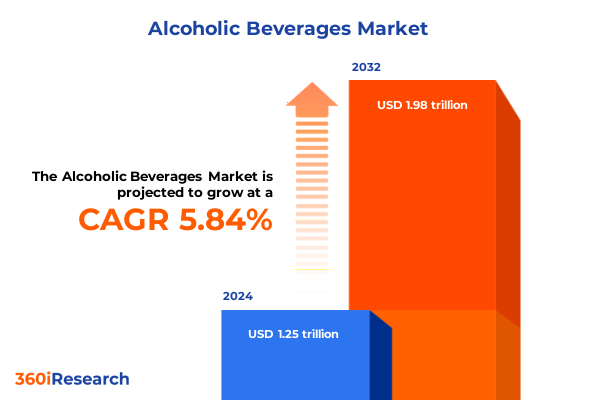

The Alcoholic Beverages Market size was estimated at USD 1.32 trillion in 2025 and expected to reach USD 1.40 trillion in 2026, at a CAGR of 5.88% to reach USD 1.98 trillion by 2032.

A strategic orientation that distills market dynamics into decision-ready insights for commercial leaders navigating consumer, regulatory, and supply chain complexities

The alcoholic beverages landscape is at a pivotal intersection of consumer preference evolution, regulatory flux, and innovation-driven category reconfiguration. This executive summary synthesizes critical themes and actionable intelligence to equip decision-makers with a concise yet substantive view of the forces shaping strategy today. It frames the immediate structural shifts, highlights how trade policy shocks are altering supply chains, and surfaces segmentation- and region-specific implications that matter for portfolio, pricing, and distribution choices.

Beginning with a clear articulation of current drivers, the analysis connects macro-level influences to on-the-ground commercial realities. It examines how consumer tastes-often expressed through demand for premium experiences, lower-alcohol options, and convenient formats-are interacting with operational constraints such as packaging supply, channel economics, and cross-border trade measures. The goal is to present a holistic narrative that supports strategic prioritization without diluting the granular clarity teams need to act. As you proceed through the summary, expect a blend of strategic framing, targeted insights for product and channel leaders, and pragmatic recommendations designed to convert intelligence into measurable outcomes.

How consumer sophistication, channel transformation, packaging imperatives, and supply chain resilience are converging to rewrite competitive playbooks across alcoholic beverage categories

Recent years have witnessed transformative shifts that have redefined competitive advantage across the alcoholic beverages sector. Consumers are migrating beyond binary preferences, blending interest in premium provenance with demand for lower-alcohol and ready-to-consume formats; this dual trajectory has increased the premiumization runway while simultaneously opening volume opportunities in convenience-oriented segments. Converging with consumer-level change, brands are responding with innovation in spirit variants, wine style extensions, and beer formulations, which in turn are reshaping assortments across hospitality, specialty retail, and digital storefronts.

Meanwhile, structural change in distribution and retail is accelerating. Online alcohol retailing has matured from a niche convenience to a core channel for trial and repeat purchase, while the traditional three-tier systems and brick-and-mortar partners continue to control critical shelf presence and event-driven consumption. In addition, packaging is becoming a strategic lever: format choices affect unit economics, consumer perception of quality, and sustainability commitments, leading many organizations to reprioritize packaging roadmaps and supplier relationships. Lastly, supply chain resilience and sourcing flexibility have moved to the top of the agenda. Companies are investing in diversified sourcing and inventory strategies to mitigate volatility in raw material pricing, container availability, and logistical disruptions. Collectively, these shifts demand integrated strategies that link portfolio architecture, channel economics, and supply-side contingencies into a single operating playbook.

A clear-eyed assessment of how 2025 transatlantic tariff measures and policy threats have shifted landed costs, assortment decisions, and distributor economics across beverage categories

Trade policy developments in 2025 introduced a material layer of uncertainty for cross-border beverage flows and reallocated risk across value chains. A transatlantic tariff settlement reached in mid-2025 established a baseline tariff on a broad set of goods including certain alcoholic beverages, creating new cost vectors for import-dependent portfolios and shifting negotiating leverage among suppliers, distributors, and on-premise operators. This settlement includes a U.S. tariff framework that applied a general 15 percent rate to many EU-origin products, a change that has required immediate commercial recalibration among importers and hospitality partners.

