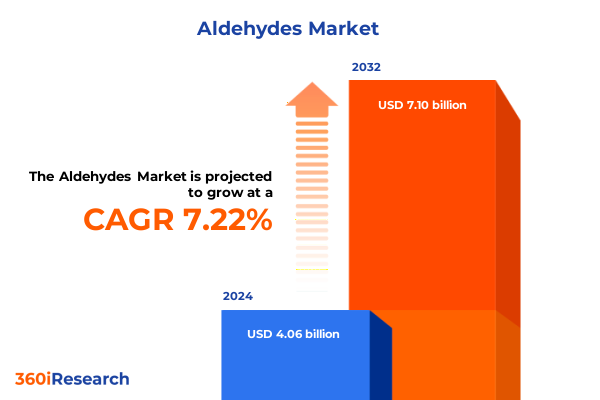

The Aldehydes Market size was estimated at USD 4.36 billion in 2025 and expected to reach USD 4.65 billion in 2026, at a CAGR of 7.20% to reach USD 7.10 billion by 2032.

Unveiling the Critical Role and Evolving Dynamics of the Global Aldehyde Landscape Shaping Innovation Across Diverse Industrial Applications

The global aldehyde sector occupies a foundational niche in modern industrial chemistry, serving as versatile building blocks that underpin applications ranging from resin synthesis to flavoring agents. Proximity to raw material streams and integration into diversified chemical value chains have established aldehydes-particularly benzaldehyde, formaldehyde, isobutyraldehyde, and N-butyraldehyde-as indispensable intermediates in plastics, pharmaceuticals, personal care, and agricultural formulations. In parallel, evolving regulatory regimes addressing safety and emissions have fostered a more rigorous compliance environment, prompting manufacturers and end-users to reassess sourcing strategies and invest in emission-control technologies to meet stringent limits on formaldehyde and related compounds.

Against this backdrop, advancements in catalysis, continuous-flow processing, and bio-based feedstock development are driving innovation, yielding higher selectivity, reduced energy consumption, and opportunities for valorizing waste streams. Meanwhile, downstream demand in sectors like construction and automotive continues to propel resin and adhesive markets, sustaining formaldehyde usage despite environmental concerns. Transitional dynamics such as these underscore the criticality of nuanced supply chain visibility, as companies seek to balance operational efficiency with compliance imperatives and sustainability goals in an increasingly complex global landscape.

Exploring the Paradigm-Shifting Technological, Environmental, and Consumer Demand Drivers Reshaping Aldehyde Manufacturing and Utilization

The aldehyde landscape is experiencing paradigm-shifting transformations driven by the convergence of technological breakthroughs, sustainability mandates, and shifting consumer preferences. Catalytic process intensification has emerged as a linchpin for improving efficiency and selectivity in aldehyde production, with heterogeneous catalysts enabling continuous conversion of bio-derived feedstocks such as glycerol and biomass-derived syngas. This technological shift is complemented by regulatory pressures to reduce greenhouse gas emissions and volatile organic compound releases, prompting investments in closed-loop systems and advanced emission control units.

Simultaneously, demand for green and bio-based chemicals is reshaping market priorities. Leading specialty chemical firms are scaling bio-catalytic routes for formaldehyde and benzaldehyde derivation, responding to consumer appetite for natural flavors and sustainable intermediates. At the same time, digitalization and Industry 4.0 frameworks-such as predictive analytics for process optimization-are gaining traction, equipping producers with real-time insights to anticipate feedstock fluctuations and maintain consistent product quality. Through these transformative shifts, the aldehyde industry is redefining its value proposition by integrating sustainability and advanced manufacturing to unlock new growth trajectories.

Assessing the Far-Reaching Economic and Operational Consequences of 2025 United States Tariff Policies on the Aldehyde Supply Chain

The implementation of 2025 United States tariffs on a broad spectrum of chemical imports has introduced significant headwinds for aldehyde supply chains, with downstream producers confronting elevated costs for key feedstocks such as methanol and certain specialty intermediates. Industry sources estimate that tariff-induced cost increases for imported chemical reagents may range from single-digit to double-digit percentages, exerting margin pressure on resin, plasticizer, and solvent upstream producers.

In response, strategic stockpiling became a common tactic among chemical distributors and end users during the early months of 2025, mirroring patterns observed in prior tariff cycles. This approach momentarily alleviated supply risks but generated inventory buildups and exacerbated working capital constraints. Moreover, retaliatory measures by key trading partners have disrupted traditional export channels for U.S.-based aldehyde producers, eroding export competitiveness in regions like Europe and Asia. As noted by the American Chemistry Council, uncertainties remain high regarding the potential expansion of tariff lines and additional levies targeting emerging markets, which could further complicate logistics and compliance frameworks for market participants.

Looking ahead, manufacturers are diversifying sourcing to domestic and alternative regional suppliers and renegotiating supply contracts to incorporate flexible clauses that accommodate tariff volatility. In parallel, some players are accelerating on-shore capacity expansions to reduce import dependence-a strategic pivot underscored by recent announcements of new formaldehyde units in the Gulf Coast to ensure near-term resilience against policy shifts.

