an operational level, artificial intelligence and predictive analytics optimize inventory allocation across diverse airport hubs, ensuring high-demand products are available while minimizing waste and stockouts.

Unpacking the Layered Consequences of 2025 United States Tariff Policies on the Airport Duty-Free Liquor Trade Ecosystem Across Global Markets

Over recent years, United States trade policy has introduced a layered tariff framework that exerts significant pressure on airport duty-free liquor channels across multiple categories. Initially, Section 232 measures imposed 25 percent duties on steel and aluminum imports in 2018, triggering retaliatory levies from major trading partners on U.S. whiskey and other spirits; these actions reverberated through global duty-free networks, elevating landed costs and complicating inventory strategies. In March 2025, announcements of potential 200 percent tariffs on European wine and champagne, contingent on EU retaliatory measures, further underscored the volatility imbuing the trade environment.

Concurrently, the administration’s threat to impose 30 percent duties on a broad array of EU goods beginning August 1, 2025, has amplified uncertainty for airport operators and brand partners seeking to secure stable pricing structures. Airlines and retailers have responded by accelerating shipments ahead of tariff deadlines, a strategy that temporarily bolstered volumes but risks leaving excess goods in downstream channels when higher duties take effect. These dynamics have compressed margins, driven real-time price adjustments at duty-free points of sale, and prompted brands to pursue cost-mitigation measures, including localized bottling and alternative sourcing.

Decoding the Multifaceted Segmentation Landscape Shaping Consumer Choices and Distribution Channels in Airport Duty-Free Liquor Markets Worldwide

The dynamics of airport duty-free liquor retail are underpinned by a rich segmentation framework that guides product development, marketing approaches, and distribution tactics. Product Type distinctions span Beer, Ready-to-Drink, Spirits, and Wine, with further granularity such as Ale, Craft, Gin, Vodka, Red Wine, and Sparkling, shaping assortment strategies tailored to discerning travelers. Price Tier designations from Value through Ultra Premium inform tiered pricing architectures that maximize basket value without alienating cost-conscious shoppers.

Brand Origin segmentation between International and Local labels influences portfolio diversification, enabling retailers to balance globally recognized names with region-specific offerings that appeal to cultural preferences. Packaging Type preferences-ranging from Minis to Gift Packs-drive gifting occasions, while Alcohol Content brackets address both regulatory constraints and consumer desires for lighter or more potent expressions. Flavor profiles, whether Fruity, Herbal, or Traditional, support targeted innovation pipelines, and the incorporation of Sales Channel options such as Curbside Pickup, In Store, and Online Pre-Order reflects the imperative for omnichannel convenience in a fast-paced environment. Together, these segmentation lenses provide a robust roadmap for engaging a spectrum of traveler profiles and elevating overall category performance.

This comprehensive research report categorizes the Airport Duty-free Liquor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Price Tier

- Brand Origin

- Packaging Type

- Alcohol Content

- Flavor

- Sales Channel

Illuminating Regional Dynamics: How the Americas, Europe Middle East & Africa, and Asia-Pacific Are Driving Distinct Trends in Airport Duty-Free Liquor

Regional dynamics play a pivotal role in sculpting the contours of airport duty-free liquor retail, as each major zone presents distinct consumer behaviors and operational considerations. In the Americas, North American hubs benefit from high volumes of long-haul traffic and a mature duty-free ecosystem, where premium spirits like aged whiskies and craft gins resonate strongly with both leisure and corporate travelers. Latin American travelers, meanwhile, show an increasing appetite for global brands, underscoring opportunities for cross-border partnerships and localized marketing campaigns.

In the Europe, Middle East & Africa region, regulatory complexity and the presence of diverse cultural traditions drive a heterogeneous market landscape; key gateway airports in Western Europe spotlight classic Champagne and Scotch varieties, while Middle Eastern carriers and terminals emphasize luxury presentation and gifting assortments tailored to high-net-worth individuals. Meanwhile, Africa’s growing outbound tourism corridors hint at untapped potential through emerging airport retail infrastructures.

Across Asia-Pacific, the resurgence of intra-regional travel has accelerated domestic spending on duty-free liquor, particularly in markets like China where domestic duty-free expansions and supportive policies have invigorated consumption. High-speed rail connections to airport precincts and an expanding network of tier-one airports underscore the structural enhancements that will continue to underpin growth in this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Airport Duty-free Liquor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Maneuvers Shaping Competitive Advantage in the Global Airport Duty-Free Liquor Arena

The competitive landscape of airport duty-free liquor retail features a blend of global spirits conglomerates and specialized travel retail operators who are constantly refining their value propositions. Companies such as Avolta have secured strategic hub contracts, exemplified by its recent deal at JFK Airport, which underscores the critical role of retail operators in orchestrating engaging, high-impact experiences for international travelers. Meanwhile, Diageo continues to leverage immersive brand activations and exclusive limited editions to cement its status as a category leader across major travel hubs; its investment in digital whisky boutiques and augmented reality experiences reflects a commitment to seamless omnichannel engagement.

Pernod Ricard has similarly emphasized experiential pop-ups and rare spirit showcases, such as the Royal Salute limited-edition series at Sydney Airport, to drive exclusivity and justify premium pricing. Lagardère Travel Retail’s successful bid at Amsterdam Schiphol further illustrates the appetite for integrated retail concessions that encompass liquor, leveraging synergies with complementary categories to maximize dwell-time spend. Across the board, leading players are also aligning with sustainability goals, deploying eco-friendly packaging trials and carbon-neutral supply chain initiatives to meet evolving stakeholder expectations and fortify long-term brand equity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airport Duty-free Liquor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anheuser-Busch InBev SA/NV

- Asahi Group Holdings Ltd.

