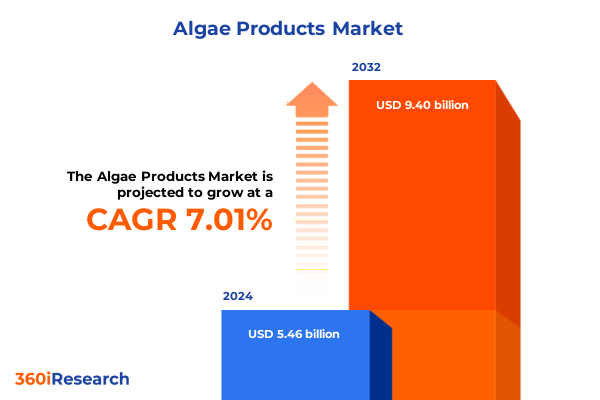

The Algae Products Market size was estimated at USD 5.83 billion in 2025 and expected to reach USD 6.22 billion in 2026, at a CAGR of 7.06% to reach USD 9.40 billion by 2032.

Revolutionary Potential of Algae Products Illuminates New Frontiers in Sustainable Nutrition Biotech Addressing Global Health and Environmental Challenges

Algae have transcended their historic role as simple aquatic organisms to become linchpin ingredients across diverse industries ranging from nutrition and pharmaceuticals to biofuels and personal care. Their exceptional profile of bioactive compounds-including pigments, proteins, and fatty acids-positions them at the confluence of health innovation and environmental stewardship. As global priorities shift toward sustainable sourcing and circular economies, algae production methods have evolved to meet stringent quality, traceability, and carbon reduction goals.

Today’s market landscape is defined by a heightened emphasis on multifunctional formulations. Astaxanthin’s antioxidative potency, beta-carotene’s provitamin A activity, chlorella’s holistic nutrient density, and spirulina’s protein-rich composition illustrate how specific algae derivatives address both preventive wellness and performance nutrition. Simultaneously, advancements in photobioreactor design, heterotrophic fermentation, and offshore cultivation enable scalable yield with minimal resource input. Regulatory clarity on novel foods and food safety frameworks further accelerates industry adoption.

Moving forward, the intersection of biotech refinements, consumer demand for clean-label solutions, and commitments to net-zero targets will define competitive differentiation. In this context, a strategic understanding of the drivers, barriers, and emerging opportunities within the algae products ecosystem is essential for stakeholders aiming to secure market leadership.

Breakthrough Innovations and Emerging Technologies Are Redefining the Algae Products Landscape from Cultivation to Commercialization

The algae products ecosystem is undergoing a radical transformation driven by technological breakthroughs and shifting consumer expectations. Precision cultivation platforms now integrate AI-enabled monitoring with automated harvesting, allowing producers to optimize light, nutrient delivery, and biomass composition in real time. Concurrently, synthetic biology techniques enable the engineering of microalgae strains with enhanced production of high-value metabolites, significantly reducing downstream processing complexity.

In parallel, the trend toward decentralized production is gaining traction. Regional biorefineries harness local renewable energy-solar, wind, or geothermal-to power closed-loop photobioreactors, thereby aligning product sourcing with carbon neutrality commitments. Such distributed models not only mitigate geopolitical risks but also enable faster go-to-market timelines for region-specific applications in cosmetics, food ingredients, and specialty chemicals.

Meanwhile, the convergence of digital supply chain solutions and blockchain-backed traceability platforms is reshaping how end users verify product origin, quality, and sustainability credentials. This transparency fosters consumer trust and underpins premium pricing for ethically sourced algae derivatives. As these transformative shifts unfold, industry incumbents and new entrants alike must adapt swiftly or risk obsolescence in a market defined by rapid innovation cycles.

