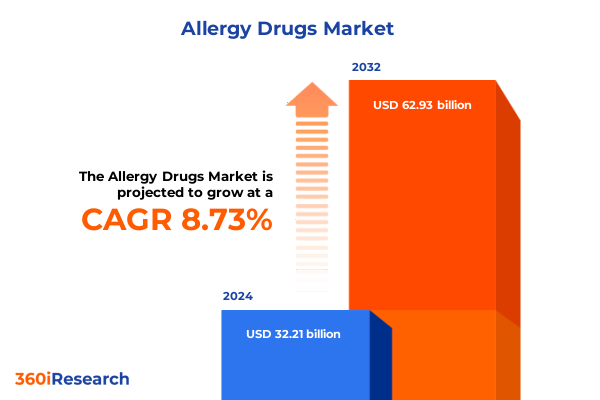

The Allergy Drugs Market size was estimated at USD 34.97 billion in 2025 and expected to reach USD 37.87 billion in 2026, at a CAGR of 8.75% to reach USD 62.93 billion by 2032.

Evolution of Allergy Therapeutics in an Era of Complex Patient Needs and Rapid Biopharmaceutical Innovation Fueling Market Transformation

The landscape of allergy therapeutics has evolved dramatically over the past decade, propelled by advances in molecular biology, personalized medicine, and an increased prevalence of allergic conditions worldwide. Recent studies indicate that factors such as urbanization, environmental pollutants, and lifestyle changes have contributed to a surge in allergic asthma, rhinitis, and food allergies. In this context, the portfolio of drugs-from first‐generation antihistamines to next‐generation biologics-has grown exponentially, necessitating an in‐depth analysis of emerging trends, patient preferences, and competitive dynamics.

Against this backdrop, an executive summary serves as an essential compass for decision-makers seeking to navigate the complexities of market entry, product positioning, and strategic partnerships. By distilling high-level insights on regulatory shifts, supply-chain vulnerabilities, and segmentation nuances, this document provides a concise yet comprehensive foundation for investment planning and go-to-market strategies. As the industry transitions from broad‐spectrum antihistamines to targeted mast cell stabilizers and leukotriene receptor antagonists, stakeholders must remain agile and informed to capitalize on evolving opportunities.

How Emerging Technologies Regulatory Reforms and Personalized Medicine Are Reshaping the Allergy Treatment Ecosystem with New Competitive Opportunities

The allergy drug ecosystem is undergoing transformative shifts driven by breakthroughs in biologics, digital health integration, and regulatory modernization. On the scientific front, monoclonal antibodies targeting key inflammatory pathways have redefined treatment paradigms, offering improved efficacy and reduced systemic side effects compared to traditional corticosteroids. Simultaneously, regulatory agencies have adopted expedited pathways for breakthrough therapies, accelerating approvals for biologics that demonstrate substantial clinical promise. This synergy between innovation and regulation has lowered barriers for new entrants and fostered collaboration across biotech, academia, and large pharmaceutical companies.

Equally influential is the rise of patient-centric digital solutions. Mobile health platforms now enable real-time symptom tracking, adherence monitoring, and remote consultations, creating deeper patient engagement and enhancing clinical trial recruitment. These platforms also provide valuable real-world data that inform drug development and post-marketing surveillance. Coupled with the growing emphasis on personalized medicine, companies are leveraging genomic and immunologic biomarkers to stratify patient populations and tailor therapies. As a result, the competitive landscape has shifted from one-size-fits-all approaches toward more nuanced strategies that prioritize unmet needs and deliver differentiated value.

Assessing the Full Spectrum Impact of the 2025 United States Tariffs on Supply Chains Pricing Structures and Industry Profitability in Allergy Drug Development

In 2025, the United States implemented a series of tariffs targeting imported pharmaceutical active ingredients and excipients, reshaping supply-chain dynamics and cost structures across the allergy drug market. These measures, intended to promote domestic manufacturing, have led to recalibrated supplier networks as companies seek to mitigate exposure to tariff‐induced price volatility. The immediate impact was felt in the pricing of corticosteroids and antihistamines, where raw material costs spiked, prompting renegotiations with suppliers and adjustments to procurement strategies.

Over time, the cumulative effect has extended beyond procurement, influencing formulation decisions and contract manufacturing relationships. Some manufacturers have accelerated onshoring of critical production processes, while contract research and manufacturing organizations (CRAMs) have adapted by developing tariff-compliant supply chains and regional hubs. Although the short-term pressures on profit margins triggered price adjustments for select product lines, the strategic response has been an overall strengthening of supply-chain resilience. Stakeholders now recognize the importance of diversified sourcing, deeper strategic partnerships, and flexible manufacturing platforms to navigate an increasingly protectionist trade environment.

