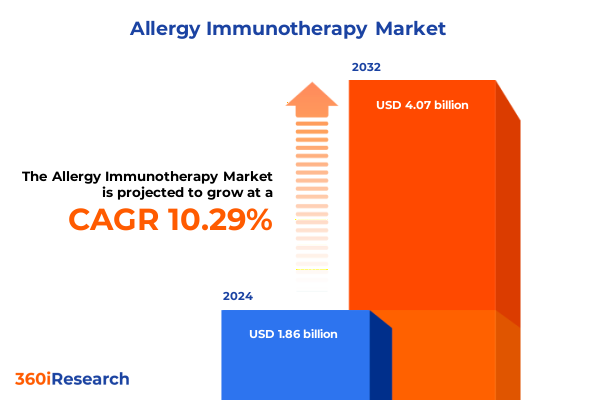

The Allergy Immunotherapy Market size was estimated at USD 2.04 billion in 2025 and expected to reach USD 2.24 billion in 2026, at a CAGR of 10.36% to reach USD 4.07 billion by 2032.

Comprehending the Escalating Prevalence of Allergic Conditions and the Pivotal Emergence of Immunotherapy as a Disease-Modifying Solution

Allergic conditions have become pervasive, afflicting nearly one-third of adults in the United States with seasonal allergies representing over a quarter of diagnosed cases and food allergies affecting more than six percent of the population. Urbanization, environmental pollution, and indoor lifestyles have driven this upward trend, fueling increasing demand for effective long-term treatments.

Immunotherapy has emerged as the only disease-modifying intervention capable of altering the immune system’s reaction to allergens, offering the potential for sustained symptom relief and reduced reliance on pharmacotherapy after the completion of a full course of treatment. Subcutaneous and sublingual immunotherapy have been the cornerstone of treatment for over a century but are constrained by lengthy treatment durations, administration complexities, and variable patient adherence.

Recent breakthroughs in oral immunotherapy, epicutaneous delivery, and monoclonal antibody approaches are transforming the therapeutic landscape by addressing safety, convenience, and broad-spectrum allergen coverage. Advances in recombinant allergen technology, nanocarrier adjuvants, and precision-targeted formulations are further enhancing efficacy and tolerability profiles, paving the way for personalized immunotherapy regimens that meet the evolving needs of diverse patient populations.

How Digital Innovations Telehealth and Novel Delivery Platforms Are Redefining Allergy Immunotherapy Patient Engagement and Outcomes

The allergy immunotherapy landscape is undergoing a fundamental shift driven by digital health and patient-centric delivery models. Telemedicine platforms specializing in allergy care now connect patients with board-certified allergists, enabling remote monitoring and real-time dose adjustments that improve adherence and reduce acute exacerbations. At the same time, at-home immunotherapy offerings leverage mail-order pharmacy services to deliver personalized treatment directly to patients, expanding access beyond traditional clinic-based settings.

Connected health solutions are also redefining the delivery of sublingual immunotherapy. The iPUMP® connected assistant integrates seamlessly with companion mobile applications to guide correct dosing technique, monitor adherence, and provide history-tracking functionality. Real-world evidence indicates a 15 percent increase in observance among users, with parents reporting heightened confidence in treatment administration for pediatric patients.

Regulatory approvals of novel formulations have further catalyzed this transformation. The FDA’s clearance of PALFORZIA as the first oral peanut immunotherapy and expanded indications for sublingual dust mite tablets reflect a broader commitment to diversifying immunotherapy options. Rising insurance coverage for these therapies, particularly within Medicaid programs, is enhancing affordability and fostering wider adoption across patient demographics.

Evaluating the Far-Reaching Effects of 2025 United States Tariff Policies on Allergy Immunotherapy Supply Chains and Treatment Costs

Beginning in 2025, the United States introduced sweeping tariff measures that have upended pharmaceutical supply chains and reshaped cost structures for allergy immunotherapy providers. A global tariff of ten percent now applies to nearly all imported goods, encompassing key healthcare inputs such as active pharmaceutical ingredients, delivery systems, and diagnostic tools. More stringent duties, ranging from twenty to twenty-five percent, target critical APIs sourced from China and India, directly inflating production costs for both generic and branded immunotherapy products.

An Ernst & Young analysis commissioned by the industry estimates that a sustained twenty-five percent tariff on pharmaceutical imports could drive U.S. drug spending up by nearly fifty-one billion dollars annually, elevating drug prices by as much as 12.9 percent if these costs are passed through to patients. Approximately thirty percent of imported pharmaceuticals serve as manufacturing inputs, meaning higher duties not only increase retail prices but also undermine the competitiveness of domestically produced therapies on the global stage.

Beyond cost inflation, these tariffs have triggered supply chain disruptions that risk critical drug shortages. Stakeholders report challenges in sourcing intermediate inputs, prompting some manufacturers to explore reshoring initiatives and alternative supplier networks to mitigate tariff exposure. In response, regulatory agencies have signaled intentions to expedite reviews for new domestic manufacturing sites and approve temporary importation of alternative sources to maintain continuity of patient care.

