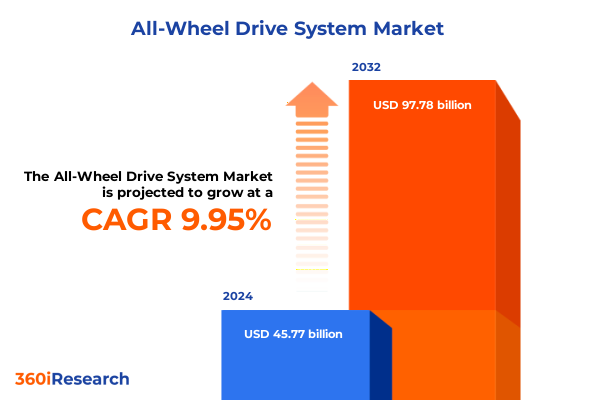

The All-Wheel Drive System Market size was estimated at USD 49.88 billion in 2025 and expected to reach USD 54.36 billion in 2026, at a CAGR of 10.09% to reach USD 97.78 billion by 2032.

Setting the Stage for a Deep Dive into the Evolution, Challenges, and Opportunities of Modern All-Wheel Drive Technologies

All-wheel drive systems have transformed from purely mechanical assemblies into sophisticated, electronically managed platforms that enhance vehicle stability, traction, and driver assurance. Over the past decade, the integration of advanced electronic control units and high-precision sensors has enabled real-time torque distribution, optimizing performance across diverse driving conditions such as wet roads, icy surfaces, and off-road terrains. This evolution reflects a broader industry shift toward intelligent drivetrain management, where software-driven decision algorithms continuously monitor wheel slip, steering angle, and vehicle dynamics to make instantaneous adjustments that improve safety and efficiency.

Simultaneously, the rise of software-defined vehicle architectures has elevated all-wheel drive systems to a new plane of complexity and capability. Centralized computing frameworks now host multiple vehicle functions, allowing over-the-air updates to torque management logic and enabling feature add-ons long after initial vehicle delivery. This approach, demonstrated in recent academic work on modular automotive deployment frameworks, underscores the potential for future obsolescence mitigation and continuous performance tuning, positioning all-wheel drive as a core software-enabled differentiator in emerging mobility solutions.

Unveiling Key Technological, Policy, and Electrification Transformations That Are Redefining the All-Wheel Drive Landscape

The first transformative shift reshaping the all-wheel drive landscape is the migration from distributed, component-centric architectures to centralized software-defined systems. By consolidating vehicle functions onto a unified hardware and abstraction layer, manufacturers can deliver more cohesive control strategies, accelerate development cycles, and introduce predictive torque management routines that learn from driver behavior patterns in real time.

Electrification represents a second major pivot, as multi-motor configurations unlock unprecedented control over power distribution. Leading electric vehicle models now employ tri-motor and quad-motor setups that individually modulate torque at each wheel, providing both enhanced off-road capability and performance gains on high-grip surfaces. This electrified approach to all-wheel drive has been validated by recent production launches where tri-motor EV pickup and SUV platforms deliver up to 850 horsepower while maintaining refined energy use through mode-select frameworks.

Concurrently, evolving policy and regulatory pressures are redefining supply chain and production strategies. Trade negotiations and tariff deadlines are compelling automakers to reconsider global sourcing models for critical drivetrain materials. The looming prospect of reduced import levies under prospective trade agreements adds further complexity, as companies balance near-term cost impacts against long-term market stability considerations.

Assessing the Multifaceted Impact of Recent U.S. Tariffs on Steel, Aluminum, and Vehicle Imports on All-Wheel Drive System Development

Early 2025 saw the implementation of sweeping U.S. tariffs, imposing a 25% duty on imported steel and a parallel rate on aluminum, with the expressed aim of bolstering domestic production. Steel and aluminum constitute foundational materials for drivetrain casings, differential housings, and torque transfer components. Given that approximately 15% of automotive-grade steel and 60% of aluminum are sourced internationally, these levies immediately heightened production costs for original equipment manufacturers and suppliers alike.

Quantifying the direct cost implications, industry analysts estimate the steel tariff adds an incremental $45 per vehicle, while aluminum tariffs introduce roughly $75 in additional material expense. When combined with domestic price pressures, these figures can escalate to around $240 per vehicle in raw material cost increases, a burden typically absorbed by manufacturer margin or passed to end consumers through higher sticker prices.

Automaker responses have varied. Some global OEMs, such as Ford, leverage high domestic sourcing ratios-90% for steel in select models-to mitigate import-duty impacts. Others have pursued tariff relief via investment in U.S. manufacturing facilities or realigning product footprints to domestic assembly lines. A notable initiative involves a major European brand proposing multibillion-dollar facility expansions in the United States in exchange for proportional tariff reductions, signaling a strategic pivot toward localized production as a lever for cost containment.

Downstream suppliers have expressed acute concern over cascading financial strain. A recent survey indicated that nearly all component-tier companies foresee significant distress due to tariff-induced input cost surges. Many lack the flexibility to rapidly overhaul sourcing strategies, exposing them to margin erosion and potential capacity reductions. These supply pressures underscore the imperative for proactive risk mitigation strategies as the tariffs remain in effect ﹘ and as the specter of further trade escalations persists.

