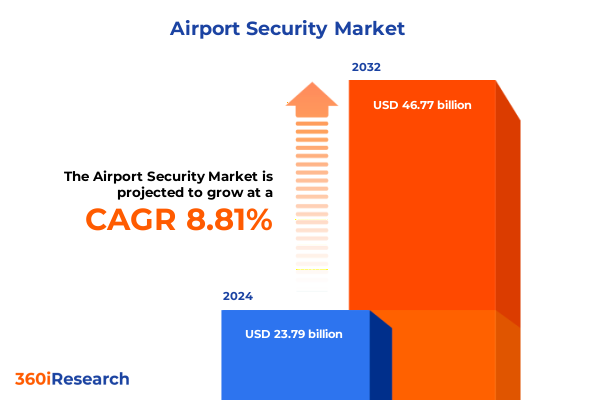

The Airport Security Market size was estimated at USD 25.88 billion in 2025 and expected to reach USD 28.02 billion in 2026, at a CAGR of 8.82% to reach USD 46.77 billion by 2032.

Framing the Asia-Pacific airport security imperative where passenger growth, technology adoption, and geopolitics converge to reshape procurement priorities

Airports in the Asia‑Pacific region stand at a pivotal intersection of rising passenger demand, technological maturation, and increasingly complex geopolitical pressures. Growth in passenger throughput and hub expansions have created the dual imperative of accelerating processing efficiency while strengthening layered security. At the same time, governments and airport authorities are pursuing contactless and automated passenger processing to improve throughput and reduce operational friction, placing identity, screening, and surveillance systems at the center of strategic modernization plans.

Operators must now balance investments in proven physical screening hardware with the migration toward software‑centric solutions that bring analytics, automation, and cloud connectivity into play. This creates new opportunities for operational resilience but also raises questions about data governance, vendor diversification, and interoperability. Across the region, procurement cycles that once prioritized unit price are evolving to prioritize lifecycle cost, cybersecurity posture, and the ability to integrate with existing airport operational systems. Framing the current landscape this way clarifies why strategic procurement choices made today will determine how effectively airports meet both efficiency and security objectives over the coming decade.

How rapid rollouts of biometrics, advanced screening hardware, edge AI and private wireless are jointly transforming airport operations and security architectures across Asia-Pacific

The last two years have produced several transformative shifts that are now converging to reshape airport security programs across the Asia‑Pacific region. First, biometrics and automated passenger processing have moved from pilot projects to operational roll‑outs at scale, changing how identity is verified at check‑in, security, and boarding. These deployments reduce manual touchpoints and queue times but also demand rigorous privacy safeguards and robust data protection frameworks. Second, advanced screening hardware-particularly computed‑tomography baggage scanners and improved trace detection-has been prioritized for checkpoint modernization, allowing passengers to retain electronics and liquids while improving detection capabilities. Third, artificial intelligence and video analytics have moved toward hybrid architectures that split inference workloads between edge devices and cloud services, enabling near‑real‑time alerts without excessive bandwidth consumption.

Concurrently, airports are modernizing network infrastructure with private wireless options such as private 5G and converged operations centers that fuse video, access control, and passenger flow data into single operational views. These architectural choices enhance situational awareness and create new operational efficiencies, but they also expand the attack surface for cyber and supply‑chain risk. The combination of these technology trends is prompting procurement teams to emphasize modularity, vendor interoperability, and security‑by‑design so that upgrades can be phased in without disruptive rip‑and‑replace projects. Evidence of these shifts is visible in multiple regional deployments and vendor announcements describing scaled biometric roll‑outs and infrastructure modernization projects across major Asia‑Pacific hubs.

How 2025 United States tariff measures triggered procurement reassessment, supplier diversification and near‑shoring strategies that affect airport security projects regionally

The arrival of broad new United States tariff measures in 2025 introduced a material variable into procurement planning for airport security systems globally. Tariff actions aimed at reducing trade imbalances and protecting domestic industry altered the cost calculus for goods and components that are commonly sourced from international supply chains. For technology and hardware that rely on imported sensors, semiconductors, and enclosures, these measures have increased landed costs and lengthened procurement lead times as buyers and suppliers re‑assess sourcing strategies.

Beyond immediate price effects, the tariff environment has accelerated supplier diversification strategies and created momentum for near‑shoring or regional manufacturing partnerships. Suppliers and integrators are responding by qualifying alternative component sources, restructuring bills of materials to reduce tariff exposure, and in some cases accelerating software‑centric solutions that reduce reliance on specialized imported hardware. At the same time, industry associations and supplier groups have sought targeted exemptions and temporary relief for critical security components to avoid undermining public safety objectives. The tariff landscape therefore functions as both a near‑term operational constraint and a trigger for longer‑term supply‑chain resilience efforts that will shape procurement decisions and partner selection in the months ahead.

