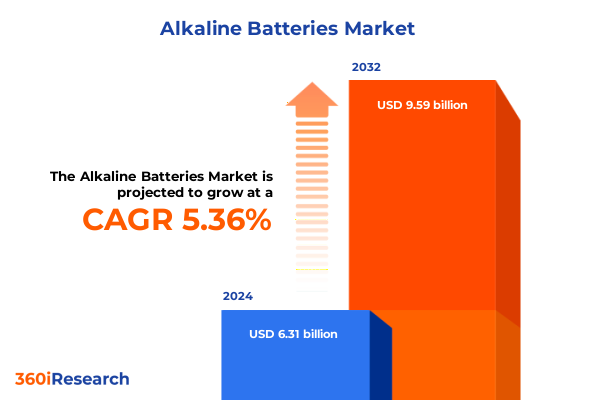

The Alkaline Batteries Market size was estimated at USD 6.63 billion in 2025 and expected to reach USD 6.98 billion in 2026, at a CAGR of 5.40% to reach USD 9.59 billion by 2032.

Evolving Role of Alkaline Batteries as a Dependable Power Backbone Across Everyday Devices, Critical Equipment, and Smart Connected Environments

Alkaline batteries remain one of the most ubiquitous power sources on the planet, quietly enabling a vast ecosystem of consumer electronics, household utilities, industrial tools, and medical devices. Billions of cells are produced annually worldwide, with AA and AAA formats alone powering everything from remote controls and toys to handheld instruments and portable lighting. Their long shelf life, robust safety profile, and ready availability ensure that alkaline chemistries continue to dominate single-use portable power, even as rechargeable technologies gain ground in some applications.

At the same time, the role of alkaline batteries is evolving rather than remaining static. Growing penetration of smart home systems, increased use of battery-powered healthcare devices in both clinical and home settings, and heightened expectations for sustainability are reshaping the demands placed on manufacturers and brands. Regulatory regimes in key markets are tightening around waste management and material stewardship, while digital channels are altering how consumers and professional buyers research, select, and replenish batteries.

Against this backdrop, stakeholders across the value chain need a more nuanced view than simple growth narratives can provide. They must understand how regulatory changes, tariff policies, evolving form factor preferences, and end-user diversification interact to create both risk and opportunity. This executive summary frames those dynamics, with particular attention to the structural shifts shaping the alkaline battery landscape through 2025 and beyond.

Key Transformative Shifts Reshaping the Global Alkaline Battery Landscape Amid Sustainability Pressures, Digitalization, and Intensifying Technology Competition

The alkaline battery landscape is undergoing a structural transition driven by three powerful forces: sustainability regulation, competitive pressure from alternative chemistries, and the digitalization of end-user devices and sales channels. In Europe, a new regulatory regime for batteries, codified in Regulation (EU) 2023/1542, extends strict requirements across the entire life cycle, from design and labelling to end-of-life collection and recycling. It mandates higher collection rates for portable batteries, minimum levels of recycled content in certain battery categories, strict controls on hazardous substances, and user-removable portable batteries in many appliances by 2027. Although much of the regulatory spotlight falls on traction and industrial chemistries, expectations around transparency, recyclability, and durability spill over into alkaline products, particularly in the European market.

Simultaneously, alkaline chemistries are facing intensifying competition from lithium-ion and other rechargeable systems in high-drain and frequently cycled applications. Portable electronics, power tools, and some categories of smart home equipment increasingly favor rechargeable solutions, pushing alkaline batteries toward roles where low self-discharge, simplicity, and broad compatibility remain decisive advantages. Industry analyses show that primary alkaline formats still dominate the installed base of household devices, toys, flashlights, clocks, and many professional instruments, but manufacturers must innovate around leak resistance, extended shelf life, and eco-designed packaging to defend that position.

