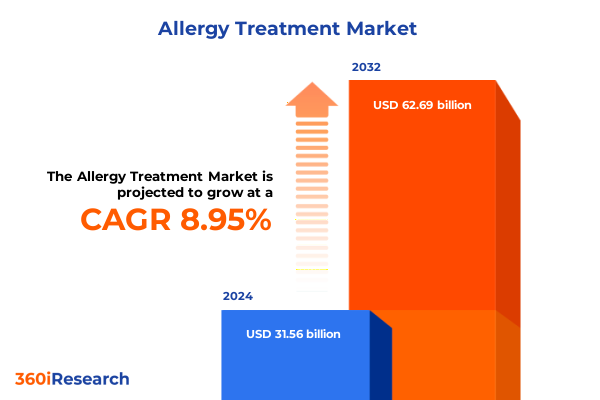

The Allergy Treatment Market size was estimated at USD 33.87 billion in 2025 and expected to reach USD 36.35 billion in 2026, at a CAGR of 9.19% to reach USD 62.69 billion by 2032.

Uncovering the Multifaceted Developments in Allergy Treatment Driving Patient Centricity and Transformative Therapeutic Pathways

Allergic conditions remain a pervasive health challenge in the United States, impacting nearly one in three adults and over one in four children across seasonal, dermatological, and food-related presentations. Data from the National Health Interview Survey reveal that in 2021, 31.8% of adults experienced at least one allergic condition while 27.2% of children endured similar diagnoses, encompassing hay fever, eczema, and food sensitivities. These conditions range from mild ocular irritation and pruritus to severe anaphylaxis, posing significant risks that extend beyond physical discomfort to include diminished work productivity, increased healthcare utilization, and reduced quality of life.

Against this backdrop, environmental and lifestyle factors are exacerbating allergic disease prevalence. Urbanization, air pollution, and climate-driven shifts in allergen dispersal now intensify symptom severity and prolong exposure windows. A recent study of U.S. fungal spore seasons found that climate change has advanced the onset of spore-related allergy triggers by an average of 22 days over two decades, illustrating the expanding threat posed by both pollen and mold spore allergens. As symptoms intensify and seasons lengthen, patients and providers alike are seeking more effective, patient-centric therapeutic strategies.

Charting the Transformational Forces Altering Allergy Treatment Paradigms Through Biotechnology Personalized Medicine and Digital Innovation

Recent years have ushered in transformative innovations reshaping how allergic diseases are diagnosed, monitored, and treated. Foremost among these are biologic therapies targeting immunological pathways once deemed untouchable by traditional pharmacological approaches. Omalizumab, a monoclonal antibody against immunoglobulin E, has demonstrated significant reductions in nasal and ocular symptoms for patients with allergic rhinitis, improving quality of life and decreasing reliance on H1 antihistamines in refractory cases. Meanwhile, emerging data on dupilumab and tezepelumab underscore an expanding pipeline of agents aimed at interleukin-4/13 signaling and thymic stromal lymphopoietin, offering hope for chronic rhinosinusitis and severe asthma with comorbid allergies.

Parallel to these pharmaceutical breakthroughs, digital health tools are enabling unprecedented personalization of care. Telemedicine platforms now integrate symptom tracking, adherence monitoring, and biomarker data-such as fractional exhaled nitric oxide-to guide therapeutic adjustments in real time. Machine learning algorithms leverage patient-reported outcomes and environmental sensor data to predict flare-ups before they occur, empowering clinicians to preempt exacerbations and refine immunotherapy dosing schedules. This convergence of biotechnology and digital innovation marks a paradigm shift from reactive to proactive allergic disease management.

Additionally, clinical trials in oral immunotherapy for peanut allergy highlight a movement toward desensitization approaches for food allergies. At the 2025 AAAAI annual meeting, investigators reported that 100% of high-threshold peanut-allergic children receiving store-bought peanut butter under strict supervision tolerated significant peanut protein loads, compared to only 10% in the avoidance cohort. Such advances underscore a broader trend emphasizing curative rather than solely symptomatic therapies, driven by advances in immunological understanding and patient demand for durable solutions.

Analyzing the Compound Effects of 2025 US Trade Tariffs on Allergy Therapy Supply Chains Cost Structures and Strategic Adaptations

In 2025, U.S. trade policy ushered in a suite of tariffs targeting pharmaceutical imports that cumulatively impact allergy treatment supply chains and cost structures. Under a broad global tariff regime effective April 5, nearly all imported goods-including active pharmaceutical ingredients (APIs) critical to allergy medications-are now subject to a 10% levy. In addition, Section 301 tariffs impose duties of up to 25% on APIs sourced from China and 20% on those from India, affecting the raw materials for both generic and branded antihistamines, corticosteroids, and allergen extracts.