How product, service, deployment and end‑user segments shape procurement trade‑offs and performance expectations for airport security programs across the region

Segmentation insight begins by recognizing that product portfolios, service offerings, deployment options, and end‑user priorities dictate very different risk profiles and procurement behaviors across airports. When evaluated by product type, access control, screening, and surveillance produce distinct investment drivers: access control programs are increasingly focused on biometric modalities such as fingerprint and face templates alongside legacy RFID and smart card ecosystems to support both staff and passenger flows; screening investments prioritize CT‑based baggage scanners, millimeter wave passenger scanners, metal detectors, and explosive trace detectors to improve throughput without sacrificing detection performance; surveillance strategies emphasize CCTV fleets paired with increasingly capable video analytics to offer real‑time operational and threat detection capabilities. From a service perspective, consulting, installation, maintenance, and training services act as force multipliers for capital purchases because successful deployments rely on integration, systems tuning, and operator proficiency rather than equipment alone.

Deployment mode drives operational trade‑offs: cloud‑based services and VSaaS models accelerate rollout, remote management, and scalability but require rigorous contractual cybersecurity controls and data residency planning, while on‑premise implementations preserve local control and may simplify compliance for certain regulators and missions. End‑user context also matters: commercial airports have to balance retail, passenger experience, and aviation compliance; government agencies and border authorities prioritize identity assurance and linkage with law‑enforcement databases; military airfields demand hardened, often air‑gapped solutions with strict access control. Understanding these segmentation layers enables procurement teams to prioritize capability, supportability, and compliance attributes rather than comparing products only on headline features or initial price.

This comprehensive research report categorizes the Airport Security market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution

- Detection Technology

- Threat Type

- Deployment Mode

- Application

- End User

Why regional procurement patterns vary globally and how Americas, Europe‑Middle East‑Africa and Asia‑Pacific dynamics translate into different vendor and solution selection criteria

Regional dynamics continue to produce differentiated demand patterns and decision criteria across the globe. In the Americas, emphasis is frequently placed on retrofitting legacy infrastructure and integrating federal compliance requirements with cloud and analytics offerings; procurement cycles are often shaped by public‑sector budgeting timelines and central agency certifications. Across Europe, the Middle East and Africa, airports balance harmonization with regional standards and ambitious greenfield hub projects that specify high throughput and integrated passenger experience features, leading to large, bespoke programs that combine screening, access control, and smart terminal design. The Asia‑Pacific region distinguishes itself by rapid capacity expansion, diverse regulatory environments, and a combination of mature hubs and fast‑growing secondary airports; this mix drives both high volumes of unit procurements and a willingness among authorities to adopt contactless biometric systems at scale.

These regional contrasts mean vendors and systems integrators must present flexible commercial models and demonstrate both regulatory compliance and local support ecosystems. For buyers and program managers, the practical implication is that comparative vendor evaluation must include local maintenance capabilities, the ability to meet regional certification standards, and an understanding of how regional policy initiatives-such as passenger identity programs and border modernization efforts-will affect technology choices and timelines.

This comprehensive research report examines key regions that drive the evolution of the Airport Security market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Why vendors combining robust hardware, integrated software ecosystems and local delivery capabilities win long‑term contracts in airport security programs

Competitive dynamics in the airport security sector continue to favor firms that combine hardware excellence with software ecosystems, services capability, and regional delivery capacity. Vendors that lead with proven screening hardware-CT scanners, advanced X‑ray systems, and trace detection-are strengthening their value propositions by integrating detection algorithms, automated adjudication workflows, and maintenance services that reduce total cost of ownership. Simultaneously, firms that supply access control and biometric systems are differentiating through identity lifecycle management, interoperability with passenger processing systems, and compliance with privacy and data protection regulations.

A second axis of competitive advantage derives from software and services: companies that offer cloud‑capable video analytics, VSaaS options, and edge compute appliances for low‑latency inference are able to present more flexible procurement options to operators seeking phased modernization. Finally, regional partnerships and local delivery networks increasingly determine win rates. Vendors that can demonstrate localized engineering, authorized spare‑parts channels, and accredited training programs gain credibility with airport authorities that must minimize downtime. For buyers, these attributes should be weighted ahead of product feature checklists to ensure operational sustainability after deployment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airport Security market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADB SAFEGATE

- Agilent Technologies Inc.

- Amadeus IT Group SA

- Analogic Corporation

- Autoclear LLC

- Axis Communications AB

- BEUMER Group GmbH & Co. KG

- Bosch Sicherheitssysteme GmbH

- CEIA S.p.A.

- Cisco Systems Inc.

- Daifuku Co., Ltd.

- Elbit Systems Ltd.

- FLIR Systems, Inc.

- Genetec Inc.

- Hitachi Limited

- Honeywell International Inc.

- Indra Sistemas, S.A.

- International Business Machines Corporation

- Johnson Controls International PLC

- L3Harris Technologies, Inc.

- Leidos, Inc.

- Leonardo S.p.A.

- NEC Corporation

- Nuctech Technology Co., Ltd.

- OPTEX CO., LTD.

- Securitas AB

- Siemens AG

- SITA N.V.

