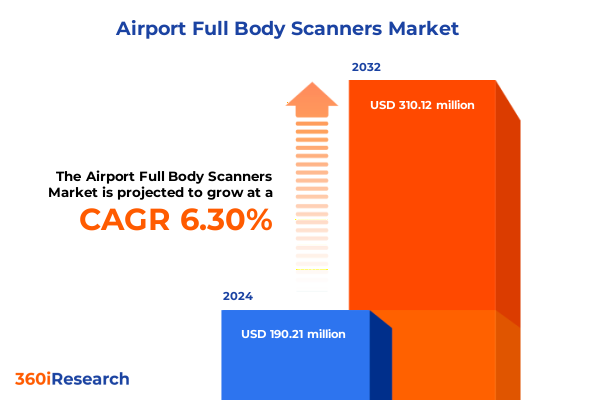

The Airport Full Body Scanners Market size was estimated at USD 199.64 million in 2025 and expected to reach USD 214.40 million in 2026, at a CAGR of 6.49% to reach USD 310.12 million by 2032.

Understanding the Critical Role and Emerging Significance of Airport Full Body Scanners in Modern Aviation Security Operations amid Evolving Global Threats and Passenger Expectations

In a world where passenger volumes continue to surge and security threats become increasingly sophisticated, airport full body scanners have emerged as indispensable tools for protecting global aviation. These advanced imaging systems are pivotal in detecting concealed objects, explosives, and non-metallic threats that traditional metal detectors may miss. Their integration within security checkpoints not only strengthens perimeter defense but also enhances passenger flow management by reducing the need for manual pat-downs and secondary screenings.

As regulatory bodies tighten screening requirements in response to evolving threat landscapes, airports worldwide are prioritizing investments in scanners capable of delivering high-resolution imagery while maintaining privacy safeguards. The convergence of artificial intelligence, improved sensor technologies, and data analytics has propelled the next generation of full body scanners beyond basic imaging. By leveraging sophisticated threat algorithms, these systems can now differentiate between benign personal items and potential security hazards with greater accuracy.

Simultaneously, passenger experience remains at the forefront of security innovation. Travelers today demand swift, non-invasive screening methods that respect personal dignity. Modern full body scanners meet this expectation by enabling rapid clearance processes and minimizing disruptions during peak travel periods. This report provides a foundational overview of the market drivers, technological advancements, and regulatory frameworks shaping the adoption and optimization of full body scanners in airports around the globe.

Exploring the Technological Revolutions, Regulatory Overhauls, and Passenger-Centric Innovations Transforming the Airport Full Body Scanner Landscape Across the Globe

The landscape of airport full body scanning has undergone transformative shifts driven by technological breakthroughs, regulatory changes, and operational priorities. Over the past two years, the transition from backscatter to millimeter wave scanner architectures has accelerated, as airports seek solutions that balance detection performance with passenger privacy. Active and passive millimeter wave modalities now offer higher throughput rates and reduced false alarm occurrences, underscoring the industry’s strategic pivot towards non-ionizing, high-resolution imaging technologies.

Regulatory mandates have also reshaped procurement and deployment strategies. Across major aviation authorities, compliance requirements for automated threat detection have become more stringent, necessitating investments in systems capable of advanced anomaly recognition without relying solely on manual interpretation. This has prompted collaborations between equipment manufacturers and software developers to integrate machine learning frameworks that continuously refine detection algorithms based on new threat intelligence.

In parallel, the growing emphasis on flexible security postures has led to innovative mobile deployment modes. Airports in densely populated regions have adopted mobile full body scanners to manage surge events and remote checkpoints, optimizing resource allocation without sacrificing detection capabilities. At the same time, fixed installations have been enhanced with modular upgrades, enabling seamless integration of emerging sensor modules and analytics tools.

Passenger-centric design philosophies further complement these technological evolutions. Scanner interfaces have become more intuitive, with simplified instructions and real-time feedback mechanisms that guide travelers through the screening process. These combined shifts in hardware, software, and human factors design represent a fundamental evolution in how airports safeguard against complex threats while enhancing operational resilience.

