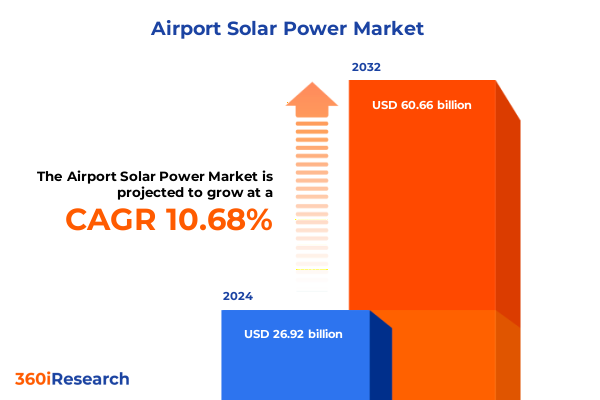

The Airport Solar Power Market size was estimated at USD 29.81 billion in 2025 and expected to reach USD 33.01 billion in 2026, at a CAGR of 11.19% to reach USD 62.66 billion by 2032.

Revolutionizing Airport Energy Systems Through Solar Innovations to Achieve Operational Efficiency Resilience and Environmental Stewardship Across Aviation Hubs

The global solar energy sector has reached unprecedented heights, with cumulative photovoltaic capacity surpassing 2.2 terawatts by the end of 2024 and record additions of over 600 gigawatts, underscoring solar’s emergence as a central pillar of the worldwide energy transition. As airports grapple with rising energy costs, stringent sustainability mandates, and the imperative for resilient operations, on-site photovoltaic installations are increasingly recognized as a transformative solution that aligns environmental stewardship with operational efficiency.

Against this backdrop, aviation stakeholders are exploring solar integration to enhance energy security and mitigate carbon footprints. Innovative funding mechanisms, such as the FAA’s Airport Terminals Program grant leveraged by Killeen Regional Airport, illustrate how federal incentives can underwrite capital-intensive projects and drive early adoption. Through this analysis, we illuminate the factors reshaping the airport solar power landscape, identify critical segmentation and regional dynamics, and offer strategic guidance to navigate emerging challenges and opportunities.

Emerging Trends in Airport Solar Projects Highlight a Paradigm Shift Toward Large-Scale Photovoltaic Farms Integrated with Microgrids and Sustainable Infrastructure

Recent years have witnessed an escalation in airport solar initiatives, moving beyond small-scale carport arrays to expansive, utility-grade installations. In the Pacific Northwest, Bellingham International Airport commissioned a 250-panel rooftop array that generates over 100,000 kilowatt-hours annually, reducing reliance on conventional power sources while augmenting the facility’s resilience and sustainability credentials. Similarly, airports along California’s Central Coast are implementing photovoltaic canopies over primary parking facilities, delivering shaded parking and significant energy offsets.

Concurrently, major hubs are embracing large-scale solar farms paired with battery storage to optimize both energy generation and grid integration. Dulles International Airport’s 200,000-panel, 835-acre solar farm will not only supply clean power to the airport but also support 37,000 homes with 50 megawatts of battery-backed storage, showcasing a shift toward combined renewable generation and storage ecosystems. Pittsburgh International Airport has announced plans to more than double its existing solar field by leveraging a microgrid model that ensures continuous power supply while fostering regional economic development.

These projects exemplify a transformative phase in which airports integrate solar arrays of varying scales, adopt microgrid architectures, and incorporate complementary upgrades such as LED retrofits and electric vehicle charging infrastructure. This holistic approach not only delivers environmental and financial benefits but also positions airports as leaders in sustainable infrastructure innovation.

Understanding the Layered Impact of 2025 U.S. Solar Tariffs on Airport Photovoltaic Projects and the Evolving Dynamics of Supply Chain Resilience

The United States solar sector is navigating an increasingly intricate policy landscape shaped by layered tariffs that commenced in early 2025. Modifications to Section 232 duties on steel and aluminum, expansions of Section 301 measures on Chinese-origin components, and the introduction of a universal 10% tariff have converged to form a complex duty framework that can stack additional anti-dumping and countervailing duties on solar cells and modules. These shifts, including a temporary 90-day pause on certain reciprocal levies, have created substantial uncertainty for developers, manufacturers, and investors alike.

At the project level, preliminary analysis indicates that utility-scale solar deployments may experience cost escalations of roughly 30%, with some developers delaying or canceling initiatives due to tightened margins and supply chain disruptions. Residential and commercial integrators are similarly contending with module price increases of up to $0.15 per watt, while balance-of-system components such as inverters and racking are experiencing additional price pressures. These trends are prompting market participants to pursue supply chain diversification strategies, including sourcing from tariff-exempt regions and doubling down on domestic manufacturing partnerships.

Energy storage systems have faced even steeper cost hikes-ranging from 12% to 50%-as lithium-ion batteries and related components fall under import restrictions, highlighting the need for alternative storage technologies and accelerated domestic cell production investments. Overall, the cumulative impact of the 2025 tariff regime underscores the importance of proactive risk mitigation, robust procurement planning, and policy advocacy to sustain project pipelines and preserve the trajectory of airport solar adoption.

