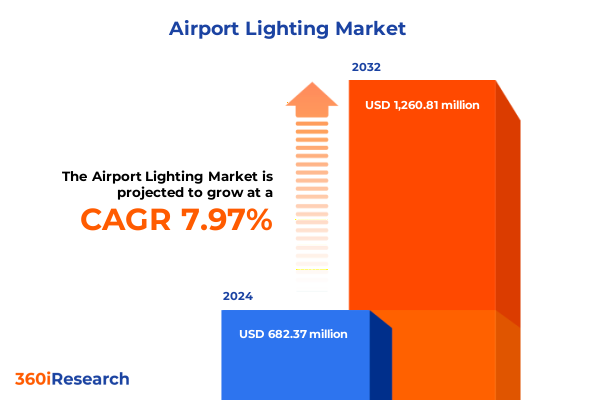

The Airport Lighting Market size was estimated at USD 734.04 million in 2025 and expected to reach USD 789.64 million in 2026, at a CAGR of 8.03% to reach USD 1,260.81 million by 2032.

Unveiling the Critical Role of Innovative Airport Lighting Solutions in Enhancing Operational Safety and Efficiency Across Global Aviation Hubs

The modernization of airport lighting infrastructure has emerged as a pivotal factor in enhancing airfield safety operational efficiency and environmental sustainability. Over the past decade, innovations in light-emitting diode (LED) technology have fundamentally reshaped the design and deployment of runway taxiway and apron illumination systems. This evolution has enabled airports to reduce energy consumption, minimize maintenance cycles, and deliver more precise visual guidance for pilots under varying meteorological conditions. Simultaneously, tightening regulatory requirements and a global emphasis on reducing carbon footprints have driven operators to prioritize lighting solutions that offer both compliance and economic performance.

Against this backdrop, a comprehensive understanding of the technological drivers market segmentation and competitive landscape is essential for stakeholders seeking to align capital investments with strategic objectives. By examining the latest product architectures, control methodologies, and distribution paradigms, decision-makers can anticipate emerging challenges and capitalize on new growth opportunities. In particular, a nuanced appreciation of segment-specific dynamics-from control systems and guidance signage to floodlights and mast lights-will inform procurement strategies and lifecycle management approaches. Moreover, an assessment of regional variances and regulatory developments will further elucidate pathways to sustainable modernization across civil military and private aviation facilities.

Examining the Evolutionary Shifts in Airport Lighting Technology and Infrastructure that are Rewriting Standards for Sustainability and Performance

The airport lighting sector is experiencing a transformative shift driven by the convergence of digital technologies and sustainability imperatives. Traditional incandescent and halogen fixtures are rapidly being supplanted by LED luminaires integrated with advanced control systems that leverage programmable logic controllers and wireless networks. This digital transition not only extends fixture lifespans but also enables dynamic intensity adjustment and real-time monitoring of operational parameters. Consequently, airports can implement adaptive lighting protocols that respond to runway occupancy and visibility metrics, thereby optimizing energy usage and reducing carbon emissions.

Furthermore, the integration of predictive analytics and Internet of Things (IoT) architectures is redefining maintenance paradigms. By equipping lighting assets with sensor arrays that transmit performance data to centralized platforms, facility managers can anticipate component failures and schedule proactive interventions. This shift from time-based to condition-based maintenance models yields significant cost savings, minimizes unscheduled downtime, and enhances system reliability. Additionally, growing alignment with broader airport digitalization initiatives and green certification frameworks has spurred collaboration between lighting manufacturers and aviation authorities to establish new performance benchmarks. As a result, operators are positioned to unlock both operational and environmental benefits while meeting evolving stakeholder expectations.

Analyzing the Far-Reaching Consequences of the 2025 United States Tariff Regime on Component Costs Supply Chains and Competitive Dynamics

The imposition of expanded tariff measures by the United States in 2025 has introduced a complex layer of cost pressures and supply chain recalibrations for airport lighting suppliers. While steel and aluminum levies have long influenced fixture housing expenditures, recent tariff escalations on imported electronic components have further elevated manufacturing outlays, particularly for LED drivers and wireless control modules. As a consequence, many vendors have revisited their sourcing strategies, seeking low-tariff jurisdictions and engaging in direct negotiations with raw material suppliers to mitigate inflated input costs.

Moreover, these trade barriers have indirectly accelerated the push for domestic production capabilities and diversified assembly footprints. By repatriating component fabrication or partnering with regional microfactories, manufacturers aim to circumvent tariff liabilities while bolstering supply chain resilience against future policy shifts. However, these adjustments require significant capital investment and carry integration risks. Therefore, stakeholders must weigh near-term cost implications against long-term benefits related to inventory agility and geopolitical stability. In the interim, collaborative discussions between industry associations, regulatory bodies and government agencies are critical to navigating the tariff landscape and advocating for exemptions or phased implementations that support essential aviation infrastructure upgrades.

