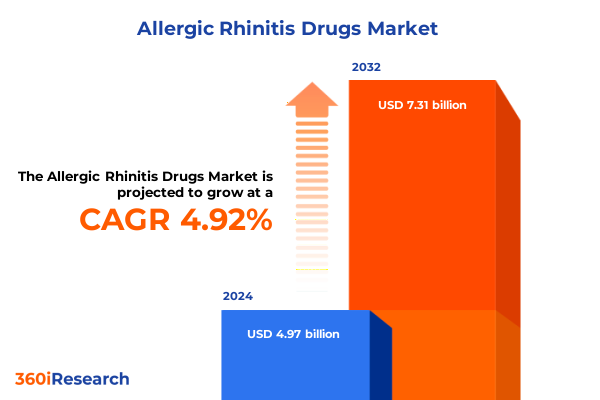

The Allergic Rhinitis Drugs Market size was estimated at USD 5.21 billion in 2025 and expected to reach USD 5.46 billion in 2026, at a CAGR of 4.94% to reach USD 7.31 billion by 2032.

Exploring the Complexities and Emerging Opportunities in Allergic Rhinitis Drug Therapeutics to Illuminate Critical Industry Trends and Stakeholder Priorities

Allergic rhinitis imposes a substantial burden on patients, healthcare providers, and payers alike, as persistent nasal congestion, sneezing, and ocular irritation can severely disrupt quality of life. Rapid advancements in immunology, formulation science, and digital health are converging to reshape the therapeutic landscape, promising more targeted and patient-centric approaches. Recognizing these shifts early and comprehensively is essential for stakeholders seeking to align product portfolios with evolving unmet needs and competitive pressures.

This executive summary synthesizes the most salient trends influencing allergic rhinitis drug development, from the macroeconomic implications of tariff policies to the granular insights afforded by robust segmentation. The ensuing sections will illuminate how distribution channels, patient demographics, dosage forms, administration routes, and drug classes interact to define market dynamics. Additionally, regional disparities in access, the strategic maneuvers of leading innovators, and actionable recommendations for charting a path to success will be thoroughly explored.

By framing the discussion within a cohesive narrative, this introduction establishes the foundation for a deeper dive into the factors driving disruption and opportunity. Stakeholders-from product managers and clinical affairs leaders to business development executives-will emerge with a well-rounded understanding of where to focus resources and how to tailor strategies that deliver measurable impact and sustainable growth.

Uncovering the Transformative Shifts Redefining Allergic Rhinitis Treatment Paradigms Amidst Technological Innovation and Evolving Regulatory Landscapes

The therapeutic landscape for allergic rhinitis is being transformed by breakthroughs in biologic therapies, digital monitoring tools, and precision medicine paradigms. Over the past few years, novel monoclonal antibodies targeting specific immunoglobulin pathways have demonstrated enhanced efficacy for patients unresponsive to traditional antihistamines and corticosteroids. These biologics are complemented by smart inhalation devices equipped with dose-tracking sensors, which integrate seamlessly with mobile applications to deliver real-time adherence data to both patients and healthcare providers. Consequently, the convergence of pharmacological innovation and digital health is creating a more granular understanding of treatment outcomes, enabling personalized care at unprecedented scale.

Regulatory frameworks have adapted in parallel, streamlining pathways for biosimilars and expedited approval processes for breakthrough therapies. Emerging guidance on real-world evidence collection has encouraged manufacturers to leverage patient registries and observational studies, accelerating launch readiness while ensuring rigorous safety monitoring. Furthermore, cross-industry collaborations between biotech firms and software developers are driving integrated solutions that combine pharmacotherapy with behavioral nudges, thereby enhancing patient engagement and therapeutic adherence.

These transformative shifts underscore a broader trend toward holistic care models, where pharmacological potency is matched with digital scaffolding to support patient journeys. As stakeholders acclimate to these changes, the ability to anticipate regulatory adaptations and harness digital enablers will distinguish market leaders from those struggling to maintain relevance.

Assessing the Broad Impact of 2025 United States Tariff Measures on Allergic Rhinitis Drug Supply Chain Dynamics and Cost Structures

In 2025, the United States implemented revised tariff measures that have reverberated through the global supply chain for allergic rhinitis therapeutics. Components imported for nasal spray devices, excipients for formulations, and packaging materials all experienced cost adjustments that have prompted manufacturers to reassess procurement strategies. Many organizations responded by diversifying supplier networks, establishing secondary sourcing agreements in markets less affected by tariff escalations, and pursuing nearshoring initiatives to mitigate logistical vulnerabilities.