Digitalization compounds these shifts. The proliferation of connected devices, sensors, and remote controls multiplies the number of alkaline-powered nodes in homes, workplaces, and public infrastructure. At the same time, e-commerce marketplaces and direct-to-consumer brand websites are changing how batteries are discovered, compared, and purchased, raising the importance of online visibility, ratings, and subscription or auto-replenishment models. Together, these trends are transforming alkaline batteries from a largely commoditized category into a more strategically managed one, where design, sustainability claims, and channel execution increasingly differentiate winners from laggards.

Assessing the Cumulative Impact of United States Tariffs Through 2025 on Alkaline Battery Supply Chains, Input Costs, Sourcing Strategies, and Competitiveness

United States trade policy has become a significant structural factor in the economics of alkaline battery supply chains. Section 301 tariffs on a wide range of Chinese-origin goods, initially imposed in earlier trade rounds, have been reaffirmed and sharpened through a four-year review completed in 2024. The review confirms that existing duties on Chinese imports will largely remain in place and introduces higher tariff rates on strategic product categories, including battery parts for non-lithium-ion technologies. For alkaline manufacturers that rely on components, sub-assemblies, or metallic inputs sourced from China, this has already translated into higher landed costs and more complex sourcing decisions.

The path into 2025 adds further layers of uncertainty. The increase of Section 301 duties on battery parts to 25% elevates the cost baseline for U.S. importers of upstream materials, from electrode components and separators to certain metal housings. While most alkaline cells sold in the U.S. are finished domestically or within the broader Americas, many still depend on imported intermediate goods and production equipment. As a result, tariffs affect not only direct material costs but also capital expenditure plans, with some battery-related factories in the broader energy-storage sector already pausing or reassessing investments amid volatile trade conditions.

Trade tensions have also prompted retaliatory measures, including broad-based tariff increases by China on U.S. imports and additional export controls on certain critical materials. Although alkaline batteries themselves are not always named explicitly in these actions, the cumulative effect is to raise the risk profile for any supply chain that depends heavily on a single bilateral trade corridor. Manufacturers serving the U.S. market are therefore accelerating diversification strategies, cultivating alternative suppliers in Southeast Asia, Mexico, and domestic sources for key components, and exploring localized production of packaging and metal parts.

By 2025, the combined impact of sustained Section 301 duties, targeted tariff hikes on battery-related goods, and reciprocal measures abroad is reshaping cost structures and bargaining power along the alkaline value chain. Producers that successfully redesign their supply networks to reduce exposure to tariffed inputs, while maintaining quality and consistency, are likely to gain a competitive edge. Conversely, brands that rely on legacy sourcing patterns face mounting margin compression or the difficult choice of passing higher costs through to price-sensitive retail channels.

Unpacking Critical Segmentation Dynamics Across Product Types, Form Factors, End Users, and Distribution Channels in the Alkaline Battery Ecosystem

Segmentation by product type remains fundamental to understanding performance within the alkaline category. Disposable alkaline batteries continue to account for the overwhelming majority of unit sales worldwide, driven by their convenience, stable voltage output, and suitability for devices with modest to moderate energy demands. These cells are favored in applications where users expect simple, occasional replacement rather than regular charging cycles, such as remote controls, wall clocks, toys, and basic flashlights. Rechargeable alkaline batteries, while technologically viable and attractive from a waste-reduction standpoint, occupy a narrower niche. Their economics are less compelling in high-drain applications compared with nickel-metal hydride or lithium-ion systems, and they require stronger consumer education to overcome entrenched habits around single-use cells.

Form factor segmentation provides another layer of strategic insight. AA and AAA cells remain the workhorses of the category, serving as default formats for handheld electronics, battery-operated toys, wireless peripherals, grooming devices, and small flashlights. C and D cells continue to play a critical role in high-drain or extended runtime devices such as industrial flashlights, portable radios, and some larger household appliances. The 9V format maintains steady demand within smoke and carbon monoxide detectors, alarm panels, and certain measurement instruments, where regulatory or safety requirements often prescribe periodic replacement regardless of remaining capacity. Button cells serve more specialized functions in compact devices, including some medical instruments and miniature electronics, where space constraints outweigh absolute capacity.

