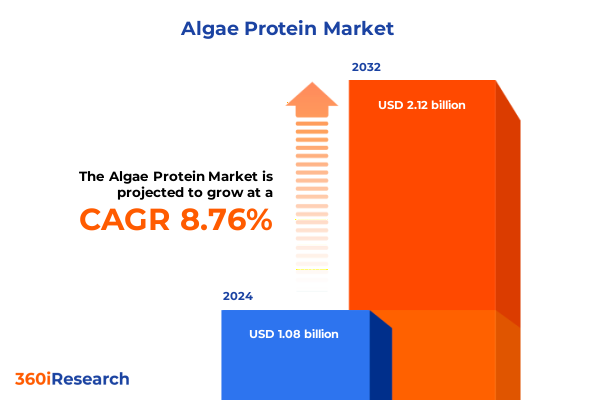

The Algae Protein Market size was estimated at USD 1.17 billion in 2025 and expected to reach USD 1.27 billion in 2026, at a CAGR of 8.87% to reach USD 2.12 billion by 2032.

Unveiling the Potential of Algae Protein as a Sustainable Nutritional Powerhouse Driving Innovation Across Food, Feed, Pharma, and Beyond

Algae protein has emerged as a pivotal frontier in the quest for sustainable nutrition, propelled by its exceptional amino acid profile, minimal land requirements, and low ecological footprint. This versatile bioresource bridges critical gaps in global protein demand while catering to a rapidly evolving consumer base increasingly prioritizing health, environmental stewardship, and ethical sourcing. As the global food system grapples with resource constraints and climate imperatives, algae protein stands out for its capability to deliver high-quality nutrition through efficient phototrophic cultivation and closed-loop production frameworks.

Moreover, the ascendance of algae protein is closely intertwined with shifts in regulatory landscapes and public awareness campaigns championing alternative proteins. Consumers are now more informed about the environmental toll of conventional livestock systems, leading to heightened receptivity toward plant-based and microbial-derived proteins. Consequently, algae protein not only addresses macro-level challenges such as land use and greenhouse gas emissions but also aligns with micro-level health aspirations by offering a clean-label ingredient devoid of allergens and common dietary sensitivities.

In essence, the introduction of algae protein into mainstream food, feed, pharmaceutical, and cosmetic segments signifies a transformative pivot toward resilient, nutrient-dense, and eco-friendly solutions. This report delves into the multifaceted drivers underpinning this dynamic market, providing decision-makers with a comprehensive lens into how algae protein is redefining the contours of modern nutrition and wellness.

Examining Transformative Shifts Reshaping the Algae Protein Landscape Through Technological Breakthroughs, Consumer Preferences, and Sustainable Practices

The algae protein sector is undergoing profound metamorphosis driven by technological breakthroughs in cultivation, extraction, and formulation. Advanced photobioreactor designs and precision-controlled growth environments now maximize biomass yield, ensuring consistent protein quality while reducing energy and water consumption. Concurrently, innovations in downstream processing have elevated extraction efficiencies, enabling high-purity concentrates that integrate seamlessly into diverse matrices-from powdered supplement blends to functional ingredients in beverages.

Besides technological strides, consumer market dynamics have shifted decisively toward transparency, traceability, and multifunctionality. Modern consumers demand not just protein augmentation but also ancillary benefits such as omega-3 enrichment, antioxidant activity, and natural pigmentation. In response, producers are developing tailored algae profiles that leverage specific species capabilities, thereby unlocking differentiated value propositions in end products. As a result, the landscape is ripe for cross-sector collaboration between ingredient suppliers, food manufacturers, and research institutions.

Transitioning from niche applications to mainstream integration, the algae protein ecosystem now benefits from robust venture capital investment and strategic partnerships with established agribusiness and ingredient companies. These collaborations are accelerating scaling efforts and diversifying product pipelines, ultimately bridging the gap between laboratory innovation and commercial viability. Through these transformative shifts, algae protein is solidifying its role as a foundational pillar of next-generation nutrition.