- Smiths Detection Group Ltd.

- Thales Group

- T‑Systems International GmbH

- Vanderlande Industries B.V.

- Westminster Group Plc

- Wipro Limited

Immediate practical actions for airport operators and security procurement teams to reduce tariff exposure, accelerate modular upgrades and secure operational resilience

Industry leaders should take immediate, pragmatic steps to protect project timelines and preserve operational capability in the face of tariff pressure and rapid technology evolution. First, accelerate vendor qualification for alternate suppliers and encourage dual‑sourcing of critical components to reduce single‑point dependency. Second, prioritize modular and software‑forward architectures that permit incremental upgrades-this reduces stranded capital risk and enables rapid adoption of cloud or edge analytics when local policy permits. Third, make cybersecurity and data governance a gating criterion in RFPs so that cloud adoption or identity programs do not outpace contractual protections and operational readiness.

Additionally, invest in operator training and performance engineering up front to ensure new screening technologies and analytics produce measurable throughput gains. Finally, establish a cross‑functional procurement governance team that includes security, IT, legal, and operations stakeholders to evaluate total lifecycle implications rather than focusing on initial purchase price. These steps will help leaders maintain pace with technological change while controlling cost, compliance, and serviceability risks.

A transparent, triangulated research approach combining vendor disclosures, policy updates and deployment case studies to validate technology, procurement and risk observations

This analysis synthesizes primary and secondary research across vendor announcements, industry association policy updates, technical whitepapers and public sector procurement notices. Primary inputs included vendor product specifications, press releases describing deployments, and regulatory updates from national aviation and border authorities where available. Secondary inputs included industry trade publications, operator statements, and subject‑matter commentary on technology trends such as edge AI, private wireless, and biometric deployments. The methodology prioritized triangulation: claims and trends were cross‑checked against at least two credible sources whenever possible and verified for relevance to the Asia‑Pacific operational context.

Where geopolitical and policy drivers-such as tariff actions-were material to procurement risk, the analysis incorporated official policy statements, industry association responses, and reputable reporting on the likely operational consequences. Vendor‑level competitive observations were based on documented product roadmaps, contract awards, and public case studies. Finally, the segmentation and regional insights were validated against observable program decisions and recent large‑scale deployments across the Asia‑Pacific region to ensure the recommendations are practicable for decision makers and program managers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airport Security market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airport Security Market, by Solution

- Airport Security Market, by Detection Technology

- Airport Security Market, by Threat Type

- Airport Security Market, by Deployment Mode

- Airport Security Market, by Application

- Airport Security Market, by End User

- Airport Security Market, by Region

- Airport Security Market, by Group

- Airport Security Market, by Country

- United States Airport Security Market

- China Airport Security Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Conclusions on why modularity, interoperability, local service capacities and supply‑chain resilience define successful airport security modernization in Asia‑Pacific

The Asia‑Pacific airport security landscape is not defined by a single trend but by the intersection of multiple, reinforcing shifts: automated identity at scale, a move to advanced CT and trace screening, the maturation of video analytics across edge and cloud architectures, and an elevated focus on supply‑chain resilience driven by tariff and geopolitical pressures. Together these forces are changing what “security capability” means for airports: it is no longer only about hardware performance, but about integrability, data stewardship, lifecycle support, and the agility to evolve as threats and regulations change.

For decision makers, the path forward is clear: prioritize modular, interoperable systems; require vendor commitments for local service and spare parts; bake cybersecurity and privacy protections into procurement documents; and maintain diversified sourcing strategies that reduce exposure to sudden policy shifts. Executed coherently, these measures will enable airports to deliver safer, faster, and more passenger‑friendly operations without sacrificing resilience.

Secure an executive briefing and tailored purchase conversation with Ketan Rohom to convert the market research findings into procurement and deployment decisions

For executive teams, procurement leads, and security integrators seeking an actionable, evidence-based roadmap to navigate near-term tariff turbulence, supply-chain volatility, and rapid technology migration across the Asia‑Pacific airport security landscape, securing the full market research report is the next strategic step. The report consolidates vendor profiles, procurement drivers, regulatory developments, and implementation case studies into a single reference that supports capital planning, RFP design, and vendor negotiations.

If you would like to discuss how this research aligns with your procurement timeline, vendor strategies, or to request a tailored briefing, please connect with Ketan Rohom, Associate Director, Sales & Marketing at the publisher. Ketan can arrange an executive summary briefing, a scope walk‑through of the report’s chapters, and options for enterprise licensing or bespoke add‑ons that focus on the Asia‑Pacific region and specific technology domains such as biometric access control, CT baggage screening, video analytics, or cloud/hybrid deployments.

Engaging with Ketan will accelerate access to the detailed findings, regional case studies, and vendor scorecards that support rapid decision making. Reach out to arrange a confidential briefing and to learn how the full report can address your specific operational or procurement questions before the next budget cycle.

- How big is the Airport Security Market?

- What is the Airport Security Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?