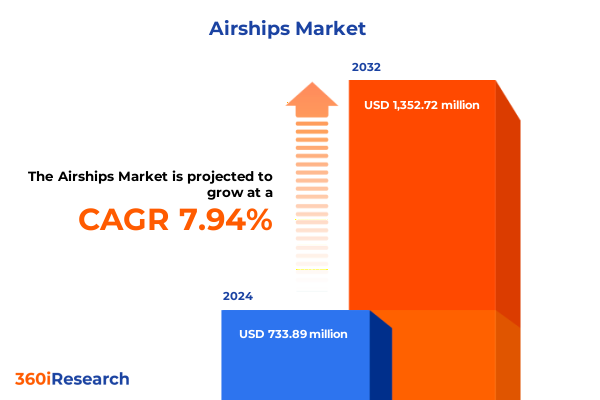

The Airships Market size was estimated at USD 791.19 million in 2025 and expected to reach USD 856.64 million in 2026, at a CAGR of 7.96% to reach USD 1,352.72 million by 2032.

Introducing the Next Era of Lighter-Than-Air Innovation Transforming Connectivity, Cargo Transport, and Surveillance Through Advanced Airship Platforms

The resurgence of lighter-than-air platforms is redefining the aerospace landscape and challenging conventional paradigms of connectivity, logistics, and surveillance. As technological advancements reduce operational costs and improve structural reliability, airships are emerging as a versatile complement to traditional fixed-wing and rotorcraft solutions. This shift has garnered significant interest from industry stakeholders seeking to leverage higher payload capacities, extended loiter times, and lower carbon footprints to address unmet needs in remote transport, disaster relief, and persistent observation missions.

Drawing on decades of pioneering research alongside breakthroughs in envelope materials, propulsion systems, and avionics integration, the airship sector is on the cusp of mainstream adoption. Recent engineering milestones-including the certification of hybrid-electric powertrains and the field testing of semi-rigid designs-underscore a new era where airships are not only operationally viable but strategically indispensable. In this context, a specific focus on cross-sector collaboration, regulatory harmonization, and enhanced supply-chain resilience is paramount to unlocking the full commercial potential of these buoyant platforms.

Charting Disruptive Technological and Commercial Paradigm Shifts Reshaping Airship Development Strategies and Operational Models Worldwide

The airship industry is undergoing a profound transformation driven by disruptive technological and commercial inflection points. Advanced composite and high-strength polymer envelopes now deliver unprecedented durability while reducing weight, enabling designers to push the limits of structural integrity without compromising payload capacity. Meanwhile, progress in hybrid propulsion architectures-combining conventional fuel, electric motors, and emerging hydrogen-fuel cells-has significantly improved fuel efficiency and operational range. These technological leaps are accompanied by the integration of digital avionics suites, which facilitate automated flight control, predictive maintenance, and real-time mission planning, further enhancing the reliability and cost-effectiveness of airship operations.

Concurrently, a wave of strategic investments and public-private partnerships has accelerated market momentum. Governments across multiple regions are incorporating airships into defense modernization programs, scientific research campaigns, and environmental monitoring initiatives. In parallel, commercial operators are recognizing the value of these platforms for specialty logistics and advertising endeavors, leading to novel business models centered on rapid mobilization and low-altitude connectivity. This convergence of technical innovation and market demand is reshaping the competitive landscape, compelling incumbents and new entrants alike to refine their development roadmaps and forge collaborative ecosystems that bridge aerostructures, propulsion, and digital solutions.

Assessing Comprehensive Effects of 2025 United States Tariff Policies on Raw Materials, Component Sourcing, and Global Supply Chains in Airship Manufacturing

In 2025, revised United States tariff regulations have materially altered the cost structure for raw materials and critical components in airship manufacturing. Steel alloys, composite fabrics, and specialized polymers now attract elevated duties, driving manufacturers to recalibrate supplier networks and reassess procurement strategies. These changes have prompted nearshoring initiatives, as domestic producers pursue closer supply partnerships to mitigate both regulatory exposure and logistics volatility. At the same time, the elevated costs have incentivized innovation in material efficiency, with research teams accelerating development of next-generation envelope coatings that reduce dependency on high-tariff inputs.

Moreover, restrictions on imported avionics and propulsion systems have led to an uptick in strategic alliances and joint development agreements. Companies are increasingly sharing intellectual property to co-develop compliant solutions, thus diffusing the financial impact of expanded trade barriers. This collaborative approach not only spreads risk across multiple stakeholders but also fosters a more robust domestic ecosystem, capable of supporting future exports without incurring additional tariff liabilities. As a result, the industry is witnessing a shift from a reliance on global supply chains to a more regionally integrated manufacturing footprint, enhancing resilience against both geopolitical dynamics and sudden policy shifts.