Complex Trade Policies and Tariff Exemptions Are Reshaping Algae Ingredient Supply Chains and Cost Structures in the United States Market

On April 2, 2025, the U.S. government instituted a 10 percent global tariff on a broad range of imported goods, accompanied by substantial reciprocal tariffs for select trading partners, reshaping the policy environment for ingredient sourcing across multiple sectors. In recognition of the critical public health and nutrition implications, key dietary ingredients such as vitamins, minerals, amino acids, CoQ10, and choline were subsequently exempted under Annex II of the executive order. Although these exemptions offer relief for many conventional supplement components, most algae-derived compounds-particularly specialty extracts and pigment fractions-remain subject to the new tariff rates.

As a result, producers of astaxanthin, beta-carotene, spirulina, and chlorella face mounting cost pressures that threaten profitability and supply chain stability. Recent consumer interest in red algae ingredients, which has surged by over 300 percent in online trend data, underscores the tension between growing demand and increased import costs. Companies are compelled to reevaluate their sourcing strategies, exploring options such as nearshore cultivation, vertical integration, and accelerated contract negotiations to hedge against further policy volatility.

In response to the increasingly complex trade landscape, market leaders are deploying advanced supply chain analytics and dual-sourcing frameworks to maintain uninterrupted supply. By investing in domestic cultivation facilities and forging partnerships with alternative global suppliers, they are building resilience into their value chains. These adaptive measures not only mitigate the immediate tariff impact but also position stakeholders to navigate future policy shifts with greater agility.

Strategic Dissection of the Algae Products Market Reveals Distinct Consumer and Industry Preferences Across Types Forms Sources Applications and Channels

A nuanced segmentation framework reveals how diverse consumer and industry demands converge across multiple dimensions of the algae products market. When evaluating product categories such as astaxanthin, beta-carotene, chlorella, and spirulina, it becomes clear that end-use applications dictate ingredient sourcing criteria-purity and potency requirements for nutraceuticals differ markedly from cost-sensitivity thresholds in animal feed formulations. In addition, the physical form of the ingredient-be it liquid concentrates, powdered powders, or encapsulated tablets and capsules-directly influences processing pathways, shelf life considerations, and labeling claims, shaping how manufacturers architect their supply and distribution strategies.

Source type further segments the market into microalgae and seaweed, each encompassing distinct taxonomic groups with unique biochemical profiles. Microalgae varieties such as blue-green, green, and red algae are prized for targeted high-value compounds, while brown, green, and red seaweeds contribute high-volume polysaccharides and functional fibers. Application zones ranging from animal feed and biofuel to cosmetics, food and beverages, and pharmaceuticals underscore the multifaceted utility of algae ingredients. Distribution channels that include both offline outlets-such as pharmacies, specialty stores, and supermarkets-and burgeoning online platforms illustrate how omnichannel strategies optimize market reach and consumer engagement.

By synthesizing these intersecting segments, stakeholders gain clarity on priority growth areas, risk exposures, and competitive dynamics, enabling more precise resource allocation and tailored product development efforts.

This comprehensive research report categorizes the Algae Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Form

- Cultivation Method

- Grade

- Nature

- Application

- End-Use Industry

- Distribution Channel

Regional Dynamics in Algae Product Adoption Highlight Diverse Market Drivers in Americas EMEA and Asia Pacific Ecosystems

Regional market dynamics for algae products are shaped by distinct regulatory regimes, infrastructure capacities, and end-use market maturity across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, established consumer familiarity with nutraceutical and functional food applications drives steady demand, while governmental incentives for sustainable crop alternatives bolster biofuel and feed segments. North American production benefits from robust R&D funding and integrated logistics networks, although regional cost structures and labor considerations influence facility deployment strategies.

Across Europe, the Middle East and Africa, stringent regulatory frameworks around novel foods and environmental compliance shape both product innovation and market entry timelines. The European Union’s focus on circular bioeconomy policies has catalyzed public-private partnerships supporting advanced algae cultivation technologies. In parallel, Gulf Cooperation Council countries are increasingly investing in algae-based carbon capture and seawater cultivation projects, leveraging abundant solar energy resources to scale operations.