The resultant recalibration of cost structures has influenced pricing strategies as well as capital allocation for research and development. Instead of absorbing increased expenses, several companies have opted to optimize upstream operations, investing in modular manufacturing platforms that enable rapid formulation changes and localized production runs. These adaptive measures have proven effective in preserving margin integrity, while simultaneously reinforcing operational resilience against future tariff fluctuations.

Moreover, the tariff-induced realignment has accelerated consolidation within the pharmaceutical value chain. Contract development organizations and specialized packaging partners with diversified geographic footprints have emerged as preferred collaborators, offering turnkey solutions that navigate customs complexities and leverage economies of scale. As a knock-on effect, strategic alliances have become instrumental in maintaining continuity of supply and ensuring that patient access remains uninterrupted despite international trade headwinds.

Deriving Actionable Insights from Multifaceted Segmentation to Navigate Diverse Channels, Patient Groups, Dosages, Administration Routes, and Drug Classes

Granular segmentation reveals differentiated trajectories across multiple vectors of the allergic rhinitis drug market, each demanding tailored strategic responses. When examining distribution channels, hospital pharmacy continues to anchor institutional demand for injectable formulations and specialized parenteral therapies, while online pharmacies leverage digital convenience to reach tech-savvy patients seeking nasal sprays and oral solutions. Retail pharmacy remains a cornerstone for over-the-counter antihistamines and decongestants, yet specialty pharmacy is carving out a niche by supporting advanced biologics that require patient education and adherence monitoring.

Analyzing patient age groups, adults represent the largest cohort pursuing self-managed therapies, frequently transitioning between oral tablets and liquid formulations based on convenience and onset of action. Pediatric populations, conversely, demonstrate a preference for single-use eye drops and ready-to-use nasal sprays formulated for minimal dosing errors, while geriatric patients exhibit higher adoption rates of extended-release tablets that align with simplified dosing regimens and improved tolerability.

Dosage form segmentation underscores distinct value propositions: eye drops, available in both multiuse and single-use formats, tackle ocular symptoms directly, whereas intramuscular and subcutaneous injections deliver systemic relief for severe presentations. Dry powder and metered dose nasal sprays address patient preferences for portability and precision, and oral solutions offered as both liquid concentrates and ready-to-use options cater to varying needs in pediatric and adult care settings. Tablets, whether immediate or extended release, continue to deliver consistent serum levels, underpinning their enduring popularity among long-term management strategies.

Route of administration insights further accentuate the interplay between patient lifestyle and therapeutic efficacy. Nasal delivery maximizes local bioavailability with minimal systemic exposure, ocular administration targets lacrimal inflammation directly, and oral routes remain favored for their user familiarity. Parenteral options-intramuscular, intravenous, and subcutaneous-serve acute cases and hospital settings, yet they also highlight an opportunity for self-administered subcutaneous biologics that bridge the gap between outpatient convenience and clinical-grade efficacy.

Drug class segmentation illuminates differentiated therapeutic niches. Decongestants, including phenylephrine and pseudoephedrine, offer rapid nasal decongestion, while first- and second-generation H1 antihistamines balance symptom relief against side-effect profiles. Intranasal corticosteroids-budesonide, fluticasone, mometasone, triamcinolone-remain the mainstay for long-term inflammation control, as leukotriene receptor antagonists such as montelukast and zafirlukast provide oral alternatives for select patients. Mast cell stabilizers like cromolyn sodium and nedocromil illustrate preventive approaches, particularly in populations intolerant of corticosteroids. By understanding these nuanced segmentation axes, stakeholders can refine product positioning and tailor market entry strategies to the precise needs of each patient subgroup.

This comprehensive research report categorizes the Allergic Rhinitis Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Dosage Form

- Patient Age Group

- Route Of Administration

- Distribution Channel

Examining Regional Dynamics Influencing Allergic Rhinitis Drug Accessibility, Adoption Patterns, and Innovation Trajectories Across Global Markets

Regionally, market dynamics diverge based on regulatory priorities, healthcare infrastructure, and cultural attitudes toward allergic rhinitis management. In the Americas, established insurance frameworks and direct-to-patient digital models support broad access to both generic nasal sprays and high-value biologics. Patient advocacy groups have successfully elevated symptom awareness, driving early intervention and sustained demand for advanced therapies.

