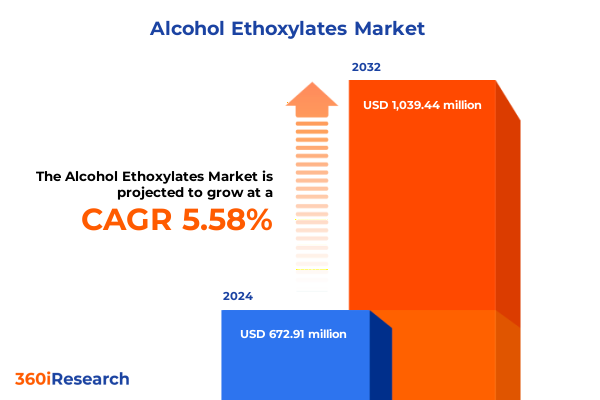

The Alcohol Ethoxylates Market size was estimated at USD 709.59 million in 2025 and expected to reach USD 754.90 million in 2026, at a CAGR of 5.60% to reach USD 1,039.43 million by 2032.

Unveiling the Critical Role of Alcohol Ethoxylates as Non‐Ionic Surfactants Powering Diverse Industrial and Everyday Consumer Applications Worldwide

Alcohol ethoxylates are a class of non-ionic surfactants produced through the ethoxylation of fatty alcohols with ethylene oxide. This reaction yields molecules with a hydrophobic alkyl tail and a hydrophilic ethoxylate head, enabling them to reduce surface tension between liquids and solids. Their tunable ethoxylate chain length allows manufacturers to precisely balance solubility and performance requirements across a broad array of applications.

The production of alcohol ethoxylates involves blowing ethylene oxide into a fatty alcohol under controlled temperature and pressure conditions, typically around 180 °C and 1–2 bar, in the presence of a potassium hydroxide catalyst. This highly exothermic process demands precise heat management to prevent runaway reactions, and technological advances have improved reactor design and safety controls over recent decades.

Their versatility is reflected in widespread use across household detergents, dishwashing products, fabric softeners, industrial cleaners such as equipment and process cleaners, specialized sanitizers, oilfield chemical emulsifiers, personal care formulations like shampoos and lotions, agrochemical adjuvants, and textile processing aids. Their ability to emulsify oils, wet surfaces, and disperse solids makes them indispensable in both consumer and industrial settings.

Environmental and safety considerations have driven a shift toward naturally derived feedstocks. Biodegradable grades of alcohol ethoxylates derived from plant-based fatty alcohols minimize ecological impact, and their acute toxicity is generally low, though trace amounts of 1,4-dioxane-an ethoxylation byproduct-are carefully monitored and removed through advanced purification techniques. This commitment to ecological stewardship supports their continued adoption in markets with stringent environmental regulations.

Navigating a Landscape Transformed by Sustainability, Innovation, and Technology Driving the Future of Non‐Ionic Surfactant Production

The alcohol ethoxylates landscape is undergoing transformative shifts fueled by mounting sustainability imperatives. Manufacturers are increasingly sourcing renewable feedstocks such as seed oils and agricultural byproducts to develop biodegradable, low-toxicity surfactants that align with consumer demand for eco-friendly formulations. This transition is reshaping supply chains, with closed-loop recycling of surfactant materials and green chemistry principles becoming core to production strategies.

Technological innovation is further accelerating this transformation. Enzymatic catalysis and microbial fermentation processes are emerging as viable alternatives to traditional base-catalyzed ethoxylation. These biocatalytic approaches operate under milder conditions, reducing energy consumption and greenhouse gas emissions while delivering high-purity products. Hybrid synthesis methods that integrate bio-based and petrochemical feedstocks are also gaining traction, offering flexibility to scale up sustainable surfactant production without compromising performance.

Leading chemical producers are launching next-generation product lines tailored for high-growth segments. For example, Dow’s ECOSURF™ SA series utilizes seed-oil derivatives to deliver robust wetting and detergency performance in household and industrial cleaners while ensuring rapid biodegradation. These offerings demonstrate how innovation can reconcile stringent environmental targets with demanding application requirements.