Discerning Key Market Segments in Airport Solar Power from Components and Technologies to Installation Configurations and End User Verticals Across Facility Types

The airport solar power market can be dissected by key component classes encompassing inverters, modules, and mounting structures, each with nuanced sub-categories that influence system architecture and cost profiles. Within the inverter segment, central and string inverters cater to large utility installations and distributed carport arrays respectively, while module selection oscillates between monocrystalline and polycrystalline technologies, balancing efficiency and upfront investment. Mounting structures are differentiated by fixed-tilt solutions for rooftop and open-field deployments and tracking systems that maximize energy yield through dynamic orientation.

Complementing the component framework, technology classifications bifurcate into crystalline silicon and thin film, with monocrystalline and polycrystalline materials delivering mature performance metrics and thin-film variations such as amorphous silicon, CdTe, and CIGS offering flexible application profiles and lower temperature coefficients. Installation typologies further segment the market into ground-mounted and rooftop systems: ground arrays manifest as carport structures over parking areas or open-field farms adjacent to runways, while rooftop installations utilize terminal and warehouse roofs to capitalize on underutilized real estate.

Project scale delineates large (>10 MW), medium (1–10 MW), and small (<1 MW) initiatives, each aligned with strategic objectives ranging from airport-wide microgrid integration to targeted shade-provision carport projects. Finally, end-user verticals span cargo hubs, commercial and government airports, and military bases, reflecting varied operational priorities such as supply chain continuity, passenger amenities, regulatory compliance, and defense readiness. These interlocking segmentation dimensions provide a comprehensive lens through which stakeholders can evaluate opportunities, tailor technology selections, and optimize capital deployment across diverse airport environments.

This comprehensive research report categorizes the Airport Solar Power market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Installation Type

- End User

Comparative Regional Analysis of Airport Solar Power Adoption Patterns Revealing Growth Drivers and Policy Landscapes in the Americas EMEA and Asia-Pacific

In the Americas, robust policy support-exemplified by the Inflation Reduction Act-has propelled solar capacity to add over 47 gigawatts in 2024, reinforcing the United States as a global leader in PV adoption. Airports in the region are capitalizing on grant programs and power purchase agreements to develop both rooftop canopies and ground-mounted farms, spurring regional economic growth and enhancing energy security at major hubs from Texas to New York.

The Europe, Middle East & Africa (EMEA) region registered approximately 62.6 gigawatts of new PV installations outside China in 2024, driven by the European Union’s Fit for 55 climate package and ambitious targets for net-zero emissions. Across the continent, airport operators are collaborating with energy service providers to retrofit existing facilities and explore large-scale desert solar parks in the Middle East, leveraging high solar irradiance and strategic infrastructure to reduce operational emissions.

Asia-Pacific markets demonstrated dynamic expansion, with India installing 31.9 gigawatts and China surpassing one terawatt of cumulative capacity by late 2024, supported by national solar missions and state-level renewable energy mandates. Airports across Australia, Southeast Asia, and India are increasingly integrating PV arrays and microgrid systems, harnessing solar to decarbonize operations, stabilize grid interactions, and unlock resilience in the face of rising energy demand.

This comprehensive research report examines key regions that drive the evolution of the Airport Solar Power market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Strategic Partnerships and Technology Providers Forging the Future of Solar Integration at Airports Through Collaboration and Innovation

Ameresco has emerged as a preeminent partner for airport solar integration, orchestrating projects such as the 1.2 MW solar carport installation at Killeen Regional Airport in Texas, which also featured LED retrofits to enhance energy resilience and traveler experience. In the Mid-Atlantic, Dominion Energy’s collaboration with the Metropolitan Washington Airports Authority on the Dulles International Airport solar farm underscores the pivotal role of utilities in financing and operating large-scale installations that serve both airports and surrounding communities.

Duquesne Light Co. and IMG Energy Solutions have partnered to expand Pittsburgh International Airport’s solar field, leveraging a microgrid architecture to ensure uninterrupted power and foster regional economic development through clean energy investment. Meanwhile, Veregy’s multi-array 2.88 MW project at Abraham Lincoln Capital Airport in Illinois has garnered industry accolades for its scale and integration with net metering strategies, showcasing how regional authorities can deploy solar to achieve both sustainability and financial objectives.

On the Pacific Coast, Ecotech Solar’s installation of a 250-panel rooftop array at Bellingham International Airport illustrates the growing influence of local contractors in delivering tailored clean energy solutions that balance environmental goals with community engagement and cost-effectiveness. These partnerships epitomize the collaborative ecosystem needed to drive airport solar deployment, from multinational utilities to specialized engineering firms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airport Solar Power market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ameresco, Inc.

- Canadian Solar Inc.

- Enphase Energy, Inc.

- Fronius International GmbH

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- LONGi Group

- Robert Bosch GmbH

- Siemens AG

- Solar Frontier Europe GmbH

- SolarEdge Technologies Inc.