Europe, Middle East, and Africa present a heterogeneous environment. In Western Europe, stringent regulatory standards and centralized procurement mechanisms favor intranasal corticosteroids with extensive clinical validation. Contrastingly, emerging markets in the Middle East and Africa grapple with supply chain disruptions and affordability constraints, prompting government initiatives to bolster generic capacity and incentivize local manufacturing of key antihistamines and decongestants.

Asia-Pacific is characterized by rapid urbanization and rising healthcare spending, fueling adoption of novel formulations and digital adherence platforms. Japan and South Korea lead in biologic penetration, underpinned by robust reimbursement schemes and domestic biotech innovation. Southeast Asian nations demonstrate appetite for cost-effective nasal sprays and oral solutions, while China’s evolving regulatory landscape has accelerated approvals for locally developed monoclonal therapies and combinations integrating corticosteroids with antihistamines.

These regional insights reveal that success hinges on adaptive go-to-market strategies, effective navigation of local regulatory pathways, and culturally attuned patient engagement initiatives. By leveraging region-specific intelligence, pharmaceutical stakeholders can optimize resource allocation and align their portfolios with distinct needs across the Americas, EMEA, and Asia-Pacific.

This comprehensive research report examines key regions that drive the evolution of the Allergic Rhinitis Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Company Movements and Collaborations Sculpting the Competitive Terrain of Allergic Rhinitis Therapeutics

Leading pharmaceutical and biotechnology companies are embracing a range of strategic imperatives to secure competitive advantage in allergic rhinitis therapeutics. Some have sharpened their portfolios through targeted acquisitions of promising biologics developers, prioritizing assets that complement existing intranasal corticosteroid franchises. Others have formed co-development partnerships with digital health startups to integrate inhalation sensors and mobile adherence platforms directly into branded nasal sprays, thereby reinforcing patient loyalty and generating real-world evidence.

In parallel, contract manufacturing organizations specializing in complex parenteral formulations have attracted investment from established drug makers seeking to de-risk production and expedite capacity expansion. Companies with in-house biologics capabilities are scaling subcutaneous and intravenous platforms, anticipating increased demand for self-administered immune modulators. Meanwhile, players focusing on traditional small molecules are differentiating through formulation enhancements-such as improved bioavailability in extended-release tablets and more user-friendly single-use eye drops.

Across the board, cross-sector collaborations are emerging as essential conduits for innovation. Partnerships with academic research centers have yielded early-stage insights into novel immunomodulatory targets, while joint ventures with logistics and packaging experts have optimized cold-chain distribution for temperature-sensitive biologics. This convergence of expertise underscores a collective recognition that addressing allergic rhinitis in the twenty-first century demands more than incremental product tweaks-it requires a concerted, ecosystem-driven approach.

This comprehensive research report delivers an in-depth overview of the principal market players in the Allergic Rhinitis Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALK‑Abelló A/S

- Allergy Therapeutics PLC

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim International GmbH

- Dr. Reddy’s Laboratories Ltd.

- GlaxoSmithKline PLC

- Glenmark Pharmaceuticals Ltd.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Stallergenes Greer International AG

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- UCB S.A.

- Viatris Inc.

Formulating Practical Recommendations to Empower Industry Leaders in Capitalizing on Emerging Trends and Optimizing Portfolio Strategies

Industry leaders should prioritize the development of integrated care solutions that marry pharmacotherapy with digital adherence tools, recognizing that patient outcomes are increasingly driven by behavioral engagement rather than drug efficacy alone. Allocating resources to pilot projects that test sensor-enabled delivery devices alongside companion apps can yield valuable insights into real-world usage patterns and identify opportunities to enhance dosing accuracy and long-term compliance.

Furthermore, establishing flexible manufacturing agreements with geographically diversified contract partners will mitigate future tariff shocks and shipping delays. By securing multiple sourcing lanes for critical formulation ingredients and device components, companies can maintain uninterrupted supply while negotiating more favorable terms with suppliers who value long-term collaboration over transactional relationships.

