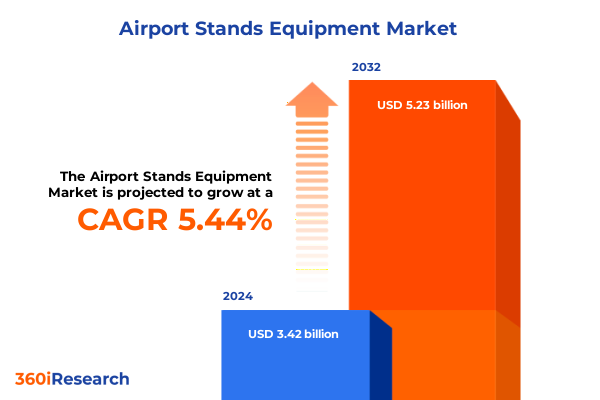

The Airport Stands Equipment Market size was estimated at USD 3.59 billion in 2025 and expected to reach USD 3.77 billion in 2026, at a CAGR of 5.52% to reach USD 5.23 billion by 2032.

Setting the Stage for Airport Ground Support Equipment Market Evolution with a Focus on Operational Efficiency and Emerging Technologies

The airport ground support equipment (GSE) market has undergone profound changes driven by technological innovation, regulatory evolution, and shifting operational priorities. From the growing emphasis on sustainability to the proliferation of digital platforms that enable predictive maintenance and remote monitoring, airport stands equipment has advanced beyond its traditional role of providing rudimentary services to aircraft. Today’s stakeholders require a comprehensive understanding of how this critical infrastructure is transforming to support safer, more efficient, and more environmentally responsible operations.

Against this backdrop of dynamic change, airport operators and equipment manufacturers alike are seeking clarity on emerging trends, competitive strategies, and regional variations in demand. The purpose of this executive summary is to distill the most salient insights from our in-depth market research, providing decision-makers with a strategic blueprint for navigating the complexities of the GSE landscape. By illuminating the technological, regulatory, and economic drivers shaping the market, this summary will equip readers with the knowledge needed to identify high-value opportunities and anticipate potential challenges.

Uncovering the Technological, Operational, and Regulatory Shifts Reshaping Airport Stands Equipment Landscape in a Post-Pandemic World

Over the past few years, the airport ground support equipment sector has experienced a series of transformative shifts that extend far beyond incremental improvements. The integration of IoT-enabled sensors and advanced telematics has shifted maintenance paradigms from reactive to predictive, substantially reducing aircraft ground time and lowering total cost of ownership. Moreover, the rapid ascent of electrification has challenged legacy diesel-powered units, leading to a redefinition of product portfolios as manufacturers race to meet stringent emissions regulations. This transition not only underscores a broader industry commitment to sustainability but also opens new avenues for service-based business models that leverage data analytics and pay-per-use frameworks.

Concurrent regulatory developments have further accelerated this evolution. Enhanced emissions standards in key regions, particularly for nitrogen oxides and particulate matter, have prompted airports to incentivize low-emission equipment through gate fee discounts and preferential access to charging infrastructure. At the same time, a rising focus on cybersecurity for connected GSE systems has led to new requirements for data encryption and secure device authentication. In parallel, end-users are increasingly prioritizing equipment modularity and interoperability to accommodate diverse fleet compositions and minimize training overheads. Taken together, these technological and regulatory shifts are redefining competitive dynamics and compelling stakeholders across the value chain to adopt more agile, data-driven strategies to remain relevant.

Analyzing the Combined Effects of New United States Tariff Measures on Airport Ground Support Equipment Supply Chains and Procurement Costs

As of early 2025, the United States government has implemented a series of targeted tariffs affecting various components and finished units used in airport ground support equipment. These measures, intended to bolster domestic manufacturing capacity, have cumulatively raised the import duty on select power electronics, steel frameworks, and specialized mechanical parts by up to 25 percent. For OEMs that rely on global supply chains to source high-precision subassemblies, the immediate effect has been a marked increase in procurement costs, which has placed pressure on margins and forced a renegotiation of supplier contracts.

