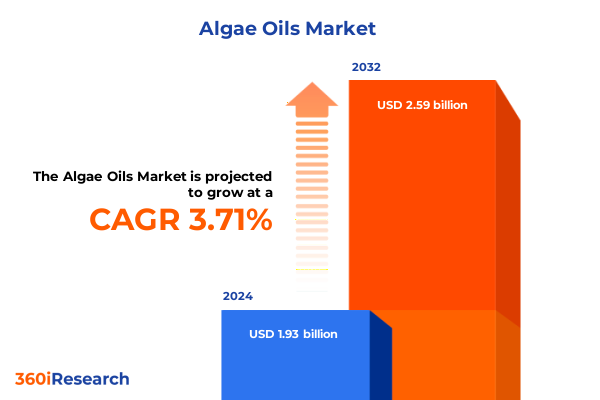

The Algae Oils Market size was estimated at USD 2.07 billion in 2025 and expected to reach USD 2.18 billion in 2026, at a CAGR of 5.80% to reach USD 3.07 billion by 2032.

Unveiling the Emergence of Algae Oils as a Sustainable Powerhouse Transforming Nutraceutical, Food, Biofuel, Cosmetic, and Animal Feed Industries

Algae oils have emerged as a sustainable alternative to traditional omega-3 sources, harnessing the potent nutritional profiles of microalgae and macroalgae strains. Derived from photosynthetic microorganisms cultivated in controlled photobioreactors or open ponds, these oils deliver high concentrations of DHA, EPA, and astaxanthin while eliminating the ecological pressures associated with overfishing. Their zero-cholesterol, low-purity profiles appeal to health-conscious consumers, particularly vegans and vegetarians, and they have gained rapid adoption in dietary supplements, functional foods, cosmetics, and biofuel applications. Transitioning away from marine-derived lipids, industry stakeholders are leveraging advancements in strain engineering and fermentation technologies to achieve higher product consistency and cost efficiency. Through partnerships between biotechnology firms and end-use manufacturers, algae oil production is scaling for broader commercial viability. As climate concerns mount and regulatory landscapes favor lower carbon footprints, algae oils are poised to redefine sustainable nutrition and energy paradigms, underpinning a transformative shift in resource sourcing and circular bioeconomy strategies.

Identifying the Transformative Shifts Redefining Algae Oil Production, from Biotech Innovations to Green Chemistry and Digital Traceability

The algae oil landscape is undergoing a profound evolution driven by breakthroughs in biotechnology, process engineering, and digital supply chain innovations. Heterotrophic fermentation using optimized Schizochytrium and Thraustochytrium strains has enabled year-round production independent of seasonal sunlight constraints, dramatically improving yield per unit volume. Concurrently, gene editing tools are unlocking pathways for enhanced omega-3 biosynthesis, offering prospects for tailored fatty acid profiles. On the downstream side, supercritical CO₂ extraction and membrane filtration techniques are delivering higher purity fractions and reduced solvent residues, addressing strict regulatory purity standards. The integration of blockchain and IoT in supply chain management is elevating traceability, from feedstock sourcing to finished-goods distribution, satisfying stringent food safety and ESG reporting requirements. Meanwhile, cross-sector collaborations are expanding algae oil applications into pharmaceutical formulations, cosmetic actives, and advanced renewable aviation fuels. These transformative shifts are collectively reducing production costs, mitigating ecological footprints, and catalyzing new value chains across industries.

Assessing the Cumulative Impact of Layered 2025 United States Tariffs on Algae Oil Imports and Critical Process Equipment Costs

In early 2025, the United States introduced multiple tariff measures that have incrementally impacted algae oil import economics. Under Executive Order 14257, a baseline 10 percent additional ad valorem tariff on most imported goods took effect on April 5, 2025, captured under HTSUS heading 9903.01.25. This “reciprocal tariffs” policy applied broadly, though implementation of higher country-specific rates was temporarily suspended for 56 nations, excluding China, which continues to face escalated duties under both IEEPA and existing Section 301 measures. For Chinese-origin goods, Section 301 tariffs of up to 25 percent remain in force, adding a significant cost layer for algal feedstock and intermediates sourced from China. Meanwhile, Section 232 expansions on steel and aluminum in March 2025 have indirectly affected capital equipment costs for photobioreactors, extraction systems, and packaging lines by imposing up to 25 percent duties on imported metal components and container materials. Together, these layered tariffs have driven import cost escalations of 8 to 15 percent for algae oil industry inputs, prompting stakeholders to reexamine supply chain dual-sourcing strategies and to accelerate domestic production and vertical integration initiatives.