Strategic investment in localized clinical trials and real-world evidence studies across diverse regions will also pay dividends. Tailoring research initiatives to capture patient-reported outcomes in both mature and emerging markets will strengthen regulatory dossiers and support differentiated positioning. Additionally, exploring lifecycle management strategies, such as reformulating established agents into single-use delivery systems or combining corticosteroids with antihistamines, can extend product lifecycles without necessitating full-scale new-molecule development.

Finally, cultivating open-innovation platforms and academic alliances will accelerate the discovery of non-traditional targets, including mucosal immunomodulators and microbiome-based therapies. By fostering collaboration across disciplines, industry players can stay ahead of the curve and bring truly transformative solutions to patients suffering from allergic rhinitis.

Detailing a Rigorous Research Methodology Employing Comprehensive Data Triangulation and Quality Controls for Valid Insights

The research underpinning this report employs a multi-phased methodology designed to ensure rigor, reliability, and relevance. In the initial phase, exhaustive secondary research was conducted using peer-reviewed journals, regulatory filings, and patent databases to map existing therapeutic modalities and innovation streams. These insights provided the foundation for drafting the segmentation framework and identifying key market drivers.

Subsequently, primary research protocols engaged a diverse panel of stakeholders, including clinicians, pharmacists, procurement specialists, and patient advocacy representatives. Through in-depth interviews and structured surveys, qualitative insights were triangulated against quantitative data to validate emerging trends, uncover unmet patient needs, and calibrate perceptions of novel delivery mechanisms. Interview guides were iteratively refined to focus on areas of greatest strategic ambiguity and market opportunity.

Data integrity was further reinforced through a dual-review process, where subject matter experts cross-verified findings and statistical analysts performed consistency checks across datasets. Triangulation with public health statistics and commercial prescription databases ensured that the report’s narrative aligns with observable market behavior while respecting confidentiality and data privacy standards.

Throughout the study, adherence to ethical research principles and regulatory compliance guidelines was paramount. All primary research participants provided informed consent, and proprietary insights were anonymized to protect competitive intelligence. This robust methodological approach underpins the credibility of the insights presented and offers stakeholders confidence in the strategic recommendations derived.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Allergic Rhinitis Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Allergic Rhinitis Drugs Market, by Drug Class

- Allergic Rhinitis Drugs Market, by Dosage Form

- Allergic Rhinitis Drugs Market, by Patient Age Group

- Allergic Rhinitis Drugs Market, by Route Of Administration

- Allergic Rhinitis Drugs Market, by Distribution Channel

- Allergic Rhinitis Drugs Market, by Region

- Allergic Rhinitis Drugs Market, by Group

- Allergic Rhinitis Drugs Market, by Country

- United States Allergic Rhinitis Drugs Market

- China Allergic Rhinitis Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings to Highlight Strategic Imperatives and Illuminate Future Opportunities in Allergic Rhinitis Drug Development

The confluence of biologic innovation, digital health integration, and strategic supply chain realignment paints a vivid picture of an allergic rhinitis market at the cusp of transformation. Stakeholders who embrace patient-centric care models, invest in adaptive manufacturing, and cultivate cross-industry collaborations will be best positioned to seize emerging growth opportunities. Moreover, the insights revealed by meticulous segmentation and regional analysis underscore the imperative to customize strategies for distinct patient cohorts and geographic contexts.

In sum, unlocking value in the allergic rhinitis therapeutics space demands a balanced blend of technological foresight, operational agility, and robust evidence-generation frameworks. By synthesizing these elements within a cohesive strategic roadmap, industry leaders can both meet heightened patient expectations and navigate regulatory and economic headwinds with confidence.

Inviting Engagement with Ketan Rohom to Access the In-Depth Allergic Rhinitis Drugs Market Research Report and Drive Informed Decisions

The comprehensive insights you have just explored underscore the critical importance of staying informed and agile in the dynamic allergic rhinitis therapeutics landscape. To harness these findings for actionable business growth, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through the nuances of this market intelligence, ensuring that your strategic initiatives are underpinned by robust data and tailored analysis.

By partnering with Ketan Rohom, you will gain priority access to the full market research report, refine your competitive positioning, and identify high-potential opportunities across segments, regions, and novel product classes. Reach out today to secure this essential resource and empower your organization to anticipate change, mitigate risk, and accelerate innovation in allergic rhinitis treatment.

- How big is the Allergic Rhinitis Drugs Market?

- What is the Allergic Rhinitis Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?