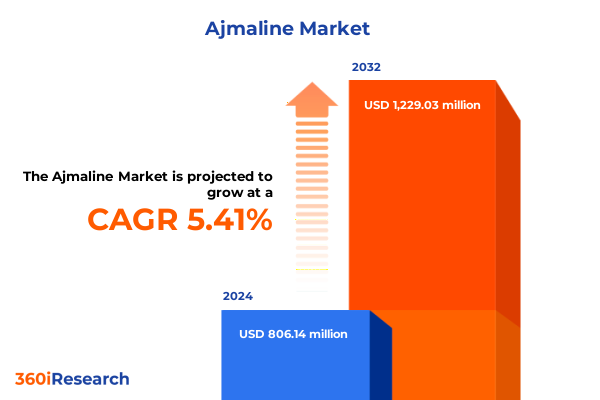

The Ajmaline Market size was estimated at USD 844.14 million in 2025 and expected to reach USD 890.70 million in 2026, at a CAGR of 5.51% to reach USD 1,229.03 million by 2032.

Exploring Ajmaline’s evolving influence in modern cardiology from its pharmacological foundations through its pivotal diagnostic applications against a backdrop of shifting global market forces

Ajmaline is a naturally occurring indole alkaloid belonging to the Class Ia antiarrhythmic family, primarily used to unmask latent Brugada syndrome patterns during electrophysiological testing. Originating from the roots of Rauvolfia serpentina and first isolated by Salimuzzaman Siddiqui in 1931, Ajmaline’s mechanism of action involves potent sodium channel blockade and hERG potassium channel interference, ultimately prolonging cardiac action potential and refractory periods on the electrocardiogram. This dual ion channel effect facilitates controlled provocation of arrhythmic events under monitored conditions, offering cardiologists a reliable diagnostic tool for patients with suspected sodium channelopathies.

Despite its well-established pharmacodynamics, Ajmaline’s global accessibility is shaped by its narrow therapeutic index, complex biosynthesis from botanical sources, and semisynthetic derivative development aimed at improving bioavailability. The challenge of standardizing alkaloid content in plant-derived APIs has prompted explorations into synthetic and biotechnological production routes, but high costs have thus far limited large-scale adoption. As a result, Ajmaline remains a specialized agent predominantly administered as Hydrochloride Injection at 100 mg and 200 mg dosages, with supplemental oral formulations in solution and tablet formats serving niche clinical scenarios.

Rapid technological advances, evolving clinical guidelines, and regulatory pivots are driving a transformative shift in the Ajmaline landscape across diagnostics, manufacturing, and patient care

Recent advances in cardiac imaging and electrophysiology have escalated the strategic importance of Ajmaline provocation testing. High-resolution cardiac magnetic resonance imaging platforms now pair Ajmaline administration with deformation imaging techniques, uncovering right ventricular functional abnormalities that correlate directly with arrhythmogenic substrates, thus elevating diagnostic precision for Brugada syndrome. Concurrently, updates in the 2022 European Society of Cardiology guidelines formally recognize Ajmaline as a first-line agent for provocative testing in individuals presenting with syncope or equivocal baseline ECG findings.

On the manufacturing front, process intensification technologies and enhanced quality control protocols have been introduced to mitigate batch variability inherent in botanical extraction. Advanced chromatographic purification and stability optimization measures are being adopted by select suppliers to ensure consistent API potency and safety. These shifts, coupled with digital supply chain monitoring tools, are redefining stakeholder expectations around Ajmaline’s reliability and availability.

Assessing how the 2025 United States tariff policies have cumulatively impacted Ajmaline’s supply chain resiliency, production costs, and market accessibility across global pharmaceutical networks

April 2025 marked a significant turning point as the United States implemented a baseline 10 percent global tariff on imported goods, encompassing active pharmaceutical ingredients critical to Ajmaline production. While broad exemptions for pharmaceuticals were initially considered, the blanket tariff remains applicable to associated packaging and ancillary materials, incrementally driving up overall treatment costs for diagnostic kits. In parallel, specific sectoral duties ranging from 20 to 25 percent on APIs sourced from China and India have created sustained upward pressure on Ajmaline API procurement costs, compelling manufacturers to reevaluate supplier portfolios and expand domestic sourcing initiatives.