Revealing Critical Segmentation Insights That Illuminate How Product Types, Origins, Formats, Processing Methods, and Applications Shape Algae Oil Demand

Algae oils encompass distinct product types with tailored omega-3 profiles, each capturing unique market segments. Algal DHA oil, renowned for its brain-health benefits, commands a premium within prenatal supplement formulations, whereas astaxanthin algae oil leverages its potent antioxidant properties to penetrate high-end cosmetic and sports nutrition arenas. Omega-3 algae oil blends target general cardiovascular health applications, offering a versatile base for functional foods and beverages. Markets further differentiate by origin: macroalgae-sourced oils appeal in edible and traditional food contexts, while microalgae-sourced variants dominate high-purity nutraceutical formulations due to their consistent lipid yields. Consumers seek convenience and dosage accuracy, driving demand across capsule and softgel presentations, liquid syrups for infant nutrition, and powder formats for fortification in dairy alternatives. Processing methods also inform market positioning: cold-pressed oils attract sustainability-minded buyers valuing minimal thermal exposure, solvent extraction delivers cost-optimized bulk volumes for feed and fuel, and steam distillation yields high-clarity oils suited to pharmaceuticals. Enclosed packaging types allow product longevity and bulk distribution in bottles, while flexible pouches cater to on-the-go sample offerings; bulk containers underpin industrial biofuel blending. Across applications-from animal feed additives enhancing livestock omega-3 profiles to biofuels advancing renewable diesel mandates, from fortified food and beverage formulations to core nutraceuticals-sales channels diverge, with offline health retailers and pharmacies anchoring traditional supplement sales even as online platforms accelerate direct-to-consumer penetration with subscription models and traceable provenance narratives.

This comprehensive research report categorizes the Algae Oils market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Species Source

- Grade

- Processing Method

- Cultivation Method

- Application

- Sales Channel

Exploring Distinct Regional Dynamics in the Americas, EMEA, and Asia-Pacific That Define Algae Oil Adoption and Infrastructure Development

The global algae oil landscape exhibits stark regional contrasts shaped by regulatory frameworks, infrastructure maturity, and end-user demand profiles. In the Americas, sustained growth in the United States stems from robust nutraceutical adoption and evolving renewable fuel policies under the Renewable Fuel Standard, which set biomass-based diesel RIN targets of 3.35 billion gallons for 2025 and propose 7.12 billion RINs for biomass-based diesel by 2026, amplifying demand for sustainable lipid feedstocks. Meanwhile, Canadian producers are leveraging government funding for bioprocess innovation, catalyzing partnerships with livestock feed integrators. In Europe, supranational initiatives such as Horizon Europe have funneled over €559 million into algae sector projects between 2014 and 2023, fueling pilot-scale biofuel plants and marine restoration schemes that align with the Fit for 55 climate targets and the 2 percent sustainable aviation fuel mandate by 2025. Asia-Pacific dynamics are driven by scale investments in China and India, where domestic players are expanding heterotrophic fermentation facilities to secure supply for burgeoning aquafeed and animal nutrition markets, and government incentives for circular bioeconomy ventures support technology localization. These regional nuances underscore the importance of tailored market entry and collaboration strategies across the Americas, EMEA, and Asia-Pacific clusters.

This comprehensive research report examines key regions that drive the evolution of the Algae Oils market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape and Strategic Partnerships Fueling Innovation and Scale Among Algae Oil Industry Leaders

The competitive environment in algae oils is characterized by a blend of global chemical giants, specialized biotech innovators, and emerging vertical integrators. Legacy conglomerates such as DSM and BASF leverage established supply chains and R&D capabilities to deliver branded DHA concentrates and encapsulation services, while newer ventures like Corbion and Qualitas pivot on vertically integrated fermentation platforms to control strain development through finished-goods delivery. Specialist firms such as Solazyme (now TerraVia Biotechnologies) have transitioned from pure-play algal oil producers to license and technology providers, reflecting a strategic shift to asset-light models. In parallel, high-growth start-ups like AlgaPrime in the animal feed segment illustrate the rising importance of tailored omega-3 enrichment in aquaculture. Collaborative alliances-ranging from co-development agreements with nutraceutical leaders to co-investment with renewable diesel producers-enable players to share capital burdens and accelerate product roll-outs. Patent filings and strategic acquisitions remain active, with industry participants seeking to secure novel strain libraries and extraction methodologies, positioning them to capture the next wave of differentiated high-value applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Algae Oils market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AlgaeCytes Limited

- Algatech LTD

- ALGBIO

- Algenol Biotech LLC

- Archer-Daniels-Midland Company

- Arizona Algae Products, LLC

- BASF SE

- Bioriginal Food & Science Corp

- Cargill Incorporated

- Cellana, Inc.