At the same time, compliance with evolving regulatory frameworks is compelling rapid portfolio evolution. Stricter guidelines on surfactant toxicity, aquatic safety, and greenhouse gas reporting are driving proactive reformulation efforts. Companies that seamlessly integrate sustainable design into their R&D pipelines are positioned to capture market share as environmental compliance increasingly becomes a competitive advantage.

Examining the Far‐Reaching Consequences of 2025 United States Tariff Policies on Raw Material Costs and Supply Chains for Alcohol Ethoxylates

The United States’ 2025 tariff regime has introduced layered duties across key chemical import sources, imposing a baseline 10% tariff on most imports, 25% on goods from Canada and Mexico, 10% on Chinese imports with reciprocal levies reaching up to 54%, and higher “reciprocal” rates for select trading partners. These measures aim to address trade imbalances but have significantly elevated raw material costs for alcohol ethoxylate manufacturers, prompting concerns over cost pass-through and supply chain reliability.

Industry organizations such as the Society of Chemical Manufacturers and Affiliates (SOCMA) have cautioned that these additional duties could disrupt established supply chains and heighten operational expenses. Specialty chemical producers relying on imported ethylene oxide and fatty alcohol feedstocks anticipate margin pressure, with some reporting the need to reassess long-term supply agreements in light of abrupt rate changes.

Global exporters are already feeling the ripple effects. Brazilian chemical companies have seen U.S. customers cancel orders ahead of anticipated 50% tariffs on select exports, triggering financing challenges and contract renegotiations. This pre-emptive market shift underscores the broader uncertainty created by fluctuating trade policies and the potential for redirected trade flows toward alternative markets.

To mitigate these impacts, major surfactant manufacturers are accelerating domestic capacity expansions and forging local partnerships. Some multinationals have announced plans to ramp up U.S. production capabilities, prioritizing investments in local alkoxylation and ethoxylation hubs to safeguard supply continuity and reduce exposure to volatile tariff schedules.

Deep Insights into Market Segmentation Revealing How End‐Use Industries, Product Types, Distribution Channels and Physical Forms Drive Demand

The market for alcohol ethoxylates is dissected through a multifaceted segmentation framework that illuminates the diverse pathways to growth. Based on end-use industry, applications in agrochemicals leverage surfactant properties for pesticide and fertilizer dispersion, while the household care sector harnesses detergent, dishwashing, and fabric softener formulations to meet consumer hygiene expectations. In industrial cleaning, specialized grades tailored for equipment maintenance, process cleaning, and sanitization ensure compliance with rigorous operational standards. Beyond these, oilfield chemicals exploit emulsion control, personal care products benefit from mildness and foaming attributes, and textile processors rely on wetting and softening functionalities to optimize fabric treatments.

Product type segmentation by carbon chain length further differentiates performance. The C12-14 ethoxylates balance hydrophilicity and lipophilicity to achieve broad formulation compatibility. C14-16 grades excel in heavy-duty cleaning applications where enhanced oil emulsification is required. Meanwhile, C9-11 ethoxylates find niche roles in personal care and specialty industrial formulations demanding rapid biodegradation and low irritation profiles.

Distribution channel analysis reveals a dual-track commercial model. Business-to-Business customers often engage through direct sales agreements or distributor networks to secure consistent bulk supply. Conversely, Business-to-Consumer channels are served via eCommerce platforms, modern trade outlets, and traditional retail, reflecting shifting consumer purchasing behaviors toward online and value-added retail experiences.

Physical form segmentation distinguishes liquid grades, prized for ease of formulation and dosing accuracy, from solid forms valued for transport efficiency and storage stability. These diverse formats enable suppliers to tailor offerings to end-user preferences and logistical constraints, reinforcing the importance of a segmented approach for market participants.