Understanding Market Segmentation in All-Wheel Drive Systems through System Components, Propulsion Types, and Vehicle Classifications

In dissecting the all-wheel drive system market through a lens of system components, it becomes clear that the actuator and control unit segment anchors torque distribution strategies. This segment, encompassing electronic control units that process sensor inputs and hydraulic actuators that execute torque commands, underpins the transition toward dynamic, on-demand torque delivery. Differential assemblies-center, front, and rear-facilitate mechanical differentiation of wheel speeds, while transfer case designs alternate between purely mechanical and electronically shifted variants to accommodate variable driving modes.

Shifting focus to propulsion types reveals distinct nuances. In battery electric vehicles, integrated electric motor arrangements capitalize on multi-axis power distribution to optimize energy efficiency and traction. Hybrid electric vehicles blend combustion engine outputs with auxiliary electric motor torque management routines to smooth transient responses. In contrast, traditional internal combustion engine platforms rely on mechanical couplings and precision-tuned electronic controls to modulate torque across axles in response to terrain or performance demands.

When segmenting by vehicle classification, commercial platforms such as heavy and light trucks demand robust transfer cases capable of high-torque operations and sustained duty cycles, often favoring electro-mechanical on-demand designs that balance efficiency with durability. Passenger car implementations range from compact hatchbacks and sedans equipped with electronically controlled, front-biased systems for fuel economy, to sports utility vehicles that integrate adaptive multi-mode differentials for both on-road handling and off-road capability. Across all classifications, the pursuit of optimized vehicle dynamics continues to drive innovation in component modularity and software calibration.

This comprehensive research report categorizes the All-Wheel Drive System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Component

- Vehicle Propulsion Type

- Vehicle Type

Examining Regional Dynamics That Define All-Wheel Drive System Demand and Adoption across the Americas, EMEA, and Asia-Pacific Territories

In the Americas, widespread consumer appetite for SUVs, crossovers, and light trucks has catalyzed growth in all-wheel drive adoption. Manufacturers and suppliers respond by tailoring systems to North American driving preferences-prioritizing torque for towing, payload handling, and winter performance. Moreover, regional safety mandates and consumer expectations for year-round reliability reinforce investment in adaptive torque management technologies that can seamlessly shift between rear-bias and full-traction modes ﹘ a dynamic now viewed as table stakes rather than a luxury feature.

Europe, the Middle East, and Africa present a mosaic of market dynamics. In Western Europe, stringent safety and emissions regulations have spurred integration of all-wheel drive in premium electric and hybrid models, while countries in the Middle East gravitate toward robust, terrain-capable variants suited for desert and mountainous conditions. Africa’s emerging automotive markets show early signs of AWD interest in South African and North African markets, where road infrastructure variability demands systems capable of coping with both urban and rugged environments.

Asia-Pacific stands out as a dual engine of production and consumption. China’s status as a manufacturing powerhouse has led local OEMs to increasingly embed intelligent all-wheel drive modules into mass-market EVs and SUVs, leveraging advanced torque control to differentiate products in a hyper-competitive landscape. In Japan and South Korea, technological leadership in electronic control units and sensor subassemblies has positioned regional suppliers at the forefront of AWD system innovation, feeding global supply chains with next-generation components.

This comprehensive research report examines key regions that drive the evolution of the All-Wheel Drive System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Innovations and Investments of Leading All-Wheel Drive System Suppliers and OEM Partnerships Driving Industry Progress

BorgWarner has solidified its position in the electric AWD domain through recent eXD (electric cross differential) supply agreements with multiple global OEMs, ranging from East Asian vehicle brands to European premium manufacturers. This initiative, part of BorgWarner’s electric torque management system portfolio, enables intelligent on-demand torque modulation that significantly enhances stability and grip during dynamic maneuvers. The technology’s versatility across rear-, front-, and dual-motor architectures underlines the supplier’s strategic emphasis on scalable, software-driven drivetrain solutions.

Similarly, GKN Automotive’s collaboration with leading off-road vehicle brands highlights innovation in powertrain distribution. By co-developing intelligent AWD modules optimized for electric and hybrid applications, GKN leverages deep OEM partnerships to accelerate time to market for advanced torque split strategies. These alliances underscore the rising importance of cross-industry collaboration in driving AWD system refinement and integration efficiency.

ZF has also emerged as a pivotal player, unveiling a new range extender system that combines generator and drive modes in a single electric drive unit, reducing cost and complexity for extended-range AWD applications. Concurrently, its recently introduced modular e-drive SELECT platform offers a broad spectrum of power, voltage, and software configurations designed to streamline multi-variant system solutions. This dual focus on hardware compactness and software flexibility exemplifies ZF’s commitment to delivering future-proof drivetrain architectures for both passenger and commercial vehicles.

This comprehensive research report delivers an in-depth overview of the principal market players in the All-Wheel Drive System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AISIN Corporation

- American Axle & Manufacturing, Inc.

