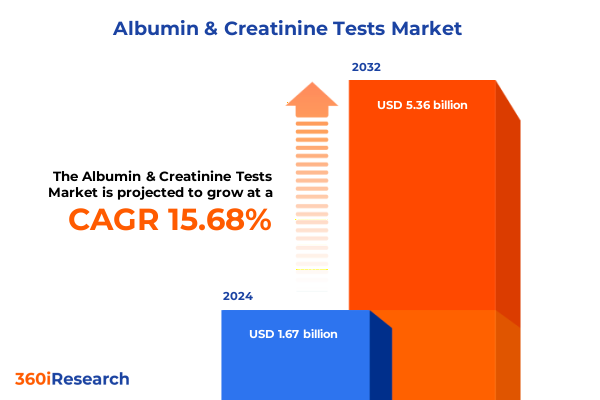

The Albumin & Creatinine Tests Market size was estimated at USD 1.91 billion in 2025 and expected to reach USD 2.20 billion in 2026, at a CAGR of 15.82% to reach USD 5.36 billion by 2032.

Introducing the Critical Role of Albumin and Creatinine Testing in Modern Healthcare Diagnostics and Patient Management

Albumin and creatinine testing serve as foundational pillars in the detection, monitoring, and management of renal and cardiovascular conditions. By quantifying protein excretion relative to creatinine clearance, clinicians gain critical insights into kidney integrity and early-stage dysfunction, enabling timely intervention that can prevent progression to chronic kidney disease. Furthermore, the ratio of albumin to creatinine functions as a potent prognostic biomarker in diabetes management and cardiovascular risk assessment, bridging laboratory diagnostics and personalized medicine approaches. As healthcare systems worldwide prioritize preventive care and cost containment, these tests assume heightened significance. They inform clinical decision-making at every level, from routine wellness evaluations to advanced risk stratification protocols in specialty clinics.

In parallel with their clinical utility, albumin and creatinine assays have become integral to quality benchmarks mandated by regulatory bodies and reimbursement frameworks. Laboratories and diagnostic centers are tasked with maintaining stringent performance criteria, driving demand for validated assay technologies and standardized workflows. Moreover, the surge in telehealth adoption and remote patient monitoring has catalyzed innovations in point-of-care testing platforms, expanding access to these critical diagnostics outside traditional hospital settings. Consequently, industry participants are navigating a dynamic environment shaped by evolving care delivery models, digital health integration, and heightened emphasis on patient-centric outcomes. This executive summary outlines the emerging trends, structural shifts, and strategic imperatives shaping the future trajectory of albumin and creatinine testing across diverse clinical and commercial contexts.

Mapping the Transformative Technological Advances and Clinical Drivers That Are Reshaping the Albumin and Creatinine Testing Landscape

Rapid technological advancements and shifting clinical paradigms are redefining the albumin and creatinine testing ecosystem. Cutting-edge immunoassay techniques, including enzyme-linked and turbidimetric methods, now deliver enhanced analytical sensitivity, enabling earlier detection of microalbuminuria in at-risk populations. Concurrently, high-performance liquid chromatography platforms have evolved with optimized column chemistries and faster run times, improving throughput for urine creatinine quantification with minimal sample preparation. Electrochemical detection systems, leveraging amperometric and potentiometric principles, have emerged as versatile options for both laboratory and point-of-care applications, offering seamless integration with digital interfaces and cloud-based analytics. These instrumentation breakthroughs are complemented by automation in sample handling and reagent dispensing, driving workflow efficiency gains in high-volume clinical laboratories.

Beyond instrumentation, shifts in healthcare delivery models further influence test adoption. The proliferation of ambulatory surgical centers, diagnostic chains, and independent laboratories has diversified access points, while regulatory bodies are harmonizing quality standards across settings. Telemedicine platforms now enable remote ordering and interpretation of albumin and creatinine assays, reinforcing the trend toward decentralized diagnostics. Artificial intelligence–driven algorithms overlay longitudinal patient data, predicting renal deterioration trajectories and customizing screening intervals. Patient-focused care initiatives incentivize regular monitoring, with health plans embedding albumin–creatinine ratio testing into value-based reimbursement schemes. Together, these transformative shifts underscore the convergence of technology, policy, and patient engagement, positioning albumin and creatinine testing at the forefront of preventive and precision medicine.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Production and Distribution of Albumin and Creatinine Diagnostic Tests

Recent tariff measures enacted by the United States government in early 2025 have introduced significant cost considerations for manufacturers and distributors of albumin and creatinine diagnostic assays. These duties apply to imported raw materials, reagents, and fully assembled testing kits, prompting industry players to reassess global supply chain configurations. As costs for key components rise, laboratories face upward pressure on per-test expenses, which can translate into reimbursement challenges under fixed fee schedules. In response, several equipment producers have initiated dual-pricing strategies, differentiating between domestic and imported product lines to mitigate margin erosion while preserving access to cutting-edge assay technologies.

