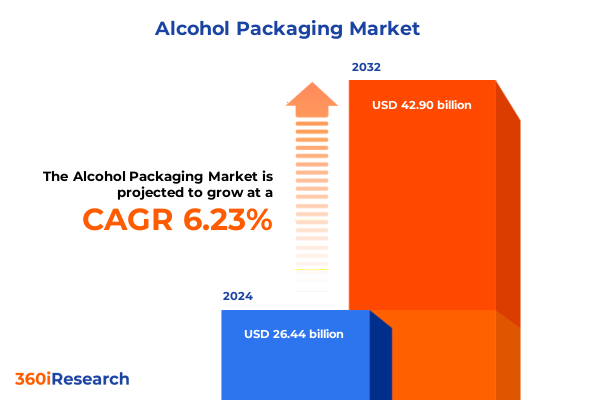

The Alcohol Packaging Market size was estimated at USD 28.02 billion in 2025 and expected to reach USD 29.71 billion in 2026, at a CAGR of 6.27% to reach USD 42.90 billion by 2032.

Exploring the Critical Intersection of Consumer Demand Sustainability Standards and Technological Innovation Impacting Alcohol Packaging

The global alcohol packaging sector stands at the convergence of evolving consumer expectations, heightened regulatory scrutiny, and rapid technological advancement. Within this multifaceted environment, brands must balance the desire for striking, premium designs with mounting calls for sustainable practices. As consumers increasingly prioritize environmental integrity alongside product experience, packaging decisions have become central to brand differentiation and long-term loyalty.

Moreover, the shift toward direct-to-consumer channels and the expansion of e-commerce have created fresh imperatives for packaging that protects products during transit while reinforcing brand narratives at the point of unboxing. Industry stakeholders now face a dual mandate: optimize supply chain efficiency and minimize carbon footprints, even as packaging innovations serve as key touchpoints within digital and physical retail ecosystems.

Understanding the interplay between material science developments, emerging closure technologies, and evolving labeling approaches is essential for market players seeking to capture share and anticipate regulatory dynamics. This introduction frames the broader context in which packaging strategies operate, outlining the key drivers of change and positioning the subsequent sections to delve into transformative shifts, tariff impacts, segmentation insights, regional dynamics, and recommended action points.

Uncovering the Pivotal Shifts Reshaping Alcohol Packaging Through Digitalization Sustainability and Changing Consumer Engagement Models

In recent years, digital printing capabilities have unlocked on-demand customization and enhanced storytelling through high-resolution graphics, enabling brands to engage consumers with personalized experiences directly on packaging surfaces. Concurrently, the circular economy model has gained momentum, with refillable glass loops and recycled plastic resins emerging as viable solutions to reduce environmental impact. This transition reflects growing regulatory mandates that target single-use plastics and encourage extended producer responsibility schemes.

Meanwhile, the rapid growth of ready-to-drink formats has driven new packaging choices, particularly aluminum cans that offer portability, recyclability, and strong shelf visibility. Simultaneously, smart packaging applications-ranging from QR codes to NFC tags-have empowered brands to establish direct lines of communication with end users, enhancing traceability and enabling interactive marketing campaigns.

Taken together, these developments signal a fundamental realignment of the alcohol packaging landscape, where sustainability, digital engagement, and format innovation converge to shape consumer perceptions and supply chain strategies. Industry participants must navigate these transformative forces to deliver packaging that resonates with modern audiences, aligns with policy landscapes, and supports operational resilience.

Assessing the Compound Effects of United States Tariff Adjustments on Alcohol Packaging Supply Chains Pricing and Market Strategies

Since early 2025, tariff adjustments implemented by U.S. authorities have applied additional duties to imported aluminum and steel packaging substrates, prompting suppliers to reevaluate global sourcing arrangements and cost structures. These measures, introduced amid broader trade negotiations, have incrementally increased landed expenses for aluminum cans and steel containers, driving many stakeholders to consider alternative materials or localized manufacturing solutions.

