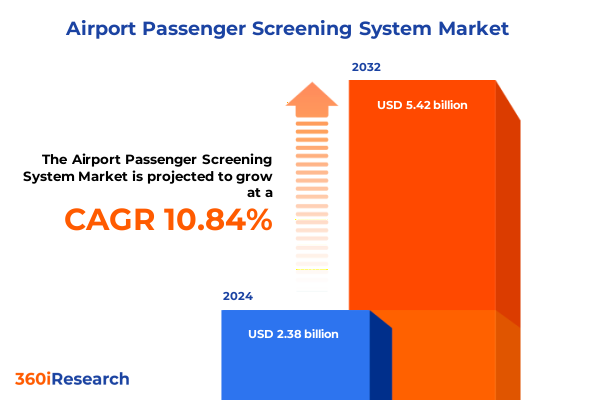

The Airport Passenger Screening System Market size was estimated at USD 2.63 billion in 2025 and expected to reach USD 2.93 billion in 2026, at a CAGR of 10.83% to reach USD 5.42 billion by 2032.

Introducing the Evolving Imperatives and Opportunities in Modern Airport Passenger Screening Systems on a Global Scale Post-Pandemic Transformation Era

Airport operators worldwide are contending with an unprecedented convergence of passenger growth and heightened security threats. As volumes rebound beyond pre-pandemic levels, screening checkpoints must seamlessly process a diverse array of travelers without undermining safety or operational efficiency. Intelligence-driven screening protocols are becoming indispensable for distinguishing between genuine threats and innocuous anomalies in real time. Simultaneously, regulatory requirements continue to evolve in response to global security incidents, compelling stakeholders to reassess existing screening infrastructures and embrace transformational upgrades.

Taken together, these trends underscore an urgent need for a holistic perspective on passenger screening systems that balances advanced detection capabilities with passenger throughput. Decision-makers require insights into emerging technologies, integration challenges, and best practices for aligning security objectives with customer experience goals. By examining the intersection of threat evolution, regulatory pressures, and technology innovation, this report unveils the strategic imperatives that will define the next generation of airport passenger screening.

Identifying the Paradigm-Shifting Technological and Threat Evolution Catalyzing Next-Generation Airport Passenger Screening Practices

Over the past several years, the airport screening landscape has undergone profound shifts driven by both threat dynamics and technological breakthroughs. The rise of sophisticated concealment techniques has coincided with the rapid maturation of artificial intelligence and machine learning, enabling automated analyzers to detect nuanced anomalies that eluded traditional x-ray interpretation. Additionally, the integration of computed tomography with dual-energy material discrimination has redefined what constitutes reliable threat resolution, moving beyond two-dimensional imaging into comprehensive volumetric analysis of carry-on and checked baggage.

Furthermore, passenger expectations have evolved in parallel, demanding a frictionless journey that marries robust security with minimal wait times. To meet these demands, operators are piloting inline automated screening lanes equipped with advanced video analytics that monitor behavioral cues, and are optimizing personnel deployment through dynamic resource allocation. Together, these transformations signal a paradigm shift where intelligence-rich screening ecosystems will be central to achieving both safety and operational resilience.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on the Dynamics of Airport Passenger Screening Equipment Supply Chains

The implementation of United States tariffs on imported security screening equipment in early 2025 has introduced a significant inflection point for airport operators and equipment manufacturers alike. Imposed to protect domestic industries and incentivize local production, these tariffs have increased the landed costs of components and systems, prompting stakeholders to reevaluate sourcing strategies and total cost of ownership. Consequently,OEMs have accelerated domestic manufacturing initiatives and sought tariff exemptions for dual-use technologies, reshaping long-established global supply chains.

Moreover, screening solution providers are negotiating volume commitments and long-term service agreements to mitigate tariff-induced price volatility. Airports are diversifying their supplier base to include both domestic and international partners offering tariff-resilient manufacturing footprints. In parallel, collaborative dialogues with policy makers have intensified, advocating for harmonized regulatory frameworks and streamlined approval pathways. As the cumulative impact of these measures unfolds, stakeholders are balancing near-term cost pressures against the strategic imperative of building a more resilient and diversified procurement ecosystem in the face of evolving trade landscapes.

Unveiling Critical Segmentation Approaches Illuminating Technology, Passenger Behavior, Screening Procedures, Checkpoint Locations, Deployment Models and End Users

A nuanced understanding of market segmentation reveals the multifaceted nature of airport screening demand. On the technology front, solutions range from AI-powered video analytics to millimeter wave scanners and explosive trace detectors, each addressing distinct threat vectors and throughput requirements. Computed tomography systems stand out as a critical category, with single-energy variants delivering high-resolution 2D scans, while dual-energy platforms advance material discrimination and three-dimensional imaging to pinpoint concealed threats with greater accuracy.