End-user segmentation further clarifies growth priorities. Consumer electronics represent a central pillar, encompassing remote controls, toys and games, flashlights and headlamps, clocks and timers, and audio devices such as portable speakers and radios. These categories generate frequent replacement cycles, particularly in households with multiple entertainment systems and children’s toys. Household utilities form another important cluster, spanning smoke and carbon monoxide detectors, security systems, and thermostats and HVAC controls, many of which depend on alkaline cells as backup or primary power to ensure fail-safe operation.

Industrial and manufacturing users rely on alkaline batteries in instrumentation, test and measurement equipment, and maintenance tools, where predictable discharge profiles and long shelf life support calibration integrity and operational readiness. Healthcare applications, including blood pressure monitors, glucose meters, and digital thermometers, represent a structurally important and expanding segment, particularly in aging societies where home monitoring is on the rise; in the United States alone, tens of millions of portable medical devices depend on alkaline cells for safe and reliable function.

Finally, distribution channel segmentation is increasingly shaping brand strategy. Offline outlets such as supermarkets, convenience stores, electronics retailers, and industrial distributors still account for a significant portion of alkaline sales, especially for impulse or emergency purchases. However, online channels are growing rapidly, with brand websites and large e-commerce marketplaces enabling bulk-pack offerings, subscription replenishment, and targeted promotions. Suppliers that tailor pack sizes, pricing, and messaging to the distinct behaviors of offline and online buyers-while aligning assortments to the specific product types and form factors favored by each end-user segment-are better positioned to capture value in what might otherwise appear to be a commoditized space.

This comprehensive research report categorizes the Alkaline Batteries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form Factor

- End User

- Distribution Channel

Regional Perspectives on Alkaline Battery Demand and Innovation Across the Americas, Europe, Middle East & Africa, and Rapidly Expanding Asia-Pacific

Regional dynamics create pronounced differences in how alkaline batteries are produced, regulated, and consumed. In the Americas, the United States stands out as both a manufacturing center and the single largest importer of alkaline batteries by shipment count, reflecting its role as a demand hub for consumer electronics, toys, industrial tools, and medical devices. A mature retail environment, strong presence of global brands, and extensive use of alkaline cells in portable healthcare equipment all support sustained consumption. At the same time, U.S. trade and industrial policy, including Section 301 tariffs on Chinese-origin battery parts and associated inputs, is accelerating efforts to localize or regionalize portions of the supply chain. Across Latin America, adoption of battery-powered devices is rising with urbanization and increasing household incomes, though price sensitivity and informal distribution remain important considerations for brand strategy.

Europe, the Middle East, and Africa present a more regulatory-driven picture, especially in the European Union. The EU’s comprehensive battery regulation introduces stringent sustainability, safety, and labelling requirements that apply to all battery chemistries, including portable alkaline cells. Mandatory collection rate targets for portable batteries, enhanced recycling efficiency thresholds, and due-diligence obligations on raw material sourcing all raise the compliance bar for suppliers into the region. These measures are intended to promote a circular economy and reduce environmental impacts, but they also favor players able to invest in closed-loop systems and transparent supply chains. In parts of the Middle East and Africa, market development is more heterogeneous, with alkaline demand growing alongside electrification, expansion of modern retail, and increased availability of battery-dependent consumer goods, albeit from a lower base.

Asia-Pacific combines the world’s largest alkaline battery production base with some of its fastest-growing consumption markets. China is a dominant exporter of alkaline cells and a major supplier of upstream components, underpinning the global availability of cost-effective batteries. At the same time, rapidly expanding middle classes in countries such as India and Southeast Asian nations are driving up per-household device counts, particularly in toys, entertainment electronics, and basic household utilities. Competition between global brands, strong regional players, and local manufacturers is intense, with e-commerce platforms playing an outsized role in product discovery and price comparison. As regional governments increasingly adopt their own e-waste and battery management regulations, Asia-Pacific is expected to remain both an engine of volume growth and a focal point for supply-chain risk management in the alkaline segment.