As a result of these cumulative duties, supply chains have experienced heightened complexity, with importers negotiating surcharges and navigating evolving customs protocols. Some producers have accelerated investments in domestic facilities to insulate against further tariff volatility, while others have explored glass and paperboard systems that remain exempt from added levies. This strategic pivot underscores a broader industry trend toward localization, as companies seek to mitigate geopolitical risks and secure stable access to critical packaging components.

Looking ahead, the prospect of further trade policy shifts underscores the importance of supply chain agility. Brands and converters must maintain close monitoring of tariff schedules and cultivate diversified supplier relationships to manage cost pressures effectively. In this dynamic environment, proactive planning and scenario modeling emerge as essential tools to sustain profitability and ensure uninterrupted production.

Deriving Strategic Insights from Material Format Pack Size Closure and Label Segmentation Trends Driving Alcohol Packaging Evolution

When examining the market through the lens of material segmentation, distinct growth trajectories become evident. Glass packaging spans nonreturnable, refillable, and returnable formats, each serving unique beverage categories-from single-serve craft spirits to premium returnable wine bottles. Aluminum cans and steel cans, within the metal category, have surged in popularity for their lightweight and fully recyclable nature, particularly in the burgeoning ready-to-drink segment. Within paperboard, boxboard and cartons offer economical, lightweight options for wine and bulk formats, while plastic-encompassing HDPE bottles and PET bottles-remains indispensable for flavored malt beverages and entry-level spirits seeking cost efficiencies.

Considering format segmentation, bag-in-box solutions have retained strong appeal among value-oriented wine consumers, while bottles-both glass and plastic-continue to dominate mainstream spirits packaging. Cans, divided into aluminum and steel varieties, have emerged as a dynamic canvas for innovation in RTD cocktails and craft beers, and cartons provide a lightweight, sustainable alternative for select wine and cider products.

Assessment of pack size trends reveals a diverse marketplace: smaller 251–500 mL formats cater to on-the-go consumption, 501–750 mL serves as the industry standard for spirits, volumes above 750 mL address communal occasions, and up to 250 mL miniatures facilitate sampling and portable experiences. Closure preferences range from classic corks to crown caps and screwcaps, each signaling quality levels while balancing cost and convenience. Label innovations, spanning glue-applied, in-mold, pressure-sensitive, and sleeve options, allow brands to optimize visual appeal, tamper evidence, and production throughput.

Integrating these segmentation insights illuminates opportunities for targeted product launches and optimized packaging portfolios. By aligning material choices with consumer behaviors and regulatory landscapes, stakeholders can refine their offerings to maximize market resonance and operational efficiency.

This comprehensive research report categorizes the Alcohol Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Format

- Pack Size

- Closure Type

- Label Type

Illuminating Regional Dynamics Across the Americas EMEA and Asia-Pacific That Influence Alcohol Packaging Preferences and Regulatory Approaches

The Americas market exhibits robust demand for premium spirits packaged in heavy-weight glass, yet aluminum cans and PET bottles have charted an impressive trajectory within the hard seltzer and RTD cocktail categories. In North America, tax incentives for recycled content have further fueled investments in reclaimed PET and aluminum recycling infrastructure, enabling a closed-loop supply chain in select regions.

Across Europe, Middle East and Africa, extended producer responsibility mandates are accelerating the shift toward light-weight glass and refillable systems, particularly within Western Europe’s wine sector. Meanwhile, Eastern European markets are leveraging affordable steel cans and boxboard solutions for value-oriented beverage segments. In the Middle East, luxury spirits producers emphasize ornate closures and premium sleeve labeling to reinforce brand heritage.

In Asia-Pacific, dynamic urbanization and rising disposable incomes have driven exponential growth in single-serve RTD packaging, where aluminum and PET formats enjoy widespread adoption for their convenience and recyclability. Regional packaging regulations in Japan and South Korea are pioneering high-efficiency recycle-ready designs, while Australia emphasizes reusable glass loops for craft and boutique producers. Southeast Asian markets combine cost sensitivity with sustainability ambitions, adopting a mix of paperboard and plastic innovations to balance performance and environmental stewardship.