Analyzing the Multifaceted Impact of United States Tariffs Implemented in 2025 on Algae Protein Supply Chains, Trade Dynamics, and Pricing Structures

The imposition of targeted tariffs by the United States in 2025 has introduced a new dimension to algae protein trade dynamics, exerting considerable influence on import costs and supply chain optimization strategies. By elevating duty rates on specific algae biomass and derivative imports, these measures have prompted manufacturers to reassess sourcing geographies and strengthen domestic production capacities. As a direct consequence, supply chain stakeholders have accelerated investments in local cultivation infrastructure and forged strategic alliances with domestic photobioreactor technology providers to mitigate tariff-induced cost pressures.

Beyond immediate cost implications, the 2025 tariff framework has reshaped trading patterns, encouraging greater diversification of supply origins. While traditional import corridors from Asia-Pacific regions experienced contraction, alternative sourcing from Latin America and Europe has gained traction. In turn, this realignment has triggered advancements in cold-chain logistics and standardized quality verification protocols to accommodate heterogeneous biomass profiles. These adaptations have not only preserved the integrity of production pipelines but also fostered resilience against geopolitical and trade uncertainties.

Consequently, the cumulative impact of these tariff adjustments underscores the criticality of agile procurement strategies and vertically integrated operations. Companies that have proactively localized key stages of the value chain-ranging from seed culture banking to downstream fractionation-are better positioned to absorb incremental duty expenses while maintaining competitive pricing. As the market evolves, continuous monitoring of tariff schedules and bilateral trade negotiations will be essential for stakeholders seeking to capitalize on emerging growth corridors and maintain cost leadership.

Revealing Critical Segmentation Insights Across Algae Protein Types, Delivery Forms, Application Verticals, and Distribution Channels for Targeted Strategy Development

Deep-dive analysis across type, form, application, and distribution channel reveals nuanced performance differentials and usage patterns shaping market strategies. Based on source categorization, Chlorella has demonstrated broad applicability in dietary supplements due to its rapid biomass accumulation and favorable nutrient spectrum, whereas Haematococcus commands premium positioning for its astaxanthin-rich profile catering to cosmetics and nutraceutical applications. Spirulina, with its established global footprint, continues to dominate food and beverage formulations owing to its robust protein concentration and natural pigmentation.

Examining product forms underscores the strategic significance of powder as an entry-level delivery mechanism, offering flexibility for ingredient blending and formulation customization. Capsules, by contrast, cater to convenience-oriented supplementation markets, while liquid formats are increasingly adopted in ready-to-drink beverages with clean-label positioning. Tablet presentations, though less prevalent, are gaining momentum in pharmaceutical and veterinary feed segments where precise dosing and stability are paramount.

Insight into application verticals highlights animal feed as a growth engine, driven by aquaculture’s pursuit of sustainable alternatives to fishmeal and soybean meal. Cosmetics and personal care segments leverage algae’s bioactive compounds for skin rejuvenation and UV-protection formulations. Within dietary supplements, clean-label athletes and wellness enthusiasts gravitate toward algae sources for hypoallergenic protein. In food and beverage, functional bars and plant-based dairy analogs incorporate algae protein to enhance nutritional density. Pharmaceuticals harness algal polysaccharides and peptides for drug delivery and immunomodulation research.

Distribution channel scrutiny reveals that direct sales channels enable strategic partnerships and bulk procurement, while online platforms, including e-commerce and mobile applications, are propelling consumer-centric outreach for specialty formulations. Traditional retail remains vital for mass-market penetration in health food outlets and pharmacy chains, whereas wholesale networks support large-scale feed and industrial ingredient deployments. Together, these segmentation insights guide targeted commercial tactics and innovation roadmaps.

This comprehensive research report categorizes the Algae Protein market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Application

- Distribution Channel

Highlighting Pivotal Regional Dynamics in the Algae Protein Market Across Americas, Europe Middle East & Africa, and Asia-Pacific to Guide Strategic Investments

Regional analysis illuminates distinct market drivers and adoption curves across the Americas, Europe Middle East & Africa, and Asia-Pacific zones. In the Americas, robust investment in bioprocess engineering and supportive policy frameworks have accelerated the establishment of large-scale algae farms, positioning the region at the forefront of cost-competitive production. Increasing consumer affinity for plant-based proteins in North America is translating into higher retail penetration of algae-infused foods and supplements.

