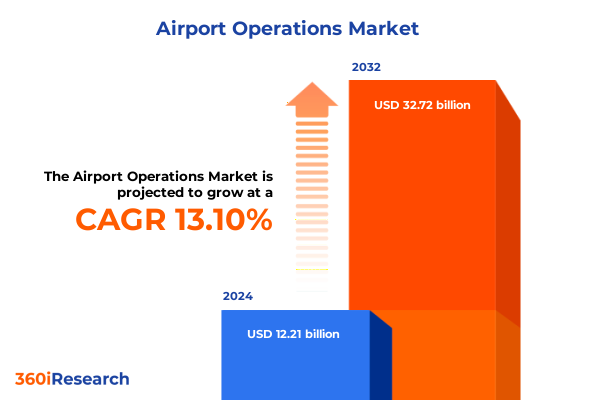

The Airport Operations Market size was estimated at USD 13.83 billion in 2025 and expected to reach USD 15.67 billion in 2026, at a CAGR of 13.56% to reach USD 33.72 billion by 2032.

Setting the Stage for Airport Operations Excellence in a Post-Pandemic Era Defined by Innovation, Resilience, and Evolving Passenger Expectations

The airport operations landscape has entered a new era in which evolving passenger expectations, post-pandemic recovery imperatives, and rapid technological advancement are converging to reshape how airports plan and execute their services. Over the past two years, digital travelers have become the dominant demographic, with a majority demanding seamless, mobile-enabled experiences at every touchpoint of their journey. In response, airport executives and technology providers have prioritized upgrades in self-service check-in, biometric screening and real-time baggage tracking to enhance throughput and reduce dwell times at critical nodes. Meanwhile, the resurgence of air travel volumes has placed renewed focus on operational resilience and agility, prompting bipartisan legislative support in the U.S. to invest hundreds of millions in advanced screening systems and checkpoint modernization to alleviate security bottlenecks.

At the same time, industry stakeholders are embracing sustainability goals as a core facet of operations management, integrating energy-efficient facility designs and waste-reduction protocols into renovation and expansion projects. Airports are increasingly leveraging big data analytics and AI-driven tools to forecast passenger flows, optimize resource allocation and ensure service continuity under volatile conditions. Through a holistic view of digital, environmental and security objectives, this introduction outlines the foundational themes that underpin the strategic narrative for airport operations excellence in 2025.

How Digital Transformation, Sustainability Imperatives and Emerging Technologies Are Redefining Airport Operations with Unprecedented Speed and Scale

The pace of change in airport operations over the past few years has been nothing short of transformative, driven by a synergy of digitalization, advanced analytics and environmental imperatives. Airports and airlines have doubled down on cybersecurity investments and cloud migration efforts to safeguard critical systems and passenger data, with nearly three-quarters of airport leaders citing cybersecurity as a top strategic priority in 2024. Concurrently, the rise of biometrics and AI-powered passenger processing solutions is reimagining checkpoints, baggage handling and boarding gates, enabling airports to achieve throughput gains of 20–30 percent while streamlining labor requirements.

Sustainability has also emerged as a driving force, with airports setting ambitious targets for carbon neutrality and renewable energy adoption. From electrification of ground support fleets to integration of solar and wind power in terminal infrastructures, environmental considerations are now embedded in long-term master plans. As the industry navigates labor constraints and supply chain complexities, predictive maintenance systems and digital twinning technologies are gaining traction, offering real-time diagnostics and scenario planning capabilities. Together, these transformative shifts are redefining the architecture of airport operations, creating a more agile, resilient and passenger-centric ecosystem that can adapt to evolving global demands.

Unpacking the Strategic Implications of 2025 United States Steel and Aluminum Tariffs on Airport Equipment Supply Chains and Operational Expenditures

In March 2025, the U.S. government reinstated across-the-board Section 232 tariffs, imposing a 25 percent duty on all steel and aluminum imports effective March 12, 2025, and eliminating previous exemptions to foster domestic production. By June 4, 2025, these tariffs were further elevated to 50 percent for steel and aluminum imports from most countries, excluding a reduced rate for select partners under evolving trade agreements. This escalation has significantly increased costs for procurement of critical infrastructure components such as baggage handling conveyors, screening equipment and terminal structural materials.