Gaining In-Depth Insights into Segmentation by Treatment Type Allergen and Technology Variables Shaping the Allergy Immunotherapy Market

An in-depth segmentation of the allergy immunotherapy market reveals nuanced dynamics across multiple axes of patient need and delivery modality. By treatment type, epicutaneous immunotherapy emerges as an innovation frontier, offering needle-free desensitization, while oral immunotherapy gains traction for food allergy management in pediatric populations. Subcutaneous immunotherapy continues to serve as the clinical mainstay for respiratory allergies, and sublingual immunotherapy tablets and drops provide convenient home-use alternatives.

Allergen type segmentation highlights the diversity of triggers driving patient demand. Animal dander, divided into cat and dog allergens, remains a significant focus for immunotherapy protocols, while dust mites represent another ubiquitous indoor allergen requiring specialized extracts. Food allergens, further categorized into egg, milk, peanut, and tree nuts, are shaping the development of targeted oral tolerance induction therapies. Pollen allergies, spanning multiple plant species, continue to drive high-volume demand for seasonal immunotherapy products.

Delivery form influences patient preference and program design. Dermal patches deliver controlled epicutaneous exposure, dips into the emerging epicutaneous field, while liquid drops and standardized tablets have accelerated uptake of sublingual routes. Injectable formulations retain a critical role in subcutaneous protocols, offering flexible dosing schedules under clinical supervision.

Technology platforms underpin the next wave of innovation. Adjuvant systems enhance immune modulation and accelerate desensitization, nanotechnology-based carriers optimize allergen presentation, and recombinant allergens promise greater purity and reduced risk of adverse reactions. Allergy type segmentation, covering allergic asthma, allergic rhinitis, atopic dermatitis, and urticaria, underscores the multifaceted clinical indications driving therapy customization. End-user environments, spanning homecare settings, hospitals, research and academic laboratories, and specialty clinics, dictate service delivery models and the adoption of point-of-care innovations. Finally, distribution channels, including hospital pharmacies, online pharmacies, and retail pharmacies, complete the market ecosystem by shaping patient access and supply chain logistics.

This comprehensive research report categorizes the Allergy Immunotherapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Allergy Type

- Allergen Type

- Treatment Type

- Immunotherapy Delivery Form

- Technology Platform

- End User

- Distribution Channel

Unveiling Regional Market Dynamics Across the Americas Europe Middle East Africa and Asia Pacific in Allergy Immunotherapy Adoption and Growth

Regional dynamics in the allergy immunotherapy market vary considerably across global territories. In the Americas, robust reimbursement frameworks and established healthcare infrastructure have fostered early adoption, particularly in the United States and Canada. Meanwhile, Latin American markets demonstrate growing interest in cost-effective sublingual and epicutaneous therapies driven by rising prevalence rates and expanding private payer coverage.

Europe, the Middle East, and Africa encompass a heterogeneous landscape of mature markets in Western Europe, where standardized immunotherapy protocols and strong specialty clinic networks ensure sustained growth. Central and Eastern Europe are advancing through increased investment in allergy diagnosis and treatment centers, while the Middle East and Africa are at an inflection point, with public health initiatives and out-of-pocket expenditures catalyzing nascent immunotherapy uptake.

In the Asia-Pacific region, demographic trends and environmental factors have contributed to some of the highest allergy burdens globally. Rapid urbanization, air pollution, and changing dietary habits are driving heightened demand for immunotherapy solutions. Market growth is fueled by expanding specialty care capacity in countries such as China, Japan, Australia, and South Korea, alongside emerging economies that are enhancing healthcare access through public and private partnerships.

This comprehensive research report examines key regions that drive the evolution of the Allergy Immunotherapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing the Strategic Positions Innovations and Competitive Landscape of Leading Companies Driving Allergy Immunotherapy Advances

Leading companies in the allergy immunotherapy space are pursuing differentiated strategies that blend innovation with commercial rigor. Aimmune Therapeutics, recently acquired by Nestlé Health Science, remains at the forefront of food allergy management, leveraging its PALFORZIA platform to expand pediatric access. ALK-Abelló has distinguished itself through strategic launches of sublingual tablets and partnerships to broaden geographic reach.

DBV Technologies is advancing epicutaneous immunotherapy research with its Viaskin patch program, aiming to provide non-invasive desensitization options for peanut and other food allergies. Stallergenes Greer continues to deepen its digital health footprint via connected adherence tools, reinforcing its leadership in allergen extract development.

Major pharmaceutical stakeholders such as Sanofi, Novartis, and Merck are augmenting their portfolios with monoclonal antibody therapies like omalizumab and next-generation biologics targeting key immunological pathways. Smaller biotechs are also vying for market share by focusing on recombinant allergen formats and nanotechnology-based adjuvant systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Allergy Immunotherapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adamis Pharmaceuticals Corporation

- Aimmune Therapeutics Inc.