Across Europe, Middle East & Africa, diverse regulatory landscapes and heterogeneous dietary norms influence market uptake. Western European nations, with stringent sustainability mandates and functional food regulations, have fostered innovation hubs that emphasize high-value extracts for cosmetics and pharmaceuticals. Meanwhile, nascent markets in the Middle East & Africa are rapidly embracing aquaculture feed applications to bolster food security, presenting lucrative entry points for exporters and technology licensers.

Asia-Pacific maintains its status as a production powerhouse, leveraging low-cost labor and favorable climatic conditions for year-round cultivation. China and India lead capacity expansion efforts, while Japan continues to drive premium product development, particularly in nutraceuticals. Regional supply chain integration is facilitated by coastal proximity and established maritime logistics, although recent environmental compliance requirements are prompting modernization of cultivation practices to reduce eutrophication risks.

By synthesizing these regional dynamics, stakeholders can align investment priorities with regulatory landscapes and end-market potential, thereby optimizing resource allocation and strategic alliances across global growth corridors.

This comprehensive research report examines key regions that drive the evolution of the Algae Protein market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting the Competitive Landscape to Uncover Strategic Moves and Growth Trajectories of Leading Algae Protein Companies Shaping Industry Evolution

The competitive arena of algae protein is characterized by a blend of vertically integrated agritech enterprises and specialized ingredient innovators. Leading agribusiness conglomerates have diversified their portfolios to include algae-based proteins, leveraging established distribution networks and capital resources to scale production. These integrated players often secure downstream partnerships with food and feed manufacturers, accelerating route-to-market for algae-derived ingredients.

Specialist producers differentiate through proprietary strain libraries and patented extraction technologies that yield higher protein purity and targeted bioactive profiles. By offering application-specific variants-such as high-astaxanthin Haematococcus extracts or high-phycocyanin Spirulina fractions-these innovators capture premium margins and foster customer loyalty within niche segments like sports nutrition and cosmeceuticals.

Meanwhile, contract development and manufacturing organizations are emerging as pivotal enablers, providing turnkey solutions from strain cultivation to formulation. Their value proposition centers on reducing time-to-market for new product launches, especially for startups and mid-sized brands lacking in-house bioprocessing capabilities. Concurrently, strategic collaborations between ingredient incumbents and academic research centers are fueling next-generation product pipelines, integrating synthetic biology for tailored protein expression and metabolic pathway optimization.

Collectively, these strategic moves underscore an industry trajectory toward consolidation, scale optimization, and value-added differentiation. Stakeholders prioritizing both technological acumen and market access will be best positioned to navigate competitive pressures and capture long-term growth opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Algae Protein market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AlgaEnergy, S.L.

- Algatechnologies Ltd.

- Algenuity Limited

- Allmicroalgae, UAB

- BASF SE

- Beijing Gingko Group Co., Ltd.

- Cellana, Inc.

- Corbion N.V.

- Cyanotech Corporation

- DIC Corporation

- E nergybits Inc.

- Earthrise Nutritionals LLC

- Far East Bio-Tec Co., Ltd.

- Fuji Chemical Industries Co., Ltd.

- Heliae Development LLC

- Nutrex Hawaii Inc.

- Roquette Frères S.A.

- Solazyme, Inc.

- Sun Chlorella Corporation

- TerraVia Holdings, Inc.

- Vibragy LLC

Formulating Actionable Strategic Recommendations to Empower Industry Leaders in Leveraging Algae Protein Innovations for Sustainable Growth and Competitive Advantage

Industry leaders can fortify their market position by adopting a multi-pronged innovation strategy that aligns strain development with end-market requirements. Establishing collaborative research programs with academic institutions and technology startups will accelerate discovery of novel algal strains enriched in targeted peptides and microcompounds. Concurrently, investing in modular cultivation facilities will enable scalable production with reduced capital expenditure and expedited deployment across strategic geographies.

To enhance downstream value, companies should prioritize development of versatile formulation platforms that accommodate consumer trends toward convenience and personalization. By integrating digital consumer engagement tools, such as interactive mobile applications and personalized e-commerce portals, brands can capture real-time feedback and tailor product offerings to evolving preferences. In parallel, cultivating strategic alliances with major food, feed, and pharmaceutical manufacturers will facilitate co-development of turnkey ingredient solutions tailored to large-scale production requirements.