These regional dynamics underscore the importance of customizing packaging strategies to local regulatory contexts, consumer preferences, and supply chain infrastructures. By tailoring material and format selections to each market’s unique drivers, companies can optimize adoption rates and enhance brand relevance.

This comprehensive research report examines key regions that drive the evolution of the Alcohol Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Packaging Providers and Brand Innovators Steering the Alcohol Packaging Sector Through R&D Partnerships and Sustainability

Leading glass container manufacturers have doubled down on lightweighting initiatives, leveraging advanced mold designs to reduce carbon intensity while maintaining structural integrity for high-end spirits. Metal packaging titans have expanded capacity for aluminum can production, integrating recycled content streams and digital printing lines to accommodate shorter runs and premium graphics. Paperboard innovators are investing in barrier coatings that extend shelf life for wine and cider without compromising recyclability, while plastic bottle specialists pursue biobased and mechanically recycled PET to meet escalating sustainability targets.

At the brand level, major beverage groups are piloting reusable packaging programs in select markets, partnering with converters and logistics providers to orchestrate returnable glass loops. Concurrently, independent craft brands are adopting pressure-sensitive labels and shrink sleeves to elevate visual storytelling, often collaborating with specialized label converters to achieve intricate embellishments and tactile finishes.

Technology firms offering smart packaging platforms have seen rising adoption, embedding QR codes and near field communication markers into closures and labels to connect consumers with immersive brand experiences. Additionally, cross-sector alliances among material suppliers, recycling coalitions, and beverage companies are fostering take-back schemes, underscoring a collective drive toward circularity.

By closely monitoring these partnerships and investments, industry participants can identify emerging best practices, foster strategic joint ventures, and prioritize collaborations that reinforce both brand equity and sustainability objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alcohol Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGI Glaspac Ltd

- Amcor plc

- Ardagh Group S.A.

- Ball Corporation

- Beatson Clark Ltd

- Berlin Packaging LLC

- Berry Global Group, Inc.

- Crown Holdings, Inc.

- DS Smith plc

- Gerresheimer AG

- Glassworks International Ltd.

- Huhtamäki Oyj

- Krones AG

- Mondi Group plc

- O-I Glass, Inc.

- Orora Group Ltd

- Smurfit Kappa Group plc

- Stora Enso Oyj

- Tetra Pak International S.A.

- Verallia S.A.

- Vetropack Holding Ltd

- WestRock Company

Mapping Actionable Strategies for Packaging Leaders to Capitalize on Sustainability Localization and Customer-Centric Innovation Imperatives

Industry leaders should prioritize investment in sustainable material alternatives that align with emerging regulatory frameworks and consumer expectations for low-impact packaging. By conducting lifecycle assessments and engaging with recyclers early in the design phase, businesses can preempt potential compliance challenges and signal commitment to circular economy principles. Moreover, localizing production through regional manufacturing hubs can reduce exposure to tariff fluctuations, shorten lead times, and support community-based circular infrastructure.

Simultaneously, embracing digital printing and modular production technologies enables shorter run lengths without cost penalties, supporting limited-edition launches and personalization initiatives that resonate with modern consumers. Integrating smart tags and QR codes within packaging ecosystems also fosters direct consumer engagement, enabling brands to gather real-time insights and drive loyalty programs.

Given the growth of e-commerce and direct-to-consumer channels, packaging designs must emphasize damage resistance and unboxing experiences that reinforce brand narratives. Collaboration between packaging engineers, marketing teams, and logistics partners is critical to balance structural performance with aesthetic appeal.

Finally, forging strategic alliances with material innovators, label suppliers, and technology providers can expedite the development of next-generation packaging solutions. By proactively piloting novel materials and tracking pilot outcomes, leaders can scale successful innovations more rapidly and fortify their competitive advantage in an evolving market.

