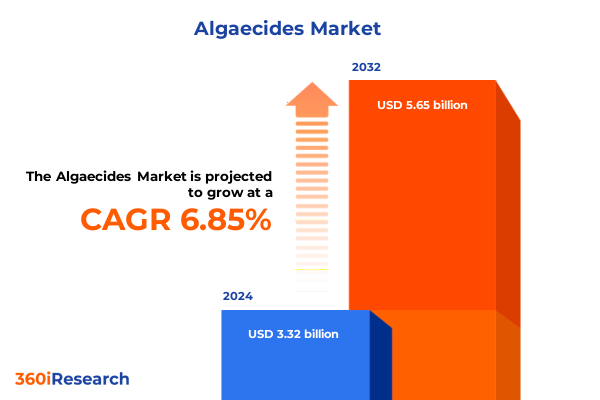

The Algaecides Market size was estimated at USD 3.55 billion in 2025 and expected to reach USD 3.78 billion in 2026, at a CAGR of 6.84% to reach USD 5.65 billion by 2032.

Exploring How Innovations in Algaecide Solutions Are Shaping Water Quality Management and Driving Strategic Priorities in a Rapidly Evolving Industry

Algaecides have become indispensable tools in safeguarding water resources against the rapid proliferation of algae that threaten aquatic ecosystems and industrial processes. In recent years, heightened regulatory scrutiny, intensified concerns over waterborne pathogens, and the necessity for operational efficiency have converged to elevate the role of algaecide solutions across diverse sectors. Market participants now confront a landscape in which performance criteria extend beyond mere efficacy to encompass environmental sustainability, regulatory compliance, and cost resilience. Accordingly, understanding the foundational drivers that underpin algaecide demand is critical for stakeholders seeking to optimize treatment protocols and derive maximum value from every application.

Against this backdrop, the evolution of algaecide technology underscores a pivotal shift in water quality management. Traditional chemistries are increasingly complemented by advanced formulations that balance potency with environmental stewardship, addressing the rising call for eco-friendly alternatives. Moreover, the integration of digital monitoring platforms enables real-time insights into algal dynamics, empowering operators to make data-driven decisions and minimize chemical overuse. As a result, the market has become more sophisticated, demanding comprehensive intelligence on current usage patterns, technological breakthroughs, and emerging competitive threats. This introduction frames the essential context for a deeper exploration of how strategic innovations and regulatory developments are reshaping the algaecide landscape.

Unveiling the Regulatory, Sustainability, and Technological Forces Transforming the Algaecide Market Landscape

The algaecide market is experiencing a transformative wave driven by converging forces of regulatory evolution, sustainability imperatives, and technological innovation. On the regulatory front, governments are tightening discharge limits and imposing stringent chemical usage standards, compelling suppliers to reformulate products that demonstrate both efficacy and lower environmental impact. This shift has catalyzed the emergence of greener chemistries, including peroxide-based and quaternary ammonium compounds, which deliver targeted algaecidal action while aligning with circular economy principles.

Concurrently, the adoption of integrated water management platforms is redefining how operators engage with algaecide applications. Advanced sensors, machine learning algorithms, and automated dosing systems now enable precision targeting, reducing waste and enhancing cost efficiency. Alongside digital advancements, strategic partnerships between chemical manufacturers and service providers are fostering end-to-end solutions, marrying product innovation with technical expertise. In parallel, the industry has seen increased investment in bio-based algaecide research, with several pilot programs demonstrating promise in minimizing ecological disruption. Collectively, these trends signal a market in flux-one where agility, interdisciplinary collaboration, and a commitment to sustainability are becoming non-negotiable pillars for success.

Analyzing How the 2025 United States Tariff Measures on Key Raw Materials Reshaped Supply Chains and Cost Structures in Algaecide Production

The imposition of new United States tariffs in 2025 has reverberated across the algaecide supply chain, creating tangible cost pressures and strategic pivots among producers and end users. Tariffs on copper compounds, a cornerstone of many algaecide formulations, have elevated input expenses, prompting manufacturers to reassess sourcing strategies and explore alternative raw material suppliers outside traditional import channels. At the same time, levies on hydrogen peroxide imports have translated into higher baseline prices for peroxide-based solutions, compelling some stakeholders to negotiate longer-term supply agreements or vertically integrate production to regain cost control.