- Solis Australasia Pty Ltd.

- SunPower Corporation

- Trina Solar Co., Ltd.

Strategic Actionable Recommendations for Airport Operators and Industry Stakeholders to Accelerate Solar Adoption Mitigate Risks and Enhance Project Viability

To advance airport solar power initiatives, stakeholders should prioritize the development of flexible procurement strategies that incorporate both domestic manufacturing agreements and diversified international suppliers to mitigate tariff-related cost escalations. Establishing long-term supply contracts with U.S.-based module producers and exploring tariff-exempt sourcing regions will enhance project budget certainty and bolster supply chain resilience.

Engagement with regulatory bodies and participation in grant and incentive programs, such as the FAA’s Airport Terminals Program and state-level renewable energy funds, will unlock non-dilutive financing opportunities that reduce upfront capital expenditure and accelerate time to commissioning. Airport operators must also integrate energy storage and microgrid solutions into project planning to ensure reliable power supply for mission-critical operations during grid disturbances.

Furthermore, forging public-private partnerships with technology providers and research institutions can drive innovation in emerging technologies, including bifacial modules, tracking systems, and advanced battery chemistries. Leveraging digital monitoring platforms and predictive maintenance analytics will optimize asset performance, extend system lifespans, and maximize return on investment. By adopting these strategic actions, airport industry leaders can navigate policy complexities, contain costs, and position their facilities at the forefront of sustainable aviation infrastructure.

Comprehensive Research Methodology Combining Primary Interviews Secondary Data Analysis and Expert Validation to Ensure Robust and Actionable Market Insights

This research encompasses a hybrid methodology that integrates primary qualitative engagement with secondary quantitative analysis. Primary insights were garnered through structured interviews with airport sustainability officers, energy service company executives, and regulatory experts to contextualize operational drivers and identify emerging policy trends. Secondary analysis synthesized publicly available data from industry reports, government grant databases, and technical publications to map project pipelines and technology deployments.

A rigorous validation process involved cross-referencing project details with press releases, regulatory filings, and financial disclosures to ensure data integrity. Segmentation frameworks were developed by categorizing projects across component, technology, installation type, project size, and end-user verticals, enabling a granular assessment of market dynamics. Regional insights were triangulated against global capacity trends reported by leading agencies to confirm alignment with broader renewable energy trajectories.

To enhance the robustness of findings, an advisory panel of subject-matter experts reviewed draft analyses, provided feedback on emerging risks, and identified gaps for further inquiry. This comprehensive approach delivers actionable intelligence that stakeholders can utilize to inform investment decisions, technology adoption, and strategic planning in the airport solar power market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airport Solar Power market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airport Solar Power Market, by Component

- Airport Solar Power Market, by Technology

- Airport Solar Power Market, by Installation Type

- Airport Solar Power Market, by End User

- Airport Solar Power Market, by Region

- Airport Solar Power Market, by Group

- Airport Solar Power Market, by Country

- United States Airport Solar Power Market

- China Airport Solar Power Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Insights to Highlight the Path Forward for Solar-Powered Airport Infrastructure Transformation Anchored in Sustainability and Operational Excellence

The convergence of policy imperatives, technological advancements, and competitive pressure is catalyzing a new era for airport energy management, with solar power at the core of sustainable transformation. As airports seek to enhance operational resilience and achieve ambitious decarbonization targets, the integration of photovoltaic systems-ranging from compact rooftop arrays to expansive ground-mounted farms-offers a path to reduce energy costs, stabilize supply, and reinforce environmental leadership.

Navigating the evolving landscape of tariffs and supply chain constraints requires agile procurement strategies, collaborative stakeholder engagement, and ongoing investment in emerging technologies such as energy storage and digital asset management. Regional market dynamics-from the mature incentive structures in the Americas to the policy-driven growth in EMEA and the rapid expansion across Asia-Pacific-underscore the need for tailored approaches that address local regulatory frameworks and resource endowments.

By leveraging the detailed segmentation insights and company profiles provided herein, industry participants can identify high-impact opportunities, optimize technology selections, and forge partnerships that drive sustainable growth. The recommendations outlined in this analysis serve as a blueprint for airport operators and their strategic allies to overcome challenges, capitalize on market momentum, and realize the full potential of solar integration across aviation infrastructures.

Engage with Ketan Rohom to Secure Exclusive Insights and Leverage Customizable Solar Power Market Intelligence for Strategic Decision Making and Competitive Advantage

If you’re ready to harness the insights detailed in this executive summary and guide your organization’s solar strategy with authoritative data and tailored analysis, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex market research into actionable intelligence will ensure you secure the comprehensive report that illuminates key trends, competitive dynamics, and strategic pathways. Connect with Ketan to arrange a personalized briefing and gain immediate access to in-depth research, empowering your team to make data-driven decisions and achieve a competitive edge in the evolving airport solar power market

- How big is the Airport Solar Power Market?

- What is the Airport Solar Power Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?