Simultaneously, the tariffs have spurred renewed investment in local manufacturing capabilities. By establishing domestic reagent production facilities and reagent formulation centers, leading diagnostic companies aim to insulate themselves from import levies and logistical disruptions. This strategic pivot not only addresses tariff-driven cost inflation but also aligns with government incentives promoting onshore biomanufacturing. Nevertheless, the transition involves significant capital expenditure and extended timelines for regulatory approvals. Healthcare providers are monitoring these developments closely, balancing the benefits of supply security against the transition costs. Ultimately, the 2025 tariff landscape is catalyzing a structural reorganization of production and distribution networks in the albumin and creatinine testing market, shaping strategic priorities for manufacturers, laboratories, and policy stakeholders.

Unveiling Key Segmentation Insights Across Test Types, End Users, Technologies, Applications, Distribution Channels, and Sample Types in Diagnostic Testing

A nuanced understanding of market segmentation reveals critical vectors for competitive differentiation and targeted growth. Based on test type, analysis encompasses the albumin creatinine ratio test, the urine albumin test, and the urine creatinine test, each distinguished by its analytical focus on relative protein excretion and renal clearance markers. This classification underpins assay development, as technologies are tailored to address specific sensitivity and dynamic range requirements. In examining end-user segmentation, the market spans ambulatory surgical centers, clinical laboratories, diagnostic centers, and hospitals. Ambulatory surgical centers are further differentiated into multi specialty and single specialty facilities, reflecting varied procedural volumes and testing portfolios. Clinical laboratories occupy both hospital-based and independent channels, with the former benefiting from integrated care pathways and the latter offering flexible service models. Diagnostic centers operate as chain or stand-alone units, balancing standardized protocols against localized customer engagement, while hospitals are categorized into private and public institutions, each subject to distinct budgeting and procurement processes.

Technological segmentation adds another dimension, with colorimetric assay platforms including both dipstick and microplate formats and electrochemical detection methods subdivided into amperometric and potentiometric systems. High-performance liquid chromatography advances are partitioned into ion exchange and reverse phase chromatography modalities, while immunoassays leverage ELISA and turbidimetric techniques. Application-based stratification spans cardiovascular disease monitoring, chronic kidney disease detection, diabetes tracking, hypertension monitoring, and comprehensive risk assessment programs. Distribution channels unfold across direct sales-delivered through field force and telemarketing networks-distributor resellers comprised of medical device and pharmaceutical distribution partners, and online channels accessed via e-commerce platforms and mobile application portals. Finally, from a sample type perspective, the market distinguishes between 24-hour urine and spot urine specimens, each presenting unique logistics and patient compliance implications. This multi-layered segmentation framework informs product positioning, distribution strategies, and service offerings throughout the value chain.

This comprehensive research report categorizes the Albumin & Creatinine Tests market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Product Type

- Specimen Type

- Mode of Testing

- Application

- End User

Highlighting Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia Pacific in Albumin and Creatinine Testing

Regional dynamics play an instrumental role in shaping the strategic landscape of albumin and creatinine testing. Within the Americas, the United States and Canada maintain sophisticated diagnostic networks, buoyed by favorable reimbursement environments and widespread adoption of electronic health record integration. Latin America, while exhibiting rising demand driven by increasing prevalence of diabetes and hypertension, contends with uneven infrastructure and variable regulatory frameworks, prompting stakeholders to adopt hybrid service models that combine centralized assay processing with remote sample collection.

Across Europe, Middle East & Africa, established markets in Western Europe benefit from stringent quality standards and advanced point-of-care testing penetration, whereas Eastern European countries are advancing through targeted funding initiatives aimed at modernizing laboratory infrastructure. Middle Eastern nations exhibit strategic partnerships with multinational diagnostic firms to expand local testing capabilities, and selected African regions are witnessing pilot programs that leverage mobile health units for community-based screenings.