This comprehensive research report examines key regions that drive the evolution of the Alkaline Batteries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning of Leading Alkaline Battery Companies as They Balance Brand Loyalty, Sustainability, Supply Resilience, and Channel Diversification

The competitive landscape in alkaline batteries is characterized by a small group of global brands, a robust tier of regional specialists, and a growing presence of private-label offerings. Leading multinational companies operate extensive portfolios that span premium, mainstream, and value-focused alkaline products, often complemented by adjacent chemistries such as lithium primary and rechargeable systems. Industry analyses highlight brands such as Duracell, Energizer, Panasonic, and GP Batteries among the prominent players shaping global pricing, innovation, and marketing agendas. Their strategies increasingly emphasize differentiated performance claims, long-shelf-life guarantees, and leak-resistance assurances aimed at both consumer and professional users.

Sustainability has become a central axis of competition. Major brands have largely transitioned to mercury-free alkaline formulations and are now extending their efforts into recyclable packaging, reduced plastic use, and participation in formal collection and recycling schemes, particularly in Europe and North America. Compliance with the EU battery regulation’s labelling, information, and potential deposit-return provisions requires substantial investment in traceability systems, digital labelling tools such as QR codes, and closer collaboration with recyclers. Companies that can demonstrate credible progress toward circularity and responsible sourcing gain an advantage with regulators, retailers, and increasingly sustainability-conscious consumers.

Supply-chain strategy is another defining theme. Global leaders are diversifying their manufacturing footprints to mitigate tariff risk and geopolitical uncertainty, balancing long-standing production bases in Asia with incremental capacity in the Americas and Europe. Some are reevaluating the mix of imported components versus locally sourced materials in light of higher duties on battery parts and critical minerals. At the same time, private-label products-often sourced from large contract manufacturers-continue to exert pricing pressure in retail channels, particularly in bulk and value packs sold through supermarkets, warehouse clubs, and online marketplaces.

Innovation in form factors and packaging also distinguishes leading companies. Beyond conventional AA, AAA, C, D, 9V, and button cells, suppliers are experimenting with specialized alkaline formats and pack configurations tailored to specific use cases such as professional lighting, medical devices, or industrial instruments. Marketing is increasingly integrated across offline and online channels, with brand websites used to educate consumers on optimal battery selection for remote controls, toys, flashlights, clocks, audio devices, smoke detectors, security systems, thermostats, instrumentation, and healthcare monitors, while e-commerce marketplaces serve as key battlegrounds for search visibility and product reviews.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alkaline Batteries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Beijing Huaju New Power Technology & Development Co., Ltd.

- Camelion Battery Co., Ltd.

- Duracell Inc.

- Energizer Holdings, Inc.

- Enix Power Solutions by Upergy Limited

- Eveready Industries India Limited

- FDK Corporation

- Geep Industries Pvt. Ltd.

- Gold Peak Technology Group Limited

- Imerys S.A.

- Koninklijke Philips N.V.

- MAXWELL TECHNOLOGIES

- Nippo by Indo National Limited

- Nortek AS

- Panasonic Holdings Corporation

- Saft Groupe SAS

- Silicon Power Computer & Communications Inc.

- Sony Corporation

- Tenergy Power by Tenergy Corporation

- Toshiba Corporation

- Varta AG

- Zeus Battery Products

Actionable Strategic Recommendations for Industry Leaders Seeking Competitive Advantage in a Constrained Yet Opportunity-Rich Alkaline Battery Market

Industry leaders navigating the alkaline battery space should focus on turning structural challenges-tariffs, regulation, and technology shifts-into levers for competitive advantage. A first priority is to reassess sourcing architectures in light of the cumulative impact of U.S. tariffs on battery parts and related inputs. This involves mapping cost exposure across each bill-of-materials element, from metallic canisters to separators and packaging, and selectively relocating or dual-sourcing high-risk components. By anchoring at least part of the supply chain in tariff-neutral or preferential-trade jurisdictions, producers can reduce volatility in landed costs while maintaining responsiveness to key markets.