This comprehensive research report categorizes the Alcohol Ethoxylates market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Physical Form

- End Use Industry

- Distribution Channel

Exploring Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia‐Pacific Shaping Alcohol Ethoxylates Adoption Trends

Regional markets for alcohol ethoxylates display distinct characteristics shaped by local regulatory, economic, and industrial dynamics. In the Americas, stringent environmental regulations from bodies like the U.S. Environmental Protection Agency have spurred demand for biodegradable, plant-derived ethoxylates. North American manufacturers are pioneering green feedstock initiatives, and strong consumption in household care and personal hygiene categories underscores the region’s mature appetite for sustainable formulations.

Europe, the Middle East, and Africa are influenced by robust regulatory frameworks under REACH and emerging national chemical safety mandates. European companies invest heavily in emission control technologies and eco-label compliance to maintain market access. Meanwhile, Middle Eastern and African markets are expanding use in industrial cleaning and oilfield applications due to infrastructure development and rising maintenance standards, creating pockets of rapid growth within a regulation-driven landscape.

Asia-Pacific stands out as a global manufacturing hub with surging demand across multiple end uses. Rapid urbanization and rising disposable incomes in China, India, and Southeast Asia are fueling consumption in household care and personal care segments. Governments in key markets offer incentives for bio-based chemical production, and investments in downstream oleochemical capacity in countries such as Indonesia further bolster supply chain resilience. This confluence of demand and production capability positions Asia-Pacific as a central driver of the global alcohol ethoxylates market.

This comprehensive research report examines key regions that drive the evolution of the Alcohol Ethoxylates market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Revolutionizing Alcohol Ethoxylates Production and Supply Networks

Major chemical companies are advancing their strategic positions through capacity expansions, technology partnerships, and specialized product launches. Dow has introduced its ECOSURF™ SA series of nonionic surfactants, leveraging seed-oil based materials to deliver high performance in cleaning and textile applications while ensuring rapid biodegradation. This line exemplifies a broader pivot toward sustainable, bio-derived surfactants that meet both performance and ecological criteria.

Stepan Company recently commenced operations at its new alkoxylation hub in Pasadena, Texas, adding an annual capacity of 75,000 metric tons for ethoxylates and propoxylates. Located on the U.S. Gulf Coast, this facility mitigates supply chain risk by providing proximity to key feedstocks and logistical networks. The investment underscores Stepan’s commitment to enhancing manufacturing flexibility and delivering reliable supply to agricultural, oilfield, cleaning, and personal care customers.

Clariant, Evonik, Huntsman, and other leading surfactant producers are similarly investing in process intensification, narrow-range ethoxylation technologies, and digitalization of supply chain operations. These collective efforts aim to drive cost efficiencies, reduce energy consumption, and accelerate time to market for customized surfactant grades tailored to emerging application requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alcohol Ethoxylates market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AkzoNobel N.V.

- BASF SE

- ChemPoint by Univar Solutions Inc.

- Clariant AG

- Dow Chemical Company

- Enaspol A.S.

- Evonik Industries AG

- Haihang Group

- India Glycols Limited

- Julius Hoesch GmbH & Co. KG

- Kemipex

- Matangi Industries

- Mitsui Chemicals Group

- Nouryon Chemicals (Ningbo) Co., Ltd.

- Oxiteno S.A.

- Royal Dutch Shell PLC

- Sasol Limited

- Saudi Basic Industries Corporation

- Solvay Group

- Stepan Company

- Thai Ethoxylate Co., Ltd.

Actionable Strategies for Industry Leaders to Capitalize on Growth Opportunities and Mitigate Risks in the Evolving Surfactant Landscape

Industry leaders should prioritize investment in sustainable feedstock research, accelerating the shift from petrochemical-based inputs to renewable oleochemical sources. Collaborative R&D with feedstock suppliers and academic institutions can yield novel bio-based ethoxylation pathways that lower carbon footprints and enhance product differentiation.