In the Asia-Pacific region, rapid urbanization and demographic shifts underpin market growth. Japan and Australia have mature reimbursement systems supporting routine albumin–creatinine assessments, while China and India represent high-volume laboratories investing heavily in local manufacturing and reagent development. Southeast Asian markets display strong uptake of point-of-care solutions in primary care settings, and a proliferation of telehealth platforms is enhancing remote monitoring. Government-led chronic disease management programs across the region prioritize early detection, creating significant opportunities for integrated diagnostic and digital health solutions tailored to diverse healthcare delivery models.

This comprehensive research report examines key regions that drive the evolution of the Albumin & Creatinine Tests market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Innovation and Competitive Positioning in Albumin and Creatinine Test Markets

Market leadership within albumin and creatinine diagnostics is characterized by ongoing innovation, strategic alliances, and portfolio optimization. A major global diagnostics company has intensified its efforts in immunoassay research, launching enhanced ELISA kits that deliver lower detection limits and improved reagent stability. Partnerships with university research centers have accelerated the development of next-generation electrochemical sensors, paving the way for portable devices capable of real-time data transmission.

Another prominent life sciences conglomerate has expanded its chromatography division to include high-throughput HPLC modules with automated calibration features, addressing the needs of large clinical laboratories facing stringent regulatory audits. This entity’s collaboration with software developers has produced integrated data management platforms that streamline result reporting and compliance documentation. Meanwhile, a specialized clinical diagnostics provider has prioritized the ambulatory surgical and point-of-care segments, deploying cloud-enabled microplate readers that facilitate batch testing across decentralized sites.

Smaller agile companies are also making strategic inroads. One innovator has introduced microfluidic dipstick assays optimized for spot urine samples, reducing reagent volumes and waste while maintaining clinical sensitivity. Another has formed distribution alliances with pharmaceutical wholesalers to expand access to reagent kits in emerging markets. Across the competitive landscape, research and development investments remain focused on assay robustness, user-friendly interfaces, and interoperability with laboratory information systems, underscoring a collective drive toward enhanced diagnostic accuracy and workflow efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Albumin & Creatinine Tests market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abcam PLC by Danaher Corporation

- Anamol Laboratories Pvt. Ltd.

- Arbor Assays Inc.

- ARKRAY, Inc.

- Aviva Systems Biology Corporation

- Bio-Rad Laboratories, Inc.

- BTNX Inc.

- Cleveland Clinic

- Eagle Biosciences, Inc.

- F. Hoffmann-La Roche AG

- Fujifilm Corporation

- House Of Diagnostics

- Labcorp Holdings Inc

- Merck KGaA

- Metropolis Healthcare Limited

- Nova Biomedical Corporation

- Practo Technologies Private Limited

- Quantimetrix Corporation

- QuidelOrtho Corporation

- Randox Laboratories Ltd.

- Randox Laboratories Ltd.

- RayBiotech, Inc.

- Sekisui Medical Co., Ltd.

- Siemens AG

- Sysmex Europe SE

- Teco Diagnostics, Inc.

- Thermo Fisher Scientific Inc.

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Challenges in Diagnostic Testing

To capitalize on emerging growth vectors, industry leaders should prioritize investments in integrated diagnostic platforms that unify immunoassay, electrochemical, and chromatography modalities under a single interoperable software ecosystem. This approach will facilitate seamless data sharing across clinical settings, reduce time to result, and support value-based care initiatives. Concurrently, establishing dual supply chain frameworks that blend domestic reagent production with strategic international partnerships can mitigate the impact of potential tariff fluctuations and logistical disruptions.

Additionally, companies should deepen engagement with ambulatory surgical centers and independent laboratories through specialized training programs and service-level agreements that emphasize assay validation, technical support, and workflow optimization. Strategic alliances with telehealth providers and digital health startups will unlock new channels for remote test ordering and patient self-collection, bolstering market penetration in underserved regions. Investing in miniaturized point-of-care devices and microfluidic technologies can address patient compliance challenges associated with 24-hour urine collections by enabling accurate spot urine analysis, thereby improving testing adherence.

Finally, proactive participation in regulatory working groups and disease management consortiums will strengthen advocacy for standardized quality criteria and reimbursement codes. By aligning product development roadmaps with evolving clinical guidelines and value-based reimbursement models, diagnostic manufacturers and service providers can enhance their competitive positioning and ensure sustained relevance in a rapidly transforming healthcare landscape.