Beyond direct cost implications, these tariff measures have also triggered broader supply chain adjustments. Equipment manufacturers are responding by exploring alternative sourcing strategies, including nearshoring to Latin American and Caribbean partners that benefit from favorable trade agreements. In parallel, several leading suppliers have announced capacity-expansion investments in U.S. production facilities to mitigate exposure to future tariff escalations and to capture government incentives for domestic job creation. While these strategic shifts promise long-term resilience, they have introduced transitional challenges such as retooling lead times and workforce training requirements. Consequently, procurement teams at major airports are recalibrating purchasing schedules and considering total landed cost scenarios to manage both budgetary constraints and service level expectations.

Deciphering Market Dynamics through Equipment, Mounting, Operation, and Power Rating Segmentation to Reveal High-Value Opportunities Across Categories

A nuanced view of the GSE market emerges when dissecting performance across distinct segmentation criteria. When examining the market by equipment type, it becomes evident that electric air start units are gaining traction due to their zero-emissions profile, while hydraulic and pneumatic alternatives maintain strong positions in regions where electrification infrastructure remains nascent. Within ground power units, trailer-mounted configurations are preferred at airports prioritizing flexibility and mobility, whereas fixed and trolley variants are entrenched in established hubs with consistent power requirements. Benchtop pitot testers continue to serve centralized maintenance operations, yet handheld models are carving out growth opportunities among line technicians who value portability.

Shifting focus to mounting type reveals that vehicle-mounted solutions are increasingly integrated into multifunctional service fleets, allowing operators to maximize utilization and streamline operator training. Walk-behind and trolley models, in contrast, retain relevance in smaller airports that emphasize cost control over advanced telematics features. Operation-based segmentation highlights alternating current systems as the default for large wide-body gate operations, while direct current equipment is favored in remote stands and apron-pushed scenarios due to lower power consumption and simplified cable management. Finally, power rating stratification indicates that units under 30 kVA are driving adoption in regional and general aviation contexts, whereas the 30 to 90 kVA range dominates mainline airport operations and units above 90 kVA are primarily deployed for heavy-lift or high-voltage specialized applications.

This comprehensive research report categorizes the Airport Stands Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Mounting Type

- Operation

- Power Rating

Mapping Regional Demand Patterns and Growth Drivers in the Americas, EMEA, and Asia-Pacific for Airport Ground Support Equipment and Services

A regional lens further refines the strategic outlook for the GSE market, exposing a range of divergent demand drivers. In the Americas, the United States market is fuelled by aggressive fleet renewal programs at major hub airports, often supported by public-private partnerships that fund infrastructure upgrades and emissions reduction targets. Latin American airports, while more budget-constrained, are capitalizing on flexible financing solutions to modernize operations, with a particular focus on scalable ground power and air start solutions.

Europe, the Middle East, and Africa present a fragmented landscape defined by regulatory heterogeneity. The European Union’s commitment to carbon neutrality by 2050 has accelerated the rollout of electric and hydrogen-powered GSE, while Middle Eastern aviation giants invest in seamless, digitalized ground operations to support hyper-growth passenger volumes. In Africa, market maturation is at an earlier stage, with opportunities concentrated in foundational equipment procurement and maintenance training programs.

Asia-Pacific stands out as the fastest-growing region, driven by massive airport expansion projects in China, India, and Southeast Asia. The combination of greenfield mega-airport developments and existing hub modernization is elevating demand for integrated GSE fleets, sophisticated telematics platforms, and hybrid power solutions that can accommodate diverse grid reliability scenarios. As a result, manufacturers with established local partnerships and flexible production footprints are securing the most significant contracts and establishing leadership positions.

This comprehensive research report examines key regions that drive the evolution of the Airport Stands Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Moves, Innovation Pipelines, and Competitive Positioning of Leading Players in Airport Ground Support Equipment Sector

Key industry participants are actively reshaping their strategic playbooks to align with market imperatives. Leading OEMs have introduced modular GSE platforms that enable seamless upgrades across power sources, communication protocols, and mounting configurations. Several firms have launched digital service ecosystems that integrate real-time performance dashboards, remote diagnostics, and predictive maintenance alerts, thereby reducing unplanned downtime and extending equipment life cycles.

In response to tariff-induced cost volatility, top companies are diversifying their component sourcing and forging joint ventures with regional partners to localize production. Strategic acquisitions have emerged as another hallmark tactic, with market leaders absorbing niche telematics providers or specialized component manufacturers to bolster their value-added service offerings. Meanwhile, aftermarket service providers are transitioning from time-and-material contracts to outcome-based agreements, aligning fees with equipment uptime guarantees and performance metrics. These strategic moves underscore a broader industry shift toward integrated, service-oriented business models, the success of which hinges on the ability to deliver consistent, data-driven value to end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airport Stands Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Adelte Group S.L.