Unlocking Critical Segmentation Insights to Illuminate Product Installation End User and Channel Drivers Shaping the Airport Lighting Market Landscape

Segmenting the airport lighting market by product type installation type end user and distribution channel reveals intricate demand drivers and strategic imperatives. Within the product type category, apron lighting encompasses floodlights and mast lights that deliver uniform illumination across airfield work zones while control systems include programmable logic controllers relay controllers and wireless control systems that coordinate fixture performance and diagnostics. Additionally, guidance signs provide critical pilot orientation through directional informational location and mandatory signage, and runway and taxiway lighting systems ensure safe aircraft movement along airside pavements. Transitioning to installation type, new installation projects often focus on deploying cutting-edge LED arrays and integrated management platforms as part of terminal expansions, whereas retrofit initiatives concentrate on upgrading legacy fixtures to improve energy efficiency and reduce lifecycle costs.

Considering end users, civil airports prioritize compliance with stringent FAA and international standards alongside passenger throughput demands, military airports underscore robustness and redundancy for mission-critical operations, and private aviation facilities seek turnkey lighting packages tailored to bespoke runway configurations. Finally, distribution channels encompass aftermarket services that support maintenance contracts and spare part provisioning, and OEM partnerships that supply fixture hardware and control software directly to ground handling integrators. Understanding how these segmentation axes intersect allows market entrants and incumbents alike to customize product offerings, refine go-to-market strategies, and allocate R&D resources to segments with the greatest opportunity potential.

This comprehensive research report categorizes the Airport Lighting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Installation Type

- End User

- Distribution Channel

Revealing Regional Variations and Growth Opportunities Across the Americas Europe Middle East Africa and Asia Pacific in the Airport Lighting Sector

Regional dynamics in the airport lighting market underscore the importance of localized regulatory frameworks infrastructure investment cycles and sustainability objectives. In the Americas, North American airports are undergoing extensive modernization under NextGen air traffic control initiatives, resulting in steady demand for LED replacements and advanced control systems. Latin American hubs, meanwhile, are focusing on capacity expansion projects that include apron and taxiway illumination to accommodate rising passenger volumes and cargo throughput. Throughout both regions, government funding programs and public–private partnerships are key enablers for largescale lighting upgrades.

In Europe, Middle East and Africa, European airports emphasize adherence to stringent European Union environmental directives, driving a shift toward low-carbon lighting technologies and integrated energy management systems. At the same time, Middle Eastern nations are investing in landmark airport megaprojects that leverage state-of-the-art illumination to reinforce their position as global transit hubs. African markets are characterized by a dual emphasis on upgrading legacy facilities and establishing new greenfield airports, creating incremental opportunities for both retrofit and greenfield installations. Transitioning to the Asia Pacific arena, rapid air traffic growth in China India and Southeast Asia has intensified the need for scalable and reliable lighting solutions. Governments across the region are also embracing environmental certifications, which further propels the adoption of energy-efficient fixtures and sophisticated control architectures.

This comprehensive research report examines key regions that drive the evolution of the Airport Lighting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players and Their Strategic Innovations Partnerships and Competitive Strategies Driving the Evolution of Airport Lighting Solutions

Key players within the airport lighting landscape are executing diverse strategies to capture emerging opportunities and fortify competitive positioning. Several leading manufacturers have accelerated their LED innovation pipelines, introducing high-lumen fixtures with optimized thermal management to extend service lifetimes and minimize energy consumption. Concurrently, companies specializing in control systems are forging partnerships with IoT platform providers and air traffic management firms to integrate lighting assets into broader airport operation command centers. These collaborations ensure seamless data exchange and remote management capabilities, thereby elevating overall airside operational visibility.

Additionally, a wave of mergers and acquisitions is reshaping the industry’s competitive structure, as established OEMs acquire specialized niche providers to enhance their product portfolios in guidance signage and wireless control modules. Strategic alliances are also prevalent, with certain firms co-developing modular retrofit kits that simplify on-site installation and reduce downtime. Meanwhile, service-oriented competitors are expanding aftermarket offerings by bundling predictive maintenance analytics, spare parts logistics and technical training. This shift from transactional sales toward lifecycle service models underscores the need for a holistic approach that spans fixture design supply chain orchestration and end-to-end asset management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airport Lighting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- ADB SAFEGATE

- Astronics Corporation

- atg airports limited

- Avlite Systems

- Carmanah Technologies Corporation

- Eaton Corporation

- Hella KGaA Hueck & Co.