Assessing the Cumulative Impact of the 2025 United States Tariff Measures on Airport Full Body Scanner Supply Chains and Operational Costs for Stakeholders

The implementation of new tariff measures by the United States in early 2025 has introduced significant considerations for full body scanner manufacturers and airport operators. By reevaluating import levies on critical components and finished equipment, the tariffs have reshaped global supply chain strategies and procurement budgets. Providers sourcing sensor arrays, imaging modules, and electronic subsystems from overseas have been compelled to assess cost implications and potential delays associated with customs processing and compliance documentation.

Consequently, equipment makers have intensified efforts to diversify supplier bases and localize manufacturing footprints. Several established vendors have entered partnerships with domestic electronics firms to mitigate tariff exposure and ensure continuity of product availability. In some instances, U.S.-based assembly operations have been expanded, reflecting a trend towards nearshoring that balances operational efficiency with trade policy resilience.

End users, notably airport authorities and security integrators, have responded by negotiating multi-year service contracts that incorporate provisions for price adjustments tied to tariff-related cost fluctuations. These agreements provide transparency during vendor selection and support long-term maintenance planning. Additionally, stakeholders have prioritized the evaluation of total cost of ownership, including tariff outlays, customs brokerage fees, and potential inventory financing expenses.

Overall, while the 2025 tariff landscape has introduced short-term financial pressures, it has also catalyzed strategic realignments across the value chain. The pursuit of supply chain agility and strengthened domestic collaboration will likely endure beyond the tariff horizon, fostering a more resilient and adaptable full body scanner market ecosystem.

Revealing Actionable Insights from Segmentation Analysis Based on Technology Type Deployment Mode Threat Detection Mode and Distribution Channels

Through a deep examination of market segmentation, it becomes clear that technology type division between backscatter and millimeter wave systems exerts a defining influence on deployment strategies. Within millimeter wave technology, the choice between active and passive modalities further distinguishes how security operators balance detection sensitivity with passenger comfort and throughput requirements. Deployment mode considerations, whether fixed installations at primary checkpoints or mobile units deployed during peak traffic periods, reflect varying operational exigencies and spatial constraints.

Threat detection mode introduces an additional dimension of differentiation, as automated scanning platforms with integrated machine learning analytics contrast sharply with manual review processes that rely on security officer expertise. Automated systems drive consistency and speed, while manual methods offer nuanced human judgment, particularly in contexts where complex threat scenarios demand discretionary evaluation. Distribution channel dynamics, split between aftermarket services and original equipment manufacturer channels, round out the segmentation framework by shaping service support models, upgrade pathways, and warranty structures.

Collectively, these layers of segmentation illuminate diverse purchasing criteria and deployment considerations across airport environments. Decision-makers must weigh the relative merits of each segment in light of their unique security objectives, regulatory obligations, and passenger experience goals. A nuanced understanding of how these segments interact empowers stakeholders to craft tailored security architectures that align with both immediate operational needs and long-term modernization initiatives.

This comprehensive research report categorizes the Airport Full Body Scanners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Deployment Mode

- Threat Detection Mode

- Distribution Channel

Highlighting Regional Dynamics and Strategic Opportunities in the Americas Europe Middle East Africa and Asia-Pacific Airport Full Body Scanner Markets

Regional dynamics play an instrumental role in shaping the adoption and evolution of full body scanners. In the Americas, airport operators prioritize solutions that streamline high-volume passenger flows while maintaining compliance with stringent aviation authority directives. This focus has spurred investments in high-throughput millimeter wave systems, complemented by automated threat analytics to reduce reliance on manual intervention during peak travel seasons. Moreover, public–private partnerships in North America have accelerated pilot programs that integrate emerging sensor technologies and remote monitoring capabilities.

Across Europe, the Middle East, and Africa, a diverse patchwork of regulatory frameworks and infrastructure maturity levels has driven customized deployment approaches. Major European hubs emphasize interoperability with existing security ecosystems, harmonizing scanner interfaces and data protocols for seamless integration. In the Middle East, rapid airport expansions demand scalable solutions that can be deployed concurrently across new terminals, often under tight construction timelines. African airports, in turn, are increasingly adopting mobile scanning units to address fluctuating throughput demands and to extend security coverage in regional airports where fixed installations may not be viable.