These tariff measures have also accelerated conversations around onshoring and regional API hubs, with a growing number of specialty chemical firms exploring localized extraction partnerships in North America and Europe. However, the strategic realignment of supply chains requires extensive capital investment and regulatory approvals, posing short-to-mid-term operational hurdles. Ultimately, the cumulative impact of these trade policies has underscored the need for robust inventory buffers and multi-country sourcing strategies to safeguard clinical continuity.

Uncovering nuanced market segmentation perspectives for Ajmaline across product formats, administration routes, end user categories, distribution channels, and clinical indications

Insights into the Ajmaline market emerge from a multifaceted segmentation lens. By formulation type, the market spans Hydrochloride Injection in both 100 mg and 200 mg strengths, an Oral Solution at 2.5 mg/mL, and Oral Tablets in 50 mg and 100 mg dosages, each catering to specific clinical scenarios from acute electrophysiology labs to outpatient monitoring protocols. Route of administration further delineates Intravenous use for provocation testing and Oral delivery in solution or tablet form for less intensive diagnostic follow-ups.

Healthcare settings represent another dimension of market stratification: Ambulatory Surgical Centers and Clinics-which include both Cardiology-specialized and General practice facilities-rely on Ajmaline for workflow-driven ECG challenge tests, while Private and Public Hospitals maintain larger reserves for emergency and inpatient electrophysiology studies. Distribution channels encompass Hospital Pharmacies, Retail outlets, and rapidly expanding Online Pharmacy platforms, reflecting a transitional shift toward digital procurement for specialist cardiology drugs. Finally, clinical use cases bifurcate into Supraventricular Arrhythmia protocols and Ventricular Arrhythmia management, illustrating Ajmaline’s dual diagnostic and therapeutic roles in arrhythmia care.

This comprehensive research report categorizes the Ajmaline market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Route Of Administration

- End User

- Distribution Channel

- Indication

Revealing how regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific are uniquely influencing Ajmaline adoption, access, and strategic priorities

Regional dynamics exert a profound influence on Ajmaline adoption and strategic priorities. In the Americas, advanced cardiac care infrastructure and growing electrophysiology procedure volumes have driven consistent demand, particularly in the United States where specialized Brugada testing centers expand capacity in major academic hospitals. Europe, Middle East, and Africa exhibit heterogeneous uptake: Western Europe benefits from uniform ESC guideline adoption and robust reimbursement frameworks, while emerging EMEA markets experience uneven access due to logistical constraints and variable pharmacovigilance capabilities.

Across the Asia-Pacific region, rapid healthcare modernization and rising cardiovascular disease burdens in countries like China, Japan, and South Korea underpin steady growth for Ajmaline diagnostic applications. Nevertheless, remote and underserved APAC markets face last-mile temperature-controlled distribution challenges that threaten batch integrity. Tailored regional strategies-including centralized specialist hubs in metropolitan centers and telecardiology collaborations-are emerging as solutions to these disparities.

This comprehensive research report examines key regions that drive the evolution of the Ajmaline market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading industry players shaping the Ajmaline market through strategic manufacturing, distribution partnerships, and innovation in antiarrhythmic diagnostics

Ajmaline’s specialized nature has fostered a concentrated competitive environment among a small cadre of suppliers. Solvay and Lacer lead the marketing of the Gilurytmal brand in European markets, leveraging established hospital pharmacy networks and dedicated cardiology partnerships to ensure product consistency. Scandinavian Formulas, Inc. has emerged as a prominent U.S. supplier for Ajmaline API, bolstered by its GMP-certified production lines and flexible contract manufacturing services. In France, Extrasynthese maintains a niche role, supplying high-purity alkaloid extracts compliant with stringent EU botanical sourcing standards.

Smaller specialty chemical firms are capitalizing on clinical research demand, producing laboratory-grade Ajmaline for investigative applications, while new entrants explore semisynthetic analog development. However, leading global generics companies have not prioritized Ajmaline, citing limited treatment volumes and high regulatory barriers as deterrents. This competitive structure underscores opportunity for strategic partnerships and co-development models that can expand manufacturing scale and introduce cost efficiencies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ajmaline market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALKALOIDS PRIVATE LIMITED

- Central Drug House (P) Ltd

- Cipla Limited

- Dr. Reddy’s Laboratories Limited

- Fresenius Kabi AG

- Glentham Life Sciences Limited

- Intas Pharmaceuticals Limited

- MP Biomedicals

- North China Pharmaceutical Group Corporation

- Sandoz International GmbH

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Limited

- Torrent Pharmaceuticals Limited

- Viatris Inc.