- Honeywell International Inc.

- OCEM Airfield Technology S.p.A.

- S4GA Sp. z o.o.

- Signify N.V.

- TKH Airport Solutions B.V.

- Vosla GmbH

- Youyang Airport Lighting Equipment Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends Technologies and Regulatory Changes in Airport Lighting

Industry leaders should prioritize a suite of actionable strategies to strengthen market presence and capitalize on emerging trends. First, accelerating the deployment of IoT-enabled control platforms will unlock significant operational efficiencies and offer differentiated value propositions to airport operators. By harnessing real-time data streams, suppliers can offer performance-based service agreements that align incentives across the value chain. Furthermore, expanding retrofit solution portfolios to include turnkey installation services will address the growing demand for energy-efficient upgrades without disrupting airport operations.

Additionally, diversifying production footprints by establishing regional assembly hubs can mitigate tariff exposure and expedite order fulfillment in key markets. Collaborations with local manufacturers and logistics providers can streamline supply chains and reduce lead times. From a product development standpoint, embedding sustainability credentials-such as carbon footprint labeling and end-of-life recyclability-into fixture design will resonate with airport authorities seeking to meet net-zero targets. Lastly, companies must proactively engage with regulatory stakeholders to influence future standards, ensuring that technology roadmaps remain aligned with evolving safety and environmental requirements.

Outlining Rigorous Research Methodology Framework and Data Sources Utilized to Ensure Comprehensive Reliable and Actionable Airport Lighting Market Intelligence

The research methodology underpinning this analysis combines qualitative and quantitative approaches to ensure comprehensive and reliable insights. Primary data collection involved structured interviews with airport facility managers regulatory experts lighting engineers and procurement officers, yielding firsthand perspectives on installation challenges and future investment priorities. These dialogues were complemented by expert workshops convening industry thought leaders to validate emerging technology roadmaps and corroborate thematic trends.

Secondary research encompassed an extensive review of regulatory publications from aviation authorities, technical white papers, trade association reports and patent filings to map out innovation trajectories and compliance requirements. Financial disclosures and annual reports from publicly listed manufacturers were analyzed to assess strategic investments and revenue diversification. Data triangulation was employed to reconcile divergent information sources, while a rigorous validation framework was applied to ensure the accuracy and consistency of segmented market insights. This multifaceted methodology establishes a robust foundation for actionable intelligence and strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airport Lighting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airport Lighting Market, by Product Type

- Airport Lighting Market, by Installation Type

- Airport Lighting Market, by End User

- Airport Lighting Market, by Distribution Channel

- Airport Lighting Market, by Region

- Airport Lighting Market, by Group

- Airport Lighting Market, by Country

- United States Airport Lighting Market

- China Airport Lighting Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Conclude an Insightful and Forward Looking Synopsis of the Airport Lighting Market Journey

This executive summary has synthesized the dynamic intersection of technological innovation regulatory influence segmentation complexity and regional diversity that defines today’s airport lighting ecosystem. Cutting-edge LED and control system advances are propelling both operational efficiency and environmental stewardship, while tariff developments have introduced new cost and supply chain considerations. Detailed segmentation analysis has illuminated how product types installation modalities end user requirements and distribution channel structures shape market demand.

Regional explorations further revealed distinctive growth trajectories across the Americas Europe Middle East Africa and Asia Pacific, each driven by local infrastructure investments and sustainability mandates. Competitive profiling highlighted an industry in flux, marked by strategic alliances, M&A activity, and a pivot toward service-centric offerings. Taken together, these insights underscore the importance of proactive strategy formulation, tailored to evolving customer needs technological capabilities and regulatory landscapes. As stakeholders navigate this complex environment, informed decision-making supported by rigorous data and expert guidance will be essential to capturing the next wave of opportunity in airport lighting.

Take Decisive Next Steps with Ketan Rohom to Acquire In Depth Airport Lighting Market Intelligence and Drive Your Competitive Advantage

Unlock unparalleled insights by partnering with Ketan Rohom to secure a comprehensive airport lighting market research report that will inform strategic decisions and fuel growth. By reaching out to an experienced industry professional, stakeholders can gain clarity on the latest technological innovations regulatory shifts and segmentation dynamics shaping the airport lighting landscape. Engaging directly with an associate director specializing in sales and marketing ensures personalized guidance tailored to unique business objectives and timely access to critical market intelligence. This interaction paves the way for deeper consultations bespoke data services and ongoing support to navigate complex procurement processes and accelerate return on investment. Take action now to obtain the definitive source of competitive intelligence and drive transformative outcomes for your organization with expert assistance.

- How big is the Airport Lighting Market?

- What is the Airport Lighting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?