Passenger type also plays a pivotal role, as behavior patterns and risk profiles vary widely between business travelers, leisure guests, transit passengers, and crew members. Screening workflows must adapt accordingly, deploying automated protocols for high-frequency flyers while maintaining enhanced manual inspections for irregular travel patterns. Further, screening loạiexchange-whether inline automated screening or manual procedures such as bag searches and physical pat downs-must align with checkpoint location constraints, whether at departure terminals, arrival zones, boarding gates, checked baggage areas, or dedicated security lounges.

Deployment models further refine the market landscape, distinguishing permanent installations tailored to new builds or retrofits from temporary setups for seasonal surges or special events. Finally, end users-from airport authorities and airlines to private contractors and security agencies-exert unique requirements and procurement timelines, shaping technology adoption curves and service preferences across the industry.

This comprehensive research report categorizes the Airport Passenger Screening System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Passenger Type

- Screening Type

- Checkpoint Location

- Deployment Model

- End User

Exploring the Distinct Regional Drivers, Challenges, and Growth Catalysts Shaping Airport Passenger Screening Markets Across the Americas, EMEA, and Asia-Pacific

Regional dynamics in airport screening are deeply influenced by geopolitical, economic, and regulatory environments. In the Americas, there is a pronounced focus on modernization initiatives driven by a commitment to public safety and the imperative to support rapidly rising passenger numbers. Operators in North America are investing heavily in next-generation CT scanners and AI-based analytics to streamline throughput and comply with stricter homeland security mandates.

In Europe, Middle East & Africa, the landscape is characterized by diverse regulatory frameworks and a strong emphasis on cross-border harmonization. The EU’s unified aviation security protocols intersect with Middle Eastern mega-hub expansion, resulting in hybrid procurement strategies that blend advanced European detection algorithms with large-scale infrastructure projects. Meanwhile, African airports are increasingly leveraging portable and temporary screening models to accommodate growth in regional connectivity.

Asia-Pacific remains a highly dynamic market, where aggressive infrastructure spending in major hubs coexists with burgeoning secondary airports seeking cost-effective, modular solutions. Governments are prioritizing investment in automated screening lanes to manage exponential growth, while operators explore strategic partnerships with technology providers to localize manufacturing and support models, thus aligning with national security and economic diversification agendas.

This comprehensive research report examines key regions that drive the evolution of the Airport Passenger Screening System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Edge of Leading Technology Providers and Integrators Innovating Next-Generation Passenger Screening Solutions

Leading technology providers and systems integrators are at the forefront of innovation in passenger screening. Major defense and security equipment manufacturers have expanded their portfolios to include fully integrated screening lanes, combining explosives detection, CT scanning, and high-definition video analytics into coherent ecosystems. Collaborative ventures between avionics experts and software developers have produced open-architecture platforms that enable third-party analytics modules, fostering a competitive market for specialized threat libraries and biometric enhancement tools.

Beyond hardware, key players are differentiating themselves through services such as remote monitoring, predictive maintenance, and cloud-based data aggregation. These capabilities allow end users to anticipate component failures, optimize staffing levels, and generate unified threat assessments in real time. In addition, partnerships with airport authorities, airlines, and security agencies are facilitating pilot programs for emerging modalities like millimeter wave imaging and trace detection robotics, setting new benchmarks for accuracy and passenger-centric operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airport Passenger Screening System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analogic Corporation

- Astrophysics Inc

- Autoclear LLC

- Bosch Ltd

- Bruker Corporation

- C.E.I.A. S.p.A

- Garrett Electronics Inc

- Honeywell International Inc

- IDEMIA

- L3Harris Technologies

- Leidos Inc

- Leonardo S.p.A

- NEC Corporation

- Nuctech Company Limited

- Optosecurity Inc

- OSI Systems Inc (which includes the Rapiscan Systems brand)

- Panasonic Corporation

- QinetiQ Group plc

- Rohde & Schwarz GmbH & Co. KG

- Safran Identity & Security

- SITA

- Smiths Group plc

- Tek84 Inc

- Teledyne Technologies Incorporated

- Thales Group

Strategic Roadmap for Industry Leaders to Leverage Cutting-Edge Technologies, Optimize Operations, and Navigate Regulatory and Economic Barriers

Industry leaders should commence by investing in interoperable screening architectures that seamlessly integrate AI-driven analytics, computed tomography, and traditional detection methods. To achieve this, procurement teams must establish cross-functional working groups that align security, IT, and operations stakeholders, thereby ensuring unified decision-making on technology roadmaps. Additionally, organizations should prioritize modular deployment strategies that enable scalable expansion during peak travel seasons and large events, while controlling capital expenditures.