Uncovering Deep Segmentation Patterns Across Drug Classes Routes of Administration Patient Demographics and Distribution Channels Driving Market Dynamics

Deep analysis of market segments reveals that innovation and opportunity are far from uniform across drug classes, routes of administration, patient indications, age cohorts, and distribution networks. Within the drug class spectrum, second-generation antihistamines are rapidly displacing first-generation counterparts due to superior safety and dosing convenience, while corticosteroids maintain prominence for moderate to severe respiratory allergies. Decongestants continue to offer short-term relief, but emerging leukotriene receptor antagonists and mast cell stabilizers are gaining traction for their targeted mechanisms.

Route of administration further differentiates treatment adoption: injectable biologics address severe allergic asthma with high efficacy, while nasal sprays and drops dominate seasonal rhinitis management due to convenience and rapid onset. Ophthalmic solutions retain a loyal following for eye allergies, and oral therapies remain the mainstay for broad-spectrum allergy control. Topical formulations are increasingly used for skin allergies, leveraging localized delivery. In parallel, drug indications exhibit distinct growth trajectories: respiratory allergies, subdivided into allergic asthma and allergic rhinitis, represent the largest share of chronic treatment, while food, drug, and latex allergies call for highly specialized interventions. Adult patients continue to consume the majority of units, but pediatrics demand safer dosing profiles and flavor-masked formulations. Finally, the distribution ecosystem shapes market access: hospital pharmacies provide channel stability for injectable therapies, online pharmacies attract price-sensitive consumers with broad formularies, and retail pharmacies-both chain and independent-serve as critical touchpoints for over-the-counter antihistamines and topical products.

This comprehensive research report categorizes the Allergy Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Allergy Indication

- Patient Age Group

- Distribution Channel

Strategic Regional Perspective Highlighting Growth Drivers and Obstacles in the Americas Europe Middle East Africa and Asia Pacific Allergy Drug Markets

A regional lens brings into focus the distinctive drivers and restraining factors across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, rising awareness campaigns and advanced reimbursement policies have accelerated the uptake of both branded and generic allergen immunotherapies, while robust R&D ecosystems support clinical trials for novel biologics. The United States remains a hotspot for innovation, but Canada and Brazil are emerging as pivotal markets due to expanding healthcare access.

In Europe Middle East & Africa, heterogeneous regulatory frameworks and variable reimbursement landscapes create a patchwork of market conditions. Western Europe leads in early adoption of second-generation antihistamines and nasal sprays, whereas Eastern markets show promise for growth as healthcare infrastructures evolve. The Middle East is witnessing government-led initiatives to improve allergy diagnostics, and select African nations are investing in basic allergy care infrastructure, presenting long-term opportunities.

Asia-Pacific is experiencing a rapid epidemiological shift driven by urbanization, pollution, and changing lifestyles. Countries such as China, India, and Australia are witnessing surges in allergic rhinitis and asthma rates, prompting both multinational and domestic players to expand localized manufacturing and distribution agreements. Seasonal allergy seasons vary widely, influencing product mix and inventory planning, while digital health platforms are gaining momentum as a means to manage large patient populations effectively.

This comprehensive research report examines key regions that drive the evolution of the Allergy Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies Innovations and Partnerships from Leading Pharmaceutical Players Shaping the Future of Allergy Treatment Worldwide

Leading pharmaceutical and biotech organizations are deploying a mix of organic innovation, strategic partnerships, and acquisitions to solidify their foothold in allergy therapeutics. Established players in large molecule development continue to leverage their biologics expertise to advance monoclonal antibodies and small interfering RNA candidates through late-stage trials. Several have formed alliances with biotech startups specializing in novel delivery platforms, such as microneedle patches and nanoparticle carriers, aimed at enhancing efficacy and patient adherence.

Meanwhile, companies with robust generic portfolios are investing in controlled-release formulations and combination products to differentiate offerings in crowded markets. Strategic licensing agreements have emerged as a critical mechanism for securing exclusive rights to promising compounds, while mergers and acquisitions enable rapid expansion of therapeutic pipelines and geographic reach. Equity investments in digital health ventures demonstrate a commitment to end-to-end patient engagement, integrating symptom tracking, telemedicine, and adherence monitoring into holistic treatment bundles. As the lines between pharma, biotech, and tech converge, alliance networks increasingly determine time to market and post-launch performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Allergy Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Alcon Inc.

- ALK-Abelló A/S

- Apotex Inc.

- Bayer AG

- Boehringer Ingelheim International GmbH

- Cipla Ltd.

- Dr. Reddy’s Laboratories Ltd.