- Audi AG

- Bayerische Motoren Werke AG

- BorgWarner Inc.

- Continental AG

- Dana Incorporated

- Eaton Corporation

- GKN Automotive Limited

- Honda Motor Co., Ltd.

- JTEKT Corporation

- Magna International Inc.

- Subaru Corporation

- Toyota Motor Corporation

- ZF Friedrichshafen AG

Actionable Strategic Recommendations for Automotive Leaders to Capitalize on All-Wheel Drive Advancements and Navigate Industry Disruptions

Automotive leaders should prioritize the development of centralized software platforms that unify torque management algorithms with broader vehicle control systems. By adopting architectures that enable over-the-air updates, organizations can accelerate responsiveness to performance tuning requests and safety enhancements, thereby extending vehicle value and reducing recall risks.

A second critical action is to diversify raw material sourcing and reinforce domestic partnerships. Given current supply chain vulnerabilities exposed by tariff fluctuations, forging strategic alliances with steel and aluminum producers can stabilize costs and ensure continuity of key component flows. Collaborative ventures or off-take agreements may provide price hedging and capacity guarantees amidst geopolitical uncertainties.

Third, deepening integration with electric powertrain strategies will unlock the full potential of multi-motor AWD systems. OEMs and tier-one suppliers should co-invest in joint development programs that align motor design, inverter control, and differential integration to optimize energy efficiency and dynamic performance in electric vehicle architectures.

Finally, engaging proactively with trade associations and regulatory bodies offers a seat at the table when future tariffs or safety mandates are negotiated. By contributing empirical data on cost impacts and safety outcomes, industry consortia can shape balanced policy frameworks that protect consumer interests and encourage sustainable investment in advanced drivetrain technologies.

Detailing the Comprehensive Research Methodology Employed to Ensure Robust, Objective, and Industry-Relevant Insights into All-Wheel Drive Markets

This research adhered to a multi-phase methodology combining primary qualitative insights with rigorous secondary data analysis. In the initial phase, industry experts-including senior drivetrain engineers, procurement managers, and aftermarket specialists-were interviewed to capture firsthand perspectives on technology barriers, supply chain pressures, and customer preferences.

The secondary phase involved systematic review of publicly available patent filings, regulatory publications, and peer-reviewed academic research to trace the evolution of electronic control architectures and electric drivetrain components. Press releases and financial disclosures from leading suppliers informed the identification of emerging product launches and strategic alliances. Data triangulation across these sources reinforced the validity of key insights.

A final validation workshop convened a panel of cross-functional stakeholders to challenge preliminary findings and refine actionable recommendations. This collaborative process ensured that the research outcomes deliver both strategic relevance and operational feasibility for decision-makers seeking to navigate the rapidly evolving all-wheel drive systems landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our All-Wheel Drive System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- All-Wheel Drive System Market, by System Component

- All-Wheel Drive System Market, by Vehicle Propulsion Type

- All-Wheel Drive System Market, by Vehicle Type

- All-Wheel Drive System Market, by Region

- All-Wheel Drive System Market, by Group

- All-Wheel Drive System Market, by Country

- United States All-Wheel Drive System Market

- China All-Wheel Drive System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings and Forward-Looking Perspectives on the Future Trajectory of All-Wheel Drive Technologies in Global Automotive Markets

The collective analysis highlights a convergence of software-intensive architectures, electrified torque distribution, and dynamic trade environments as the primary forces shaping the future of all-wheel drive systems. While tariff-driven cost pressures present immediate challenges, they also incentivize innovation in localized production strategies and raw material partnerships.

Market segmentation insights reveal substantial variation across system components, propulsion types, and vehicle classes, underscoring the necessity for modular, scalable solutions that can serve diverse application requirements. Regionally, the Americas, EMEA, and Asia-Pacific each exhibit unique growth drivers-from SUV demand and regulatory mandates to EV adoption and local manufacturing capacities.

Leading suppliers are responding with advanced electric cross differentials, integrated range extenders, and modular e-drive platforms that reflect a shift toward holistic drivetrain ecosystems. By embracing software-defined vehicle principles, strengthening supply chain resilience, and fostering collaborative R&D, industry stakeholders can capitalize on these transformative trends and secure a competitive foothold in the next generation of mobility solutions.

Seize Personalized Insights from Ketan Rohom to Unlock Critical All-Wheel Drive System Intelligence and Guide Strategic Investments

To explore the full depth of these findings, engage directly with Ketan Rohom, the Associate Director of Sales & Marketing whose expertise in automotive systems sales strategy can guide your organization’s next steps. Ketan’s insights into market dynamics and buyer personas will ensure you extract maximum value from the report’s data and recommendations.

Don’t miss the opportunity to leverage this comprehensive analysis to fortify your product roadmaps, optimize supply chain resilience, and stay ahead of competitive shifts in all-wheel drive technologies. Reach out today to schedule a briefing with Ketan Rohom and secure immediate access to the intelligence you need to drive sustained growth in the evolving global automotive landscape.

- How big is the All-Wheel Drive System Market?

- What is the All-Wheel Drive System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?