- CIMC ENRIC Holdings Limited

- FMT Industrie S.r.l.

- Honeywell International Inc.

- JBT Corporation

- Mallaghan Engineering Company Limited

- Oshkosh Corporation

- Tetrahedron

- Textron Inc.

- ThyssenKrupp AG

- TLD Global NV

Strategic Imperatives for Industry Leaders to Navigate Market Uncertainties, Enhance Operational Efficiency, and Capitalize on Emerging Opportunities

Industry leaders must take decisive action to navigate the complexities of a rapidly evolving GSE landscape. First, investing in electrified and hybrid powertrain technologies will be essential to meet tightening emissions regulations and to capitalize on incentive programs at global airports. Concurrently, assembling an agile supply chain-one that balances onshore capacities with strategic nearshore partnerships-will mitigate tariff risks and reduce lead-time variability. Equally important is the deployment of standardized telematics platforms, which can be scaled across diverse equipment types and permit seamless data integration into airport operations centers.

To maximize return on investment, equipment suppliers should transition toward performance-based service models that reward uptime and efficiency gains. This approach will foster deeper customer loyalty while generating recurring revenue streams. Lastly, focusing on emerging markets-particularly in Asia-Pacific and underserved segments in Latin America and Africa-will unlock new growth corridors. By aligning product development roadmaps with regional infrastructure initiatives and sustainability targets, companies can outpace competitors and secure long-term partnerships.

Adopting a Robust Research Framework Integrating Primary Insights, Secondary Research, and Analytical Rigor to Deliver Comprehensive Market Intelligence

Our research approach combined comprehensive secondary research with rigorous primary validation to ensure the highest level of accuracy and relevance. Secondary insights were derived from industry publications, financial reports of leading equipment manufacturers, regulatory filings, and proprietary databases. This foundation was complemented by primary interviews conducted with senior executives at airport operators, procurement directors, and engineering managers at GSE suppliers. These discussions provided qualitative perspectives on procurement criteria, technology adoption barriers, and upcoming capital investment plans.

Data triangulation techniques were applied to reconcile discrepancies between sources, and a multi-step validation process ensured consistency across market segment definitions and regional categorizations. Analytical models were then developed to identify key drivers, assess competitive intensity, and map the interdependencies among technological, regulatory, and economic factors. The result is a robust, data-driven framework that underpins all insights and recommendations, offering stakeholders a clear, actionable understanding of the current state and future trajectory of the airport ground support equipment market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airport Stands Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airport Stands Equipment Market, by Equipment Type

- Airport Stands Equipment Market, by Mounting Type

- Airport Stands Equipment Market, by Operation

- Airport Stands Equipment Market, by Power Rating

- Airport Stands Equipment Market, by Region

- Airport Stands Equipment Market, by Group

- Airport Stands Equipment Market, by Country

- United States Airport Stands Equipment Market

- China Airport Stands Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Strategic Insights to Illuminate the Path Forward for Stakeholders in the Evolving Airport Ground Support Equipment Market

The airport ground support equipment market stands at a pivotal juncture, defined by the convergence of sustainability mandates, digital transformation, and geopolitical realignments impacting supply chains. Stakeholders that embrace innovation, leverage data-driven service models, and adopt resilient sourcing strategies will be best positioned to lead in this dynamic environment. By synthesizing the segmentation, regional, and competitive insights presented, decision-makers can chart a clear course toward long-term value creation and operational excellence.

Engage with Ketan Rohom to Unlock In-Depth Insights, Secure Tailored Intelligence Packages, and Accelerate Informed Decisions with Our Latest Market Report

Unlock unparalleled market intelligence and gain a decisive competitive advantage by partnering with Ketan Rohom, Associate Director of Sales & Marketing. Tailored to your strategic objectives, our comprehensive market research report on airport ground support equipment offers in-depth analysis, actionable insights, and forecast-driven recommendations designed to accelerate your decision-making process. Reach out today to secure your copy, arrange a personalized briefing, and empower your organization with the authoritative data needed to stay ahead in a rapidly evolving industry

- How big is the Airport Stands Equipment Market?

- What is the Airport Stands Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?