- F. Hoffmann-La Roche Ltd

- Faes Farma, S.A.

- Genentech, Inc.

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd.

- Johnson & Johnson

- LETI Pharma, S.L.U.

- Meda Pharmaceuticals

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Prestige Brands Holdings Inc

- Regeneron Pharmaceuticals, Inc.

- Sanofi S.A.

- Stallergenes Greer International AG

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

Driving Sustainable Growth Through Adaptable Business Models Strategic Investments and Dynamic Partnerships in an Evolving Allergy Drug Marketplace

For industry leaders charting the next phase of growth, a multipronged approach to portfolio management, supply-chain resilience, and patient engagement is vital. By prioritizing second-generation antihistamine development and pipeline biologics targeting novel immunoglobulin E pathways, organizations can address unmet needs while commanding higher value. Complementing this, expansion of digital health platforms for remote monitoring and adherence support will foster long-term loyalty and generate real-world evidence for regulators.

Equally important is the optimization of manufacturing footprints to balance cost-effectiveness with tariff compliance. Companies should evaluate joint ventures with regional contract manufacturers, develop dual-sourcing strategies for critical APIs, and invest in modular onshoring capabilities. Collaboration with local distributors and specialty pharmacies can unlock last-mile access, especially in emerging markets. Finally, establishing cross-functional innovation councils that bring together R&D, commercial, and regulatory teams will accelerate decision-making and ensure alignment across the product lifecycle, ultimately translating scientific breakthroughs into sustainable commercial success.

Rigorous Multistage Research Framework Integrating Primary Expertise Secondary Data and Analytical Rigor for Comprehensive Allergy Drug Market Insights

This analysis is grounded in a rigorous multistage research framework that combines primary expertise, extensive secondary data, and robust analytical methodologies. Initially, primary inputs were gathered through interviews with industry executives, allergists, regulatory experts, and supply-chain specialists, ensuring firsthand insights into emerging trends and challenges. Secondary sources encompassed peer-reviewed journals, government publications, and proprietary clinical trial databases, enabling comprehensive mapping of therapeutic pipelines and regulatory approvals.

Quantitative modeling and qualitative triangulation were applied to validate findings and identify discrepancies. Market dynamics were further illuminated by analyzing patent landscapes, M&A activity, and tariff impact assessments. Geographic segmentation leveraged regional healthcare expenditure data and demographic indicators to contextualize growth potential. The synthesis of these layers of evidence resulted in a holistic view of the allergy drug market, delivering both high-level strategic implications and actionable recommendations for stakeholders across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Allergy Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Allergy Drugs Market, by Drug Class

- Allergy Drugs Market, by Route Of Administration

- Allergy Drugs Market, by Allergy Indication

- Allergy Drugs Market, by Patient Age Group

- Allergy Drugs Market, by Distribution Channel

- Allergy Drugs Market, by Region

- Allergy Drugs Market, by Group

- Allergy Drugs Market, by Country

- United States Allergy Drugs Market

- China Allergy Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Converging Trends Competitive Dynamics and Policy Shifts Underscore the Imperative for Stakeholders to Embrace Next Generation Allergic Treatment Solutions

The convergence of biologic innovation, protective trade policies, and evolving patient expectations underscores the imperative for stakeholders to adapt rapidly. Competitive dynamics are increasingly shaped by speed to market and the ability to deliver integrated treatment experiences that span therapeutics, diagnostics, and digital health. Policy shifts, from expedited regulatory pathways to tariff regimes, have both accelerated the introduction of breakthrough therapies and introduced new cost considerations that cannot be ignored.

Moving forward, organizations that embrace next generation allergic treatment solutions-be it targeted monoclonal antibodies, novel delivery platforms, or real-world evidence ecosystems-will secure a distinct competitive edge. The cumulative insights from segmentation, regional analysis, and company strategies highlight that success will depend on an orchestrated approach spanning R&D, manufacturing, and commercialization. Ultimately, the allergy drug market in 2025 and beyond will reward those who combine scientific rigor with strategic foresight, ensuring resilient growth in an increasingly complex healthcare environment.

Secure Your Competitive Advantage with Exclusive Access to a Definitive Allergy Drug Market Report by Engaging with Ketan Rohom Today

To gain immediate competitive insights and strategic advantage, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly will allow tailoring the executive briefing to your organization’s unique positioning and decision-making needs. Secure your organization’s roadmap in the allergy therapeutics landscape by partnering with an expert who can guide you to the most critical data points and actionable intelligence. Take the next pivotal step in aligning your product portfolio with market demand by contacting Ketan Rohom today.

- How big is the Allergy Drugs Market?

- What is the Allergy Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?