The immediate impact on airport operators has been twofold: first, capital expenditure budgets for modernization and expansion projects have been stretched by higher input costs, leading many airports to reassess project scopes or phase implementation timelines. Second, original equipment manufacturers and technology suppliers have faced margin pressures, passing through incremental cost burdens or negotiating alternative sourcing strategies to mitigate tariff exposure. Companies like RTX have already flagged a substantial profit impact-an expected $500 million hit in 2025-primarily attributed to doubling of steel and aluminum duties. As a result, airport planners and procurement teams are now prioritizing material substitution, regional vendor partnerships and advanced forecasting models to navigate the new tariff landscape.

Illuminating the Multifaceted Segmentation Landscape of Airport Operations to Uncover Critical Insights Across Diverse Service Domains and Touchpoints

The airport operations market can be understood through a multifaceted segmentation framework that spans the full spectrum of passenger services from baggage handling systems-which encompass carousels, screening technologies and real-time tracking solutions-to boarding modalities such as airbridge and remote bus boarding. Check-in services now prioritize mobile and kiosk-based interactions, complemented by traditional counters for high-touch scenarios, while immigration and customs processing increasingly relies on a hybrid of e-gate automation and manual controls to balance throughput and security. Security screening has progressed toward full-body tomographic scanners and advanced X-ray capabilities alongside manual pat-down protocols for anomaly resolution.

Retail and concessions remain a vital non-aviation revenue stream, integrating dynamic digital advertising platforms alongside static displays, while food and beverage outlets now range from quick-service formats to premium dining experiences. Specialty retail has diversified into electronics, luxury accessories and souvenir offerings tailored to traveler demographics. Ground handling services-including refueling, pushback and ramp operations-are evolving through automation of wheelchair lifts and ground power units, with ground transportation solutions spanning shuttle buses, trolley networks and VIP transfer fleets. Cargo services have responded to growth in e-commerce demand by expanding temperature-controlled logistics for perishables and pharmaceuticals, while maintenance, repair and overhaul activities ensure aircraft airworthiness through base maintenance and engine overhaul facilities. IT and communication services underpin operations via advanced airport management platforms, passenger Wi-Fi and integrated security systems, whereas parking, landside transport and facility management functions handle car parking, shuttle loops, energy management and waste reduction. Finally, security services deliver layered perimeter control, biometric access management and 24/7 surveillance to safeguard airport assets and personnel.

By weaving these service domains into a cohesive operational strategy, airport leaders can identify synergies, prioritize investments and align stakeholder responsibilities across every touchpoint of the passenger and cargo journey.

This comprehensive research report categorizes the Airport Operations market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Passenger Services

- Retail And Concessions

- Ground Handling

- Cargo Services

- Maintenance Repair And Overhaul

- IT And Communication Services

- Parking And Landside Services

- Facility Management

- Security Services

Exploring the Distinct Regional Dynamics Shaping Airport Operations Across the Americas, Europe Middle East and Africa, and Asia Pacific Markets

Regional dynamics in airport operations reflect both the maturity of existing infrastructure and the growth trajectories of air travel markets. In the Americas, airport authorities and government agencies are focused on modernizing aging terminals with digital technologies, often leveraging public-private partnerships to fund upgrades in self-service kiosks, biometric boarding and advanced baggage tracking. The region also faces capacity constraints in legacy hubs, driving investment toward satellite gates and automated people movers.

Europe, the Middle East and Africa present a dual narrative of regulatory harmonization and ambitious sustainability targets. European airports are aligning with EU mandates for carbon reduction and noise abatement while deploying digital platforms to integrate airside and landside operations. In the Middle East, greenfield megaprojects emphasize mass transit connectivity, automated people-flow analytics and elite passenger experiences, whereas Africa’s emerging airports prioritize scalable modular solutions and affordable security screening to accommodate rising domestic and regional travel.