In the Asia Pacific, widespread governmental support, lower production costs, and proximity to end-use markets for feed and food applications have established the region as a global production hub. Growing consumer awareness of health and sustainability trends in markets such as Japan, South Korea, and Australia further drives innovation in premium algae derivatives. Meanwhile, emerging markets across Southeast Asia and India present untapped potential, albeit with infrastructure and quality-assurance challenges that require targeted capacity building and regulatory harmonization.

This comprehensive research report examines key regions that drive the evolution of the Algae Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Industry Leadership in Algae Innovation Spotlighting Key Players Driving Growth and Sustainable Solutions Across the Global Value Chain

The competitive landscape of the global algae products market features a balanced mix of large-scale integrators, specialized innovators, and biotech pioneers. Cyanotech Corporation, headquartered in Hawaii, leverages patented cultivation and drying techniques to produce high-purity spirulina and astaxanthin, maintaining strong market penetration in North America and growing export volumes in Asia and Europe. Earthrise Nutritionals, operating one of the world’s largest spirulina farms in California, prioritizes solar-powered bioreactors and vertical integration to ensure consistent quality and supply chain transparency.

Algatech, now under Solabia Group’s stewardship, dominates the astaxanthin segment with its proprietary closed-tubular photobioreactor system that achieves significantly higher biomass yields compared to open-pond methods. AstaReal AB, a leader in natural astaxanthin production, maintains rigorous R&D and strategic partnerships to optimize strain performance and extraction efficiency. Corbion and Cargill have each enhanced their portfolios through acquisitions and joint ventures, integrating algae-derived lipids and proteins into their broader ingredient offerings for human and animal nutrition, as well as specialty chemicals.

DuPont’s Nutrition & Biosciences division, following its integration into IFF, delivers microalgae-derived proteins and antioxidants to global food and beverage customers. E.I.D. Parry (India) Limited provides scale in chlorella production via its established fermentation facilities, while Xiamen Kingdomway Group focuses on nutritional blends incorporating spirulina and other microalgae extracts. Each of these leading companies differentiates through proprietary technologies, sustainability credentials, and strategic alignment with high-growth applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Algae Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Algae Cooking Club

- Algae Products International Ltd.

- Algaenergy, S.A.

- Algenol

- Algenol Biotech LLC

- Archer Daniels Midland Company

- Arizona Algae Products, LLC

- AstaReal Co., Ltd.

- BASF SE

- Beijing Ginkgo Group Co., Ltd.

- Benivio GmbH

- BlueBioTech International GmbH

- Bluetec Naturals Co., Ltd.

- Cargill, Incorporated

- Cellana Inc.

- Corbion N.V.

- Cyanotech Corporation

- Dalton Cosmetics Germany GmbH

- DIC Corporation

- DSM-Firmenich AG

- E.I.D. – Parry (India) Limited

- Earthrise Nutritionals LLC

- IGV GmbH

- International Flavors & Fragrances Inc.

- MiAlgae Ltd.

- Origin by Ocean

- Pond Technologies Inc.

- Scipio Biofuels Inc.

- Solabia Group

- The Algenist LLC

- Tianjin Norland Biotech Co., Ltd.

- Zhejiang Binmei Biotechnology Co., Ltd

Actionable Strategies for Industry Leaders to Strengthen Algae Supply Resilience Drive Innovation and Capitalize on Emerging Market Opportunities

Industry leaders seeking to navigate the evolving algae product landscape should implement multifaceted strategies that reinforce supply chain resilience while fostering innovation. First, it is essential to diversify sourcing footprints through nearshore and onshore cultivation facilities, which can mitigate policy-induced disruptions and tariff fluctuations. Concurrently, partnerships with research institutions and technology providers can accelerate the adoption of advanced photobioreactor designs, automation systems, and strain-engineering capabilities that elevate yield and compound specificity.

Moreover, integrating digital supply chain management platforms equips executives with real-time visibility into inventory levels, production metrics, and logistics performance. This transparency enables proactive mitigation of bottlenecks and enhances decision-making around procurement and inventory. Alongside these operational measures, companies should pursue value-added product development-such as customized microencapsulations or novel delivery formats-to capture higher-margin applications in pharmaceuticals, personal care, and specialty nutrition.