In the short term, major pharmaceutical firms have largely absorbed these added costs to shield patients and health insurers from immediate price increases, but this strategy has compressed margins-particularly for generic drug manufacturers operating on narrow profitability thresholds. This manufacturing squeeze has catalyzed a strategic pivot toward “China-plus-one” sourcing models, with companies diversifying supply chains to India, Germany, and emerging API hubs in Eastern Europe. While onshoring API production in the U.S. is gaining momentum, the ramp-up time for new facilities and the FDA’s rigorous validation requirements mean that supply chain realignment will unfold over several years.

Ultimately, the tariff environment is accelerating investments in domestic and nearshore manufacturing capacity, digital supply chain management tools, and strategic partnerships. Companies that proactively redesign their procurement frameworks and forge government-backed alliances are positioning themselves to mitigate the tariff burden, secure sustainable API supplies, and maintain competitive cost structures in the evolving policy landscape.

Illuminating Key Insights from Treatment Type Distribution Channel Allergy Type and End User Segmentation to Drive Strategic Decision Making

Effective navigation of the allergy treatment ecosystem requires an understanding of market dynamics rooted in distinct patient and provider segments. The treatment landscape is organized by type, with allergen immunotherapy delivered via subcutaneous or sublingual routes, over-the-counter remedies such as antihistamines, decongestants, eye drops, and nasal sprays, and prescription pharmaceuticals ranging from antihistamines and corticosteroids to leukotriene modifiers and mast cell stabilizers. Each modality caters to specific severity levels, patient preferences, and cost considerations.

Access channels represent another critical differentiation. Hospital pharmacies provide rapid, clinician-supervised delivery of advanced therapies, online pharmacies offer convenience and broad geographic reach for chronic management, and retail outlets ensure immediate over-the-counter relief for acute symptoms. These distribution pathways shape prescribing behaviors, adherence rates, and ultimately, patient outcomes.

Allergic diseases themselves are classified by type, encompassing drug and food allergies that demand careful avoidance strategies and emergency preparedness, respiratory allergies triggered by dust mites, mold spores, pet dander, and pollens, and skin manifestations ranging from urticaria to atopic dermatitis. Each category presents unique immunopathological mechanisms and therapeutic requirements, reinforcing the need for targeted intervention.

Finally, the channel through which treatments reach end users varies widely. Clinics specializing in allergic disorders provide comprehensive diagnostic testing and personalized immunotherapy regimens, hospitals deliver acute care and complex biologic administrations under specialist supervision, and homecare models empower self-management through ongoing remote support. Recognizing these segment interdependencies enables industry stakeholders to tailor strategies that align product development, pricing models, and outreach efforts with end-user demands and care delivery frameworks.

This comprehensive research report categorizes the Allergy Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Allergy Type

- Distribution Channel

- End User

Distilling Critical Regional Variations in Allergy Care Across the Americas Europe Middle East Africa and Asia Pacific to Uncover Growth Drivers

Geography remains a powerful determinant of allergic disease patterns and therapeutic adoption. In the Americas, especially the United States, high allergy prevalence combines with advanced healthcare infrastructure to foster rapid uptake of cutting-edge immunotherapies and biologics. Robust reimbursement pathways and widespread specialist networks support patient access, while climate change-driven intensification of pollen seasons underlines the urgency for effective long-term solutions.

Across Europe, the Middle East, and Africa, heterogeneity in healthcare systems influences allergy care delivery. Western European markets emphasize precision medicine approaches and maintain strong investments in research, while emerging economies within the region are expanding diagnostic capabilities and integrating digital tools to extend specialist care into underserved areas. Regulatory harmonization efforts by the European Medicines Agency further streamline cross-border clinical development and market entry for novel allergy therapeutics.

The Asia-Pacific region stands out for its rapidly growing patient base, fueled by urbanization, environmental pollutants, and heightened public awareness. Countries such as China, Japan, and Australia are driving clinical research into sublingual immunotherapy, oral biologics, and digital health platforms, supported by governmental initiatives to bolster healthcare access. Simultaneously, increasing investments in local manufacturing capabilities aim to meet regional demand and reduce dependence on external API suppliers.

This comprehensive research report examines key regions that drive the evolution of the Allergy Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exposing Strategic Movements of Leading Pharma Innovators Shaping the Competitive Allergy Treatment Ecosystem Through Alliances and R&D

The competitive landscape of allergy treatment showcases a blend of established pharmaceutical giants and specialized biotech innovators. Sanofi and Regeneron continue to expand the label of dupilumab into allergic rhinitis and chronic rhinosinusitis, leveraging joint R&D and marketing synergies to sustain momentum in biologic therapies. Concurrently, the introduction of omalizumab-igec as the first interchangeable biosimilar to Xolair underscores a shift toward cost-effective monoclonal antibodies, offering payers and patients a more accessible option for severe allergic conditions.

In parallel, companies like Aimmune Therapeutics, now part of a major pharmaceutical portfolio, are advancing oral immunotherapy protocols for peanut allergy. Phase 2 data presented by leading allergists confirm the potential for store-bought peanut preparations to achieve high desensitization thresholds in pediatric populations, marking a meaningful departure from strict avoidance strategies. At the same time, innovators in the generic sector, including Viatris and Sandoz, are investing in China-plus-one API sourcing and domestic production hubs to insulate margins from tariff pressures.