Outlining the Rigorous and Multidimensional Research Methodology Underpinning Insights in the Albumin and Creatinine Testing Market Analysis

The insights presented in this executive summary are grounded in a rigorous, multidimensional research methodology designed to ensure accuracy, relevance, and strategic applicability. Secondary research involved an exhaustive review of regulatory filings, clinical practice guidelines, and peer-reviewed literature to capture evolving analytical techniques and quality standards. This was complemented by an extensive scan of public company disclosures, patent databases, and industry white papers to contextualize technological advancements and strategic partnerships.

Primary research included structured interviews with over fifty clinical laboratory directors, point-of-care testing specialists, and supply chain executives across key geographic markets. These qualitative engagements provided firsthand perspectives on operational challenges, investment priorities, and regulatory considerations affecting albumin and creatinine testing. Quantitative data were validated through triangulation of proprietary survey results, laboratory performance benchmarks, and public health statistics on renal disease prevalence.

Data synthesis employed advanced analytical frameworks to segment the market by test type, end user, technology, application, distribution channel, and sample type, ensuring a comprehensive understanding of demand drivers and competitive dynamics. A quality assurance process involving cross-functional peer review and expert validation safeguarded the credibility of findings. This methodological rigor underpins the actionable intelligence designed to inform strategic decision-making for manufacturers, distributors, and healthcare providers alike.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Albumin & Creatinine Tests market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Albumin & Creatinine Tests Market, by Test Type

- Albumin & Creatinine Tests Market, by Product Type

- Albumin & Creatinine Tests Market, by Specimen Type

- Albumin & Creatinine Tests Market, by Mode of Testing

- Albumin & Creatinine Tests Market, by Application

- Albumin & Creatinine Tests Market, by End User

- Albumin & Creatinine Tests Market, by Region

- Albumin & Creatinine Tests Market, by Group

- Albumin & Creatinine Tests Market, by Country

- United States Albumin & Creatinine Tests Market

- China Albumin & Creatinine Tests Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Concluding Strategic Takeaways Emphasizing the Strategic Imperatives and Future Outlook for Albumin and Creatinine Testing Stakeholders

As the diagnostic landscape evolves, albumin and creatinine tests will remain central to patient care pathways for early detection of renal impairment and chronic disease management. The confluence of technological innovation, decentralized testing models, and dynamic policy environments underscores the need for adaptable strategies across the value chain. Stakeholders must navigate tariff considerations, regulatory shifts, and fragmented demand drivers while maintaining focus on accuracy, efficiency, and patient accessibility.

Key segmentation insights highlight the importance of tailoring offerings to specific clinical and operational contexts-from high-throughput HPLC applications in hospital laboratories to portable electrochemical assays for ambulatory and home-based settings. Regional dynamics reinforce the significance of localized manufacturing, reimbursement alignment, and digital health integration, particularly in markets with nascent infrastructure or rapidly expanding patient populations. Competitive profiling reveals that ongoing R&D investments, strategic partnerships, and software-enabled solutions will differentiate market leaders, driving both innovation and scale.

Ultimately, the future of albumin and creatinine testing will be shaped by collaborative efforts among manufacturers, laboratories, payers, and regulators. By embracing integrated technologies, diversified supply chains, and patient-centric models, industry participants can elevate diagnostic accuracy, enhance clinical outcomes, and foster sustainable growth in an increasingly complex healthcare ecosystem.

Engage Directly with an Expert to Access Comprehensive Albumin and Creatinine Testing Market Intelligence and Drive Strategic Business Outcomes

For organizations seeking unparalleled depth in their understanding of the albumin and creatinine testing landscape, direct engagement with an experienced market research professional offers the most efficient pathway to actionable insights and strategic clarity. Ketan Rohom, Associate Director of Sales & Marketing, is poised to guide decision-makers through the comprehensive report, providing tailored support that aligns data-driven findings with specific business objectives. Whether refining product development roadmaps, optimizing distribution networks, or assessing competitive positioning, this consultative interaction ensures an accelerated return on investment and equips stakeholders with the necessary intelligence to navigate evolving regulatory frameworks and tariff environments. Reach out to initiate a personalized briefing that unlocks detailed market stratification, advanced segmentation analysis, and nuanced regional dynamics exclusively compiled in the full research dossier. This direct dialogue facilitates customized data extracts, supplemental slide decks, and priority responses to bespoke queries, empowering companies to seize emergent opportunities and reinforce resilience against industry headwinds.

- How big is the Albumin & Creatinine Tests Market?

- What is the Albumin & Creatinine Tests Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?