Unveiling Market Segmentation Insights Across Platform, Propulsion, Product, Payload, Altitude, Application, and Customer Dimensions for Strategic Decisions

A nuanced understanding of airship market segmentation reveals critical avenues for targeted development and commercialization. In terms of platform typology, non-rigid airships provide cost-effective flexibility for applications requiring rapid deployment, whereas rigid designs-encompassing structured envelopes and traditional zeppelin-style craft-offer maximum lift and payload stability suited to long-duration missions. Semi-rigid variants bridge these extremes by integrating partial structural support with reinforced envelope sections, yielding balanced performance characteristics that appeal to both cargo transport and elevated observational tasks.

Propulsion choices further delineate market opportunities, as conventional fuel systems maintain dominance in heavy-lift scenarios, while electric propulsion gains traction in low-emission, short-range operations. Hybrid configurations-ranging from fuel-electric combinations to innovative fuel-hydrogen assemblies-are unlocking new mission profiles by delivering extended endurance without compromising environmental objectives. Product classification underscores another dimension, distinguishing manned cargo and passenger platforms from unmanned solutions that operate autonomously or under remote piloting for applications spanning surveillance, mapping, and asset delivery.

Payload capacity segmentation shapes development priorities by aligning designs with specific mission thresholds, from sub-500-kilogram packages that enable precision logistics to vehicles exceeding 1,000 kilograms for large-scale cargo lifts. Operating altitude distinctions-categorized into low, medium, and high regimes-directly influence aerodynamic design, envelope pressure management, and payload integration, guiding manufacturers toward optimized configurations. Application-driven segmentation highlights the importance of aligning platform capabilities with end-use scenarios, from immersive tourism and promotional flights to defense, security, scientific exploration, and commercial logistics. Finally, customer type segmentation underscores the divergent needs of commercial service providers, government agencies, and military operators, each demanding tailored reliability standards, certification pathways, and lifecycle support frameworks.

This comprehensive research report categorizes the Airships market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Propulsion Type

- Product Type

- Payload Capacity

- Operating Altitude

- Application

- Customer Type

Decoding Regional Dynamics and Growth Drivers Within the Americas, Europe Middle East Africa, and Asia Pacific Markets for Tailored Expansion Strategies

Regional dynamics in the airship sector exhibit pronounced variance driven by economic priorities and environmental considerations. In the Americas, adoption is led by defense and logistics stakeholders seeking resilient aerial solutions for remote supply chains and disaster relief operations. The vast geography and diverse terrain catalyze investments in heavy-lift and long-endurance designs, positioning North and South American developers as pioneers in operationalizing cargo-centric airship networks.

Across Europe, the Middle East, and Africa, emphasis has gravitated toward tourism, scientific research, and surveillance missions. European regulatory frameworks have facilitated the integration of low-emission airships into environmental monitoring programs, while Middle Eastern nations with expansive desert landscapes leverage sustained loiter capability for border security and resource exploration. In parallel, African research institutions are deploying specialized platforms for wildlife surveying and epidemiological studies, underscoring the region’s strategic utilization of airships for non-invasive scientific initiatives.

The Asia-Pacific market, propelled by dense urbanization and burgeoning e-commerce platforms, prioritizes rapid cargo delivery and last-mile connectivity. National innovation programs in Japan and Australia are testing high-altitude demonstrators for telecommunications relay and climate data collection, while Southeast Asian logistics providers pilot hybrid fleets to service archipelagic communities. This convergence of commercial ingenuity and public support is driving a multi-modal infrastructure approach that integrates airships with maritime and terrestrial networks, creating resilient supply chains tailored to the region’s complex geography.

This comprehensive research report examines key regions that drive the evolution of the Airships market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Established Providers Shaping the Competitive Airship Ecosystem Through Technological Advancements and Strategic Alliances

Leading aerospace integrators and agile startups alike are carving out distinct competitive positions in the evolving airship ecosystem. Established defense contractors are leveraging decades of aerostructure expertise to fast-track hybrid craft that satisfy stringent military certification requirements, while emerging innovators are capitalizing on flexible manufacturing processes and modular design philosophies to iterate rapidly on next-generation prototypes. Strategic joint ventures have become commonplace, linking envelope specialists with propulsion technology firms to co-develop turnkey solutions that meet cross-sector demand.

Simultaneously, concerted collaborations among technology providers are accelerating the maturation of core subsystems. For instance, alliances between battery technology pioneers and traditional fuel engine developers have produced hybrid powertrains that seamlessly switch energy sources in flight, optimizing efficiency across mission phases. In parallel, partnerships between avionics integrators and data-analytics companies are embedding advanced sensor fusion and machine-learning capabilities into airship control systems, enhancing situational awareness and enabling predictive maintenance protocols. This interplay of strategic investment, intellectual property sharing, and targeted R&D is shaping a dynamic competitive landscape characterized by both specialization and cross-disciplinary synergies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airships market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 21st Century Airships Inc.