These tariff measures have further accelerated the diversification of algaecide portfolios, with industry leaders amplifying research into quaternary ammonium chemistries and hybrid formulations that mitigate reliance on tariff-exposed inputs. Meanwhile, regional production hubs in the Gulf Coast and the West Coast have ramped up capacity expansions to serve domestic demand and circumvent import constraints. Despite short-term margins compression, this reshuffling has yielded a more resilient domestic manufacturing base and fortified supply chain visibility. In sum, the United States tariff regime introduced in 2025 has acted as a catalyst for operational optimization and supply chain realignment, reshaping competitive dynamics and fostering long-term self-reliance within the industry.

Revealing Detailed Insights into How Type, Formulation, Application, and End-Use Factors Define Algaecide Market Dynamics

Delving into the segmentation of the algaecide market reveals critical nuances that inform product development, marketing strategies, and distribution networks. In terms of chemical type, copper-based algaecides have long dominated thanks to proven efficacy, but a growing emphasis on environmental compatibility has elevated interest in peroxide-based and quaternary ammonium compound options. Insights into formulation preferences indicate that liquids, available as concentrates or ready-to-use preparations, capture significant share owing to their ease of handling and compatibility with automated dosing systems, while granular, pellet, and tablet formats maintain relevance in applications requiring controlled release or specific deployment protocols.

Application analysis underscores that agricultural irrigation systems, where biofilm and algal fouling can compromise crop yields, represent a core segment, closely followed by aquaculture operations that rely on precise water quality for stock health. Industrial water treatment processes-including cooling towers, municipal water facilities, and process water streams-demand robust algaecidal performance under varied pH and temperature conditions. Recreational water venues and residential treatments also present unique requirements, spanning fountain maintenance and pool clarity, each with distinct dosing and regulatory considerations. From an end-use vantage point, sectors such as mining, municipal water treatment, oil and gas exploration, power generation, and pulp and paper processing drive demand through operational imperatives for uninterrupted throughput and regulatory compliance.

This comprehensive research report categorizes the Algaecides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Formulation

- Application

- End Use

Uncovering How Distinct Regulatory Drivers, Water Infrastructure Challenges, and Sectoral Priorities Influence Algaecide Demand Across Global Regions

Regional analysis illuminates the distinct drivers shaping algaecide demand across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, aging water infrastructure and stringent discharge regulations are spurring investments in advanced algaecide treatments, particularly within municipal and power generation sectors. The region’s robust agricultural base also fuels demand for irrigation-specific products that mitigate biofilm formation and crop contamination risks.

Meanwhile, the Europe, Middle East & Africa region presents a complex tapestry of regulatory regimes and water scarcity challenges. European Union directives on ecological preservation have accelerated the adoption of low-impact algaecide chemistries, while Middle Eastern nations are investing heavily in aquaculture and desalination facilities, translating into tailored product requirements. African markets, though nascent, are showing potential through infrastructure modernization initiatives supported by international development financing.

Across Asia-Pacific, rapid industrialization and urbanization are driving heightened focus on water treatment solutions, with key markets in China, India, and Southeast Asia prioritizing cost-effective, scalable algaecide applications. The region’s burgeoning aquaculture sector and expanding municipal water networks underscore the importance of flexible formulation offerings that accommodate diverse operational contexts and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Algaecides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Top Industry Players Are Driving Innovation, Partnerships, and Supply Chain Resilience to Secure Leadership in the Algaecide Market

Leading companies in the algaecide landscape are differentiating themselves through a blend of product innovation, strategic partnerships, and targeted geographic outreach. Some established chemical manufacturers have fortified their market positions by acquiring niche biotechnology firms that specialize in enzymatic treatments, thereby broadening their portfolios beyond conventional chemistries. Others are entering collaborative agreements with engineering service providers to deliver turnkey water treatment packages that integrate algaecide dosing with monitoring and maintenance services.

Innovation extends to formulation technologies as well, with several key players investing in controlled-release matrices and encapsulation techniques to optimize active ingredient longevity and minimize non-target impacts. Moreover, supply chain resilience has become a competitive battleground, prompting leading organizations to develop localized production capabilities and multi-source procurement strategies. Marketing and distribution channels have similarly evolved, encompassing digital platforms that facilitate rapid order fulfillment, technical support, and regulatory compliance documentation. Collectively, these company-level initiatives exemplify a market in which agility, differentiation, and end-to-end service offerings define leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Algaecides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuro Organics Limited