Asia-Pacific continues to lead global passenger growth, prompting massive expansions and new airport developments. Capacity-strained gateways in China and India are investing heavily in smart airport frameworks, including integrated airport operation control centers and digital twin environments for real-time decision support. Southeast Asian hubs balance growth with environmental stewardship, integrating renewable energy and community engagement programs. Across all regions, the pursuit of seamless interoperability and cross-border data exchange underpins collaborative efforts to deliver consistent, secure and efficient traveler journeys worldwide.

This comprehensive research report examines key regions that drive the evolution of the Airport Operations market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Industry Players Driving Innovation and Shaping the Future of Airport Operations with Cutting-Edge Technologies and Strategic Alliances

Leading technology and service providers are at the forefront of advancing airport operations through strategic innovation and collaborative partnerships. SITA’s 2025 digital passenger report underscores how a majority of travelers expect end-to-end mobile engagement, prompting airport IT teams to adopt unified identity management and real-time baggage notification platforms to meet these demands. Complementing this trend, SITA’s cybersecurity focus-highlighted by 73 percent of airports prioritizing data protection in 2024-demonstrates the critical role of secure cloud architectures and AI-driven threat detection in sustaining uninterrupted operations.

In the baggage handling domain, Vanderlande’s Baggage 4.0 vision showcases robotic bag-loading solutions and autonomous transport modules, which have undergone live trials at Oslo Airport to validate performance gains in last-mile automation and cost efficiency. Thales is strengthening air traffic control and passenger experience through its Smart Digital Platform, which integrates radar modernization projects in Brazil and biometric screening innovations that enable passengers to maintain liquids and electronics in carry-on luggage, thus streamlining checkpoint flows. Meanwhile, original equipment manufacturers such as Honeywell and Amadeus continue to deploy integrated tower management systems and global distribution systems, respectively, creating a cohesive ecosystem of solutions tailored to future-ready airports.

These strategic players, alongside defense and aerospace leaders like RTX, are navigating tariff-driven cost pressures and supply chain complexity by forging regional manufacturing partnerships, investing in material alternatives, and co-developing modular solutions. Their combined efforts are reshaping airport operations through agile innovation and targeted ecosystem engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airport Operations market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADB SAFEGATE Group

- Aena S.M.E., S.A.

- Airports of Thailand Public Company Limited

- Amadeus IT Group, S.A.

- Collins Aerospace Inc.

- Dubai Airports Corporation

- Groupe ADP

- Honeywell International Inc.

- IBM Corporation

- Indra Sistemas, S.A.

- NEC Corporation

- Siemens AG

- Société Internationale de Télécommunications Aéronautiques (SITA)

- Thales S.A.

- VINCI Airports SAS

Charting Actionable Pathways for Industry Leaders to Enhance Operational Resilience, Drive Innovation and Secure Competitive Advantage in Airport Management

To thrive in the rapidly evolving airport operations landscape, industry leaders must take decisive action across several fronts. First, it is imperative to accelerate digital transformation initiatives by deploying digital twin environments and AI-driven decision support tools that enable predictive maintenance, dynamic resource allocation and rapid incident response. Investing in scalable cloud platforms with robust cybersecurity controls will protect mission-critical systems while ensuring operational continuity under cyber threat scenarios.

Second, airport operators and suppliers should establish diversified procurement strategies to mitigate the impact of tariffs and material shortages. By cultivating regional vendor partnerships and exploring alternative materials such as composite alloys and high-strength polymers, stakeholders can reduce cost volatility and maintain capital project momentum. Collaboration agreements and supply chain risk assessments will further enhance resilience against future trade policy shifts.

Third, fostering interoperability through open API frameworks and standardized data protocols will streamline passenger and baggage journeys across multiple service providers. Industry consortia and regulatory bodies should prioritize harmonized standards for biometric identity management, cargo tracking and landside mobility to unlock seamless integration.