Finally, active engagement with policymakers and industry consortia ensures that regulatory frameworks evolve in tandem with technological advancements. By contributing to standards development for novel foods, environmental compliance, and sustainability reporting, companies can shape market conditions, drive industry credibility, and ultimately secure leadership positions as the algae products market progresses.

Comprehensive Research Methodology Underpins Reliable Algae Market Insights Combining Primary Data Secondary Sources and Rigorous Analytical Frameworks

This research report leverages a comprehensive methodology that integrates primary and secondary data sources to ensure robust and reliable insights. The primary research component encompassed structured interviews with executives and subject-matter experts across leading algae producers, ingredient formulators, regulatory agencies, and end-user brand manufacturers. These qualitative discussions provided context on strategic priorities, technology adoption curves, and policy influences shaping the market.

Secondary research involved an extensive review of industry publications, patent filings, sustainability reports, and trade association documents to validate emerging trends and technological breakthroughs. Detailed analysis of customs data, tariff schedules, and international trade flows supplemented the trade policy evaluation. Market segmentation was constructed using a triangulation approach, reconciling supply-side capabilities with demand-side application benchmarks.

All data points and insights were subjected to multi-layer validation through cross-referencing independent sources and employing scenario-analysis techniques to test sensitivity against key variables. The outcome is a holistic perspective designed to inform strategic decision-making from product innovation to market entry and regulatory engagement.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Algae Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Algae Products Market, by Product Type

- Algae Products Market, by Source

- Algae Products Market, by Form

- Algae Products Market, by Cultivation Method

- Algae Products Market, by Grade

- Algae Products Market, by Nature

- Algae Products Market, by Application

- Algae Products Market, by End-Use Industry

- Algae Products Market, by Distribution Channel

- Algae Products Market, by Region

- Algae Products Market, by Group

- Algae Products Market, by Country

- United States Algae Products Market

- China Algae Products Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 5565 ]

Concluding Perspectives on Algae Products Emphasizing Sustainable Growth Innovation and Strategic Imperatives for Future Market Evolution

The algae products industry stands at a pivotal inflection point, driven by converging imperatives of sustainability, health, and innovation. Stakeholders that recognize the multifaceted value proposition of algae derivatives-from micronutrient-dense spirulina and chlorella to high-purity astaxanthin and beta-carotene-are positioned to capture opportunities across nutrition, cosmetics, biofuels, and beyond. Technological advances in cultivation, processing, and digital track-and-trace systems underpin the sector’s transformation.

Simultaneously, trade policies and tariff regimes present both challenges and incentives to refine supply chain strategies, invest in localized production, and advocate for favorable regulatory frameworks. Robust segmentation analysis highlights how divergent end-use requirements and distribution channels shape product portfolios, while regional insights delineate where government support, consumer preferences, and infrastructure readiness intersect to drive demand.

As leading companies demonstrate, sustained competitiveness hinges on strategic partnerships, R&D investment, and an unwavering commitment to quality and sustainability metrics. By synthesizing these elements, industry participants can chart a clear pathway toward scalable growth, risk mitigation, and value creation in the rapidly evolving global algae products market.

Unlock In-Depth Algae Market Research Insights and Collaborate with Ketan Rohom to Propel Your Strategic Decisions and Gain a Competitive Edge

To obtain a comprehensive deep dive into the complex dynamics of the global algae products market, connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in market analysis and strategic positioning within the nutrition, biotech, and sustainability sectors. By partnering with him, you will gain tailored insights that support evidence-based decision making, empower your executive team with actionable intelligence, and help you outpace competitors. Engage today to secure an exclusive licensing opportunity for the full research report and unlock access to granular data, expert commentary, and custom forecasting models. Propel your organization forward by leveraging this authoritative resource and ensuring your strategies align with the most current industry evolution.

- How big is the Algae Products Market?

- What is the Algae Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?