In parallel, political rhetoric and policy threats earlier in the year-most prominently the public announcement in March 2025 of an intention to consider dramatically higher ad valorem measures on selected European wines and spirits-triggered short-term market dislocations. That threat prompted many U.S. importers, retailers, and hospitality buyers to pause replenishment activity or defer investment decisions while seeking clarity on potential duty exposure and contractual commitments. The announcement itself intensified bargaining over exemptions and accelerated government-to-government engagement, increasing the time horizon for certainty and elevating the cost of inventory decisions.

The cumulative impact is not uniform across the sector. Products that depend on fine-margin distribution and brand equity-particularly premium European wines and certain high-value spirits-are most exposed to tariff-driven price elasticity in the U.S. market. Retailers and on-premise operators have signaled concern that steep import levies would erode category breadth and reduce consumer choice, in some instances prompting temporary suspension of purchases until the trade posture clarified. The desire to maintain assortment balance during a highly promotional period has strained distributor margin models and increased pressure on domestic sourcing alternatives. Trade associations and industry groups have actively sought carve-outs and transitional mechanisms to limit downstream disruption and preserve critical supply relationships.

Forward-looking commercial teams should view tariff exposure as an operational stress test rather than a binary existential risk. Short-term tactics include re-evaluating landed-cost models, implementing dynamic pricing protocols that preserve retail and on-premise volume, and negotiating temporary margin-sharing arrangements with suppliers. On a medium-term horizon, companies should double down on portfolio diversification-spanning origin, format, and alcohol-content tiers-to create demand elasticity that is less concentrated against any single trade-exposed source. Finally, active engagement with trade bodies and coalition-building across supplier and importer networks remains essential to secure exemptions, phase-in relief, or other policy mitigants; these advocacy efforts have already begun to shape negotiation priorities in 2025.

How aligning product taxonomy, packaging strategy, alcohol-content cohorts, and distribution channel economics creates a resilient portfolio and go-to-market advantage

Segment-level clarity is the foundation for effective category strategy, and a disciplined segmentation lens reveals where risk and opportunity intersect across beverages. When products are considered by type-beer, spirits, and wine-the commercial dynamics differ sharply: beer often competes on frequency and packaging economics, spirits compete on brand storytelling and variant innovation with subcategories such as brandy, gin, rum, tequila, vodka, and whiskey each following distinct trajectory drivers, and wine competes on provenance and format experimentation. Thus, portfolio choices must align product development, pricing, and channel placement to the behavior profile of each category.

Packaging choices are equally consequential. Pack formats such as bottles, cans, and tetra packs carry implications for consumer perception, logistical costs, and sustainability positioning. Within the bottle format, the distinction between glass and plastic alters both unit economics and premium signaling, influencing where a SKU is best deployed across on-premise, specialist retail, and mass-channel environments. Packaging decisions should therefore be treated as strategic levers that influence distribution eligibility, promotional cadence, and environmental messaging.

Alcohol content segmentation-high, medium, and low-has become a meaningful predictor of consumer journeys and channel preference. High-alcohol offerings often align with premiumization and occasion-centric consumption, medium-alcohol products sit in the mainstream core and balance value with experience, while low-alcohol innovations capture health-conscious or daytime-consumption occasions. Aligning assortment and marketing investments to these alcohol-content cohorts enables clearer trade promotion calculus and better matches with consumer lifetime value objectives.

Distribution channel segmentation also shapes commercial choices: offline and online pathways require different margins, merchandising strategies, and promotional mechanics. Offline distribution remains diverse, encompassing convenience stores, hotels/restaurants/bars, liquor stores, specialist stores, and supermarket/hypermarket channels, each with unique assortment rules and shopper economics. Online distribution, meanwhile, accelerates trial, subscription models, and data-driven reordering, but demands fulfillment sophistication and compliance management. A winning go-to-market model weaves product, packaging, alcohol-content, and channel segmentation into a coherent route-to-consumer that optimizes for margin, growth, and resilience.

This comprehensive research report categorizes the Alcoholic Beverages market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Alcohol Content

- Ingredient Base

- Production Method

- Packaging Type

- Pack Size

- Distribution Channel

Regional demand, regulatory complexity, and channel maturity across the Americas, Europe Middle East & Africa, and Asia-Pacific require differentiated commercial playbooks for sustainable growth

Regional dynamics continue to create asymmetric opportunity and risk for beverage companies, and a region-specific lens is essential for prioritization. Across the Americas, consumption patterns are being reshaped by premiumization in urban centers, the growth of convenient formats in everyday retail, and evolving on-premise recovery patterns; these features encourage mixed investments in brand-led premium offers and high-velocity packaged formats to capture both occasion and convenience-driven demand.