Furthermore, building strategic partnerships with policy makers and industry consortia will be critical to shaping favorable regulations and securing tariff relief. Operators can benefit from proactive engagement in standardization initiatives and by sharing anonymized performance data to inform evolving threat profiles. Finally, adopting predictive maintenance frameworks and remote diagnostics will minimize downtime and extend equipment lifecycles. By executing these strategies, decision-makers can enhance security resilience, achieve operational efficiencies, and maintain a competitive edge in an increasingly complex aviation environment.

Detailing the Rigorous Multi-Source Research Methodology Underpinning Robust and Actionable Insights in Airport Passenger Screening Analysis

This analysis is underpinned by a rigorous multi-source methodology designed to ensure both depth and accuracy. Primary research included in-depth interviews and structured workshops with airport security directors, equipment OEM executives, and regulatory agency representatives, providing first-hand perspectives on technology adoption drivers and operational pain points. Complementary passenger focus groups were convened to capture end-user sentiment around screening experiences and perceived security efficacy.

Secondary research comprised an extensive review of industry publications, government security advisories, and white papers from leading defense and aviation authorities. Data triangulation techniques were applied to reconcile interview insights with documented regulations, patent filings, and trade statistics. Finally, findings were validated through expert panels and cross-referenced against publicly available procurement announcements, ensuring that the narrative accurately reflects both current deployments and emerging trends in airport screening systems.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airport Passenger Screening System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airport Passenger Screening System Market, by Technology

- Airport Passenger Screening System Market, by Passenger Type

- Airport Passenger Screening System Market, by Screening Type

- Airport Passenger Screening System Market, by Checkpoint Location

- Airport Passenger Screening System Market, by Deployment Model

- Airport Passenger Screening System Market, by End User

- Airport Passenger Screening System Market, by Region

- Airport Passenger Screening System Market, by Group

- Airport Passenger Screening System Market, by Country

- United States Airport Passenger Screening System Market

- China Airport Passenger Screening System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Illuminate Strategic Imperatives and Future Directions in the Evolution of Airport Passenger Screening Systems

Our comprehensive examination reveals that airport passenger screening is at a strategic inflection point marked by converging technology advances and shifting threat landscapes. Key takeaways underscore the pivotal role of computed tomography, AI-driven analytics, and flexible deployment models in reconciling security imperatives with passenger expectations. Further, regional variations in regulatory requirements and infrastructure investment highlight the need for tailored strategies across the Americas, EMEA, and Asia-Pacific markets.

Moreover, the imposition of US tariffs has catalyzed efforts to diversify supply chains and foster domestic manufacturing partnerships, setting the stage for a more resilient procurement environment. As competition among technology providers intensifies, organizations must adopt a holistic approach that integrates hardware, software, and service elements to sustain operational agility. By synthesizing these insights, decision-makers can chart a clear path toward implementing screening ecosystems that not only mitigate evolving threats but also enhance the overall travel experience, driving both safety and efficiency.

Ultimately, operators equipped with these strategic imperatives will be best positioned to navigate future disruptions and capitalize on emerging opportunities in the dynamic realm of airport passenger screening systems.

Engage with Ketan Rohom to Secure Comprehensive and Actionable Airport Passenger Screening Market Research Insights for Informed Strategic Decision Making

We welcome you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore the full depth of our market research on airport passenger screening systems. Ketan Rohom brings extensive expertise in translating complex industry insights into actionable strategies that empower decision-makers. By engaging directly, you will gain clarity on the comprehensive analysis, detailed segmentation, and regional breakdowns that shape our report.

Our dialogue with Ketan Rohom will allow you to understand how leading providers are navigating emerging threats, implement cutting-edge screening technologies, and adapt to evolving tariff landscapes. You will uncover tailored recommendations on optimizing deployments across different checkpoint locations and passenger segments. Further, you can learn how to leverage the detailed research methodology to validate your own security strategies.

Whether you represent an airport authority, airline, security agency, or private contractor, arranging a consultation with Ketan ensures you receive targeted guidance on procurement, technology integration, and strategic partnerships. Do not miss the opportunity to elevate your operational readiness and strengthen passenger safety protocols. Reach out today to secure your copy of the complete airport passenger screening market research report and position your organization at the forefront of industry innovation.

- How big is the Airport Passenger Screening System Market?

- What is the Airport Passenger Screening System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?