Technology partnerships also characterize this arena, with digital health firms collaborating with pharma players to deploy AI-driven symptom trackers and remote monitoring platforms. Academic-industry consortia are underway to explore microbiome-based prophylactics inspired by environmental hypotheses, signaling a forward-looking drive toward preventive interventions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Allergy Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- ALK-Abelló A/S

- Bayer AG

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Stallergenes Greer, Inc.

- Teva Pharmaceutical Industries Ltd.

Empowering Industry Leaders with Actionable Strategies to Navigate Disruption Optimize Supply Chains and Advance Next Generation Allergy Solutions

Industry leaders must embrace an integrated strategy that spans product innovation, supply chain resilience, and digital transformation. Prioritizing investment in next-generation immunotherapies and biologics will capture unmet needs among moderate to severe allergy sufferers, while expanding sublingual and oral immunotherapy offerings will address patient demand for noninvasive treatment options.

Simultaneously, reengineering API procurement through diversified China-plus-one sourcing and accelerated onshoring initiatives can mitigate tariff impacts and strengthen supply continuity. Companies should partner with contract development and manufacturing organizations (CDMOs) in strategically located hubs to balance cost, quality, and time-to-market considerations.

Digital health integration should extend beyond pilot phases to embed AI-powered decision support within clinical workflows, facilitate remote patient monitoring, and enhance adherence through personalized engagement tools. These platforms not only improve outcome tracking but also generate real-world evidence to support market authorization and reimbursement negotiations.

Finally, forging cross-sector alliances-including academic consortia exploring microbiome therapeutics, bartering strategic investments with government R&D programs, and co-developing diagnostic and treatment bundles-will diversify innovation pathways and unlock synergies across the allergy treatment value chain.

Detailing the Rigorous Research Methodology Underpinning Comprehensive Allergy Treatment Insights From Primary Interviews to Quantitative Validation

The research underpinning this analysis combines primary and secondary methodologies to ensure comprehensive coverage and rigorous validation. Primary insights were gathered through structured interviews with leading allergists, supply chain executives, and digital health innovators. These qualitative findings were triangulated with patient advocacy group surveys to capture end-user preferences and unmet needs.

Secondary research encompassed a systematic review of scientific literature, regulatory filings, and policy briefs to map clinical advancements and legislative influences. Trade data and tariff schedules were analyzed to quantify 2025 tariff frameworks and their projected operational impacts. Industry reports on biologics trials, digital health deployments, and oral immunotherapy outcomes were synthesized to identify convergent trends.

Finally, expert panels from pharmaceutical manufacturing, allergology societies, and health economics provided iterative feedback on preliminary insights, ensuring alignment with real-world dynamics. This multi-tiered approach yields a robust foundation for the strategic recommendations and market segmentation insights presented throughout this document.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Allergy Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Allergy Treatment Market, by Treatment Type

- Allergy Treatment Market, by Allergy Type

- Allergy Treatment Market, by Distribution Channel

- Allergy Treatment Market, by End User

- Allergy Treatment Market, by Region

- Allergy Treatment Market, by Group

- Allergy Treatment Market, by Country

- United States Allergy Treatment Market

- China Allergy Treatment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings to Illuminate Future Directions in Allergy Treatment Innovation Partnerships and Patient Centric Care Models

The allergy treatment landscape is undergoing an unprecedented evolution driven by biologic innovation, digital health integration, and shifting supply chain paradigms. Leading therapies now extend beyond symptom control to immunomodulation and desensitization, fundamentally altering the patient journey. Digital decision support and remote monitoring tools are elevating the precision of care, enabling proactive interventions that reduce exacerbations and improve adherence.

At the same time, external forces-particularly the 2025 tariff environment-are reshaping cost frameworks and supply strategies, compelling organizations to diversify sourcing and invest in domestic manufacturing capabilities. Market segmentation insights reveal that success hinges on aligning product portfolios with patient needs across treatment types, distribution channels, allergy categories, and end-user preferences. Regional dynamics further underscore the importance of tailored market approaches, from advanced economies to emerging Asia-Pacific hubs.

Ultimately, companies that synthesize these insights into agile strategies-prioritizing innovation, operational resilience, and digital transformation-will redefine standards of care and capture leadership positions in the rapidly expanding allergy treatment domain.

Seize Expert Intelligence on the Allergy Treatment Market and Engage Ketan Rohom to Access Premium Research Insights and Strategic Guidance

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to access this definitive allergy treatment market research report. Ketan’s expertise ensures you receive personalized guidance on leveraging detailed therapeutic, regulatory, and supply chain insights to outpace competitors and seize emerging opportunities. Engage directly with Ketan to explore tailored research packages, secure executive briefings, and unlock premium data visualizations that will inform and accelerate your strategic decision making. Reach out today to elevate your market intelligence and drive impactful outcomes in the rapidly evolving allergy treatment landscape.

- How big is the Allergy Treatment Market?

- What is the Allergy Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?