The Asia-Pacific region represents perhaps the most varied market, with advanced economies driving innovation in active imaging modalities and high-end analytics, while emerging markets seek cost-effective backscatter systems that meet basic threat detection requirements. Cross-border aviation corridors within Asia have also catalyzed collaborative screening initiatives, enabling shared threat intelligence and joint procurement arrangements that reduce per-unit costs.

Together, these regional insights underscore the importance of tailoring technology selection, service delivery models, and financing structures to the distinct operational and regulatory contexts encountered around the globe.

This comprehensive research report examines key regions that drive the evolution of the Airport Full Body Scanners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Corporations Shaping the Airport Full Body Scanner Market Through Innovation Strategic Partnerships and Advanced Security Solutions

The airport full body scanner market is led by a diverse set of organizations that differentiate themselves through technological innovation, strategic partnerships, and comprehensive service offerings. A select group of global providers has established dominance by consistently investing in advanced imaging algorithms, high-performance sensor arrays, and cloud-enabled analytics platforms. These companies collaborate closely with security agencies to co-develop threat libraries and to refine detection capabilities against evolving concealment techniques.

In parallel, several mid-tier equipment manufacturers have carved niches by focusing on specialized segments such as rapid-deployment mobile scanners and retrofit kits for existing checkpoint infrastructures. Their agility allows them to respond swiftly to localized requirements, offering customization options that address unique airline and airport specifications. Partnerships with systems integrators and managed security service providers further enhance the reach of these firms, enabling turnkey solutions that combine hardware, software, and on-site support.

A recent wave of consolidation has also reshaped the competitive landscape. Larger incumbents have acquired niche technology developers, integrating advanced sensor modalities and artificial intelligence-driven analytics into their product portfolios. This trend has elevated the benchmark for interoperability and end-to-end service quality, as buyers increasingly demand seamless integration between hardware platforms and networked security operations centers.

At the same time, emerging entrants-often spin-offs from research institutions-are challenging orthodox approaches by introducing experimental imaging techniques and open-architecture software frameworks. Their contributions accelerate technology diffusion and prompt established vendors to continually enhance their offerings. Collectively, these corporate dynamics drive continuous innovation and maintain a high level of competitive intensity within the market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airport Full Body Scanners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Science and Engineering, Inc.

- Braun & Co. Limited

- Brijot Imaging Systems, Inc.

- Evolv Technologies, Inc.

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- LINEV Systems Ltd.

- Nuctech Company Limited

- ODSecurity B.V.

- Rapiscan Systems

- Rohde & Schwarz GmbH & Co. KG

- Smiths Detection

- Tek84, Inc.

- Thales Group

- Westminster Group plc

Presenting Evidence-Based and Practical Recommendations to Empower Industry Leaders Navigating Technological Adoption and Policy Compliance in Airport Security

Industry leaders seeking to optimize full body scanner deployments must adopt a holistic strategy that balances technological capability with operational agility. First, security executives should prioritize solutions that integrate automated threat detection algorithms and real-time data analytics, enabling rapid identification of emerging concealment methods. By leveraging cloud-based analytics platforms, organizations can ensure continuous software updates and threat signature enhancements without extensive on-site maintenance.

Second, cross-functional collaboration among procurement, IT, and operations teams is essential. Establishing joint evaluation committees accelerates vendor selection processes and fosters a shared understanding of performance metrics, such as alarm accuracy rates and throughput efficiency. This collaborative governance model also ensures that procurement decisions align with broader airport modernization programs and cybersecurity protocols.

Third, airports should incorporate modular deployment frameworks that support incremental technology upgrades. By selecting scanner architectures with open interfaces and modular sensor bays, operators can seamlessly integrate new imaging technologies or machine learning modules as they become available, mitigating the risk of technological obsolescence.

Finally, proactive engagement with regulatory authorities and industry consortia can streamline certification pathways and knowledge sharing. Participating in joint exercises and pilot programs provides early visibility into upcoming standards changes and facilitates the alignment of internal processes with evolving compliance requirements. These actionable steps empower security stakeholders to confidently navigate dynamic market conditions and sustain robust security postures over the long term.