- Airmax Inc

- Applied Biochemists

- Arxada AG

- BASF SE

- BioSafe Systems LLC

- Bodal Chemicals Ltd

- Cargill Incorporated

- Chemtex Speciality Limited

- Corbion

- DIC Corporation

- Dow

- dsm-firmenich

- Ecolab Inc

- Hebei Shunxing Import and Export Co Ltd

- LANXESS AG

- Lonza Group AG

- Nufarm Limited

- Olin Corporation

- Oreq Corporation

- SePRO Corporation

- Shijiazhuang Aquaenjoy Environment Corporation Limited

- UPL Limited

- Veolia Group

- Waterco Limited

Recommending Strategic Investments in Sustainable R&D, Supply Chain Diversification, and Service-Oriented Solutions for Market Leadership

Industry leaders aiming to capitalize on evolving market conditions should invest strategically in research and development initiatives that prioritize eco-friendly chemistries and digital integration. By deepening collaborations with academic institutions and technology startups, organizations can accelerate the advancement of bio-based algaecide alternatives and real-time monitoring solutions. Additionally, diversifying raw material sourcing through partnerships with regional suppliers can alleviate exposure to tariff volatility and enhance supply chain agility.

Simultaneously, strengthening service-oriented offerings by bundling algaecide products with monitoring, maintenance, and compliance support will create value differentiation and foster longer-term customer relationships. Entering emerging markets with modular, scalable solutions tailored to local infrastructure and regulatory requirements can unlock new growth channels, particularly in regions with expanding agricultural and aquaculture operations. Finally, leveraging digital marketing strategies and data analytics to refine customer segmentation and targeted outreach will further bolster market share and brand loyalty in an increasingly competitive environment.

Detailing a Multi-Layered Research Methodology Combining Primary Stakeholder Interviews, Patent Analysis, and Data Triangulation for In-Depth Market Insights

The insights presented in this report derive from a rigorous research methodology that blended primary and secondary data collection, ensuring both depth and reliability. Primary research involved structured interviews with key stakeholders across the algaecide value chain, including product formulators, water treatment service providers, industrial end users, and regulatory experts. These dialogues provided granular perspectives on emerging chemistries, application challenges, and procurement priorities.

Secondary research encompassed an extensive review of patent filings, industry white papers, regulatory filings, and peer-reviewed journals to map technological advancements and legislation trends. Data triangulation techniques were applied to validate findings, comparing cross-industry benchmarks and historical performance metrics. Furthermore, proprietary databases were leveraged to analyze company financials, M&A activity, and product launch timelines. Throughout the process, quality assurance protocols, such as data integrity checks and expert panel reviews, were employed to maintain analytical rigor and ensure that conclusions reflect the most current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Algaecides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Algaecides Market, by Type

- Algaecides Market, by Formulation

- Algaecides Market, by Application

- Algaecides Market, by End Use

- Algaecides Market, by Region

- Algaecides Market, by Group

- Algaecides Market, by Country

- United States Algaecides Market

- China Algaecides Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Insight on How Regulatory, Sustainability, and Technological Imperatives Will Drive the Next Phase of Evolution in Algaecide Markets

As the algaecide sector navigates an era defined by heightened environmental expectations, technological breakthroughs, and evolving trade policies, the imperative for informed decision-making has never been greater. This analysis underscores how regulatory tightening, sustainability demands, and supply chain realignments are collectively reshaping market contours and prompting strategic recalibrations. Success in this dynamic environment will hinge on an organization’s ability to innovate responsibly, forge cross-sector collaborations, and anticipate shifts in customer requirements.

Looking ahead, the alignment of product performance with environmental stewardship will remain a critical differentiator, as stakeholders seek solutions that deliver robust algal control without compromising ecological integrity. Furthermore, the convergence of digital monitoring and automated dosing systems is set to redefine value propositions, emphasizing precision, efficiency, and traceability. By leveraging the insights and actionable recommendations presented herein, industry participants can position themselves to thrive amid uncertainty, strengthen supply chain resilience, and capture emerging opportunities across the global algaecide landscape.

Secure Expert Guidance from Leadership to Equip Your Organization with Actionable Intelligence for Effective Algaecide Market Penetration

To take the next step toward unlocking comprehensive insights on global algaecide markets and strategies, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. With extensive expertise in water treatment solutions and market intelligence, he is prepared to guide you toward selecting the ideal package to suit your organizational needs. By connecting with Ketan, you will gain personalized advice on how this in-depth analysis can inform procurement decisions, enhance your competitive positioning, and support long-term growth objectives. Reach out today to discuss tailored research options, secure early-access briefings, and ensure your team is equipped with the actionable intelligence necessary to navigate market headwinds, optimize supply chains, and capitalize on emerging opportunities.

- How big is the Algaecides Market?

- What is the Algaecides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?