Detailing a Rigorous Multi-Method Research Framework Combining Primary Data Expert Interviews and Comprehensive Secondary Analysis

This report synthesizes insights derived from a rigorous methodology combining primary and secondary research approaches. Primary data collection involved in-depth interviews with senior executives across the value chain, including packaging designers, material suppliers, brand marketers, regulators, and supply chain managers. These interviews provided nuanced perspectives on emerging trends, pain points, and innovation pipelines.

Secondary research encompassed an exhaustive review of industry publications, trade association reports, regulatory documents, and patent filings to contextualize market developments within broader technological and policy landscapes. In addition, proprietary shipment and customs databases were analyzed to trace the trajectory of material flows and tariff impacts.

Quantitative analysis employed segmentation models across material, format, pack size, closure, and label type to identify usage patterns and growth vectors. Scenario planning exercises were conducted to assess the implications of potential regulatory changes and trade policy shifts. Throughout the study, findings were validated through peer review by subject matter experts to ensure accuracy, relevance, and comprehensiveness.

By integrating qualitative narratives with robust quantitative assessments, this research delivers actionable intelligence that reflects both current realities and forward-looking projections for the global alcohol packaging sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alcohol Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alcohol Packaging Market, by Material

- Alcohol Packaging Market, by Format

- Alcohol Packaging Market, by Pack Size

- Alcohol Packaging Market, by Closure Type

- Alcohol Packaging Market, by Label Type

- Alcohol Packaging Market, by Region

- Alcohol Packaging Market, by Group

- Alcohol Packaging Market, by Country

- United States Alcohol Packaging Market

- China Alcohol Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights on Navigating Future Alcohol Packaging Challenges and Opportunities Amid Regulatory Sustainability and Technological Change

In conclusion, the alcohol packaging industry stands at a pivotal juncture defined by the convergence of sustainability mandates, technological innovation, shifting consumer behaviors, and evolving trade policies. Materials choices now transcend aesthetics, serving as tangible commitments to environmental stewardship and brand purpose. Digital printing, smart packaging, and e-commerce-aligned designs have become integral to engaging modern audiences while safeguarding product quality.

The cumulative impact of recent tariff adjustments has underscored the need for supply chain agility and localization, prompting many stakeholders to reconsider global sourcing strategies and embrace alternative substrates. Simultaneously, segmentation insights illuminate clear opportunities to tailor packaging solutions-whether through lightweight glass, recycled aluminum cans, or barrier-enhanced paperboard-to diverse consumer occasions and regulatory frameworks.

Regional dynamics further reinforce the importance of customized approaches, as varying EPR regulations, recycling infrastructures, and cultural preferences dictate material adoption and format popularity. Collaboration among converters, brands, and technology providers will be essential to scale circular solutions and accelerate industry transition toward net-zero pathways.

Overall, companies that embed sustainability as a core tenet of packaging innovation, while maintaining a relentless focus on consumer engagement and supply chain resilience, will be best positioned to thrive in this rapidly evolving market environment.

Empowering Your Packaging Decisions with Expert Guidance by Reaching Out to the Sales and Marketing Associate Director for Full Report Access

To secure a comprehensive and in-depth understanding of the alcohol packaging landscape and position your organization for strategic advantage, we invite you to connect directly with Ketan Rohom, the Associate Director of Sales and Marketing. Through an insightful conversation, you can explore tailored findings that address your specific challenges and objectives, enabling you to leverage the full power of the report’s actionable insights and recommendations. Engaging with the Associate Director ensures you receive personalized guidance on how to translate the intelligence within this research into concrete steps that resonate with your operational priorities and market ambitions. Don’t miss the opportunity to access the complete market research report and gain the critical context needed to drive innovation, optimize your packaging strategies, and outperform competitors in an increasingly dynamic global environment. Reach out today to discover how this cutting-edge analysis can inform your next move and help you capture emerging growth pockets across segments and regions.

- How big is the Alcohol Packaging Market?

- What is the Alcohol Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?