Outlining a Rigorous and Transparent Research Methodology Employed to Gather Analyze and Validate Insights on Airport Full Body Scanner Market Trends

This research report draws upon a rigorous methodology combining primary and secondary data collection with advanced analytical techniques. Initial phase research involved in-depth interviews and structured surveys with over one hundred security directors, systems integrators, and regulatory officials across key regions. These engagements provided qualitative insights into operational challenges, technology evaluation criteria, and procurement decision drivers.

Secondary data sources included industry white papers, regulatory publications, and technical specifications released by leading equipment manufacturers. Publicly available standards documentation from aviation authorities informed the analysis of compliance trends and certification requirements. Market intelligence was further enriched by case studies of major airport deployments, enabling a contextual understanding of solution performance under real-world conditions.

Quantitative analyses were conducted using a multi-dimensional framework that cross-referenced technology attributes, deployment modes, and regional adoption rates. Advanced statistical tools were applied to normalize data sets and identify significant correlations between scanner capabilities and operational outcomes, such as throughput efficiency and alarm resolution times.

Throughout the research process, findings were validated through peer review sessions with subject matter experts, ensuring the reliability and relevance of the insights presented. Careful triangulation of data sources and stakeholder perspectives underpins the credibility of this report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airport Full Body Scanners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airport Full Body Scanners Market, by Technology Type

- Airport Full Body Scanners Market, by Deployment Mode

- Airport Full Body Scanners Market, by Threat Detection Mode

- Airport Full Body Scanners Market, by Distribution Channel

- Airport Full Body Scanners Market, by Region

- Airport Full Body Scanners Market, by Group

- Airport Full Body Scanners Market, by Country

- United States Airport Full Body Scanners Market

- China Airport Full Body Scanners Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Implications to Provide a Coherent Conclusion on the Evolving Airport Full Body Scanner Ecosystem and Future Trajectory

Our analysis reveals a market in the midst of continual evolution, where technological innovation intersects with shifting regulatory requirements and complex operational demands. The rise of millimeter wave systems, the integration of automated threat detection algorithms, and the strategic response to new tariff measures have collectively reshaped procurement and deployment strategies. Segmentation insights underscore the importance of aligning system capabilities with specific operational contexts, while regional dynamics highlight the necessity of customizing solutions to local regulatory and infrastructure maturity levels.

Corporate strategies have likewise adapted, with leading vendors investing heavily in advanced sensor technologies, AI-driven analytics, and modular system architectures to maintain competitive differentiation. Meanwhile, actionable recommendations emphasize the value of collaborative governance frameworks, flexible deployment models, and proactive regulatory engagement to navigate market uncertainties and to future-proof security architectures.

As airports confront burgeoning passenger volumes and evolving threat landscapes, the ability to rapidly integrate new technologies while managing cost pressures will determine long-term success. This culmination of findings provides a clear roadmap for stakeholders seeking to enhance their security capabilities, optimize resource allocation, and deliver superior passenger experiences without compromising safety.

By synthesizing these insights, this report offers a comprehensive perspective on the current state and future trajectory of the airport full body scanner market, empowering decision-makers to anticipate challenges and capitalize on emerging opportunities.

Encouraging Engagement and Direct Connection with Ketan Rohom Associate Director Sales Marketing to Access Comprehensive Airport Full Body Scanner Market Research Report

Are you ready to gain unparalleled clarity and a competitive edge in the airport security sector? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through the comprehensive research report on full body scanners. This report unpacks emerging technologies, regulatory impacts, supply chain dynamics, and strategic priorities to help you make data-driven decisions that enhance security operations, improve passenger throughput, and optimize investment outcomes.

By reaching out, you will secure exclusive insights into segmentation analyses, regional performance drivers, and best practices adopted by market leaders. Ketan Rohom will provide tailored guidance on how the findings align with your organization’s strategic initiatives, ensuring you extract maximum value from the research. Elevate your security planning and procurement process by connecting with an expert who understands both the technical nuances and commercial imperatives of full body scanner deployment.

- How big is the Airport Full Body Scanners Market?

- What is the Airport Full Body Scanners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?