- Aeros Corporation

- Airborne Industries Ltd.

- Airfloat Transport Ltd.

- Airship do Brasil Ltda.

- Airship Industries Ltd.

- AT2 Aerospace LLC

- Cargo Lifter GmbH & Co. KGaA

- GEFA-FLUG GmbH

- Hybrid Air Vehicles Limited

- Lindstrand Technologies Ltd.

- Lockheed Martin Corporation

- Oberpfaffenhofen’s LTA Research & Exploration LLC

- RosAeroSystems RAS OJSC

- Solar Ship Inc.

- TCOM L.P.

- Vantage Airship Co., Ltd.

- Worldwide Aeros Corporation

- Zeppelin Luftschifftechnik GmbH

- Zero 2 Infinity S.L.

Realizing Strategic Imperatives and Operational Tactics to Capitalize on Emerging Opportunities While Mitigating Risks in the Airship Industry Landscape

Industry leaders must embrace a portfolio approach that balances near-term operational deployments with long-horizon research initiatives. To secure competitive advantage, executives should prioritize the acceleration of hybrid propulsion programs and allocate resources toward emerging hydrogen-fuel cell technologies, enabling smoother regulatory approvals and early market presence. Concurrently, forming strategic alliances with envelope material innovators and avionics specialists will streamline certification paths and create integrated platform offerings that deliver seamless performance for end users.

In parallel, businesses should engage proactively with policymakers and standards bodies to influence technical guidelines and airspace integration protocols. By contributing empirical data from pilot programs and performance assessments, organizations can help shape a regulatory environment conducive to routine airship operations. Lastly, cultivating end-user partnerships across commercial logistics, tourism, and scientific research sectors will generate real-world use-cases that validate the unique value proposition of airships. This customer-centric approach will not only refine product roadmaps but also strengthen market positioning by demonstrating tangible benefits in cost, sustainability, and operational agility.

Ensuring Robust Insights Through a Rigorously Structured Research Methodology Incorporating Qualitative and Quantitative Analytical Frameworks

This research draws upon a blended methodology that integrates both qualitative insights and quantitative analysis to ensure robust and impartial findings. Primary data was gathered through structured interviews with senior executives, engineers, and procurement leads representing platform manufacturers, propulsion developers, and end-users across commercial, governmental, and defense segments. These firsthand perspectives were complemented by in-depth dialogues with regulatory authorities and aviation safety experts to contextualize certification trends and policy trajectories.

Secondary research involved systematic review of technical publications, patent filings, industry white papers, and regulatory filings, providing empirical benchmarks for material performance, propulsion efficiency, and flight test results. Quantitative modeling techniques, including risk-factor analysis and sensitivity assessments, were applied to evaluate the impact of tariff changes and supply-chain disruptions. Finally, data triangulation and validation workshops with subject-matter experts were conducted to refine conclusions and ensure alignment with real-world applications. This multi-layered approach delivers a comprehensive view of market dynamics while upholding the highest standards of analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airships market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airships Market, by Platform Type

- Airships Market, by Propulsion Type

- Airships Market, by Product Type

- Airships Market, by Payload Capacity

- Airships Market, by Operating Altitude

- Airships Market, by Application

- Airships Market, by Customer Type

- Airships Market, by Region

- Airships Market, by Group

- Airships Market, by Country

- United States Airships Market

- China Airships Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Drawing Conclusive Perspectives on the Transformative Potential and Strategic Trajectory of Airship Technologies in the Global Aerospace Context

The confluence of advanced materials, propulsion innovation, and strategic partnerships is propelling airships from niche curiosities into versatile assets within the global aerospace arsenal. By harnessing the unique capabilities of buoyant platforms-extended endurance, high payload efficiency, and reduced infrastructure requirements-stakeholders can address critical challenges in logistics, environmental monitoring, and security operations. The strategic trajectory outlined in this summary underscores the importance of agile development, policy engagement, and ecosystem collaboration in harnessing the transformative potential of airship technologies.

As the industry matures, organizations that diligently balance technological risk with market-driven innovation will lead the charge, forging new operational paradigms and unlocking sustainable value. Ultimately, the airship renaissance represents not only an evolution in flight mechanics but also a paradigm shift in how we conceptualize aerial mobility and its role in addressing the complex demands of the twenty-first century.

Secure Your Competitive Advantage by Engaging with Ketan Rohom to Access Premium Strategic Intelligence on Airship Market Insights Today

I invite you to advance your strategic positioning by connecting with Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly will grant you exclusive access to premium analytical frameworks, bespoke advisory sessions, and an opportunity to secure the comprehensive airship market research report tailored to your organization’s unique objectives. Reach out to explore customized subscription packages, schedule a private briefing, and discover how early adoption of these insights can fortify your competitive edge and catalyze sustainable growth in this rapidly evolving aerial industry

- How big is the Airships Market?

- What is the Airships Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?