Presenting targeted, pragmatic strategies for industry leaders to navigate Ajmaline supply challenges, regulatory complexities, and evolving clinical demand in 2025

To safeguard Ajmaline supply chains, industry leaders should pursue multi-tiered sourcing agreements that encompass both established botanical extractors and emerging semisynthetic API ventures. Strengthening relationships with logistic partners for temperature-controlled transport will mitigate degradation risks and ensure batch integrity in last-mile delivery.

Proactively engaging regulatory bodies to seek targeted tariff exemptions or carve-out provisions for critical electrophysiology reagents can alleviate pending cost burdens. Concurrently, investing in digital traceability platforms will enhance transparency across distribution channels, enabling real-time monitoring of inventory levels and cold-chain compliance.

Clinically, forging collaborative research initiatives with leading electrophysiology centers can generate real-world evidence on Ajmaline’s cost-effectiveness in reducing unnecessary device implants, strengthening payer engagement. Finally, continuous alignment with evolving ESC and AHA/ACC guidelines will maintain market relevance and support clinician adoption through accredited training programs.

Detailing the rigorous mixed-methods research approach employed to generate comprehensive insights into the Ajmaline market, ensuring data integrity and actionable outcomes

This analysis employs a robust mixed-methods research framework combining primary and secondary data collection. Expert interviews with electrophysiologists, supply chain managers, and regulatory consultants informed qualitative insights into clinical adoption patterns and tariff impacts. Simultaneously, secondary datasets were aggregated from public trade announcements, peer-reviewed journals, and customs databases to quantify policy changes and supplier profiles.

Data triangulation techniques validated conflicting inputs, while segmentation schemas were developed through iterative stakeholder workshops and cross-checked against transactional sales data where available. All biosynthesis, API cost, and distribution statistics were subjected to rigorous source verification to ensure accuracy. The research methodology prioritized transparency, with detailed documentation of assumptions, sampling criteria, and analytical models to facilitate reproducibility and support strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ajmaline market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ajmaline Market, by Type

- Ajmaline Market, by Route Of Administration

- Ajmaline Market, by End User

- Ajmaline Market, by Distribution Channel

- Ajmaline Market, by Indication

- Ajmaline Market, by Region

- Ajmaline Market, by Group

- Ajmaline Market, by Country

- United States Ajmaline Market

- China Ajmaline Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding analysis that synthesizes Ajmaline’s market dynamics, tariff implications, segmentation findings, and strategic imperatives for stakeholders in cardiovascular therapeutics

The Ajmaline market is characterized by its specialized clinical utility, intricate supply chains, and emerging geopolitical and regulatory challenges. Technological innovations in diagnostic electrophysiology have strengthened Ajmaline’s diagnostic value proposition, yet shifting U.S. tariff policies and variable regional logistics underscore the critical need for diversified sourcing and strengthened cold-chain infrastructure.

Segmented insights reveal that product type, administration route, clinical setting, channel dynamics, and indication profiles each play decisive roles in shaping market performance. Regional perspectives across the Americas, EMEA, and APAC highlight both opportunities and obstacles in establishing uniform access and meeting evolving cardiology standards. Key suppliers maintain leadership through focused manufacturing capabilities and strategic partnerships, while potential entrants weigh regulatory complexity against limited volume potential.

Moving forward, industry stakeholders must harmonize supply chain resilience, regulatory advocacy, and clinical evidence generation to sustain Ajmaline’s essential role in arrhythmia diagnostics. The strategic alignment of manufacturing scale-up, distribution modernization, and guideline-driven clinician engagement will be indispensable to drive future market growth and secure patient access.

Connect directly with Ketan Rohom to access bespoke Ajmaline market intelligence and actionable insights that drive strategic advantage

Driven by complex clinical, regulatory, and market dynamics, securing in-depth Ajmaline insights is critical for strategic decision-making. Ketan Rohom, Associate Director of Sales & Marketing, is available to tailor a comprehensive package that aligns with your organizational priorities. Engage directly to explore customizable data sets, expert analyses, and proprietary forecasts that will equip you to address supply chain vulnerabilities, tariff impacts, and evolving clinical guidelines. Contact Ketan today to accelerate your path to actionable intelligence and secure a competitive edge in the fast-evolving Ajmaline landscape.

- How big is the Ajmaline Market?

- What is the Ajmaline Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?