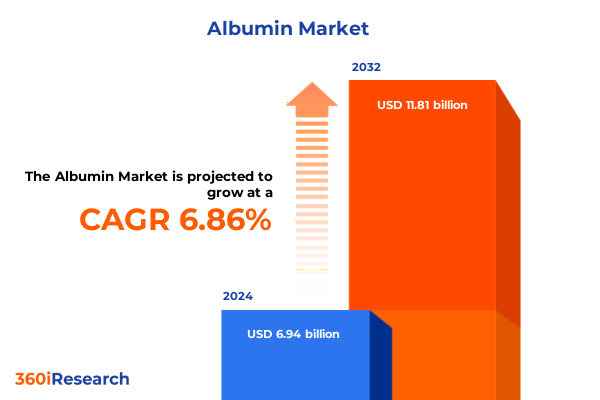

The Albumin Market size was estimated at USD 6.49 billion in 2025 and expected to reach USD 6.96 billion in 2026, at a CAGR of 7.51% to reach USD 10.78 billion by 2032.

Navigating the Evolving Albumin Landscape Through Unprecedented Applications and Strategic Industry Developments in the Global Bioprocessing Arena

Albumin, a versatile plasma protein with multifaceted applications, stands at the forefront of biopharmaceutical innovation. In recent years, this essential protein has assumed a pivotal role across diagnostic assays, advanced drug delivery systems, and cell culture supplements, fueling demand across both clinical and research settings. Transitioning from traditional sources such as bovine and human plasma-derived albumin to cutting-edge recombinant technologies, the industry has witnessed a profound shift in production paradigms, quality standards, and supply chain dynamics. Coupled with stringent regulatory oversight and a heightened emphasis on purity, albumin manufacturers are navigating increasingly complex landscapes to meet the exacting requirements of pharmaceutical companies and research institutions alike.

Moreover, the dynamic interplay between technological advancements in purification methods and evolving application scenarios has accelerated the emergence of new therapeutic modalities. As personalized medicine continues to gain momentum, albumin’s unique binding properties and biocompatibility have unlocked transformative opportunities in targeted drug delivery, biosimilar development, and diagnostic imaging. Consequently, decision-makers in pharmaceutical companies, diagnostic laboratories, and academic research centers are re-evaluating their sourcing strategies and formulation choices to capitalize on the latest breakthroughs.

Against the backdrop of shifting global trade policies, intensified competition among established producers and emerging players, and a rising emphasis on cost optimization, stakeholders are seeking deeper insights into segmentation, regional nuances, and competitive positioning. The following sections will delve into the transformative shifts in technology, the implications of new United States tariff measures in 2025, detailed segmentation perspectives across product types, formulations, grades, applications, end users, and sales channels, as well as regional and competitive analyses to inform strategic decision-making.

Unveiling the Dynamic Technological Breakthroughs and Regulatory Reforms Reshaping Global Albumin Production Purification and Quality Management Processes

Driven by rapid advancements in biotechnology, the albumin sector has undergone several transformative shifts in recent years. Recombinant DNA technologies have emerged as a viable alternative to plasma-derived sources, offering scalable, animal-free production platforms that mitigate supply risks and enhance batch-to-batch consistency. Concurrently, innovations in purification protocols, including high-resolution chromatography and ultrafiltration systems, have enabled manufacturers to achieve unprecedented levels of purity and endotoxin removal. These process improvements have not only reduced manufacturing timelines but also aligned production practices with evolving regulatory expectations for viral safety and bioburden control.

In addition, regulatory bodies worldwide have implemented rigorous guidelines to harmonize quality standards, with directives such as the International Council for Harmonisation’s Q5C guidelines and updated pharmacopoeial monographs reinforcing stringent specifications for albumin stability, potency, and impurity profiles. These reforms have catalyzed investments in digital quality management tools, process analytical technologies, and quality by design frameworks that facilitate real-time monitoring of critical process parameters. Transitioning to continuous processing and single-use bioreactor systems has further optimized production flexibility, enabling faster scale-up and reduced cross-contamination risks. As a result, industry stakeholders are better positioned to deliver higher-quality albumin products that meet the diverse demands of biosimilar developers, diagnostic entities, and research laboratories.

Assessing the Far-Reaching Consequences of Recent United States Tariff Adjustments on Albumin Supply Chains Costs and Competitive Dynamics in 2025

With the implementation of updated United States tariff measures on biopharmaceutical imports in 2025, albumin supply chains have encountered notable cost pressures and logistical complexities. These tariffs, which adjust duties on key intermediate reagents and finished protein products, have elevated landed costs for both plasma-derived and recombinant albumin. Consequently, pharmaceutical companies and diagnostic manufacturers are reevaluating their procurement strategies to mitigate the impact of increased import expenses on their operational budgets and product pricing structures.