In Europe, Middle East & Africa, the picture is more heterogeneous: mature Western European markets emphasize provenance, appellation integrity, and sustainability claims, while emerging markets within the region show faster growth potential for mainstream beer and spirits as urbanization and channel modernization proceed. Regulatory and tax complexity across the region also increases the importance of localized trade and distribution strategies, particularly where duty regimes or import rules create asymmetric cost structures.

The Asia-Pacific region remains strategically vital for long-term premium growth and innovation diffusion. Consumer openness to new formats, high-growth travel retail corridors, and a rising middle class that prizes brand discovery provide fertile ground for premium spirits and alternative low-alcohol formats. However, success requires localized taste adaptation, compliance with varied regulatory regimes, and careful orchestration of omnichannel distribution to reconcile modern e-commerce dynamics with entrenched retail behaviors. Taken together, these regionally distinct characteristics necessitate differentiated commercial playbooks that allocate investment according to channel maturity, regulatory risk, and consumer trajectory.

This comprehensive research report examines key regions that drive the evolution of the Alcoholic Beverages market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive leaders are reshaping capability investments across portfolio architecture, digital channel mastery, and supply-side partnerships to convert insight into defensible advantage

Leading companies are consolidating strengths along three complementary vectors: portfolio architecture that balances premium and accessible core SKUs, channel-centric capabilities that prioritize data and logistics for online and mass channels, and supply-side flexibility that hedges against trade and input shocks. Market leaders are increasing investment in direct-to-consumer infrastructure and digital CRM to capture first-party data and reduce dependence on intermediary margins, while at the same time deepening partnerships with traditional distributors to preserve on-premise presence and event-driven sales.

In parallel, mid-tier and specialty players are leveraging agility and storytelling to capture niche premium segments and local provenance advantages. These firms often excel at rapid product iteration and targeted experiential marketing, which enables them to win disproportionate shelf space in specialist stores and curated online marketplaces. Across the competitive spectrum, sustainability and packaging innovation are rising to the top of board-level agendas, with companies aligning carbon and circularity goals to both cost management and consumer-facing brand differentiation.

Finally, collaboration models are changing: co-packing agreements, strategic sourcing alliances, and shared logistics platforms are becoming pragmatic tools to reduce capital intensity while preserving speed to market. These arrangements allow companies of different scales to access modern filling and distribution capabilities without duplicative capital expenditures, creating a more modular industry structure where capability rather than scale alone determines competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alcoholic Beverages market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ANHEUSER-BUSCH INBEV SA/NV

- Asahi Group Holdings, Ltd.

- Bacardi Limited

- Beijing Yanjing Brewery Co., Ltd

- Boston Beer Corporation

- Brown-Forman Corporation

- Cargill, Incorporated

- Carlsberg A/S

- China Resources Beer (Holdings) Company Limited

- Constellation Brands, Inc.

- Davide Campari-Milano N.V.

- Diageo PLC

- E. & J. Gallo Winery

- Heineken N.V.

- HiteJinro Co., Ltd

- Integrated Beverage Group LLC

- KWEICHOWMOUTAI CO., LTD

- Molson Coors Beverage Company

- Pernod Ricard S.A.

- Precept Wine, LLC

- Rémy Cointreau

- Sazerac Company, Inc.

- Spirited Cocktails Corporation

- Sula Vineyards Limited

- Suntory Holdings Limited

- The Edrington Group Limited

- The Kirin Holdings Company, Limited

- Treasury Wine Estates Ltd.

- Tsingtao Brewery Company Limited

- Union Wine Company

- Vinarchy

- William Grant & Sons Limited

- Wuliangye Yibin Co., Ltd

Practical strategic moves for commercial leaders to safeguard margins, preserve assortment, and capture premium growth in the face of trade and channel volatility

Industry leaders should prioritize a set of integrated actions that protect margins while enabling growth. First, accelerate development of multi-origin portfolios that combine domestic production strengths with selective imported prestige, thereby insulating assortment from trade shocks while preserving consumer choice. Second, embed dynamic pricing and promotional governance across channels to ensure margin resilience when landed costs shift unexpectedly. These capabilities include rapid repricing mechanisms tied to landed-cost inputs and collaborative commercial terms with distributors to share near-term disruptions.

Third, commit to packaging roadmaps that optimize total cost of ownership and brand positioning; this means balancing the premium signaling of glass with the unit-cost and sustainability advantages of lightweight or alternative formats in appropriate channels. Fourth, invest in direct digital-to-consumer capabilities and first-party analytics to reduce customer-acquisition friction and to better understand occasion-based consumption patterns. This data advantage will increase speed-to-market for innovations and improve SKU rationalization decisions.