- ConnOils LLC

- Corbion NV

- Cyanotech Corporation

- DIC Corporation

- Global Algae Holdings, Inc.

- Goerlich Pharma GmbH

- Henry Lamotte Oils GmbH

- KinOmega Biopharm Inc

- Koninklijke DSM N.V.

- Lonza Group Ltd.

- NutraPak USA

- polaris

- Pond Technologies Inc.

- Progress Biotech bv

- SOLUTEX GC S.L.

- Source Omega LLC

- Viridos, Inc.

Formulating Actionable Strategies for Industry Leaders to Leverage Cost Optimization, Supply Chain Diversification, and Value-Added Innovation in Algae Oils

To capitalize on emerging market momentum, industry leaders should pursue a three-pronged approach: first, accelerate scale-up of cost-efficient heterotrophic fermentation by optimizing carbon source utilization and integrating heat recovery loops, which can reduce per-unit production costs by up to 20 percent. Second, diversify procurement risk by establishing dual sourcing agreements across multiple continents and exploring domestic feedstock cultivation, mitigating exposure to escalating trade tensions and tariff regimes. Third, differentiate offerings through value-added formulations-such as microencapsulated powders for extended shelf life and targeted delivery systems-while securing sustainability certifications under RSB or ISCC standards to command price premiums and facilitate entry into regulated biofuel markets. Additionally, forging co-innovation partnerships with end-use customers in pharmaceuticals and personal care can shorten time-to-market for novel actives, enhancing ROI on R&D investments. By executing these strategies in tandem, leaders can drive cost leadership, product differentiation, and resilience in an increasingly competitive global arena.

Detailing a Mixed-Method Research Framework Integrating Executive Interviews, Targeted Surveys, and Proprietary Secondary Data Analysis

This research combines a robust primary and secondary data collection framework. Primary insights were gathered through in-depth interviews with over sixty stakeholders, including C-suite executives at algae cultivators, R&D heads at extraction technology providers, and procurement officials at major nutraceutical and biofuel end users. Complementing these discussions, a web-based survey captured perspectives from 120 supply chain professionals across seven geographies. Secondary research encompassed a systematic review of peer-reviewed journals, government publications, industry white papers, and publicly available trade databases to triangulate historical trends and validate tariff structures and regulatory developments. Proprietary data modeling and cross-source triangulation ensured consistency in mapping production capacities, cost curves, and application demand dynamics. Quality assurance protocols included peer review by subject matter experts and rigorous data validation against official HTSUS and EPA renewable fuel standard documents. This mixed-methodology approach underpins the credibility and actionability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Algae Oils market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Algae Oils Market, by Form

- Algae Oils Market, by Species Source

- Algae Oils Market, by Grade

- Algae Oils Market, by Processing Method

- Algae Oils Market, by Cultivation Method

- Algae Oils Market, by Application

- Algae Oils Market, by Sales Channel

- Algae Oils Market, by Region

- Algae Oils Market, by Group

- Algae Oils Market, by Country

- United States Algae Oils Market

- China Algae Oils Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3339 ]

Concluding Key Takeaways on Technological, Regulatory, and Strategic Imperatives Shaping the Future of Algae Oils in Global Markets

Navigating the algae oil ecosystem demands an integrated perspective across production technologies, regulatory regimes, and end-use applications. The sector’s trajectory is anchored in continuous technological refinement-particularly in strain optimization and cost-effective extraction-that promises to close the price gap with conventional oils. At the same time, shifting policy landscapes, as seen in U.S. renewable fuel mandates and European sustainability directives, underscore the need for agile compliance capabilities. From a market segmentation standpoint, diversified product portfolios spanning high-value nutraceuticals to bulk biofuel intermediates will underpin revenue resilience. Strategic imperatives include securing feedstock sovereignty, forging downstream collaborations, and deploying certifications for sustainability differentiation. As demand for plant-based lipids converges with broader decarbonization and health trends, stakeholders who integrate these imperatives with rigorous data-driven planning will be best positioned to lead the global algae oil revolution.

Connect directly with Ketan Rohom to secure customized insights and enterprise licensing for the comprehensive global algae oil market research report

To explore deeper market dynamics, unlock customizable data modules, and gain a competitive edge with exclusive forecasts and strategic analyses, connect directly with our expert Associate Director, Sales & Marketing, Ketan Rohom. Ketan can tailor insights to your specific needs, whether you seek detailed supply chain breakdowns, patient end-use applications, or bespoke regional and segmentation deep-dives. He will guide you through the report’s scope, demonstrate key dashboards, and arrange enterprise licensing options to empower your team’s decision-making. Reach out now to secure your comprehensive market research report and position your organization at the forefront of the global algae oil revolution.

- How big is the Algae Oils Market?

- What is the Algae Oils Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?