Deriving Strategic Perspectives from Comprehensive Product, Application, End Use, Derivative, and Purity Grade Segmentation of the Aldehyde Market

The aldehyde market’s multifaceted structure benefits from distinct performance attributes and end-use profiles across its core product lines. Benzaldehyde, for instance, finds prominent application in fragrances and flavorings, while formaldehyde remains integral to acetal polymer and alkyd resin manufacturing, underpinning diverse chemical intermediates such as ion exchange resins. Isobutyraldehyde and N-butyraldehyde serve as precursors for plasticizers and surfactants, addressing critical needs in polymer modification and emulsification.

Application-centric dynamics further delineate market behavior. Chemical intermediates leverage aldehydes to produce high-performance resins and polymers, whereas fragrances and flavors capitalize on benzaldehyde’s aromatic characteristics to meet consumer sensory expectations. In the pharmaceutical domain, aldehyde derivatives facilitate active ingredient synthesis for APIs, underscoring their therapeutic significance. Plasticizers and surfactants represent additional vectors of demand, broadening the market’s end-use scope beyond conventional industrial sectors.

End-use segmentation reveals that agriculture benefits from aldehyde-derived pesticides and herbicide products, while cosmetics and personal care capitalize on aromatic aldehydes for fragrance and preservative functionalities. Pharmaceutical manufacturers depend on high-purity grades for intermediate synthesis, and the plastics industry integrates aldehydes into resin systems for molding and coating applications. Extensions into derivative markets-such as adhesives and sealants-derive from melamine, phenolic, and urea formaldehyde resins, highlighting the motif of specialization. Finally, grade-based distinctions, ranging from cosmetic and food to industrial and reagent grades, ensure that each application maintains requisite purity and performance thresholds.

This comprehensive research report categorizes the Aldehydes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Derivative

- Purity Grade

- Application

- End Use Industry

Illuminating Regional Market Dynamics and Growth Catalysts Across Americas, Europe Middle East Africa, and Asia-Pacific Aldehyde Sectors

Geographic markets exhibit differentiated demand drivers and regulatory landscapes that shape aldehyde consumption patterns. In the Americas, a robust chemicals infrastructure and established production hubs across the Gulf Coast foster competitive formaldehyde and butyraldehyde manufacturing. Meanwhile, regulatory frameworks-such as the U.S. Toxic Substances Control Act and California’s CARB Phase 2 standards-mandate stringent emission controls and third-party certification, influencing plant designs and compliance costs.

Europe, the Middle East, and Africa present a mosaic of market dynamics. Western European nations, governed by REACH regulations and sustainability directives, emphasize low-emission production practices and closed-loop resource utilization. In contrast, select Middle Eastern markets leverage petrochemical feedstock availability to expand formaldehyde and derivative manufacturing, while Africa’s emerging economies gradually adopt industrial applications for agriculture and personal care, albeit amid logistical and infrastructure constraints.

Across Asia-Pacific, China and India dominate consumption trajectories, fueled by extensive construction, automotive, and pharmaceutical sectors. China’s wood adhesive industry-the largest consumer of formaldehyde-continues to scale in step with urbanization, while India’s API manufacturing ecosystem drives demand for high-purity aldehyde intermediates. Government policies such as India’s Production-Linked Incentive scheme further incentivize local capacity expansions and R&D initiatives, reinforcing Asia-Pacific’s position as the fastest-growing regional market.

This comprehensive research report examines key regions that drive the evolution of the Aldehydes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Driving Innovation, Strategic Partnerships, and Competitive Positioning in the Global Aldehyde Market

Leading global chemical majors play pivotal roles in shaping the competitive topology of the aldehyde market. BASF, for example, attributed its revised 2025 EBITDA outlook to softened demand linked to tariff-induced order hesitations, underscoring the interconnectedness of trade policies and operating performance in specialty chemical segments. Dow, another cornerstone player, has highlighted the ramifications of proposed shipping tariffs and ocean fees on freight costs for ethylene glycol and ethanol, advocating for sector-informed regulatory approaches to safeguard downstream supply chains.

Eastman Chemical Company continues to invest in circular economy initiatives, channeling DOE funding and state incentives into molecular recycling facilities to integrate sustainability into chemical intermediates production. Despite funding uncertainties, the company remains optimistic about long-term EBITDA contributions from its methanolysis projects and biopolymer platforms, demonstrating how strategic capital allocation can reinforce resilience amid policy flux. Perstorp, a specialty chemicals innovator, has advanced capacity expansion and Pro-Environment product certifications-such as ISCC PLUS for synthetic esters and polyols-reflecting a broader industry shift toward renewable feedstocks and traceable mass-balance concepts to meet customer sustainability mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aldehydes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Celanese Corporation

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Gujarat Alkalies and Chemicals Limited

- Hubei Jinghong Chemical Co., Ltd.

- Laxmi Organic Industries Ltd.

- Merck KGaA

- Santa Cruz Biotechnology, Inc.

- Shandong Xinhua Pharmaceutical Co., Ltd.