Finally, embedding sustainability priorities into operational and infrastructure planning-through renewable energy projects, zero-waste initiatives and green building certifications-will not only reduce environmental impact but also enhance stakeholder value and community relations. Concurrently, upskilling the workforce in digital competencies, cybersecurity practices and sustainability management will empower employees to drive continuous improvement and foster a culture of innovation.

Detailing a Rigorous Multi-Stage Research Framework Integrating Primary Expert Interviews and Comprehensive Secondary Data Analysis to Inform Strategic Decisions

This research employs a structured, multi-stage methodology designed to deliver rigorous and actionable insights. The process began with an extensive secondary research phase, encompassing analysis of government proclamations, regulatory filings and industry reports from reputable public sources. Tertiary literature reviews provided contextual understanding of macroeconomic and trade policy influences affecting airport equipment supply chains.

Following the secondary research, a series of in-depth interviews were conducted with senior executives from airlines, airport authorities, technology vendors and logistics providers. These conversations yielded firsthand perspectives on operational challenges, emerging technology roadmaps and strategies for tariff mitigation. Interview subjects were selected to ensure representation across major global regions and market segments, spanning passenger services, ground handling and cargo operations.

Data triangulation was achieved by cross-referencing interview insights with quantitative data sets from open-source trade databases and certification registries, ensuring the validity of cost impact assessments and technology adoption rates. An expert panel review was convened to validate key findings and refine strategic recommendations. The resulting framework integrates qualitative and quantitative evidence, offering stakeholders both high-level strategic guidance and granular operational roadmaps.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airport Operations market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airport Operations Market, by Passenger Services

- Airport Operations Market, by Retail And Concessions

- Airport Operations Market, by Ground Handling

- Airport Operations Market, by Cargo Services

- Airport Operations Market, by Maintenance Repair And Overhaul

- Airport Operations Market, by IT And Communication Services

- Airport Operations Market, by Parking And Landside Services

- Airport Operations Market, by Facility Management

- Airport Operations Market, by Security Services

- Airport Operations Market, by Region

- Airport Operations Market, by Group

- Airport Operations Market, by Country

- United States Airport Operations Market

- China Airport Operations Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3339 ]

Drawing Together Key Learnings From Market Trends, Tariff Impacts and Technological Evolution to Define the Path Forward for Airport Operators Worldwide

In summary, the airport operations landscape in 2025 is characterized by converging drivers of digitalization, sustainability and supply chain realignment. Technology adoption in areas such as biometric processing, AI-driven analytics and digital twin modeling is rapidly advancing, reshaping traditional service flows and enabling greater operational agility. Section 232 tariffs on steel and aluminum have introduced new cost challenges, compelling stakeholders to pursue diversified sourcing, material innovation and strategic procurement partnerships.

Segmentation analysis reveals that every service domain-from baggage handling to facility management-faces unique drivers and adoption patterns, necessitating tailored strategies that align with broader organizational objectives. Regional dynamics further underscore the importance of customizing operational frameworks to reflect local regulatory environments, infrastructure maturity and passenger expectations across the Americas, EMEA and Asia-Pacific.

Leading companies are demonstrating how collaborative innovation and strategic alliances can overcome cost pressures and accelerate modernization. By embracing interoperability standards, investing in cybersecurity and embedding sustainability imperatives into operational planning, airport operators can chart a path toward resilient, future-ready aviation hubs that deliver exceptional passenger and cargo experiences.

Engaging Industry Stakeholders With a Direct Invitation to Collaborate With Associate Director Ketan Rohom and Secure Essential Airport Operations Intelligence

For further detailed insights and comprehensive data on evolving airport operations trends, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in airport industry analysis and can guide you through the findings, tailor additional custom research, and address any specific inquiries you may have regarding the full report. Connect with Ketan to secure your copy of the detailed airport operations market research report and equip your organization with the strategic intelligence necessary to navigate the complex landscape of 2025 and beyond

- How big is the Airport Operations Market?

- What is the Airport Operations Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?