At the same time, companies should actively align product development and compliance roadmaps with emerging regulatory regimes, particularly in the European Union. Designing alkaline batteries and associated packaging to meet or exceed requirements on hazardous substances, labelling, removability, and participation in collection schemes will not only secure market access but also support premium positioning with retailers and institutional buyers. Incorporating traceability features, such as QR-enabled product information, and clearly communicating sustainability attributes can further differentiate offerings in markets where environmental credentials are increasingly scrutinized.

From a commercial perspective, exploiting segmentation nuances is essential. Tailoring portfolios to the distinct needs of consumer electronics, household utilities, industrial and manufacturing users, and healthcare customers helps avoid over-generalized propositions. For example, emphasizing long shelf life and reliability for smoke and carbon monoxide detectors and security systems, enhanced robustness for instrumentation and maintenance tools, and safety and accuracy support for blood pressure monitors, glucose meters, and digital thermometers aligns alkaline products more closely with the mission-critical roles they play. In parallel, optimizing pack sizes and pricing strategies separately for offline and online channels-while exploring subscription or scheduled-replenishment models in e-commerce-can strengthen brand loyalty and smooth demand.

Finally, leaders should treat data as a strategic asset. Retail sell-out information, online search and review analytics, and field feedback from industrial and healthcare customers can all feed into faster iteration of product features, packaging, and channel programs. Organizations that establish closed loops between market insight, R&D, and go-to-market teams will be best positioned to react quickly to evolving device ecosystems and regulatory expectations, ensuring that alkaline batteries remain integral to the broader portable power mix rather than being displaced by alternative chemistries where they currently excel.

Research Methodology Underpinning the Alkaline Battery Executive Assessment, Covering Data Sources, Validation, Segmentation, and Analytical Frameworks

The insights synthesized in this executive assessment draw on a multi-stage research methodology designed to balance breadth of coverage with depth of analysis. The foundation lies in extensive secondary research across publicly available sources, including trade and customs statistics, regulatory texts and guidance from bodies such as the U.S. Trade Representative and European institutions, company filings and press releases from leading alkaline battery manufacturers, and technical publications addressing battery performance, safety, and environmental aspects. Particular attention was paid to documents detailing recent changes in tariff schedules, battery sustainability rules, and waste management obligations, given their outsized influence on supply-chain design and compliance costs.

Secondary findings were then triangulated with primary discussions and structured interviews conducted with stakeholders across the value chain. These included professionals involved in battery manufacturing, component supply, distribution, device design, and end-use segments such as consumer electronics, household utilities, industrial and manufacturing applications, and healthcare. Such conversations helped validate how regulatory texts and tariff measures are experienced in practice, clarified typical replacement cycles for various device categories, and illuminated evolving preferences around form factors, packaging, and sustainable product attributes.

Analytically, the research employed a segmentation-first approach. The market was examined along the axes of product type (disposable versus rechargeable alkaline), form factor (9V, AA, AAA, C, D, and button cells), end user (consumer electronics, household utilities, industrial and manufacturing, and healthcare, with finer-grained attention to specific device classes within each), and distribution channel (online and offline, including the role of brand websites and e-commerce marketplaces). This structure allowed for consistent comparison across regions-Americas, Europe, Middle East & Africa, and Asia-Pacific-and facilitated assessment of how tariffs, regulation, and technology trends differently affect each segment. Throughout, iterative validation was used to resolve discrepancies between sources and to ensure that qualitative judgments remained grounded in documented developments and stakeholder experience rather than speculative forecasting.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alkaline Batteries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alkaline Batteries Market, by Product Type