- Shandong Yuexing Chemical Co., Ltd.

- Sigma-Aldrich Co. LLC

- Solvay S.A.

- Tokyo Chemical Industry Co., Ltd.

- Wacker Chemie AG

- Weifang Binhai Petrochemical Co., Ltd.

Formulating Practical Strategic Imperatives and Operational Tactics to Strengthen Competitiveness and Resilience in Aldehyde Production and Distribution

Industry leaders should prioritize modular capacity expansions that adapt to shifting regulatory and trade landscapes, enabling agile responses to tariff adjustments and emission constraints. Capitalizing on continuous-flow processing and advanced catalyst platforms will allow for throughput optimization and reduced energy footprints, while bio-based feedstock integration can future-proof product portfolios against tightening sustainability requirements.

Collaborative partnerships-spanning academic institutions, technology vendors, and logistics providers-are essential for co-developing closed-loop and waste-valorization initiatives. By embedding lifecycle analysis and carbon accounting into product development, manufacturers can create differentiated value propositions, aligning with both corporate net-zero targets and consumer demand for environmentally responsible intermediates. Furthermore, supply chain diversification-through dual-sourcing agreements and regional production hubs-will mitigate geopolitical and policy risks.

Finally, fostering transparent communication channels with regulators, trade associations, and end-users will facilitate informed advocacy and early alignment on compliance frameworks. By adopting a proactive posture and leveraging predictive analytics for scenario planning, companies can position themselves to not only withstand market disruptions but also to seize emerging opportunities in green chemistry and circular economy models.

Detailing Rigorous Research Frameworks and Methodological Approaches Ensuring Robustness, Reliability, and Transparency in Aldehyde Market Analysis

This analysis employed a multifaceted research framework, combining extensive primary interviews with chemical manufacturers, distributors, and end-users with secondary data from reputable industry publications, regulatory filings, and financial disclosures. Primary engagement included structured dialogues with C-suite executives and supply chain managers across key producing regions to capture qualitative insights on technology adoption, tariff impacts, and sustainability initiatives. Secondary research encompassed a systematic review of trade association reports, regulatory announcements, and peer-reviewed literature to validate and contextualize primary findings.

Quantitative data synthesis involved cross-referencing import-export statistics, customs tariff schedules, and industrial production indices to model supply chain shifts and regional consumption patterns. Key segmentation analysis was anchored on product type, application, end use, derivative, and purity grade axes, ensuring comprehensive coverage of market dynamics. Rigorous data triangulation and quality checks-such as reconciling divergent data sets and corroborating anecdotal evidence with empirical metrics-underpin the robustness of our insights. The research methodology emphasizes transparency and replicability, providing stakeholders with a clear audit trail for data sources and analytical assumptions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aldehydes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aldehydes Market, by Product Type

- Aldehydes Market, by Derivative

- Aldehydes Market, by Purity Grade

- Aldehydes Market, by Application

- Aldehydes Market, by End Use Industry

- Aldehydes Market, by Region

- Aldehydes Market, by Group

- Aldehydes Market, by Country

- United States Aldehydes Market

- China Aldehydes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Insights and Strategic Implications to Navigate Challenges and Capitalize on Opportunities in the Evolving Aldehyde Industry

The global aldehyde industry stands at a pivotal juncture, shaped by accelerated innovation in catalysis, evolving sustainability benchmarks, and fluid trade policies. While tariff headwinds and regulatory complexities introduce near-term uncertainties, they also catalyze strategic pivots toward on-shore capacity, bio-based feedstocks, and circular economy integrations. Demand drivers in construction, automotive, pharmaceuticals, and personal care sectors continue to underpin aldehyde consumption, validating the sector’s resilience and versatility in diverse value chains.

Investor and corporate strategies that prioritize process intensification, supply chain agility, and collaborative stakeholder engagement will be best positioned to navigate the shifting terrain. As environmental and consumer expectations escalate, the capacity to integrate emission controls, traceable mass-balance products, and digital optimization tools will become core competitive differentiators. In synthesizing these insights, industry participants can chart data-driven pathways to sustain growth, mitigate risk, and harness emerging opportunities in the dynamic aldehyde landscape.

Securing Personalized Access to Premium Aldehyde Market Intelligence Through Direct Engagement with Associate Director Ketan Rohom

To gain unparalleled visibility into emerging trends, competitive dynamics, and growth opportunities in the global aldehyde market, reach out to Associate Director, Sales & Marketing, Ketan Rohom. Engage directly to customize your intelligence package according to your strategic priorities and gain access to proprietary insights, expert interviews, and tailored data visualizations. Secure your comprehensive market research report today to inform strategic decisions, optimize supply chain resilience, and unlock new avenues for innovation across benzaldehyde, formaldehyde, isobutyraldehyde, and N-butyraldehyde segments. Collaborate with Ketan Rohom to align research deliverables with your business objectives, ensuring you stay ahead in an evolving regulatory and competitive landscape. Take the next step toward data-driven growth by contacting Ketan Rohom for a personalized consultation and exclusive report access

- How big is the Aldehydes Market?

- What is the Aldehydes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?