- Bacardi Limited

- Beam Suntory Inc.

- Brown-Forman Corporation

- Campari Group

- Davide Campari-Milano N.V.

- Diageo plc

- Edrington Group Limited

- Halewood Artisanal Spirits

- HiteJinro Co. Ltd.

- Kirin Holdings Company Limited

- Lucas Bols NV

- Mark Anthony Brands International

- Mast-Jägermeister SE

- Pernod Ricard SA

- Rémy Cointreau SA

- Sazerac Company Inc.

- Stock Spirits Group PLC

- Thai Beverage PLC

- Whyte and Mackay Ltd.

- William Grant & Sons Ltd.

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in Airport Duty-Free Liquor Retail

Industry leaders should prioritize the seamless integration of digital and physical touchpoints to meet traveler expectations for convenience and personalized engagement. By enhancing mobile-preorder platforms, curating virtual tastings, and instituting predictive replenishment systems, operators can minimize stockouts and elevate conversion rates. Moreover, forging strategic alliances with airlines and loyalty programs will unlock cross-channel promotional opportunities that extend beyond the terminal, reinforcing brand resonance and driving repeat purchases.

To navigate the complexities introduced by fluctuating tariff regimes, organizations must adopt agile sourcing models that diversify production footprints and localize bottling where feasible. This approach mitigates landed cost pressures and preserves margin integrity. At the same time, sustained investment in experiential retail-through pop-up bars, limited-edition product drops, and culturally attuned activations-will amplify perceived value and support sustained premiumization.

Finally, embedding ESG principles into product sourcing, packaging design, and workforce practices is essential for cultivating enduring stakeholder trust. Leveraging transparent supply chain certifications and industry partnerships focused on decarbonization will not only resonate with eco-conscious consumers but also align with regulatory trajectories worldwide.

Comprehensive Research Framework Outlining Data Collection, Analysis Techniques, and Quality Assurance Processes Underpinning This Airport Duty-Free Liquor Study

This research study employed a multi-faceted methodology to ensure the reliability and depth of its findings. Primary data were sourced through structured interviews and in-depth discussions with senior executives, category managers, and airport retail concessionaires across key global regions. Secondary research encompassed exhaustive analysis of publicly available financial reports, trade press articles, industry white papers, and regulatory filings to contextualize market developments and policy landscapes.

Quantitative insights were triangulated through cross-verification of multiple databases and travel retail intelligence platforms, while qualitative inputs were synthesized to capture evolving consumer behavior and experiential retail innovations. Statistical rigor was maintained through consistency checks, outlier assessment, and iterative validation exercises. The final deliverables underwent rigorous review by an internal quality assurance team and external industry advisors to uphold the study’s authoritativeness and applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airport Duty-free Liquor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airport Duty-free Liquor Market, by Product Type

- Airport Duty-free Liquor Market, by Price Tier

- Airport Duty-free Liquor Market, by Brand Origin

- Airport Duty-free Liquor Market, by Packaging Type

- Airport Duty-free Liquor Market, by Alcohol Content

- Airport Duty-free Liquor Market, by Flavor

- Airport Duty-free Liquor Market, by Sales Channel

- Airport Duty-free Liquor Market, by Region

- Airport Duty-free Liquor Market, by Group

- Airport Duty-free Liquor Market, by Country

- United States Airport Duty-free Liquor Market

- China Airport Duty-free Liquor Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Concluding Reflections on Critical Insights and the Future Trajectory of Airport Duty-Free Liquor Retail in a Rapidly Evolving Global Landscape

The airport duty-free liquor sector stands at a crossroads of opportunity and complexity, where the convergence of consumer expectations for exclusivity, convenience, and sustainability defines competitive advantage. As travel volumes continue to normalize, the imperative for differentiated product assortments and immersive brand activations will only intensify. Additionally, the evolving tariff environment and regional policy shifts underscore the need for resilient supply chain strategies and proactive stakeholder engagement.

Forward-looking operators and brand owners must balance premiumization with accessible entry points, leveraging digital insights to personalize experiences and optimize channel economics. In tandem, commitment to ESG principles will serve as a key differentiator, securing the trust of a new generation of discerning travelers. Ultimately, success in this space will hinge on the ability to seamlessly meld innovation with adaptability, ensuring that airport duty-free liquor remains both a strategic revenue driver and a beacon of retail excellence in a dynamic global marketplace.

Engage with Ketan Rohom Today to Secure the Definitive Market Research Report on Airport Duty-Free Liquor and Elevate Your Strategic Positioning

For tailored guidance on leveraging these insights and strengthening your competitive advantage, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise can help you navigate the complex terrain of airport duty-free liquor retail and unlock the full value of this comprehensive market research report. Engage with an industry specialist who can provide personalized consultation, facilitate access to exclusive data sets, and support your strategic planning. Whether you’re refining your brand positioning, optimizing your distribution strategies, or exploring innovative experiential concepts, Ketan Rohom can connect you with the critical information you need to make confident, data-driven decisions. Contact him today to discuss customized deployment of the report’s insights and gain a decisive edge in a rapidly evolving travel retail environment.

- How big is the Airport Duty-free Liquor Market?

- What is the Airport Duty-free Liquor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?