Lastly, engage proactively in policy and trade forums while building scenario-based contingency plans for supply and sourcing. By marrying advocacy with operational preparedness-such as alternative sourcing agreements, flexible filling capacity, and inventory hedging-companies can convert trade volatility into a competitive differentiator rather than a recurring source of margin erosion. These actions, taken together, create a pragmatic, defensible path to durable growth in an uncertain policy environment.

A rigorous mixed-methods research approach combining stakeholder interviews, distributor consultations, documentary analysis, and scenario testing to underpin recommendations

The research behind this executive summary combined qualitative interviews, primary stakeholder consultations, and triangulated secondary research to create a robust evidence base. Primary inputs included structured interviews with category managers, trade partners, and leading on-premise operators to surface operational pain points, procurement behaviours, and assortment priorities. These interviews were complemented by retailer and distributor consultations that illuminated the practical implications of landed costs, promotional cycles, and compliance burdens.

Secondary research and documentary review were used to contextualize those primary signals within broader industry and policy dynamics. This entailed systematic review of trade announcements, regulatory filings, and industry commentary to ensure that the analysis reflected the most recent developments affecting cross-border flow and channel mechanics. In addition, scenario analysis and sensitivity testing were applied to common commercial levers-pricing, assortment, packaging-to identify resilient tactics under a range of policy and cost shocks. Throughout, the methodology emphasized source diversity and triangulation to minimize single-source bias and to increase confidence in recommended actions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alcoholic Beverages market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alcoholic Beverages Market, by Product Type

- Alcoholic Beverages Market, by Alcohol Content

- Alcoholic Beverages Market, by Ingredient Base

- Alcoholic Beverages Market, by Production Method

- Alcoholic Beverages Market, by Packaging Type

- Alcoholic Beverages Market, by Pack Size

- Alcoholic Beverages Market, by Distribution Channel

- Alcoholic Beverages Market, by Region

- Alcoholic Beverages Market, by Group

- Alcoholic Beverages Market, by Country

- United States Alcoholic Beverages Market

- China Alcoholic Beverages Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3180 ]

Concluding perspective on turning disruption into advantage through integrated portfolio, operational, and data-driven strategies for long-term resilience

In an environment defined by rapid change and policy uncertainty, the core imperative for beverage companies is to align commercial agility with strategic resilience. This means building diversified portfolios that reflect both short-term channel economics and long-term brand equity, operational playbooks that absorb trade and logistics shocks, and data capabilities that reduce reliance on third-party discovery. Companies that integrate these elements will convert market disruption into a source of strategic advantage rather than persistent vulnerability.

Looking ahead, the winners will be those that treat segmentation, packaging, and distribution not as separate choices but as interconnected levers that shape consumer perception and unit economics. By investing in flexible sourcing, innovative packaging strategies, and direct data capture, organizations can preserve margins, protect assortment breadth, and accelerate growth in priority markets. The present moment offers an opportunity to reconfigure operating models so that they are purpose-built for speed, resilience, and profitable expansion.

Engage with an experienced sales and marketing associate to procure the comprehensive alcoholic beverages market research report and convert insights into a tailored commercial action plan

For organizations ready to translate strategic insight into competitive advantage, speak directly with Ketan Rohom (Associate Director, Sales & Marketing) to acquire the full market research report and receive tailored support to align findings with your commercial objectives. The comprehensive study includes deep dives across products, packaging, alcohol-content cohorts, and distribution channels, and can be used to inform portfolio strategy, pricing plans, go-to-market sequencing, and partnership decisions. When you request the report, you will be offered options for a custom briefing, anonymized competitor benchmarking, and an executive slide pack that distills the most actionable findings for board-level discussion.

To begin, reach out to request a briefing and specify any priority regions, product categories, or channel segments you want emphasized during the onboarding conversation. Following that discussion, a dedicated engagement will be scheduled so that insights can be translated into a practical 90-day action plan aligned with your organization’s risk tolerance and growth ambitions. This is the fastest route to turn intelligence into tactical steps that safeguard margins, preserve distribution relationships, and accelerate premiumization or innovation plays. Secure the report to ensure your team has the forward-looking context and commercial playbooks needed to act decisively in a shifting regulatory and trade environment.

- How big is the Alcoholic Beverages Market?

- What is the Alcoholic Beverages Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?