In response, some market participants have shifted production closer to end-user markets, investing in domestic manufacturing facilities to qualify for duty exemptions under free trade agreements. Others have diversified their supplier base, sourcing albumin from regions with preferential tariff treatments or exploring local partnerships to benefit from reduced transport duties. While certain organizations have elected to absorb incremental costs to maintain market competitiveness, many are renegotiating long-term supply contracts to incorporate tariff adjustment clauses. Looking ahead, enhanced collaboration between regulatory authorities, trade associations, and industry stakeholders will be critical in advocating for harmonized tariff classifications and promoting resilient, cost-effective albumin supply networks in the United States.

Decoding Critical Market Segmentation Parameters to Illuminate Diverse Product Formulations Application Grades and Channel Strategies Driving Albumin Demand

In dissecting the albumin market through a segmentation lens, distinct patterns emerge across product types, formulations, grades, applications, end-user groups, and sales channels. For instance, plasma-derived bovine and human serum albumin continue to anchor diagnostic assays and cell culture feed formulations, while recombinant albumin is gaining traction in advanced drug delivery platforms due to its reduced viral risk profile. Formulation preferences also vary, with liquid albumin offering convenience for immediate use in infusion therapies, whereas lyophilized preparations provide enhanced shelf stability and simplified transport logistics.

Quality requirements further differentiate segments: diagnostic grade variants dominate laboratory testing workflows where consistent assay performance is paramount, pharmaceutical grade formulations underpin parenteral therapeutics and novel biosimilar candidates, and research grade albumin supports academic and industrial research initiatives. In application contexts, biosimilar developers prioritize grades that meet regulatory comparability criteria, diagnostic providers emphasize rapid solubility and purity, drug delivery innovators exploit albumin’s binding characteristics for targeted payload release, and research laboratories drive exploratory uses. End-user segmentation reveals that diagnostic centers and hospital settings rely heavily on established distribution networks, pharmaceutical companies increasingly adopt direct procurement models, and research laboratories leverage online sales platforms for small-volume requirements. Sales channel dynamics underscore the role of specialized distribution partners and hospital pharmacies in bulk supply, while retail pharmacies facilitate point-of-care access for consumer applications.

This comprehensive research report categorizes the Albumin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- Application

- End User

- Sales Channel

Unraveling Regional Market Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Uncover Distinct Growth Drivers and Challenges

Regional analysis of the albumin market uncovers distinct dynamics across the Americas, Europe, Middle East and Africa, and Asia-Pacific. In the Americas, robust infrastructure for biopharmaceutical manufacturing and a mature healthcare ecosystem have sustained strong demand for both plasma-derived and recombinant albumin. Innovative collaborations between US and Canadian firms have accelerated capacity expansions, while Latin American markets exhibit growing investment in local purification facilities to address increasing diagnostic and therapeutic needs.

Meanwhile, stakeholders in Europe, the Middle East and Africa are navigating diverse regulatory environments and trade frameworks. European Union member states benefit from harmonized pharmacopoeial standards, driving high-quality albumin production, whereas Gulf Cooperation Council countries leverage preferential trade agreements to source competitive blends from global suppliers. In sub-Saharan Africa, the emphasis remains on improving access through partnerships with nonprofit organizations to support diagnostic programs and basic healthcare solutions. Transitioning to the Asia-Pacific region, rapid market growth is spurred by rising clinical research activities in China and India coupled with Southeast Asian investments in biosimilar development. Key regional players are forging joint ventures to localize recombinant albumin manufacturing, and governments are incentivizing technology transfers to strengthen domestic capabilities.

This comprehensive research report examines key regions that drive the evolution of the Albumin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Portfolio Offerings Competitive Positioning and Collaborative Initiatives of Leading Albumin Producers Shaping Industry Trajectories

Examining the competitive landscape reveals that leading biopharmaceutical and life science companies are deploying strategic initiatives to fortify their position in the albumin arena. Major players with legacy expertise in plasma fractionation have expanded their portfolios to include recombinant offerings, integrating advanced purification modules and digital monitoring systems across their manufacturing lines. Meanwhile, specialized biotech firms are carving out niches through targeted R&D investments, leveraging genetic engineering to develop albumin variants optimized for drug conjugation and sustained-release formulations.

Collaborative ventures have become a hallmark of industry strategy, with cross-sector alliances between established contract development and manufacturing organizations and innovative biotech start-ups catalyzing novel application pathways. Some companies have pursued geographic diversification through acquisitions, acquiring regional purification facilities to secure localized supply chains and mitigate tariff exposure. Others have focused on strengthening sales networks by partnering with distribution specialists and hospital pharmacy chains to enhance market penetration. In parallel, research collaborations with academic institutions are accelerating next-generation albumin constructs, reinforcing the role of knowledge exchange as a driver of competitive differentiation in the protein therapeutics landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Albumin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CSL Limited

- Thermo Fisher Scientific Inc.

- Grifols, S.A.