Diversifying geographic production footprints through strategic capacity expansions will mitigate exposure to volatile tariff regimes and supply chain disruptions. Establishing multiproduct alkoxylation hubs near raw material access points will improve cost resilience and shorten lead times.

To capture evolving consumer preferences, companies must innovate across product portfolios. Developing narrow-range ethoxylates with specific viscosities and environmental profiles for personal care, household care, and industrial cleaning applications will drive premium positioning.

Engagement with policymakers and industry associations can shape balanced regulatory frameworks. Proactive alignment with global chemical safety standards will facilitate smoother market access and bolster corporate reputation.

Embracing digital supply chain tools-from predictive demand planning to real-time inventory monitoring-will optimize distribution channel performance, enhance customer responsiveness, and improve operational efficiency.

Comprehensive Research Methodology Underpinning Robust Data Collection, Analysis, and Validation for Alcohol Ethoxylates Insights

This research combined a rigorous blend of primary and secondary methodologies. Primary data collection involved in-depth interviews with senior executives across surfactant producers, raw material suppliers, distributors, and end-use representatives. These qualitative insights were supplemented by quantitative surveys capturing purchase criteria, cost pressures, and investment plans.

Secondary research encompassed a comprehensive review of public filings, technical whitepapers, regulatory databases, and industry association publications. Data triangulation was employed to reconcile discrepancies and validate trends across multiple sources.

The market segmentation, regional analysis, and competitive landscape profiles were developed through iterative data synthesis and expert validation workshops. Forecast assumptions and tariff impact assessments were tested against real-world case studies and supply chain scenarios.

Analytical models incorporating cost of goods sold, production capacity utilization, and tariff rate schedules underpinned scenario planning. Supplemental sensitivity analyses evaluated the effects of raw material price volatility and regulatory changes on profitability and supply chain stability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alcohol Ethoxylates market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alcohol Ethoxylates Market, by Product Type

- Alcohol Ethoxylates Market, by Physical Form

- Alcohol Ethoxylates Market, by End Use Industry

- Alcohol Ethoxylates Market, by Distribution Channel

- Alcohol Ethoxylates Market, by Region

- Alcohol Ethoxylates Market, by Group

- Alcohol Ethoxylates Market, by Country

- United States Alcohol Ethoxylates Market

- China Alcohol Ethoxylates Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing Conclusions on Key Drivers, Challenges, and Strategic Imperatives Defining the Alcohol Ethoxylates Market Evolution

The alcohol ethoxylates landscape stands at the intersection of sustainability momentum, regulatory tightening, and geopolitical complexity. Biodegradable, bio-based surfactant grades are redefining competitive dynamics, compelling producers to integrate green chemistry principles into core operations.

While tariff barriers in 2025 have elevated input costs and prompted trade realignments, they have simultaneously spurred domestic capacity investments and strategic partnerships that enhance supply chain resilience. Market participants adept at navigating these headwinds through localized production and diversified sourcing will emerge advantaged.

Segmentation insights reveal that tailored product offerings across end-use industries, carbon chain lengths, distribution channels, and physical forms are critical to capturing differentiated value. Distinct regional drivers-from EPA-led environmental mandates in the Americas to regulatory governance under REACH in EMEA and demand surges in Asia-Pacific-underscore the need for nuanced go-to-market strategies.

Leading companies are leveraging capacity expansions, digital supply chain innovations, and targeted R&D to consolidate market leadership. However, sustained success will hinge on agility, collaborative innovation, and proactive engagement with evolving policy frameworks.

Connect with Ketan Rohom to Secure the Full Market Research Report and Empower Your Strategic Decisions in Alcohol Ethoxylates

To explore the full spectrum of insights, detailed analysis, and strategic guidance contained in the comprehensive Alcohol Ethoxylates Market Research Report, connect with Ketan Rohom, Associate Director, Sales & Marketing, to learn more about pricing, licensing options, and customized research packages that will empower your decision-making and drive your business forward

- How big is the Alcohol Ethoxylates Market?

- What is the Alcohol Ethoxylates Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?