Risk mitigation is equally critical; industry stakeholders must implement robust supply chain traceability frameworks, leveraging blockchain and sensor networks to ensure product authenticity and compliance with emerging sustainability standards. Moreover, proactive monitoring of trade policies and tariff developments will be essential for optimizing procurement strategies and minimizing exposure to geopolitical disruptions. By embracing these actionable recommendations, businesses can secure competitive advantage and foster resilient growth in the rapidly evolving algae protein sector.

Detailing a Robust Research Methodology Combining Primary Engagement, Secondary Validation, and Analytical Rigor to Deliver Unbiased Algae Protein Market Insights

Our research methodology integrates rigorous primary and secondary approaches to ensure credible and comprehensive market insights. Primary research involved in-depth interviews with executive stakeholders across algae cultivation, processing, and end-use industries. These engagements provided direct perspectives on technology adoption curves, commercial challenges, and strategic priorities. Secondary sources included peer-reviewed journals, governmental policy documents, and industry consortium whitepapers to validate quantitative and qualitative findings.

Data triangulation was employed to reconcile information from multiple sources, ensuring consistency and minimizing bias. Quantitative datasets covering production volumes, trade flows, and R&D investment were cross-verified against proprietary databases and public filings. Qualitative insights were subjected to thematic analysis, identifying recurring patterns in technology adoption, regulatory impact, and consumer behavior. This dual-layered approach underpins the robustness of our market narratives.

Moreover, expert panel reviews were conducted at successive milestones to refine analytical frameworks and validate interpretations. These panels brought together leading scientists, regulatory specialists, and commercial strategists, fostering critical examination of assumptions and enhancing scenario planning. Ethical research practices and data integrity protocols were observed throughout, guaranteeing that all conclusions are defensible and actionable.

Through this rigorous methodology, stakeholders can trust that the insights presented herein accurately reflect current market realities and emerging trajectories, thereby informing strategic decision-making with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Algae Protein market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Algae Protein Market, by Source

- Algae Protein Market, by Form

- Algae Protein Market, by Application

- Algae Protein Market, by Distribution Channel

- Algae Protein Market, by Region

- Algae Protein Market, by Group

- Algae Protein Market, by Country

- United States Algae Protein Market

- China Algae Protein Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Synthesis of Key Findings Emphasizing Algae Protein’s Strategic Value, Industry Trends, and Future Opportunities Across Diverse End Markets

The voyage through the algae protein ecosystem reveals a sector in the throes of rapid maturation, buoyed by sustainability imperatives and technological progression. From foundational cultivation breakthroughs to sophisticated downstream fractionation, each stage of the value chain is being optimized to deliver high-purity proteins that cater to diverse end-market demands. These advances coalesce to position algae protein not merely as an alternative but as a strategic cornerstone for tomorrow’s food, feed, and health industries.

Regional and segmentation analyses underscore the heterogeneity of market dynamics, yet a common thread emerges: stakeholders that integrate agility with innovation will outperform in an environment shaped by evolving regulations and consumer preferences. The interplay of tariff adjustments, distribution channel evolution, and emerging applications in cosmetics and pharmaceuticals highlights the importance of adaptive strategies and cross-sector collaboration.

In conclusion, the algae protein market presents a compelling opportunity landscape defined by environmental necessity and commercial viability. By harnessing the insights outlined in this report-spanning transformative shifts, segmentation nuances, and competitive strategies-industry participants can chart a course toward sustainable growth, enhanced profitability, and enduring impact in the global protein milieu.

Engage with Associate Director of Sales & Marketing to Access the Comprehensive Algae Protein Market Research Report and Drive Informed Decision-Making

For tailored insights and precise data-driven strategies, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your definitive copy of the algae protein market research report today. Engage with an expert who can guide you through the nuances of algae protein applications and distribution channels, ensuring your organization capitalizes on emerging opportunities. Take the first step toward unlocking the full potential of algae-derived proteins by obtaining exclusive access to comprehensive analysis, customized slide decks, and ongoing support for seamless integration of insights into your strategic roadmap.

- How big is the Algae Protein Market?

- What is the Algae Protein Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?