- Alkaline Batteries Market, by Form Factor

- Alkaline Batteries Market, by End User

- Alkaline Batteries Market, by Distribution Channel

- Alkaline Batteries Market, by Region

- Alkaline Batteries Market, by Group

- Alkaline Batteries Market, by Country

- United States Alkaline Batteries Market

- China Alkaline Batteries Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Integrated Conclusions on the Strategic Outlook for Alkaline Batteries Amid Shifting Technologies, Trade Policies, Regulatory Demands, and End-User Expectations

Taken together, the evidence points to an alkaline battery sector that is mature in its core applications yet far from static. Single-use alkaline chemistries retain a central role in powering remote controls, toys, flashlights, clocks, audio devices, smoke and carbon monoxide detectors, security systems, thermostats, industrial instruments, maintenance tools, and a large installed base of portable medical devices. Their enduring appeal rests on reliability, safety, long shelf life, and compatibility with a vast ecosystem of products designed around standardized form factors.

However, the strategic context in which alkaline batteries compete is changing rapidly. Trade policy-particularly the cumulative effect of U.S. tariffs on battery parts and related goods-has elevated the importance of supply-chain resilience and localization, while regulatory developments such as the EU’s comprehensive battery framework are redefining what constitutes acceptable performance on sustainability, material stewardship, and consumer rights. Concurrently, alternative chemistries are capturing share in high-drain and rechargeable-centric applications, forcing alkaline suppliers to sharpen their value proposition and innovate in areas like leak resistance, eco-designed packaging, and enhanced durability.

Regional heterogeneity and segmentation complexity further underscore the need for nuanced strategies. The Americas combine high per-household device penetration and substantial healthcare demand with heightened tariff exposure; Europe, the Middle East and Africa are increasingly governed by rigorous sustainability and waste-management rules; and Asia-Pacific anchors global production while fueling much of the incremental demand growth. Within this mosaic, performance varies meaningfully by product type, form factor, end user, and distribution channel, rewarding companies that align their portfolios and go-to-market models with the specific needs of each niche.

For executives and product leaders, the implication is clear: treating alkaline batteries as a low-attention, purely commoditized category is increasingly risky. Those who integrate regulatory foresight, trade-aware sourcing, targeted innovation, and data-driven segmentation into their decision-making can preserve and enhance the role of alkaline chemistries in the broader portable power mix. Those who do not may find that margin pressure, compliance costs, and substitution by alternative technologies erode what has historically been a dependable and profitable product line.

Take the Next Step: Engage with Ketan Rohom to Unlock Deeper Alkaline Battery Insights and Purchase the Full Strategic Market Report

Alkaline batteries sit at the intersection of legacy reliability and emerging disruption, making informed, data-backed decisions more important than ever. Executives and category managers who understand how regulation, tariffs, and fast-changing end-user behaviors interact with product mix and channel strategy will be best positioned to protect margins and secure new revenue streams.

To move from high-level insight to execution-ready detail, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. A structured discussion around your portfolio, target geographies, and competitive set can quickly pinpoint which parts of the full alkaline battery report are most critical for your organization, whether you are reassessing sourcing options, planning product launches, or rebalancing channel investments.

By purchasing the complete report, decision-makers gain access to deeper segmentation analytics, regulatory and tariff mapping by supply chain node, and granular insight into brand and private-label positioning across the Americas, Europe, Middle East & Africa, and Asia-Pacific. This level of visibility supports scenario planning, board-level strategy reviews, and negotiations with both upstream suppliers and downstream retail partners.

Now is an opportune moment to translate strategic curiosity into concrete advantage. Connect with Ketan Rohom through your existing corporate engagement channels to explore licensing options, discuss enterprise access for your teams, and secure the comprehensive alkaline battery market intelligence needed to act with confidence in the current environment.

- How big is the Alkaline Batteries Market?

- What is the Alkaline Batteries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?