- ALK‑Abelló A/S

- Allergopharma GmbH & Co. KG

- Allergy Therapeutics plc

- Allovate LLC

- Anergis SA

- ASIT Biotech SA

- Biomay AG

- Circassia Pharmaceuticals Inc.

- DBV Technologies SA

- Desentum Oy

- HAL Allergy B.V.

- HollisterStier Allergy Inc.

- Inmunotek S.L.

- Jubilant HollisterStier LLC

- LETI Pharma S.L.

- Leti‑allergoid

- Merck KGaA

- Mylan N.V.

- Novartis AG

- Stallergenes Greer International AG

- Thermo Fisher Scientific Inc.

- Torii Pharmaceutical Co., Ltd.

- WOLW Pharma Limited

Actionable Strategic Roadmap for Industry Leaders to Navigate Market Challenges Embrace Innovation and Optimize Growth in Allergy Immunotherapy

Industry leaders should prioritize a multi-pronged approach to capitalize on evolving market dynamics. First, integrating digital adherence and telemedicine solutions can elevate patient engagement and improve long-term outcomes, reducing attrition in multi-year immunotherapy regimens. Second, companies should diversify supply chains by establishing alternative sourcing agreements and expanding domestic manufacturing capabilities to mitigate tariff-driven cost variability.

Third, fostering strategic alliances with payers and healthcare systems will be essential to secure favorable reimbursement and expand coverage of novel therapy modalities. Engaging in proactive regulatory dialogue can help shape policy frameworks around biologics, epicutaneous applications, and digital therapeutics. Fourth, continued investment in next-generation platforms, including recombinant allergens and nanocarrier adjuvants, will differentiate pipelines and meet the demand for personalized allergy solutions.

Finally, industry participants must remain agile, continuously monitoring legislative changes, technological advances, and patient preference trends to refine their go-to-market strategies and capture emerging growth opportunities.

Detailing Comprehensive Research Methodology Framework Employed to Derive Robust Market Insights and Ensure Data Integrity

This analysis is grounded in a comprehensive research methodology that blends primary and secondary data sources. Primary research involved in-depth interviews with key opinion leaders, allergists, supply chain experts, and industry executives. These interviews provided qualitative insights into clinical adoption patterns, patient behavior, and pipeline dynamics.

Secondary research encompassed an extensive review of peer-reviewed journals, regulatory filings, patent databases, conference proceedings, and public company disclosures. Market segmentation frameworks were validated through data triangulation techniques, ensuring consistency across geographic, clinical, and technological dimensions.

Quantitative estimates and trend analyses were cross-verified using proprietary databases and third-party intelligence platforms. All data underwent rigorous cleansing and validation protocols to ensure reliability and accuracy. The resulting multi-layered approach underpins the robustness of the strategic insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Allergy Immunotherapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Allergy Immunotherapy Market, by Allergy Type

- Allergy Immunotherapy Market, by Allergen Type

- Allergy Immunotherapy Market, by Treatment Type

- Allergy Immunotherapy Market, by Immunotherapy Delivery Form

- Allergy Immunotherapy Market, by Technology Platform

- Allergy Immunotherapy Market, by End User

- Allergy Immunotherapy Market, by Distribution Channel

- Allergy Immunotherapy Market, by Region

- Allergy Immunotherapy Market, by Group

- Allergy Immunotherapy Market, by Country

- United States Allergy Immunotherapy Market

- China Allergy Immunotherapy Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Drawing Powerful Conclusions on Market Evolution Innovation Trajectories and Strategic Imperatives for the Future of Allergy Immunotherapy

The allergy immunotherapy market is entering a phase characterized by rapid innovation and strategic complexity. Established treatment modalities retain their relevance, even as emerging platforms promise to expand therapeutic boundaries. Digital health advancements and regulatory milestones are creating new avenues for patient engagement and adherence improvement.

Tariff-induced supply chain realignments underscore the importance of resilient manufacturing strategies and alternative sourcing. Regional heterogeneity in market maturity demands tailored approaches that address local reimbursement landscapes and clinical infrastructure capabilities. Competitive dynamics are intensifying as traditional pharmaceutical companies and agile biotechs converge around advanced allergen technologies and biologics.

To succeed in this environment, stakeholders must integrate cross-functional expertise spanning clinical development, regulatory affairs, commercial operations, and supply chain management. By aligning strategic priorities with emerging trends and patient-centric imperatives, companies can reinforce their market positions and unlock sustainable growth in the evolving allergy immunotherapy landscape.

Take the Next Step Engage with Associate Director to Access the Full Market Report and Unlock Tailored Allergy Immunotherapy Insights

If you are ready to gain a competitive edge and equip your organization with actionable intelligence on the allergy immunotherapy market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the report’s key findings and help tailor the insights to your strategic objectives. Secure your copy today to position your team at the forefront of innovation and optimize your market strategies.

- How big is the Allergy Immunotherapy Market?

- What is the Allergy Immunotherapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?