- Merck KGaA

- Takeda Pharmaceutical Company Limited

- Kedrion Biopharma S.p.A.

- Sartorius AG

- Baxter International Inc.

- Shilpa Medicare Limited

- SeraCare Life Sciences Inc.

- Albumin Bioscience

- Biotest AG

- China Biologic Products, Inc.

- HiMedia Laboratories Pvt. Ltd.

- Hualan Biological Engineering Inc.

- LFB Group

- Medxbio Pte. Ltd.

- Miltenyi Biotec GmbH

- Octapharma AG

- Orion Corporation

- RayBiotech Inc.

- Ventria Bioscience Inc.

Empowering Industry Stakeholders with Practical Strategic Imperatives to Optimize Albumin Production Diversification and Regulatory Compliance for Growth

Industry leaders seeking to navigate the complex albumin market should prioritize a multifaceted approach that balances innovation with operational resilience. First, evaluating the transition from plasma-derived to recombinant albumin technologies can unlock supply chain flexibility, reduce biosafety risks, and position organizations for long-term cost efficiency. Simultaneously, investing in regional manufacturing or forging partnerships with local contract producers can mitigate the impact of tariff fluctuations and logistical bottlenecks.

Adopting advanced analytics and process analytical technology frameworks will enable real-time monitoring of critical quality attributes, enhancing batch consistency and expediting regulatory submissions. Engaging proactively with regulatory authorities to align on comparability protocols and impurity thresholds can preempt approval delays for new albumin-based products. Furthermore, establishing diversified supplier ecosystems - encompassing distribution partners, hospital pharmacies, online sales channels, and direct procurement models - will safeguard against single-source dependencies. Lastly, fostering collaborative research initiatives with academic and clinical partners will accelerate product innovation, ensuring that future formulations address emerging therapeutic and diagnostic demands while maintaining rigorous standards of safety and efficacy.

Detailing Rigorous Methodological Framework Incorporating Primary Interviews Secondary Analysis and Quality Assurance Protocols for Albumin Market Research

This report’s findings are grounded in a rigorous methodological framework that blends primary and secondary research to ensure comprehensive coverage and data integrity. Primary research activities included in-depth interviews with key opinion leaders, albumin production specialists, regulatory experts, and procurement managers at leading pharmaceutical and diagnostic companies. Insights from these discussions provided nuanced perspectives on technological trends, tariff implications, and segmentation priorities.

Complementing this, secondary analysis involved systematic review of scholarly articles, industry white papers, regulatory guidelines, and patent filings to contextualize market developments within the broader scientific and policy landscape. To validate data consistency, findings from diverse sources were cross-verified through triangulation techniques, ensuring that qualitative insights aligned with quantitative benchmarks. Quality assurance protocols were embedded throughout the research lifecycle, encompassing peer reviews of draft content, adherence to standardized taxonomy for segment definitions, and application of ethical guidelines for primary data collection. This robust approach underpins the credibility of the insights presented and supports their applicability to strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Albumin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Albumin Market, by Product Type

- Albumin Market, by Formulation

- Albumin Market, by Application

- Albumin Market, by End User

- Albumin Market, by Sales Channel

- Albumin Market, by Region

- Albumin Market, by Group

- Albumin Market, by Country

- United States Albumin Market

- China Albumin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Imperatives to Highlight the Future Trajectory of Albumin Industry Developments and Market Evolution

As the albumin market continues to evolve, stakeholders must remain agile in adapting to technological breakthroughs, regulatory reforms, and shifting trade policies. Core findings underscore the growing prominence of recombinant platforms, the critical influence of tariffs on supply chain strategies, and the diverse preferences across product grades, formulations, and end-user applications. These insights highlight strategic imperatives for manufacturers to refine their portfolios, optimize regional operations, and cultivate robust partnerships across the value chain.

Looking ahead, the trajectory of the albumin industry will be shaped by advances in molecular engineering, digital quality frameworks, and collaborative innovation ecosystems. Market participants that proactively align their R&D investments with emerging therapeutic and diagnostic needs, while maintaining supply chain resilience, will secure competitive advantages. Ultimately, a balanced focus on quality, cost-efficiency, and strategic diversification will determine which organizations lead the next wave of albumin-based solutions for healthcare and research markets.

Connect with Ketan Rohom to Empower Strategic Decision Makers Access In Depth Albumin Market Insights through a Comprehensive Industry Leading Research Report

To empower your organization with actionable intelligence on the albumin market, connect directly with Ketan Rohom, Associate Director of Sales and Marketing. He can provide a detailed overview of the report’s comprehensive insights on segmentation, regional dynamics, tariff impacts, and competitive strategies. Secure access to this indispensable resource to inform your strategic planning, investment decisions, and operational initiatives. Reach out today to discuss how a tailored licensing agreement can equip your team with the knowledge needed to navigate the evolving albumin landscape and capitalize on emerging opportunities.

- How big is the Albumin Market?

- What is the Albumin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?